Its been a stunning collapse of the premier oil and gas companies stock prices since Trump’s election. You would think that an industry so overwhelmingly Republican and a President so enamored with drilling for oil would be a combustible combination .

It’s just the opposite. It’s hard to believe that history can repeat itself right on cue as energy stocks were the laggards of the last Trump administration. With EV investment tax credits likely to disappear, with a President whose platform is “drill baby drill” you would think there would be at least some Holiday Season joy in the oil patch. None that I have seen.

But Santa might still be coming. Insiders have been buying shares in beleaguered stocks lately. This week we have Conoco, Tidewater, and Diamondback Energy scooping up bargain basement prices. Relieve might be on the way. President Claus might be ready to fill up the badly depleted Strategic Petroleum Reserve.

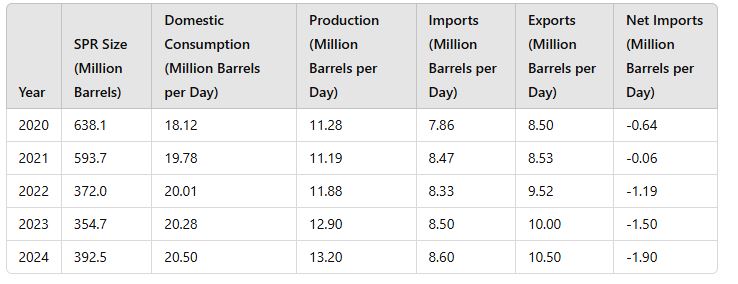

- SPR Size: Represents the year-end inventory levels of the U.S. Strategic Petroleum Reserve. When Trump left office there were~638 Millions barrel of oil in the reserve. Based on domestic consumption then, that was about 35 days of gas at the pump. Actuall a lot less since not all petroleum is turned into gas. Today it is about 19 days worth of petroleum.

- Domestic Consumption: Reflects the total petroleum products supplied, serving as a proxy for U.S. petroleum consumption.

- Production: Denotes the average daily crude oil production in the United States for each year.

- Imports: Denotes the total crude oil and petroleum products imported into the United States.

- Exports: Represents the total crude oil and petroleum products exported from the United States.

- Net Imports: Calculated as total imports minus total exports of crude oil and petroleum products. Negative values indicate that the U.S. was a net exporter for that year.

Name: Steven E West

Position: Director

Transaction Date: 2024-12-16 Shares Bought: 6,000 Average Price Paid: $162.66 Cost: $975,960

Company: Diamondback Energy Inc. (FANG)

Diamondback Energy Inc. is an independent oil and gas company that acquires, develops, explores, and exploits unconventional onshore oil and gas deposits, particularly in West Texas’ Permian Basin. This basin, which is one of the largest producing basins in the United States, is distinguished by a lengthy production history, a favorable operating climate, mature infrastructure, a long reserve life, several producing horizons, enhanced recovery potential, and a large number of operators. The company’s primary activities are centered on horizontal development of the Midland Basin’s Spraberry and Wolfcamp formations, as well as the Delaware Basin’s Wolfcamp and Bone Spring formations, both of which are part of the wider Permian Basin in West Texas and New Mexico.

Mr. West has been a director of the company since December 2011. Mr. West was Chief Executive Officer from January 2009 to December 2011 and Chairman of the Board from October 2012 to February 2022. From January 2011 to December 2016, Mr. West was a partner at Wexford Capital LP, also known as Wexford Capital, where he focused on the firm’s private equity energy projects, from August 2006 to December 2010. Mr. West worked as a senior portfolio advisor at Wexford Capital. Mr. West previously served as Chairman of the Board of Viper Energy, Inc. He served as Chairman of the Board of Rattler Midstream LP from May 2019 until August 2022, when it was bought by Diamondback in a merger and no longer trades publicly.

Opinion: Bull Case: A simple temporary fix is to fill up the Strategic Petroleum Reserve as it is a level nearly half of what it was when Trump left office. Biden kept prices low at the pump in part by emptying the Reserve. Only in the last few months have they resumed filling it. Trump is already on record of filling it back up.

Name: R A Walker

Position: Director

Transaction Date: 2024-12-17 Shares Bought: 10,400 Average Price Paid: $97.80 Cost: $1,017,161

Company: Conocophillips (COP)

ConocoPhillips is an independent exploration and production firm headquartered in Houston, Texas, with operations and activities in 13 countries. The company comprehensive, low-cost-of-supply portfolio comprises resource-rich unconventional plays in North America, conventional assets in North America, Europe, Africa, and Asia, LNG initiatives, Canadian oil sands, and an inventory of global exploration prospects. On December 31, 2023, the corporation had roughly 9,900 employees worldwide. The total firm production for the year was 1,826 MBOED. ConocoPhillips is an independent exploration and production company based in Houston, Texas, with operations and activities throughout 13 countries.

R.A. Walker joined ConocoPhillips’ Board of Directors in March 2020. Mr. Walker was the Chairman and CEO of Anadarko Petroleum Corporation until August 2019, when it was acquired by Occidental Petroleum. He joined Anadarko in 2005 as senior vice president and chief financial officer, then as president and chief operating officer, before becoming CEO in 2012. Before joining Anadarko, he worked in the oil and gas business, investment and commercial banking, and as an institutional investor. Mr. Walker is currently a senior advisor for Jefferies Financial Group Inc. He has previously served on the boards of directors for BOK Financial Corporation, CenterPoint Energy Corporation, Enable Midstream Partners, LP, and Health Care Services Corporation.

Opinion: In addition to the giant Alaska reserves, Conoco is a major natural gas producer. It will be much easier to export LNG under the Trump administration.

Name: Robin W.T. Buchanan

Position: Director

Transaction Date: 2024-12-13 Shares Bought: 5000 Average Price Paid: $76.06 Cost: $380,300

Company: LyondellBasell Industries N.V. (LYB)

LyondellBasell Industries N.V. is a multinational, independent chemical corporation that was established as a Naamloze Vennootschap under Dutch law on October 15, 2009. The company operates globally across the petrochemical value chain and is a market leader in various product areas. The company’s chemical businesses are mostly huge processing units that transform vast amounts of liquid and gaseous hydrocarbon feedstocks into plastic resins and other chemicals. Chemical products typically serve as basic building blocks for other chemicals and polymers. Plastic items are employed in both big volumes and tiny, specialized applications. Customers utilize plastics and chemicals to make a variety of products that people use in their daily lives, such as food packaging, home furnishings, vehicle components, and paints and coatings

Robin William Turnbull Buchanan is currently an Independent Non-Executive Director at LyondellBasell Industries NV since 2011. Mr. Buchanan is also a Senior Advisor at Bain & Company Inc., a worldwide business consulting firm. He previously served on the board of directors of Schroders plc., a global asset management firm, as the Chairman of PageGroup plc, a global specialist recruitment company, and as the Dean and then President of the London Business School.

Opinion: Its a toe in the water. When the mongols are at the gates, I’d like to see a hardier response with insiders buying. Stay tooned, there might be more. Some analysts downgraded the obvious, the sector sucks. This could be the bottom- I’d nibble or as Fly on the Wall

|

Name: Bruce Caswell

Position: CEO & President

Transaction Date: 2024-12-17 Shares Bought: 3,500 Average Price Paid: $70.64 Cost: $247,240

Company: Maximus Inc. (MMS)

Maximus’s mission of Moving Individuals Forward enables millions of individuals to obtain critical government services. With nearly 50 years of combined experience working with local, state, federal, and international government clients, the company takes pride in designing, developing, and delivering creative and impactful programs that make a difference. The company is dedicated to strengthening communities and improving the lives of individuals they serve. The company adds value to customers by translating health and human services public policies into operating models that produce results for governments on a large scale. Its services include managing large health insurance eligibility and enrollment programs, clinical services such as assessments, appeals, and independent medical reviews, and technology services.

Bruce Caswell became Maximus’ CEO and Director on April 1, 2018, after previously serving as President since October 2014. Bruce has held various top leadership positions, supervising all aspects of the company’s operations, since joining Maximus in 2004. Bruce oversees the Company’s strategy for assisting governments in navigating major policy reform and modernization efforts, as well as implementing solutions to meet challenging requirements for some of the world’s largest civilian programs, such as Medicaid, Medicare, the Decennial Census, CDC pandemic vaccinations, and disability benefit assessments for US veterans and UK citizens. Bruce graduated from Haverford College with a B.A. in economics and a Master of Public Policy from Harvard University’s John F. Kennedy School of Government.

Opinion: No wonder any government contractor stocks are in free fall with Musk and Vivek leading the D.O.G.E. charge

Name: Christopher J Coughlin

Position: Director

Transaction Date: 2024-12-16 Shares Bought: 10,000 Average Price Paid: $59.44 Cost: $594,400

Company: Centene Corp (CNC)

Name: H James Dallas

Position: Director

Transaction Date: 2024-12-16 Shares Bought: 1,693 Average Price Paid: $59.01 Cost: $99,904

Company: Centene Corp (CNC)

Name: Theodore R. Samuels II

Position: Director

Transaction Date: 2024-12-13 Shares Bought: 5000 Average Price Paid: $58.86 Cost: $294,300

Company: Centene Corp (CNC)

Centene Corporation is a healthcare firm that offers programs and services to underinsured and uninsured families, commercial enterprises, and military families in the United States. The company operates in four segments: Medicaid, Medicare, Commercial, and Other. Medicaid provides health plan coverage for the elderly, blind, and crippled, as well as the Children’s Health Insurance Program, foster care, Medicare Medicaid plans, and long-term services and support. This section also offers healthcare products. The Medicare segment provides special needs, Medicare supplements, and prescription medication insurance. The Commercial section offers health insurance marketplace products for individual, small, and large group commercials.

Christopher J. Coughlin was appointed to Centene Corporation’s Board of Directors on January 2022. Christopher J. Coughlin serves on the boards of Alexion Pharmaceuticals, Prestige Consumer Healthcare, and Karuna Therapeutics, Inc. In his previous career, he occupied the position of Chief Operating Officer, Director & Executive VP at Interpublic Group of Cos., Inc., Director at The Dun & Bradstreet Corp., President at Nabisco International, Inc., Chief Financial Officer & Executive Vice President at Nabisco Holdings Corp., Chief Financial Officer & Executive Vice President at Tyco International Ltd., Chief Financial Officer of Sterling Winthrop, Inc., He earned an undergraduate degree from Boston College.

H. James Dallas was appointed to Centene Corporation’s Board of Directors in 2016. H. James Dallas is President and CEO of Dallas James & Associates LLC, which he founded in 2013. He is the Chairman of Atlanta Community Food Bank, Inc., an Independent Director of KeyCorp since 2005, and an Independent Director of Centene Corporation. He formerly served as an Independent Director for WCG Health Management, Inc. from 2016 to 2020, Capella Education Co., Inc. from 2015 to 2018, the YMCA of Metropolitan Minneapolis, and Strategic Education, Inc. from 2018 to 2021.

Theodore R. Samuels II was appointed to Centene Corporation’s Board of Directors on December 2021. Theodore Rapp Samuels is an Independent Director at Bristol-Myers Squibb Co., Centene Corp., and Iron Mountain, Inc. He is also a director at Research Corporation Technologies, Inc., Capital Group Foundation, John Burroughs School, and Pasadena City College Foundation. He has previously held positions as Co-Chairman of Children’s Hospital Los Angeles, Independent Director of Auctane, Inc. and Perrigo Co. Plc, and Portfolio Manager of Capital International, Inc. He was also President of Capital Guardian Trust Co. from 2010 until 2017. Mr. Samuels earned an undergraduate degree from Harvard University in 1977 and an MBA from Harvard Business School in 1981.

Opinion: We are nibbling at this name.

Name: Global GP LLC

Position: General Partner

Transaction Date: 2024-12-12 Shares Bought: 7,000 Average Price Paid: $54.23 Cost: $379,590

Company: Global Partners LP (GLP)

Global Partners LP is a master limited partnership established in March 2005. The corporation owns, controls, or has access to a huge terminal network of refined petroleum products and renewable fuels, as well as critical rail and/or marine assets, that extends from Maine to Florida and into the United States Gulf states. The company is one of the largest independent owners, suppliers, and operators of gas stations and convenience stores, with operations primarily in Massachusetts, Maine, Connecticut, Vermont, New Hampshire, Rhode Island, New York, New Jersey, and Pennsylvania. As of December 31, 2023, the company is engaged in the purchasing, selling, gathering, blending, storing, and logistics of transporting petroleum and related products, including gasoline and gasoline blendstocks (such as ethanol), distillates (such as home heating oil, diesel, and kerosene), residual oil, renewable fuels, crude oil, and propane, as well as the rail transportation of petroleum products and renewable fuels from the mid-continent region of the United States and Canada.

Global Partners’ wide network of terminals, gas stations, and retail stations enables people to heat their homes, run their companies, and go where they need to go swiftly and easily. The corporation, headquartered in the Northeast, is a third-generation family-owned enterprise with operations across the United States.

Opinion: No opinion here.

Name: Quintin Kneen

Position: Director, President & CEO

Transaction Date: 2024-12-13 Shares Bought: 41,615 Average Price Paid: $48.06 Cost: $1,999,921

Company: Tidewater Inc (TDW)

Name: Robert Robotti

Position: Director

Transaction Date: 2024-12-13 Shares Bought: 21,147 Average Price Paid: $47.57 Cost: $1,005,873

Company: Tidewater Inc (TDW)

Tidewater Inc was founded in 1956, and for over 65 years, it has offered marine and transportation services to the global offshore energy industry. The objective involves providing high-quality operational services to clients while adhering to all rules and regulations, respecting the environment and local communities in which they work, and ensuring people’s safety. As of December 31, 2023, the company operates a vast, diverse fleet of offshore service vessels, with 217 vessels serving customers in over 30 nations. The company believes that its global operating base enables it to respond rapidly to changing local market conditions as well as to changing client requirements.

Mr. Kneen was appointed President, CEO, and Director of Tidewater in September 2019. Before this, he served as Executive Vice President and Chief Financial Officer at Tidewater since November 2018 following its acquisition of GulfMark where he served as President and Chief Executive Officer since June 2013. Mr. Kneen joined GulfMark in June 2008 as the Vice President – Finance and was named Senior Vice President – Finance and Administration in December 2008. He was subsequently appointed as the Company’s Executive Vice President and Chief Financial Officer in June 2009 where he worked until he was appointed Chief Executive Officer. He holds an M.B.A. from Rice University and a B.B.A. in Accounting from Texas A&M University, and is a Certified Public Accountant and a Chartered Financial Analyst.

Mr. Robotti has been on the Company’s Board of Directors since June 2021. Since 1983, Mr. Robotti has served as president of Robotti & Company Advisors, LLC and Robotti Securities, LLC, formerly known as Robotti & Company, LLC as well as its predecessors. Since 1980, he has been the Managing Director of Ravenswood Management Company, LLC, which is the general partner of The Ravenswood Investment Company, L.P. and Ravenswood Investments III, L.P. Mr. Robotti worked as a portfolio manager for Robotti Worldwide Fund, LLC, a worldwide equities fund, from 2007 to March 2015. He is currently a director and Chairman of the Board of Pulse Seismic Inc. the major seismic library data provider to the western Canadian petroleum sector, having held these posts for the previous five years.

Opinion: Stock seems to want to bottom. Its all about the future of hydrocarbons and Gretta Thunberg.

Name: James R Fitterling

Position: Chair and CEO

Transaction Date: 2024-12-12 Shares Bought: 25600 Average Price Paid: $41.49 Cost: $1,062,155

Company: Dow Inc. (DOW)

Name: Richard K Davis

Position: Director

Transaction Date: 2024-12-12 Shares Bought: 6,025 Average Price Paid: $41.45 Cost: $249,730

Company: Dow Inc. (DOW)

Name: Gaurdie E. Banister JR.

Position: Director

Transaction Date: 2024-12-13 Shares Bought: 7,339 Average Price Paid: $40.87 Cost: $299,932

Company: Dow Inc. (DOW)

Dow Inc. was established on August 30, 2018, under Delaware law to act as a holding company for The Dow Chemical Company and its consolidated subsidiaries. Dow Inc. conducts all of its operations through TDCC, a wholly owned subsidiary created in 1947 under Delaware law and the successor to a Michigan corporation of the same name founded in 1897. Dow is a global leader in materials science, serving customers in high-growth areas including packaging, infrastructure, transportation, and consumer applications. The Company’s global reach, asset integration and scale, focused innovation, leading market positions, and dedication to sustainability enable it to achieve profitable growth and contribute to a sustainable future. Dow has manufacturing facilities in 31 countries and employs about 35,900 people. In 2023

Jim Fitterling was designated Dow’s chief executive officer-elect in March 2018, before becoming CEO in July. He was elected as board chair in April 2020. Before becoming CEO, he was Dow’s president and COO. From September 2017 to March 2019, he was also the chief operating officer of DowDuPont’s Materials Science Division, a $86 billion holding company formed by The Dow Chemical Company and DuPont to form independent, publicly traded companies in materials science, agriculture, and specialty products. Dow and DowDuPont separated on April 1, 2019. Fitterling began his 40-year career at Dow in 1984, just two weeks after graduating from the University of Missouri-Columbia with a bachelor’s degree in mechanical engineering. During his first decade with the company, he handled several sales, marketing, and supply chain jobs in the United States.

Mr. Davis serves on the Board of Directors of Mastercard Incorporated (since June 2018) and Wells Fargo and Company (since April 2022). Mr. Davis served as director of Xcel Energy Inc. from 2006 to 2020. Mr. Davis served as a Director of TDCC from May 2015 until September 2017 when he became a member of the DowDuPont Inc. Materials Advisory Committee and then, in July 2018, a director of DowDuPont Inc. Mr. Davis resigned from DowDuPont Inc. Board in April 2019.Mr. Davis has served as Lead Director since April 2021.

Gaurdie E. Banister Jr. was elected to Dow Inc.’s Board of Directors on August 13, 2020. Mr. Banister was the former president and CEO of Aera Energy LLC, an oil and gas exploration and production business co-owned by Shell Oil and ExxonMobil, from 2007 to 2015. Mr. Banister chairs the Board of Directors of Russell Reynolds Associates, a private leadership advice and search organization. He also serves on the board of trustees of American University in Washington, D.C., as well as the foundation board of the South Dakota School of Mines and Technology. Mr. Banister is the founder and CEO of Different Points of View, a private consulting organization specializing in leadership and safety. He coaches and advises start-ups in energy and technology.

Opinion: This seem seriously undervalued by the market is a beauty contest to a value contest at the moment. Old School Value only pegs the DCF value at $14.70 so maybe what I’m looking at is clouded by all the insider buying that doesn’t know what they are doing? I don’t think so.

Name: Craig R Knocke

Position: Director

Transaction Date: 2024-12-16 Shares Bought: 5000 Average Price Paid: $36.15 Cost: $180,746

Company: HF Sinclair Corp (DINO)

Name: Atanas H Atanasov

Position: EVP and CFO

Transaction Date: 2024-12-12 Shares Bought: 9,000 Average Price Paid: $37.85 Cost: $340,624

Company: HF Sinclair Corp (DINO)

HF Sinclair Corporation is an independent energy firm. The company manufactures and sells gasoline, diesel fuel, jet fuel, renewable diesel, specialist lubricant products, specialty chemicals, specialty and modified asphalt, and other items. It owns and operates refineries in Kansas, Oklahoma, New Mexico, Utah, Washington, and Wyoming, and markets its refined products primarily in the Southwest United States and Rocky Mountains, the Pacific Northwest, and other bordering Plains states. In addition, the company provides fuel to over 1,500 independent Sinclair-branded stations and licenses the Sinclair trademark to around 300 additional locations. It also manufactures base oils and other specialist lubricants and offers petroleum product and crude oil transportation, terminalling, storage, and throughput services to the petroleum industry. HF Sinclair Corporation is headquartered in Dallas, Texas.

Mr. Knocke is a co-founder and has served as director of Turtle Creek Trust Company, a private trust and investment management firm, since 2009. He currently serves as the Chief Investment Officer and has served as a Portfolio Manager at Turtle Creek Management, LLC, a registered investment advisory firm based in Dallas, Texas, since 2007. Since 2009, Mr. Knocke has served as a Principal and a non-controlling manager and member of TCTC Holdings, LLC, a bank holding company that is a banking, securities, and investment management firm. He previously held positions as Vice President and Portfolio Manager at Brown Brothers Harriman & Co., and served in various positions at Salomon Brothers and Texas Instruments

Atanas H. Atanasov is the company’s Executive Vice President and Chief Financial Officer, having joined in September 2022. Mr. Atanasov formerly served as Chief Financial Officer of Lummus Technology LLC, a multinational chemical technology corporation for the petrochemical and energy industries, from April to September 2022. Prior to joining Lummus, he was Executive Vice President, Chief Financial Officer, and Treasurer of Kraton Corporation, a NYSE-listed specialty chemical company, from May 2019 until its merger with DL Holdings in March 2022. Mr. Atanasov served as the Chief Financial Officer of Empire Petroleum Partners, LLC, a wholesale motor gasoline distributor, from February 2016 to May 2019. He is a certified public accountant (CPA).

Opinion: Relatively small buy by an RIA. The big one to notice was the 4 million sale at $57.34 at 2-27.

Name: Eric Schuppenhauer

Position: EVP GBUL Borrow

Transaction Date: 2024-12-16 Shares Bought: 30,600 Average Price Paid: $16.34 Cost: $500,001

Company: SoFi Technologies Inc. (SOFI)

SoFi Technologies Inc. is a member-centric, one-stop shop for financial services that, through its Lending and Financial Services products, enables members to borrow, save, spend, invest, and protect their money. The objective is to assist members in achieving financial independence so that they can pursue their ambitions. Financial independence does not imply wealth, but rather the ability to achieve personal goals such as owning a home, starting a family, or pursuing a desired career. Simply put, it means having enough money to do what they want. The company was launched in 2011 and has created a suite of financial solutions that provide the speed, selection, information, and convenience that only an integrated digital platform can deliver. To support the company provide personal loans, student loans, house loans, and related services.

Eric Schuppenhauer is SoFi’s EVP and Group Business Unit Leader for Borrow. He is in charge of the following business units: Home Loans, Personal Loans, In-School Student Loans, Student Loan Refinancing, and Pricing. Eric joined SoFi from Citizens Financial Group, where he was a member of the executive committee and oversaw all aspects of the company’s Consumer Lending business, which included mortgage, home equity, credit card, unsecured, student, operations, strategy, secondary markets, digital/technology, and risk. Before joining Citizens, Eric headed Capital One’s mortgage origination and service businesses and held key leadership positions at JPMorgan Chase, including mortgage origination and servicing head and mortgage CFO.

Opinion:SoFi has been on a tear since this summer. It seems like the long held vision of a one stop financial superstore might be bearing fruit. There is still so much competition.

Opinion:

Name: Evan Joseph Calio

Position: Chief Financial Officer

Transaction Date: 2024-12-12 Shares Bought: 549,862 Average Price Paid: $1.64 Cost: $903,276

Company: FREYR Battery Inc. (FREY)

FREYR Battery, Inc., a Delaware firm, creates clean, next-generation battery solutions. The company’s objective is to expedite the decarbonization of global energy and transportation networks through the production of clean, cost-effective batteries. It aims to service the core markets of energy storage systems and commercial mobility, including marine applications and commercial vehicles, using the Speed, Scale, and Sustainability strategy, with future plans to serve the electric vehicle industry. The company is working to fully automate the production of customer testable batteries using the SemiSolidTM technology licensed from 24M Technologies, Inc. while also seeking a conventional battery technology partner to diversify and accelerate product delivery to market.

Evan Joseph Calio was appointed as Chief Financial Officer (CFO) of FREYR Battery Inc. on June 6, 2024 Mr. Calio has over thirty years of energy experience on Wall Street. Before joining BTIG, Mr. Calio worked at Morgan Stanley for 14 years, most recently as a Managing Director in Equity Research, where he covered US exploration and production firms, refiners, and integrated oils. Mr. Calio was named to Institutional Investor’s Annual All-America Research Survey in 2012, 2013, 2014, and 2016, and a Rising Star on Wall Street in 2011. Mr. Calio received a BS from Lehigh University, a JD from Widener University School of Law, and an LLM from Georgetown University Law Center.

Opinion: I’ll take a shot at the holy grail when insiders are putting their money on the line.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

You can be an insider, too– by clicking here

This blog is solely for educational purposes and the author’s own amusement. IT IS NOT INVESTMENT ADVICE. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified as soon as practically possible. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does. When I have time, over the weekend, I’ll add some preliminary analysis to the Opinion at the end. Sometimes I won’t update this for a couple of weeks or more. A good way to use this blog is as I do, it’s a reference point and filing cabinet for various stocks with notable insider buying. It’s one of many tools I use. I regularly live on Chat GPT and Microsoft Copilot now. I find the footnotes research very helpful in eliminating errors from AI hallucinations.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,