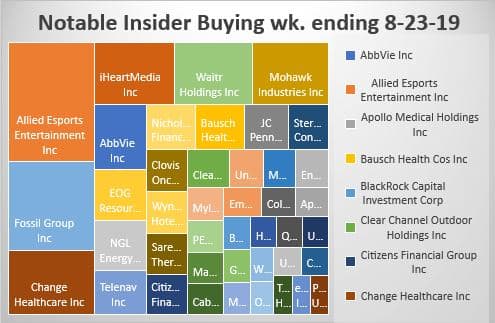

Earnings Blackout or Insiders Backing Off? Roller Coast Week of October 4, 2019

The spike in insider buying that supported the brief rally in September has predictably collapsed in part because earnings blackout has begun, but equally important insiders buy their own…

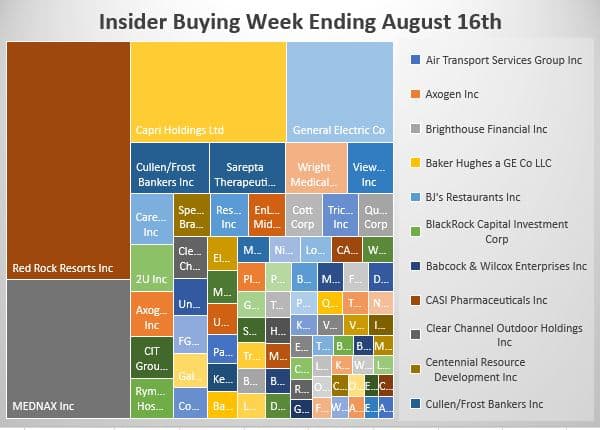

It's Getting Interesting- Insider Buying Picks Up Week Ending 8-9-19

After weeks of dull action, insider buying has finally picked up. Part of it is the end of 2nd Quarter earnings blackout and part of it is the market sell-off. The highlights: Charlie Egren, the…

A Tsunami Of New Shale Production | Oil and Gas Investor $OXY

A Tsunami Of New Shale Production by Richard Mason Chief Technical Director Hart Energy 2017/08/04 1,004 26 Fasten those seatbelts. Oil and gas has a been busier than commonly understood and the…

Why the Collapse in the Price of Oil is Reminiscent of Previous Financial Bubbles

Bubbles all have the same characteristics of unrealistic expectations but are incredibly difficult to recognize until after the effect. Prices in an economic bubble can fluctuate erratically, and…

The blatant injustice of US Government oil policy

If China was dumping a product in the US market, and businesses in the US were not allowed to sell a similar one in the Chinese market, politicians would be up in arms at the injustice of it all.…

The contrarian view in the oil patch is hard to come by these days, here's mine

It's hard to find the contrarian view in the oil patch these days but some of our contrarian observations are: A barrel of oil is worth far more in the U.S. than in other parts of the world. The U.S…

Crude oil in free fall creates long term buying opportunity

I think the sharp drop in crude and the decline in some US centric shale plays creates a buying opportunity. We bought Anadarko, Apache, Continental Resources, EOG, a little Chesapeake and quite a…