How long can the Trump stock market honeymoon go on? Of course no one knows the answer to that. Anyone who thinks they do is self delusional at best or a charlatan at worst. I did pick up a bit of Truist. It hasn’t ramped like the other names on this week’s list of notable insider buys with the exception of Valvoline. I just can’t bring myself to the table on VVV. I was surprised to find that even EVs use oil. Someone shared a story about their Tesla Cyber Truck leaking oil and the horrendous customer support. The pace of insider buying is likely to slow down as we approach the Holidays and the end of the 4th quarter and with it the traditional earnings blackout period.

Name: William H Rogers JR

Position: Chairman & CEO

Transaction Date: 2024-11-25 Shares Bought: 34,180 Average Price Paid: $48.56 Cost: $1,659,781

Company: Truist Financial Corp. (TFC)

Truist Financial Corporation is a purpose-driven financial services firm that inspires and builds better lives and communities. Truist is a large commercial bank in the United States, with a significant market share in many of the country’s high-growth sectors. Truist’s wholesale and consumer operations provide a diverse range of products and services, including consumer and small business banking, commercial banking, corporate and investment banking, insurance, wealth management, payments, and specialist lending businesses. Truist, headquartered in Charlotte, North Carolina, is a top ten commercial bank.

Rogers was appointed chairman in March 2022 for Truist Financial Corporation , and CEO on September 12, 2021, after serving as president and chief operating officer of Rogers as an advocate for the company’s generosity and volunteerism. A purpose-driven financial services firm dedicated to inspiring and developing better lives and communities. He is a member of various local and national boards, including the Board of Governors for the Boys & Girls Clubs of America and the Board of Trustees of Emory University. Rogers, a native of North Carolina, with a bachelor’s degree in business administration from the University of North Carolina at Chapel Hill and an MBA from Georgia State University.

Opinion: This is a large purchase near a lifetime high. The normal message from a large insider buy at the top ‘is business is good and getting better.’ Wall St is certainly singing this tune due to anticipation of a benign regulatory backdrop . Truist CEO’s large insider purchase seems to confirm this gospel.

Name: Charles M Sonsteby

Position: Director

Transaction Date: 2024-11-25 Shares Bought: 10,000 Average Price Paid: $39.50 Cost: $395,000

Company: Valvoline Inc (VVV)

Valvoline Inc. is a leader in vehicle preventive maintenance, providing easy and dependable services in its retail locations across the United States and Canada. Unless otherwise specified, Valvoline predecessors and consolidated subsidiaries. Valvoline, the quick, easy, and trusted leader in automobile preventive maintenance, is increasing shareholder value by maximizing the potential of its core business, speeding network growth, and innovating to suit the needs of consumers and the developing car park.

Mr. Sonsteby has been a director at Valvoline since September 2016 and brings with him to Valvoline’s Board of Directors extensive experience and knowledge in the areas of consumer wholesale, high growth retail, restaurant and franchise operations leads international franchise operations expansion into 28 countries while at EAT, sold company owned/ purchased franchise restaurants as part of a strategic, digital strategy, including stock offerings. He was CFO of Brinker International Inc. from 2001 until October 2010 and held various other positions since joining Brinker in 1990. In addition, he is a former director of Zale Corporation. Mr. Sonsteby also is a member of the University of Kentucky Gatton College of Business Dean’s Advisory Council. He previously served on the Board of Directors of Child Care Group of Dallas and the Town North YMCA.

Opinion: Valvoline has been around forever but its hard to get motivated by the internal combustion engine. Even so I read on X that a dissatisfied Tesla customer had an oil leak. Apparently this tweet went viral.

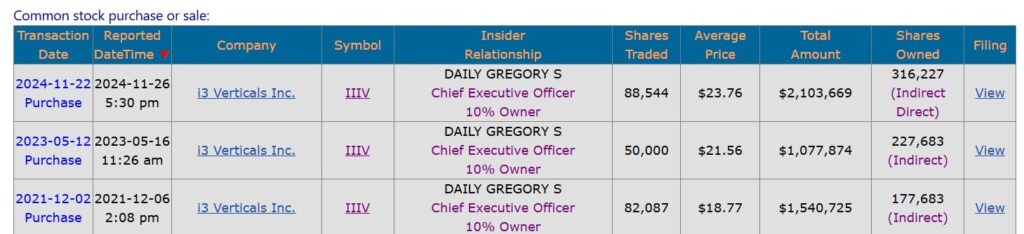

Name: Gregory S Daily

Position: Chief Executive Officer 10% Owner

Transaction Date: 2024-11-22 Shares Bought: 88,544 Average Price Paid: $23.76 Cost: $2,103,669

Company: i3 Verticals Inc. (IIIV)

I3 Verticals develops, acquires, and expands software solutions for the public and healthcare vertical sectors. The extensive range of enterprise solutions is tightly integrated into the customers’ operations, resulting in long-term collaborations. Since its inception in 2012, it has increased cash flow through organic expansion and acquisitions. The cash flow production and solid recurring revenue model have provided the company with an optimal financial framework to capitalize on strategic growth possibilities in the coming years.

Greg Daily is the CEO and Chairman of the Board of Directors of i3 Verticals since 2012. Before establishing i3 Verticals, Mr. Daily launched iPayment, Inc. in 2001 and served as its Chairman and CEO until his retirement in 2011. Mr. Daily co-founded PMT Services, Inc., a credit card processing company, in 1984 and served as President until it was sold to NOVA Corporation in 1998, where he remained Vice Chairman of the Board of Directors until 2001. Mr. Daily earned a Bachelor of Arts from Trevecca Nazarene University.

Opinion: This stock has really gone nowhere since its IPO around 2019 in spite of significant insider purchases in the past. I do give Daily credit as it looks like he has only been a buyer not a seller of his stock.

Name: Christine Mikail Cvijic

Position: President and CFO

Transaction Date: 2024-11-22 Shares Bought: 24,000 Average Price Paid: $20.48 Cost: $491,400

Company: Neurogene Inc. (NGNE)

Name: Rachel McMinn

Position: Chief Executive Officer

Transaction Date: 2024-11-22 Shares Bought: 47,500 Average Price Paid: $20.40 Cost: $969,000

Company: Neurogene Inc. (NGNE)

Neurogene Inc., a biotechnology business, creates genetic therapies for uncommon neurological disorders. It has licensing agreements with the University of North Carolina, the University of Edinburgh, Virovek, Inc., and Sigma-Aldrich Co. LLC. The company is based in New York, New York.

Christine Mikail, J.D. is Neurogene’s President and Chief Financial Officer since December 2023. Ms. Mikail oversees Corporate Strategy and Business Development, Portfolio Management, Operations, and Finance. Ms. Mikail, who joined Neurogene in 2019, has over 20 years of expertise advising biotechnology and pharmaceutical companies on corporate strategy and business development, operations, legal, and financial matters. She had worked in top management positions at NPS Pharmaceuticals, Inc., Dendreon Corporation, Eli Lilly and Company, and ImClone Systems before joining Axovant. Ms. Mikail gained experience as a corporate and securities lawyer at Reed Smith and WilmerHale before focusing on life sciences. Ms. Mikail graduated with honors from Rutgers University and received her J.D. from Fordham University School of Law in New York.

Rachel McMinn, Ph.D., is Neurogene’s Chief Executive Officer and Executive Chair of the Board of Directors of Neurogene since November 2024. She created Neurogene in January 2018, to discover genetic therapeutics to improve the lives of people with neurological impairments and their families. Before starting Neurogene, she was the Chief Business and Strategy Officer of Intercept Pharmaceuticals, a firm dedicated to patients suffering from serious liver disease. Dr. McMinn was an award-winning biotechnology analyst for 13 years at Bank of America Merrill Lynch, Cowen, and Piper Jaffray before joining the industry. She obtained her Ph.D. at The Scripps Research Institute after receiving a B.A. from Cornell University.

Opinion: Neurogene popped 20% on these large insider buys. According to Post on the Fly H.C. Wainwright analyst Mitchell Kapoor says that amid “impressive” low-dose efficacy data, Neurogene’s NGN-401 led to a treatment-related severe adverse event in a single high-dose patient, leaving investors with unanswered questions. Neurogene yesterday disclosed the patient was dosed November 5, six days before the event was made known to management, the analyst tells investors in a research note. The patient is in critical condition, after experiencing signs of systemic hyperinflammatory syndrome. Neurogene shares were down 43% yesterday, which H.C. Wainwright believes is an overreaction.

Insiders seemed to affirm this over reaction with large insider buys causing the stock to ramp over 20%. Buyers should be patient. NGNE filed to sell 4 Mill shares for outside investors on 12-2-24. You may see those prices again or even better.imnm

Name: Clay B Siegall

Position: President and CEO

Transaction Date: 2024-11-21 Shares Bought: 100,000 Average Price Paid: $9.62 Cost: $962,181

Company: Immunome Inc. (IMNM)

Name: Robert Lechleider

Position: Chief Medical Officer

Transaction Date: 2024-11-21 Shares Bought: 15,805 Average Price Paid: $9.48 Cost: $149,800

Company: Immunome Inc. (IMNM)

Name: Philip Tsai

Position: Chief Medical Officer

Transaction Date: 2024-11-21 Shares Bought: 21,000 Average Price Paid: $9.48 Cost: $198,030

Company: Immunome Inc. (IMNM)

Immunome Inc. is a biopharmaceutical firm dedicated to the development of tailored oncology medicines. The company believes that the search for novel or underexplored targets will be critical to the next generation of revolutionary medicines. As a result, the company seeks medicines that it believes have best-in-class or first-in-class potential. The goal is to build a large pipeline of preclinical and clinical assets that can be efficiently developed at successive value inflection points. To achieve this goal, it combines commercial development activities with large investments in internal discovery programs. The named pipeline includes one clinical and three preclinical assets. AL102, an experimental gamma-secretase inhibitor, is now being evaluated in a Phase 3 trial for the treatment of desmoid tumors.

Dr. Siegall is the Chairman, CEO, and President of Immunome, Inc since October 2023. He formerly served as CEO of Morphimmune, a privately held biotechnology business focusing on developing targeted oncology treatments, and supervised the successful merger of Morphimmune with Immunome. Dr. Siegall is expanding on and leveraging his experience to make Immunome a leader in targeted oncology medicines innovation, driven by a persistent desire to help cancer patients with unmet medical needs better their outcomes and quality of life. He obtained a PhD in Genetics from George Washington University and a B.S. in Zoology from the University of Maryland.

Robert Lechleider joined Immunome, Inc. as Chief Medical Officer in October 2023. He was the Chief Medical Officer of OncoResponse before joining Immunome, where he managed the development of the company’s exclusive cancer pipeline. He began his biotech career at MedImmune, then advanced to positions of increasing importance at Human Genome Sciences and Macrogenics before leading development at Seagen. He worked in academia, where he studied basic cellular and molecular biology before entering the biotech industry. He received his A.B. from Princeton University and his M.D. from the University of Illinois College of Medicine in Chicago before completing a clinical residency in internal medicine at Beth Israel-Deaconess Medical Center in Boston and later in medical oncology at the National Cancer Institute in Bethesda.

Dr. Tsai joined Immunome, Inc. as Chief Medical Officer in June 2024. Before joining Immunome, Dr. Tsai worked at Seagen and then Pfizer in positions of increasing responsibility. He was most recently the SVP of Technical Development, where he oversaw the whole development of biologics and drug-linker manufacturing processes, analytics, and therapeutic products. He has overseen a successful CMC development group for the past two decades, advancing Seagen’s pipeline and commercializing its products. Dr. Tsai started his biotech career at Biogen, where he spent seven years improving biologics manufacturing techniques. Dr. Tsai received his M.S. and PhD in Chemical Engineering with a minor in Biology from the California Institute of Technology, as well as his B.S. from the University of Illinois at Champaign-Urbana.

Opinion: Insider buying is particularly useful in pre revenue biotech since the science is so complex and opaque that if any industry is ripe for scientific fraud, this is the one. Everyone knows if a computer works or even if software razzle dazzles but drugs can take a decade and a $billion dollars to develop.

Name: Michael J Angelakis

Position: Director

Transaction Date: 2024-11-20 Shares Bought: 3,465,000 Average Price Paid: $5.16 Cost: $17,863,350

Company: Clarivate PLC.(CLVT)

Clarivate PLC is a top global information services company. The Company connects people and companies with trusted intelligence to help them alter their world. It brings together richer data, analytics and insights, workflow software, and expert services, all based on deep subject expertise across knowledge, research, and innovation. The subscription and technology-based solutions serve the Academia & Government, Intellectual Property, and Life Sciences & Healthcare markets. The mission is to provide a best-in-class experience for customers at all touchpoints while achieving extraordinary results for colleagues, communities, and shareholders.

Michael Angelakis has been on the Clarivate Board of Directors since December 2021. Mr. Angelakis has been the Chairman and CEO of Atairos Group, Inc. since 2015. He also serves as Senior Advisor to Comcast Corporation’s Executive Management Committee. Before creating Atairos, he was Comcast’s Vice Chairman and Chief Financial Officer from 2011 to 2015, and Executive Vice President and Chief Financial Officer from 2007 to 2011. Mr. Angelakis was in charge of numerous strategic, financial, administrative, and other aspects of Comcast’s operations. Mr. Angelakis was named one of “America’s Best Chief Financial Officers” by Institutional Investor magazine six times out of eight years while at Comcast. Before joining Comcast. Mr. Angelakis was the CEO of State Cable TV Corporation and Aurora Telecommunications LLC. Mr. Angelakis graduated from Babson College and Harvard Business School’s Owner/President Management Program.

Opinion: This is a massive insider buy. CLVT earned the wrath of disappointing and embarrassing Wall St. analysts. Several downgraded the firm, including Morgan Stanley which said Morgan Stanley analyst dropped his price target nearly in half and said Clarivate remains a “show me” story, and that it will look for evidence of the new CEO’s plan in 2025. This one is on my shopping list but I am concerned about AI disrupting its business model. I simply don’t know enough about this story.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

You can be an insider, too– by clicking here

This blog is solely for educational purposes and the author’s own amusement. IT IS NOT INVESTMENT ADVICE. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified as soon as practically possible. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does. When I have time, over the weekend, I’ll add some preliminary analysis to the Opinion at the end. Sometimes I won’t update this for a couple of weeks or more. A good way to use this blog is as I do, it’s a reference point and filing cabinet for various stocks with notable insider buying. It’s one of many tools I use. I regularly live on Chat GPT and Microsoft Copilot now. I find the footnotes research very helpful in eliminating errors from AI hallucinations.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,