While some stocks like the Magnificent Seven have had a phenomenal comeback year, many, many companies are depressed in value. For example, many REITs have poor returns, some as a consequence of the sharp rise in interest rates. Agree Realty had a return of -15.34% year-to-date (YTD.) Paying particular attention to significant insider buying is one way to force that discipline of buying cheaply on yourself. When not painting the tape or participating in required corporate ownership requirements, insiders are historically value buyers.

This week, we highlight what we think are notable buys. Although we pay attention to selling, we don’t write about this far more nuanced behavior. We’ve always used multiple tools in our research efforts, but this week, you’ll notice I’m paying particular attention to Microsoft’s Bing integration of Open AI.

You can be an insider, too– by clicking here.

Name: John Jr Rakolta

Position: Director

Transaction Date: 2023-12-20 Shares Bought: 13,335 Average Price Paid: $62.44 Cost: $832,627

Company: Agree Realty Corp (ADC)

Agree Realty Corp is a fully integrated REIT that primarily owns, acquires, develops, and manages retail assets net leased to industry-leading tenants. The current executive chairman, Richard Agree, started the company in 1971, and its common stock floated on the New York Stock Exchange in 1994. The Company’s assets are held by, and all of its operations are carried out through, the Operating Partnership, which is the sole general partner with a 99.6% common interest as of December 31, 2022. The Company, as the single general partner, has sole responsibility and discretion in managing and controlling the Operating Partnership under the Operating Partnership’s limited partnership agreement. The Company was established in December 1993 under Maryland law. The Company believes it has operated and will continue to operate in a manner that qualifies it as a REIT under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”).

Ambassador Rakolta formerly served on the Board from August 2011 to September 2019, when he was appointed US Ambassador to the UAE. Before his confirmation, Mr. Rakolta was the chairman and CEO of Walbridge, a privately held construction company. Mr. Rakolta is a member of the Metropolitan Affairs Corporation and the Coalition for Detroit School Children. He serves as a director and member of the Executive Committee of the Detroit Regional Chamber, as well as on the boards of directors of New Detroit, Inc., the College for Creative Studies, and Business Leaders for Michigan. Mr. Rakolta was designated Honorary Consul General of Romania to the United States 1998. 1970, Marquette University granted him a Bachelor of Science in Civil Engineering.

Opinion: REITs have historically provided inflation-protected alternatives for fixed-income investors. Bondholders can expect a return on their money and the return of their money but never an increased payout. Well-managed commercial retail REITS with good occupancy rates can raise rents as leases expire, providing some measure of inflation-protected yield. The current dividend yield of Agree Realty Corporation is 4.7485%1. The company last raised its dividend on October 12, 20232.

Ralolta is a seasoned business executive and is probably buying shares in ADC because the stock has been a dog this year and is a good rebound candidate as interest rates normalize. Agree Realty Corporation primarily serves national and super-regional tenants operating in e-commerce and recession-resistant sectors1, AKA Amazon-proof. The occupancy rate of Agree Realty Corporation has remained very strong at 99.7%123.

Name: James A Star

Position: Director

Transaction Date: 2023-12-14 Shares Bought: 12,242 Average Price Paid: $20.38 Cost: $249,519

Company: Chewy Inc. (CHWY)

Chewy, Inc. launched Chewy.com in 2011, and Chewy.com, LLC was created as a Delaware limited liability business in October 2013. Chewy.com, LLC changed its name to Chewy, Inc. on March 16, 2016, after converting from a Delaware limited liability company to a Delaware corporation. The company aims to be the most trusted and convenient place for pet parents and partners worldwide. They believe they are the preeminent online source for pet products, supplies, and prescriptions because of the broad selection of high-quality products and services they offer at competitive prices and deliver exceptional care and a personal touch to build brand loyalty and drive repeat purchasing. They work in a huge and developing business in the United States, including pet food and treats, pet supplies and drugs, other pet health items, and pet services.

Mr. Star is the Executive Chairman of Longview Asset Management LLC, a multi-strategy investment firm that invests on behalf of individuals, trusts, and charitable foundations. He was Longview’s President and Chief Executive Officer from 2003 until 2019. Mr. Star has also been a Vice President of Henry Crown and Company, a private family office linked with Longview, since 1994. Mr. Star now serves as a trustee of Equity Commonwealth, a publicly traded real estate investment trust, where he chairs the nominating and governance committee. He also serves or has served as a director or trustee of pension funds, registered mutual funds, private enterprises, and a private trust firm. Mr. Star has a Bachelor of Arts from Harvard University, a Juris Doctorate from Yale Law School, and a Master of Management from Northwestern University’s Kellogg Graduate School of Management.

Name: Douglas A Pertz

Position: Director

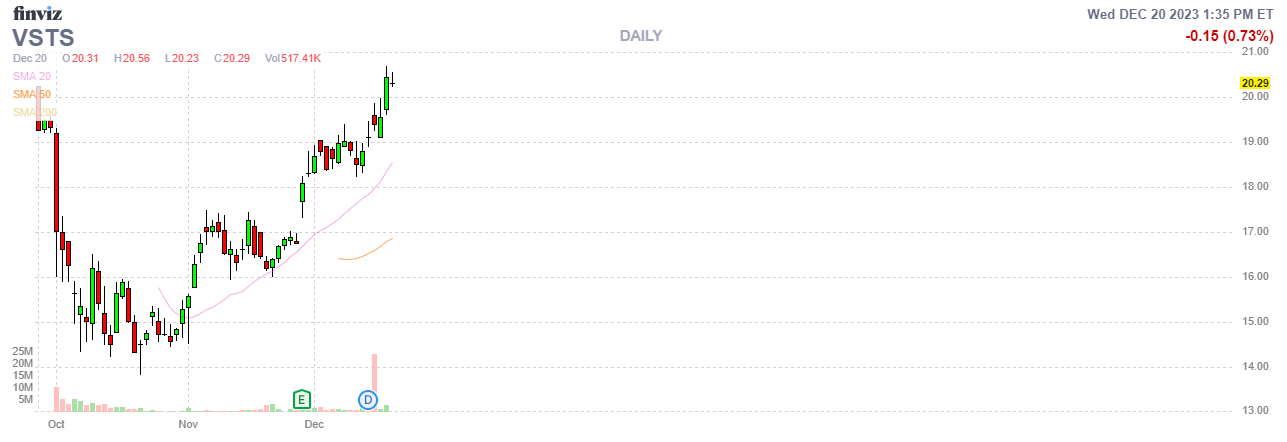

Transaction Date: 2023-12-14 Shares Bought: 10,370 Average Price Paid: $19.35 Cost: $200,627

Company: Vestis Corp (VSTS)

Vestis Corporation offers tailored uniform rental and purchase programs in the United States, Canada, Puerto Rico, and Japan. The company’s products include uniforms, floor mats, towel service, lavatory supplies, equipment, mops, first aid, flame resistance, cleanroom, and healthcare. It services the food service, food processing, automotive, manufacturing, healthcare, and cleanroom industries. Vestis Corporation was established in 1936 and is headquartered in Roswell, Georgia.

Douglas Allen Pertz is a businessman who has led eight separate enterprises. He is currently the President, Chief Executive Officer, and Director of Recall Corp. In addition, he serves on the boards of Advance Auto Parts, Inc., Ann & Robert H. Lurie Children’s Hospital of Chicago, The Chicago Council on Global Affairs, and Vestis Corp. He previously served as Executive Chairman of The Brink’s Co. and President and chief Executive Officer of Brink’s, Inc., Vice President of Danaher Corp., Partner at Bolder Capital LLC, Managing Director at OEP Capital Advisors LP, Chairman, President & Chief Executive Officer of IMC Global, Inc., President & Chief Executive Officer of Clipper Windpower Holdings Ltd., President, Chief Executive Officer & Director of Culligan Water Technologies, Inc., President, Chief Executive Purdue University awarded Douglas Allen Pertz an undergraduate degree.

Opinion: Sometimes, a spin-off is just financial engineering and not a dedicated group of hot-shot executives ready to break out of the bureaucratic chains and prove their mettle. Peter Lynch loved spin-offs, but I don’t see it these days as investment bankers and P.E shops have already squeezed every nickel out of the investment community today. Probably nothing here other than a spin-off of the old Aramark uniform company and stock market performance will be disappointing.

Name: Roger Jeffs

Position: Chief Executive Officer

Transaction Date: 2023-12-14 Shares Bought: 139,665 Average Price Paid: $7.16 Cost: $1,000,001

Company: Liquidia Corp (LQDA)

Name: Paul B Manning

Position: Director

Transaction Date: 2023-12-14 Shares Bought: 279,330 Average Price Paid: $7.16 Cost: $2,000,003

Company: Liquidia Corp (LQDA)

Liquidia Corp is a biopharmaceutical business that develops, manufactures, and commercializes pharmaceuticals that meet unmet patient needs, with a current focus on treating pulmonary hypertension. The company operates as one business Through two wholly-owned operating subsidiaries, Liquidia Technologies and Liquidia PAH. They now generate revenue through a Promotion Agreement between Liquidia PAH and Sandoz Inc., in which they share profits from selling Sandoz’s substitutable generic treprostinil injection in the United States. Liquidia PAH is the sole owner of the commercial rights to promote the proper use of Treprostinil Injection. The company uses a targeted sales team to reach out to physicians and hospital pharmacies treating pulmonary arterial hypertension and key stakeholders involved in distributing and reimbursing Treprostinil Injection.

Roger Jeffs departed as President and Co-CEO of United Therapeutics in 2016 after a successful 18-year tenure. Dr. Jeffs joined United Therapeutics Corporation in 1998 as Director of Research, Development, and Medical. Then, they served as President and Chief Operating Officer from 2001 to 2014 and President and co-CEO from 2015 to 2016. Dr. Jeffs won the 2015 Wings of Hope Award from the Solving Kids’ Cancer organization in “recognition of his visionary leadership in advancing cancer research while prioritizing the lives of children.” Dr. Jeffs previously worked in clinical development at Amgen, Inc. and Burroughs Wellcome Co. Dr. Jeffs received his undergraduate degree in chemistry from Duke University and his Ph.D. in pharmacology from the University of North Carolina School of Medicine. Dr. Jeffs has served on the boards of United Therapeutics, Dova Pharmaceuticals, Sangamo Therapeutics, and Albireo Pharma, and he currently serves on the board of Axsome Therapeutics.

Mr. Manning is the President and CEO of PBM Capital Group, headquartered in Charlottesville, Virginia. Mr. Manning, an entrepreneur with thirty years of expertise in the healthcare industry, formed PBM Capital Group in 2010, a private equity investment firm focused on healthcare and life sciences. Mr. Manning oversees all investment choices and serves on the boards of directors of several PBM Capital companies, including Avexis, Dova Pharmaceuticals, Verrica Pharmaceuticals, and PBM Pharmaceuticals. Mr. Manning launched numerous successful firms that manufactured and supplied prescription and over-the-counter medications to major US retailers. Mr. Manning started PBM Products in 1997, which grew to become the world’s largest private-label maker of infant formula and baby/toddler meals. Mr. Manning is active in the University of Virginia community, having served on the UVA Strategic Planning Committee, the UVA Health Foundation, and the President’s Advisory Committee Board. Mr. Manning earned a B.S. in Microbiology from the University of Massachusetts.

Opinion: Liquidia is the canary in the coal mine for a heated-up speculative market. The stock is up a stunning 60% since its recent December 12, 2023, secondary offering at $7.16 per share1. There may be a lot credence to this move as the courtroom decision on the 20th was a life affirming event for the biotech.

BTIG raised the firm’s price target on Liquidia to $29 from $18 and keeps a Buy rating on the shares. The company’s winning the ‘793 IPR appeal is the most de-risking legal event on YUTREPIA’s path to freedom to operate, the analyst tells investors in a research note. From here, Liquidia should request that the current injunction approved by Justice Andrews is to be removed, since it was supported by the ‘793 patent, the firm states, adding that it expects YUTREPIA to emerge as the preferred DPI treprostinil Tx option in PAH and PH-ILD.

Name: Robert C Daigle

Position: Chief Executive Officer

Transaction Date: 2023-12-18 Shares Bought: 66,000 Average Price Paid: $3.94 Cost: $260,160

Company: Amtech Systems Inc (ASYS)

Amtech Systems Inc. is a global leader in the production of capital equipment such as thermal processing, wafer polishing and cleaning, and related consumables used in the fabrication of semiconductor devices such as silicon carbide and silicon power devices, analog and discrete devices, electronic assemblies, and light-emitting diodes. The company sells these items to semiconductor device and module makers worldwide, focusing on Asia, North America, and Europe. Their strategic priority is to capitalize on semiconductor growth possibilities in power electronics, sensors, and analog devices by leveraging their thermal and substrate processing expertise. They are a world leader in the high-end power chip market (SiC substrates, 300mm horizontal thermal reactors, and electronic assemblies used in power, RF, and other sophisticated applications), designing and delivering crucial semiconductor equipment and consumables.

Robert C. Daigle was appointed to the Board on August 12, 2021, and elected Chairman on March 30, 2022. Mr. Daigle is the top Vice President and Chief Technology Officer at Rogers Corporation, where he has held various top executive positions over his 30-year career. Mr. Daigle created and led Rogers’s High-Frequency Circuit Materials and Power Electronics Solutions businesses. Mr. Daigle has a B.S. in Chemical Engineering and Materials Engineering from the University of Connecticut and an M.B.A. from Rensselaer Polytechnic Institute.

Opinion: How does a semiconductor stock, Amtech Systems, perform this poorly when the (YTD) return of the semiconductor index is 62.65%? Bing has the answers at its fingertips; Amtech reported net revenue of $27.7 million, a decrease from the previous year1. The company also reported customer orders of $18.2 million and a book-to-bill ratio of 0.7:11, which could indicate a slowdown in demand for its products. As of September 30, 2023, Amtech had unrestricted cash of $13.1 million1. However, the company was not in compliance with certain financial covenants under its loan agreement1. This could raise concerns about the company’s financial health and impact its stock performance.

Daigle is a newly appointed CEO and often there are stock ownership requirements that came along with such seniority. The agreement, which was entered into on August 14, 2023, outlines the terms and conditions of Daigle’s employment as the CEO and Chairman of the Board of Amtech, including his compensation, benefits, and termination rights1. However, the agreement does not mention any obligation or incentive for Daigle to acquire or hold any shares of Amtech’s common stock.

Daigle’s recent purchase of 66,000 shares of Amtech on December 20, 2023, may have been motivated by other factors such as the giant restoring chip program the USA is undertaking.

Perhaps they’re excited about their recent purchase in Tempe, Arizona. Amtech Systems acquired Entrepix, Inc. to expand its market opportunity and accelerate growth in the front-end wafer processing market, including silicon carbide applications1. Entrepix is a globally recognized expert in chemical mechanical polishing (CMP) and wafer cleaning1.

The acquisition of Entrepix allows Amtech Systems to add robust CMP technology portfolio and wafer cleaning equipment to its existing substrate polishing and wet process chemical offerings1. This increases Amtech’s penetration into a multitude of applications that utilize smaller wafers (200mm and below), including the high growth silicon carbide market1.

With the addition of Entrepix, Amtech now offers one of the industry’s broadest sets of substrate processing solutions, providing robust cross-selling opportunities across both Amtech’s and Entrepix’s respective customer bases1. The acquisition is expected to provide a strategic benefit to Amtech and create meaningful value for its shareholders from day one1. This one is on our radar but stock performance is nothing here yet to pull the trigger.

Name: Robert Carey

Position: Director

Transaction Date: 2023-12-18 Shares Bought: 1,200,000 Average Price Paid: $1.64 Cost: $1,962,000

Company: Beyond Air Inc. (XAIR)

Beyond Air is a medical device and biopharmaceutical company in the commercial stage that is developing a platform of nitric oxide generators and delivery devices capable of manufacturing NO from ambient air (the “LungFit® platform”). LungFit® PH, their first device, received FDA premarket approval in June 2022. In term and near-term neonates with hypoxic respiratory failure and clinical or echocardiographic evidence of pulmonary hypertension, the NO generated by the LungFit® PH system is indicated to improve oxygenation and reduce the need for extracorporeal membrane oxygenation in conjunction with ventilatory support and other appropriate agents. The Company began marketing LungFit® PH as a medical device for PPHN in the United States in July 2022. LungFit® can be used to treat ventilator-dependent patients who require NO and patients with chronic or acute severe lung infections who utilize a breathing mask or similar device.

Mr. Carey joined the Beyond Air Board of Directors in February 2019. He has a significant track record of accomplishment in the biopharmaceutical and healthcare investment banking businesses. In 2020, Mr. Carey co-founded and served as President and Chief Operating Officer of ACELYRIN, INC., a biopharmaceutical company that will invest in, develop, and commercialize life-changing medical drugs. Mr. Carey was Executive Vice President and Chief Business Officer at Horizon Therapeutics plc from March 2014 to September 2019. Before joining Horizon, he was Managing Director and Head of the Life Sciences Investment Banking Group at JMP Securities for nearly 11 years. He received his BBA in Accounting from the University of Notre Dame. Mr. Carey now serves on the boards of Sangamo Therapeutics, Inc., FS Development Corp., and Hawthorne Race Course, Inc.

Opinion: Grateful Dead heads would think, how can you go wrong making nitrous oxide out of thin air? Until they came down and read the fine print. It’s nitric, not nitrous, and that’s all the difference in the world.

Beyond Air Inc. is a clinical-stage medical device and biopharmaceutical company that has a robust active pipeline of products addressing respiratory therapeutic areas, cancer, and autism spectrum disorder1. The company’s profitability and path to profitability are influenced by the success of these pipeline products. Here are some key products and their estimated dates of delivery:

Device Therapeutic Area

- Low-concentration iNO (≤80 ppm) for pulmonary treatments:

- High-concentration iNO (80 to 400 ppm) for antimicrobial treatments:

- At-home Treatment High-concentration iNO (80 to 400 ppm) for antimicrobial treatments:

Drug Therapeutic Area

- nNOS Inhibitor Neuronal nitric oxide synthase inhibitor:

- Monotherapy UNO: Ultrahigh concentration nitric oxide (>10,000 ppm):

- Combination Therapy UNO + anti-PD-1:

- Combination Therapy UNO + anti-CTLA-4:

Name: Jonathan S Gross

Position: Director

Transaction Date: 2023-12-15 Shares Bought: 120,000 Average Price Paid: $0.67 Cost: $80,400

Company: Tellurian Inc. (TELL)

Tellurian Inc. is a Houston-based Delaware corporation developing. It intends to own and operate a portfolio of natural gas, LNG marketing, and infrastructure assets, including an LNG terminal facility, an associated pipeline, other related pipelines, and upstream natural gas assets. They will pursue alternative commercial relationships with third parties across the natural gas value chain as part of our execution strategy, which includes extending our asset base. In addition, the company is exploring operations such as direct LNG sales to worldwide counterparties, LNG trading, the acquisition of additional upstream acreage, and the drilling of new wells on existing or newly acquired upstream acreage. While managing their upstream assets, they remain focused on funding and constructing the Driftwood Project and accompanying pipelines.

Jonathan Gross is an oil and gas consultant, and his company, Jexco LLC, has provided upstream exploratory geological, geophysical, and information technology services to clients with projects in domestic and foreign basins since 2009. Mr. Gross has previously held senior executive positions at Energy Partners, Ltd., Kuwait Energy Company, and Cheniere Energy, Inc. From 1999 until 2008, he was in charge of Cheniere’s exploration program and worldwide LNG sourcing. Furthermore, from 1999 to 2005, he was in charge of IT, including data management and cybersecurity. In 1981, Mr. Gross began his work at Amoco Production Company. He sat on the board of Miller Energy Resources, Inc. (2010-2012) and Cheniere Energy Partners LP Holdings LLC, a publicly traded subsidiary of Cheniere, where he was a member of the Audit and Conflicts Committees. Mr. Gross is a Certified Director, having received the NACD.DC accreditation from the National Association of Corporate Directors.

Opinion: The Founder of Cheniere Energy, Charif Souki1. started Tellurian. Charif was the highest-paid CEO in the country at one time and was credited with the vision of reversing LNG-receiving plants to exporting ones. Carl Icahn set his sites on Cheniere and forced out its egregiously paid CEO. Small wonder that Tellurian has been a disaster for its investors

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

You can be an insider, too– by clicking here

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does.

This blog is solely for educational purposes and the author’s own amusement. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,

`

`