$OXYLast week, I had two conversations with astute market watchers, one a long-time successful UBS financial wealth manager and the other, a close personal friend who bought the second charity lunch with the Oracle of Omaha. He is a lifelong fan of Warren Buffet and a long-time investor in Berkshire Hathaway. I presented them both with the same market fact- that over the last 40 years, ~40% of the overall return of the S&P 500 has been from dividends. I asked them both the same question and got nearly identical answers.

What do you think the dividend yield of the S&P 500 should be when the 10-year Treasury yield is ~5%?

The UBS Advisor said between 3%-5%. The Buffett Acolyte said 3.2% Precisely identical answers and something I would have answered the same way. According to a 2023 study by Hartford Funds, dividend income contributed an average of 41% to the total return of the S&P 500 from 1930 to 2022.

Based on that simple but powerful assumption, the S&P 500 expected dividend payout of $62.12 in n 2024, according to S&P Global, yields a paltry 1.52%. Assuming that the economy doesn’t tank and dividends are not cut, the S&P 500 would have to decline to a level around 1941 to provide a historically in-line yield of 3.2%. That would be a historic crash of 52%. The S&P 500 is trading at 2X the levels it has normally traded at when the 10-Year Treasury was this high.

A lot of weight has been given to the argument that the disproportionate 27% weighting that giant tech stocks have on the S&P is distorting the traditional dividend yield as growth stocks pay very little if any, dividends. These stocks could pay much higher dividends as their balance sheets are flush with cash. Things look a little better, but not much, when you consider the Invesco Equal Weighted ETF, RSP. That ETF pays a slightly higher 1.91% dividend on its basket of S&P 500 stocks.

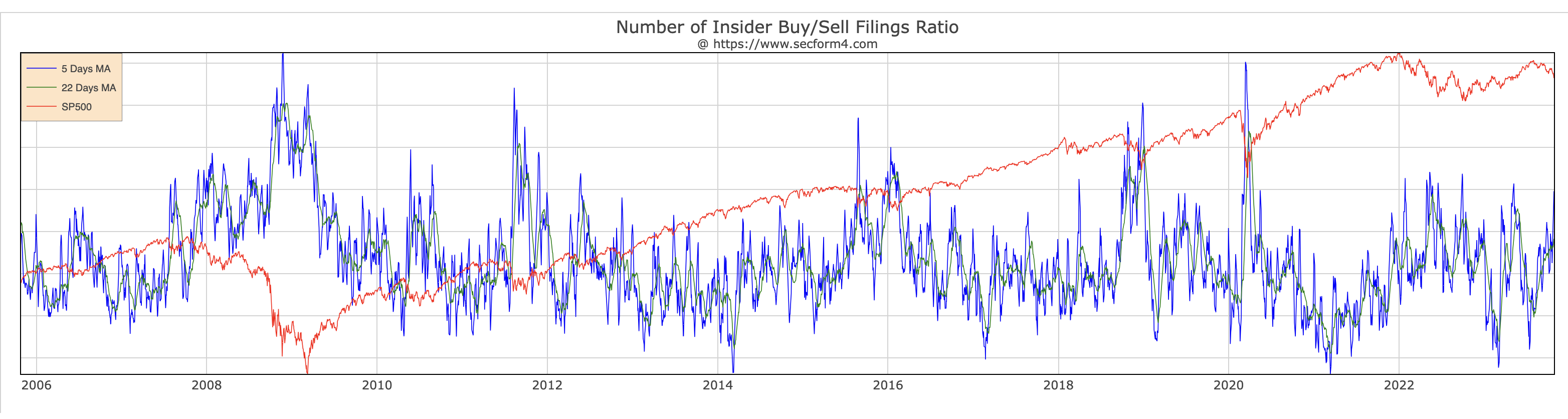

Another thing that should make investors hesitant, if they already didn’t have enough reasons, is that insider buying is anemic.

The above chart shows the S&P 500 versus a ratio of insider buying and selling. All major market corrections have ended with an exploding of insider buying. There is no evidence from insider buying that this is happening.

Name: Daryl N. Bible

Position: Sr. EVP & CFO

Transaction Date: 2023-10-25 Shares Bought: 5,000 Average Price Paid: $111.04 Cost: $555,218

Company: M&T Bank Corp (MTB)

M&T Bank Corporation is a New York business corporation registered as a financial holding company under the Bank Holding Company Act of 1956, as amended, and as a bank holding company under Article III-A of the New York Banking Law. M&T’s headquarters are at One M&T Plaza, Buffalo, New York 14203. M&T was formed in November 1969. M&T and its direct and indirect subsidiaries are referred to collectively as the Company. M&T had two completely owned bank subsidiaries on December 31, 2022: Manufacturers and Traders Trust Company and Wilmington Trust, National Association. Customers can take advantage of a wide range of retail and commercial banking, trust and wealth management, and investment services the banks provide collectively. M&T Bank represented approximately 99% of the Company’s consolidated assets as of December 31, 2022.

Daryl Bible is M&T Bank’s Chief Financial Officer, overseeing the company’s financial management. He began working for the bank in this capacity in June 2023. Daryl Bible brings three decades of banking and corporate financial experience to his new post at M&T Bank. He was previously the CFO of Truist Financial Corporation, where he created a strong track record of economic changes and operational performance. Bible joined Truist’s predecessor, BB&T, in January 2008 following a 24-year career with U.S. Bank, where he served as treasurer for ten years. Bible holds a bachelor’s and master’s degree in business administration from the University of Cincinnati, as well as a CFA® charter. Bible is a member of the CFA Society North Carolina, the CFA Society Cincinnati, the CFA Society Buffalo, and the BAI CFO Executive Roundtable.

Opinion: Where you do have outsized dividends is in the beleaguered regional banking sector. It’s hard to neglect the empty office space, and I question whether M&T Bank has reserved anywhere enough to account for that.

Name: Michael O’Grady

Position: Chairman and CEO

Transaction Date: 2023-10-23 Shares Bought: 20,000 Average Price Paid: $65.10 Cost: $1,302,000

Company: Northern Trust Corp (NTRS)

Name: Susan Cohen Levy

Position: EVP and General Counsel

Transaction Date: 2023-10-24 Shares Bought: 5,000 Average Price Paid: $64.41 Cost: $322,050

Company: Northern Trust Corp (NTRS)

Name: Jason J. Tyler

Position: EVP & Chief Financial Officer

Transaction Date: 2023-10-24 Shares Bought: 1,750 Average Price Paid: $64.12 Cost: $112,219

Company: Northern Trust Corp (NTRS)

Northern Trust Corporation is a global leader in wealth management, asset servicing, asset management, and banking solutions for organizations, institutions, families, and people. The Corporation is a financial holding corporation that operates through several domestic and international subsidiaries, including The Northern Trust Corporation. The Bank is the Corporation’s primary subsidiary and an Illinois banking corporation headquartered in Chicago. Founded in 1889, the Bank operates in the United States through its many U.S. and non-U.S. branches and subsidiaries. In 1971, the Corporation was established as a holding company for the Bank. The Corporation has offices in 25 U.S. states and Washington, D.C., as well as 23 locations in Canada, Europe, the Middle East, and Asia-Pacific.

Michael O’Grady is the Chairman and Chief Executive Officer of Northern Trust, a significant supplier of wealth management, asset service, asset management, and banking to organizations, institutions, affluent families, and individuals. Mike joined Northern Trust in 2011 after working as a managing director in the Investment Banking Group at Bank of America Merrill Lynch. He joined Merrill Lynch in 1992. Mike previously worked for Price Waterhouse. Mike has a bachelor’s degree in business administration from the University of Notre Dame and an MBA from the Harvard Graduate School of Business. He serves on the Field Museum, the Museum of Contemporary Art Chicago, Catholic Extension, and the Northwestern Medical Group Board of Directors. He also serves on the Archdiocese of Chicago’s Finance Council, the Board of Advisors of Catholic Charities, and the Civic Committee Commercial Club of Chicago.

Susan is Northern Trust Corporation’s Executive Vice President, General Counsel, Corporate Secretary, and a member of the Corporation’s Management Group. Susan is a member of the American Law Institute, the Chicago Network, the Northwestern Law Corporate Counsel Institute, the Bank Policy Institute, and the Executive Committee of the Board of Trustees of the Ravinia Festival of Chicago. Susan previously worked as the Managing Partner of the law firm Jenner & Block, LLP from July 2008 to April 2014. She was a member of the firm’s litigation department during her tenure, which began in 1982, and routinely assisted the firm’s clients on difficult commercial litigation cases. Ms. Levy graduated from Harvard Law School with a J.D. and a B.A. magna cum laude from Cornell.

Jason has previously served as Global Head of Corporate Strategy, Global Head of the Institutional Group in the Asset Management business, and Chief Financial Officer for Wealth Management at Northern Trust. Jason came to Northern Trust from Ariel Investments, where he served as Director of Research Operations and sat on the firm’s Investment Committee. Before joining Ariel, he held several positions of responsibility in Corporate Finance and Banking at American National Bank/Bank One. Jason holds an MBA from the University of Chicago Booth School of Business and a B.A. from Princeton University. Jason has previously appeared as a market analyst and contributor on Bloomberg TV, Bloomberg Radio, ABC News, PBS, and Fox Business. He serves on the boards of TreeHouse Foods, the University of Chicago Laboratory Schools, Advance Illinois, the Northwestern Memorial HealthCare Foundation, and the Joffrey Ballet, where he was previously Chairman.

Opinion: Lots of insiders are buying stock in this generational wealth manager. The generational wealthy don’t change chairs much. This looks like a timely buy at a depressed prices.

Name: Warren E Buffett

Position: 10% Owner

Transaction Date: 2023-10-23 Shares Bought: 3,921,835 Average Price Paid: $62.83 Cost: $246,408,342

Company: Occidental Petroleum Corp (OXY)

Occidental’s main businesses are divided into three reporting segments: oil and gas, chemical and midstream, and marketing. The oil and gas section discovers, develops, and produces oil, NGLs, and natural gas. The chemical segment largely manufactures and sells basic chemicals and vinyls. The midstream and marketing section acquires, markets, gathers, processes, transports, and stores oil, NGL, natural gas, CO2, and power. Occidental’s human capital resources and programs are handled by the Human Resources department, with assistance from business leaders throughout the organization. Occidental’s senior management team is responsible for establishing and monitoring the company’s culture, values, and broader human capital management practices, with oversight from Occidental’s Board of Directors, the Sustainability and Shareholder Engagement Committee of the Board, and the Environmental, Health & Safety Committee of the Board.

Warren Edward Buffett is an American businessman and philanthropist born in Omaha, Nebraska, on August 30, 1930. He is often regarded as the most successful investor of the twentieth and early twenty-first centuries. Buffett, also known as the “Oracle of Omaha,” was the son of Nebraska politician Howard Homan Buffett. After earning a B.S. from the University of Nebraska in 1950, he studied at the Columbia University School of Management under Benjamin Graham. Buffett moved to Omaha in 1956 and bought a controlling stake in textile maker Berkshire Hathaway Inc. in 1965, which he used as his primary investment vehicle.

Opinion: I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others.

Name: Robert W Stallings

Position: Director

Transaction Date: 2023-10-20 Shares Bought: 8,000 Average Price Paid: $54.54 Cost: $436,320

Company: Texas Capital Bancshares Inc (TCBI)

Texas Capital Bancshares, Inc., a Delaware business, was founded in November 1996 and began operating as a bank in December 1998. The accounts of TCBI and its fully-owned subsidiary, Texas Capital Bank, are included in the consolidated financial statements. TCBI is a bank holding company that has chosen to be a financial holding company. The company is based in Dallas, with principal banking branches in Texas’s five largest metropolitan areas: Austin, Dallas, Fort Worth, Houston, and San Antonio. The Company meets the needs of Texas-based commercial firms, entrepreneurs, and professionals by providing a customized array of financial products and services complemented by high-quality personal service. On September 6, 2022, the Company announced the sale of its insurance premium finance subsidiary, BankDirect Capital Finance, LLC, to AFCO Credit Corporation, an indirect wholly-owned subsidiary of Truist Financial Corporation.

Robert W. Stallings has been a director of Texas Capital Bancshares since August 2001, and he presently serves as the Chairman of the Board and a member of the Risk, Governance, and Nominating Committees. He is the President and CEO of Stallings Management, LLC, the Owner and Dealer Principal of Bob Stallings Hyundai in Dallas, and the Chairman and Founder of The Stallings Foundation, a Dallas-based private philanthropic organization. Stalling has previously served on the boards of The Federal Home Loan Bank of Dallas and The Goldwater Institute, a public policy think tank. He was the main Director for Crescent Realty and is well-known as an M&A strategist and expert in public market strategy. He and his wife Linda currently reside in Frisco, Texas, and they have three children and eight grandchildren.

Opinion: Stallings has been a consistent buyer of TCBI.

Name: William H Jr Rogers

Position: Chairman & CEO

Transaction Date: 2023-10-20 Shares Bought: 10,000 Average Price Paid: $28.05 Cost: $280,480

Company: Truist Financial Corp (TFC)

Truist Financial Corporation is a mission-driven financial services company dedicated to motivating and empowering people to live better lives and communities. Truist has a significant market share in many of the country’s high-growth markets. The Company provides a variety of services. Truist is a top 10 commercial bank in the United States, headquartered in Charlotte, North Carolina. Truist Bank, Truist’s largest affiliate, was established in 1872 and is the state’s oldest bank. Truist Bank offers a wide variety of banking and trust services to customers through its 2,123 locations and digital platform as of December 31, 2022.

William H. “Bill” Rogers Jr. is the chairman and CEO of Truist Financial Corporation, a mission-driven financial services company dedicated to inspiring and developing better lives and communities. Rogers was chosen chairman on March 12, 2022, and CEO on September 12, 2021, after serving as Truist’s president and chief operating officer from December 2019 to September 2021. Before that, he was the chairman and CEO of a predecessor firm from January 2012, after being named CEO in June 2011. He serves on the boards of various local and national organizations, including the Boys & Girls Clubs of America Board of Governors and Emory University’s Board of Trustees. Rogers is the Chairman of the Board of Directors of Charlotte Centre City Partners. Rogers a North Carolina native, with a bachelor’s degree in business administration from the University of North Carolina at Chapel Hill and an MBA from Georgia State University.

Opinion: It’s not a large purchase, but this is likely where the values are if you can get the balance sheet right.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

You can be an insider, too– by clicking here

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does.

This blog is solely for educational purposes and the author’s own amusement. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,