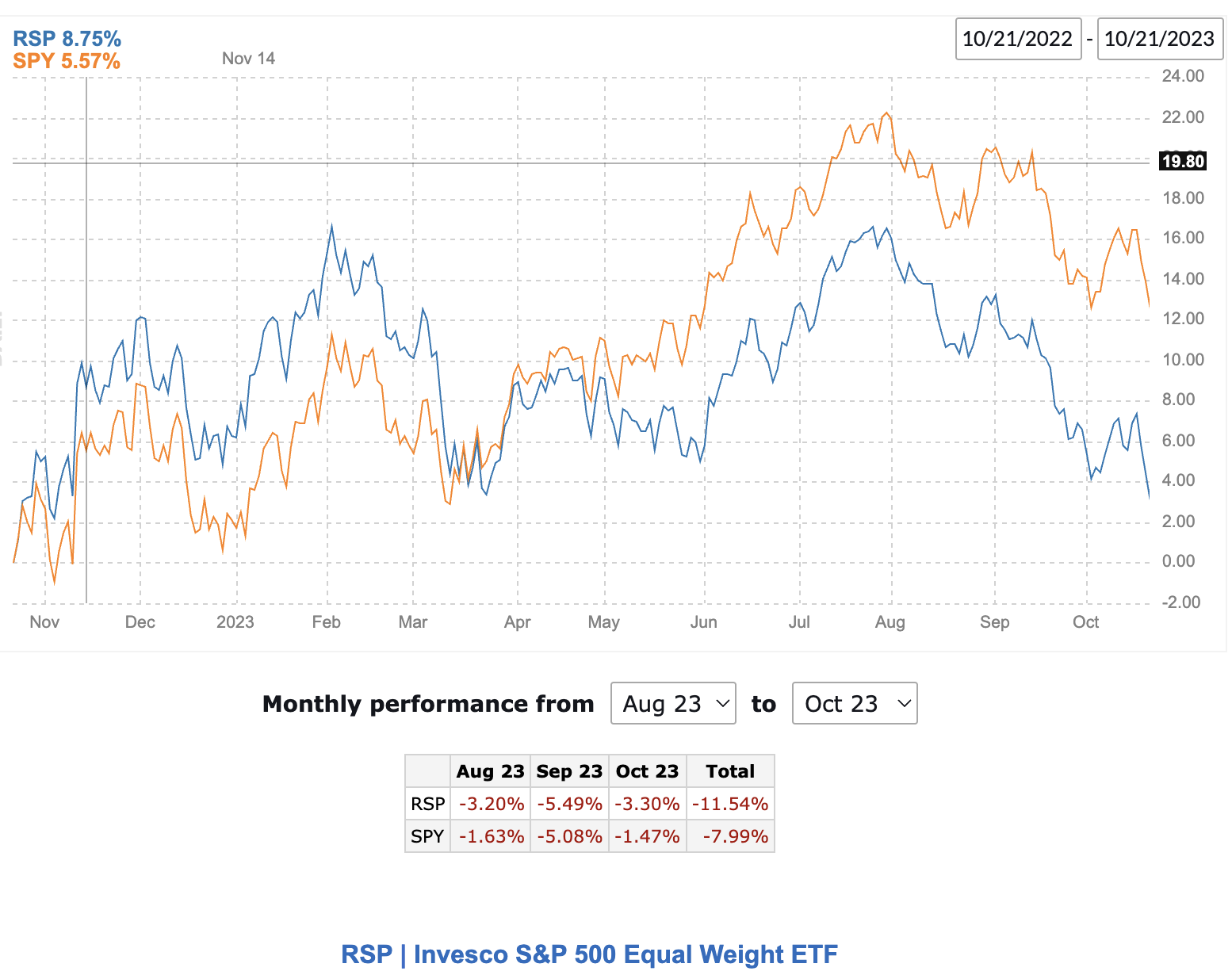

So far, 3rd quarter earnings haven’t done anything to dispel the gloom. The S&P 500 lost 2.39% last week. That’s hardly a surprise. What’s a bigger surprise is that the market is hanging on to any gains at all this year. We’ll find out how lopsided investment returns are when the tech giants report earnings this coming week. The entire S&P 500 now hangs on Microsoft, Google, Alphabet, Meta, and Amazon as the broader market is a veritable dumpster fire.

It seems like a tall order that investors continue to bid these stocks higher just because they have a lot of cash on their balance sheets or that AI will magically print profits that don’t require huge upfront capital investments. I doubt it, but one thing seems certain: the remnants of any positive returns in the market hang in the balance. October is keeping its reputation as a scary month.

You can be an insider, too– by clicking here.

Name: David S Taylor

Position: Director

Transaction Date: 2023-10-18 Shares Bought: 10,000 Average Price Paid: $33.09 Cost: $330,900

Company: Delta Air Lines Inc. (DAL)

Delta Air Lines is a legacy carrier and one of the main airlines in the United States. As a global airline headquartered in the United States, the firm connects customers worldwide while maintaining an industry-leading dedication to customer service, safety, and innovation. In 2022, demand for air travel increased dramatically beginning late in the March quarter and continued to strengthen throughout the year. They served about 177 million clients during the year. The company’s greatest competitive edge is the Delta people and culture. Their personnel create world-class travel experiences and best-in-class consumer service, resulting in customer happiness and brand preference. In 2022, they continued to invest in their people, hiring around 25,000 new team members as we rebuilt the airline.

Mr. Taylor is a Senior Operating Advisor for Clayton, Dubilier & Rice, a private investment business. From November 2021 until June 2022, he was the Executive Chairman of The Procter & Gamble Company’s Board of Directors. From 2015 to November 2021, he was President and Chief Executive Officer of Procter & Gamble; from 2016 to November 2021, he was Chairman of the Board. Mr. Taylor joined Procter & Gamble in 1980. He became Group President of Beauty, Grooming & Healthcare, Group President of Health and Grooming, Group President of Home Care, and Family Care.

Opinion: Delta is one of those names that have been crushed. Anyone who’s traveled this Summer knows airports are busy, the planes are packed, and ticket fares are borderline criminal. Why, then, do the stocks not reflect these rosy observations? Perhaps it has something to do with the fact that this is the 2nd quarter of beating and lowering expectations. The stock looks cheap, but investors aren’t buying it just yet, and I don’t see any positive catalysts on the horizon.

Name: Matthew S Kissner

Position: Interim President and CEO

Transaction Date: 2023-10-19 Shares Bought: 16,550 Average Price Paid: $30.33 Cost: $502,028

Company: John Wiley & Sons Inc. (WLY)

John Wiley & Sons Inc., formed in 1807, was incorporated in New York on January 15, 1904. Wiley is a global leader in scientific research and career-related education, unlocking human potential by enabling discovery, powering education, and influencing workforces. Wiley has driven the world’s information ecosystem for nearly 200 years. Today, their high-impact content, platforms, and services assist researchers, learners, institutions, and organizations achieve their objectives in an ever-changing environment. Wiley is primarily a digital corporation, with digital products and tech-enabled services accounting. The company has reorganized its Education lines of business into two new customer-centric segments. The Talent division provides training, sourcing, and upskilling solutions to corporate customers.

Matthew Kissner is a former Wiley Group executive and current Board Chair. He served as Wiley’s Interim CEO in 2017 and subsequently worked as an executive consultant for the company. Matt has been with Wiley for 20 years in various leadership, board, and consulting roles. He has held many executive positions at Pitney Bowes, Bankers Trust, Citibank, and Morgan Stanley and is a private equity operating partner specializing in commercial, financial, and healthcare services. Matt is also a member of the Regional Plan Association’s Board Executive Committee, a non-profit urban research and advocacy organization. Matt graduated from New York University with a Bachelor of Science in Education and a Master of Business Administration.

Opinion: I wouldn’t put much weight on a purchase from an interim CEO.

Name: N.V. Stellantis

Position: 10% Owner

Transaction Date: 2023-10-16 Shares Bought: 12,313,234 Average Price Paid: $5.68 Cost: $69,999,504

Company: Archer Aviation Inc. (ACHR)

Archer Aviation Inc. designs and develops electric vertical takeoff and landing aircraft for urban air mobility networks. The company aims to open the sky, allowing everyone to reinvent how they move and spend their time. Their eVTOL aircraft are meant to be safe, long-lasting, and silent. Midnight’s production aircraft, unveiled in November of 2022, is based on their revolutionary 12-tilt-6 aircraft arrangement. This means that it has 12 propellers attached to 6 booms on a fixed wing, with all 12 propellers providing vertical lift during takeoff and landing and the forward six propellers tilting forward to cruise position to provide propulsion during forward flight, with the wing providing aerodynamic lift like a conventional airplane. Midnight is designed to carry four passengers and a pilot for up to 100 miles at speeds of up to 150 miles per hour, although it is best suited for back-to-back short-distance excursions of around 20 miles, with a charging time of about 10 minutes between trips. The company is working with the FAA to certify Midnight in late 2024 so that they can begin commercial service in 2025.

Stellantis will collaborate with Archer to establish the company’s previously announced production plant in Covington, Georgia, where the Midnight aircraft will be manufactured in 2024. Midnight is intended to be safe, sustainable, and quiet, and it can carry four passengers, including a pilot, with a cargo of over 1,000 pounds. Midnight’s 100-mile range makes it ideal for back-to-back short-distance excursions of around 20 miles, with a charge time of about 10 minutes in between. This unique alliance in the urban air mobility industry will harness each company’s strengths and competencies to bring the Midnight aircraft to market. Archer will provide a world-class team of eVTOL, electric powertrain, and certification experts to the alliance, while Stellantis will bring innovative manufacturing technologies and expertise, experienced individuals, and finance.

Opinion: EVTOLs are coming. Joby and Archer plan to have their EVTOLs up and running in 2025 if the FAA follows through on approvals. The path to profitability is much less certain, but nimble traders should have time to sell and evaluate this later.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

You can be an insider, too– by clicking here

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone with any stock market experience pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing of any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones, but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data, so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, we analyze unusual patterns with selling, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1, are horrendously poor. Also, planned sales that pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money on which we are trying to read the tea leaves. I say generally because some 10% shareholders are great investors. Think Warren Buffett and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases, have no more idea what the future may hold than you or me. In short, you can lose money following them. We have, and we curse aloud; what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool, but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified. She probes the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does.

This blog is solely for educational purposes and the author’s own amusement. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. There are also many parts that I am not willing to share if I think it could influence trading action or be detrimental to the Fund’s partners. We could be long, short, or have no position at all in any of the stocks mentioned and express no written or implied obligation to disclose any of that.

The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in, but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,