Last August, I wrote thoughts on Denver Enercom 2022 Let The Good Times Roll. Enercom is the annual oil and gas conference in Denver in August that brings together hydrocarbon energy producers and investors, analysts, vendors, suppliers, and groups generally economically tied to the industry. The conference is free for me to attend, as I imagine it is for most. The people that pay get up on the stage and have something to say. I’ve been going to it for years, but this might be the last. The companies presented are fewer, smaller, and more speculative. Attendance has always had a strong local Denver turnout, but the business is changing, and nowhere is it more obvious than in the keynote speakers.

In the past, speakers like governors Hickenlooper and wildcatters like Harold Hamm and Cheniere LNG pioneer Charif Souki have been replaced by Republican long-shot candidate Vivek Ramaswamy running on an anti-ESG anti-woke capitalism platform. I walked out on his speech last year and as much of his partner’s speech this year. His partner, the co-founder of Strive Investment group, reminded me of Donald Trump Jr. If you yell loud enough in a room, people will think you know something. Everyone now believes that hydrocarbons contribute to CO2 in the atmosphere. We all know that the planet is warming. It’s about findings solutions and telling the transition story a lot better, not advancing a political agenda.

My favorite was J.C. Whorton, author of the book “The Flyover Nation: Energy’s Role in a Troubled Heartland”. Whorton is a frosty old geezer and a former Captain in the U.S. Army, commodities trader, and energy executive. His book discusses the challenges facing the country’s Heartland. The Government owns seventy percent of the entire Western United States. He said the U.S. is the only nation that permits individual ownership of the mineral rights to the land.

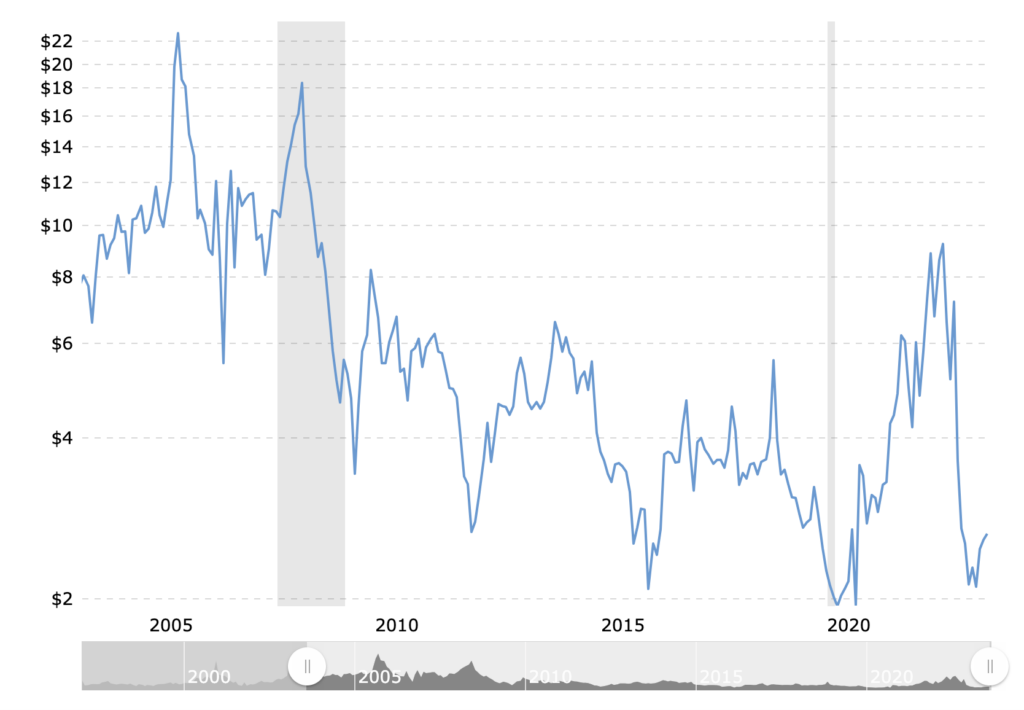

Natural Gas is at a 24-year low in price when you take out the aberration of the 2020 Pandemic.

Natural gas is so low that it is threatening the Heartland’s stable source of subsistence, oil, and gas royalty revenues. Farmers have land, and farming has become increasingly competitive with giant agricultural combines. Farmers face an existential decision to stay on an uneconomic farm or sell. Or now a new choice, mine BitCoin.

Doing a little bit of research, wondering why Bitcoin was surviving despite the Government doing everything it could to kill it. Considering all the headline risks from the SEC, normally it would cause heightened volatility. If you add farmers to the Bitcoin fan base, it adds a whole new stickier dimension. It changes the equation from fringe counter-culture and DEFI to Heartland America. It’s got the beginnings of an alternative currency and independent governance system. Of course, the grid is still largely government controlled. Who controls the grid will ultimately determine who controls the government.

https://g.co/bard/share/cc922daa759b

It’s a crying shame that attendance is down because the owners of the conference put on a great event. I’m afraid this could be the end of a near 40-year run. Investor Interest in oil and gas is low; consequently, attendance is something beyond their control, like the price of natural gas, which is at a 24-year low when you take out the aberration of the 2020 Pandemic. It’s so bad that they dropped dessert from the keynote luncheons. Even the networking event in the luxury box seats at the Colorado Rockies baseball game seemed jinxed as the home team was in last place.

Crude oil inventory is at 1985 levels even as demand has come back, according to Apache’s (APA) head of investor relations Gary Black. Gary made the argument that the whole oil and gas sector is grossly undervalued. I agree with him completely, but going to an oil and gas conference is also a great example of confirmation bias.

The Insiders Fund already has a very healthy overweight on E&P. The paltry 5% of the S&P 500 that the sector constitutes seems grossly out of line with wallet share. Valuing stocks based on wallet share metrics is not an accepted valuation method like P.E. multiples or cash flow multiples, but there is something fundamentally odd to me when a sector of the market commands only 5% weighting and the consumer spends far more than $5cts out of every dollar on transportation, heating and cooling, and the endless list of manufacturing, agriculture, and commodity products dependent on hydrocarbons.

I prefer to invest in companies when insiders are making material purchases. It’s NOT a mandate, but it does check one of the boxes. There wasn’t much of that in evidence this year.