We are deep in the darkness, the earnings blackout period in which corporate insiders are restricted from buying their own shares. It’s a perfect time for short sellers to prey on the frazzled nerves of investors that just experienced their first bank run since the Great Financial Recession of 2008. This time the run wasn’t caused by Wall Street and banks that sold liars loans to uncreditworthy customers but instead by the monetary policy of the Federal Reserve itself. Jay Powell left interest rates at zero far too long and raised them far too fast. He failed at running the machine. He needs to be fired. The economy is sputtering around the isles of the grocery store with a broken wheel in the cart, a wheel the Fed broke.

This week’s opinion pieces will be updated in time. I moved last Tuesday into a new house financed by Zions Bank. Zions has lost over 40% of its value in the short period of time between my loan application and closing. I asked the mortgage officer at the bank if it business was as usual and replied that they had a management conference call assuring them of just that. Business as usual. It will be interesting to see if there is insider buying in Zions after their earnings release on the afternoon of April 19th. The last substantive purchase by Harold Simmons was in May of 2020, during the depths of the Covid fog.

I

Name: Randall L Stephenson

Position: Director

Transaction Date: 2023-03-15 Shares Bought: 7,245 Average Price Paid: $138.05 Cost: $1,000,168

Company: Walmart Inc. (WMT)

Walmart Inc. is a people-led, technology-powered omnichannel retailer devoted to helping people all over the globe save money and live better lives – anytime and everywhere – by allowing them to purchase in retail locations and online, as well as access various service offerings. The firm strives to consistently enhance a customer-centric experience that seamlessly blends eCommerce and retail shops in an omnichannel solution that saves consumers time via innovation. The company’s objective is to simplify life for busy families, operate with discipline, polish the culture and become more digital, and turn trust into a competitive advantage. Making life simpler for busy families entails a dedication to pricing leadership, which has been and will continue to be a cornerstone of the company, as well as enhancing convenience to save consumers time.

Randall retired in January of 2021 as executive chairman of the board of AT&T Inc. Previously, he was chairman of the board and CEO of AT&T, a position he held from 2007 to July 2020 after serving as president from 2007 to September 2019. He worked for AT&T in several high-level finance, operational, and marketing roles, including a chief operating officer from 2004 until he was nominated CEO in 2007 and chief financial officer from 2001 to 2004. In 1982, he started his career at AT&T. Randall obtained his Bachelor of Science in accounting from Central State University and his Master of Accounting from the University of Oklahoma. From 2014 to 2016, he was the chairman of the Business Roundtable.

Opinion: It seems Walmart always does fine but shareholders have to be picky when they purchase. Walmart is not the supergrowth engine it was for much of its life but a staid dominant heavyweight punching above everyone’s weight class but Amazon. Pick your spots and trade this name.

Name: Linda S Harty

Position: Director

Transaction Date: 2023-03-20 Shares Bought: 5,000 Average Price Paid: $105.01 Cost: $525,038.00

Company: Chart Industries Inc (GTLS)

Name: Jillian C. Evanko

Position: President and CEO

Transaction Date: 2023-03-20 Shares Bought: 2,375 Average Price Paid: $104.29 Cost: $247,689.00

Company: Chart Industries Inc (GTLS)

Chart Industries, Inc., a Delaware business founded in 1992, is a worldwide leader in producing highly designed cryogenic equipment for use in various market applications in the industrial gas and renewable energy sectors. The distinctive product range is employed across the liquid gas supply chain, including initial engineering, servicing, and repair. The chart is a prominent producer of technology, equipment, and services relating to liquefied natural gas, hydrogen, biogas, CO2 Capture, and water treatment, among other uses, and is at the forefront of the clean energy transition. The firm maintains responsibility and transparency to team members, suppliers, customers, and communities via over 25 worldwide production facilities in the United States, Europe, China, India, Australia, and South America.

Linda Harty is an experienced board member. Her substantial broad-based expertise in finance, accounting, treasury, tax, strategy, capital allocation, and mergers and acquisitions fits Chart’s strategic objective well. Ms. Harty formerly worked for Medtronic, a multinational firm that specializes in medical technology, services, and solutions. Ms. Harty has previously held financial leadership roles at RTM Restaurant Group, BellSouth, ConAgra, and Kimberly-Clark, as well as Executive Vice President, Treasurer, and Group CFO at Cardinal Health in Columbus, Ohio. Ms. Harty received her bachelor’s and master’s degrees in finance and economics from the University of Wisconsin – Oshkosh and then studied accounting at Georgia State University. Ms. Harty also serves on the boards of Parker Hannifin, Wabtec, and Syneos Health, in addition to Chart.

Jillian Evanko has been the President and Chief Executive Officer of Chart Industries, Inc. since June 2018. Ms. Evanko joined Chart as Chief Financial Officer in February 2017. Jill joined Chart after serving as Truck-Lite Co., LLC’s Chief Financial Officer, holding several operational and financial management roles at Dover Corporation. Ms. Evanko worked in finance and operations at Arthur Andersen, LLP, Honeywell Company, and Sony Corporation before joining Dover in 2004. Ms. Evanko is an independent director of the Parker Hannifin Company Board of Directors and serves on the Chart’s Board of Directors. Jill has a Master of Business Administration from Notre Dame and a Bachelor of Science in Business Administration from La Salle University.

Opinion: Chart Industries has sold off in line with the crash in natural gas prices. They are also in the midst of digesting recent acquisitions and this is usually messy. These look like opportunistic buys at recent lows, already substantially higher in price.

Name: Lawrence A. Hilsheimer

Position: EVP and CFO

Transaction Date: 2023-03-17 Shares Bought: 3,600 Average Price Paid: $69.40 Cost: $249,832.00

Company: Greif Inc (GEF)

Greif, Inc. is the leader in the world when it comes to making and selling industrial packaging products and services. The company has operations in more than 35 countries. There are steel, fiber, and plastic drums, rigid intermediate bulk containers, closure systems for industrial packaging products, transit protection products, water bottles, and remanufactured and reconditioned industrial containers. There are also services like container life cycle management, filling, logistics, warehousing, and other packaging services. In North America, corrugated materials like containerboard, corrugated sheets, corrugated containers, and other corrugated materials are made and sold to customers in industries like packaging, automotive, food, and construction.

Mr. Hilsheimer has been a member of the board of directors since October 2020. Mr. Hilsheimer has been the Executive Vice President and Chief Financial Officer of Greif, Inc., an industrial manufacturing firm, since May 2014. From April 2013 to April 2014, Mr. Hilsheimer was the Executive Vice President and Chief Financial Officer of The Scotts Miracle-Gro Company, which makes consumer gardening products all over the world. From October 2007 to March 2013, Mr. Hilsheimer held different executive positions at Nationwide Mutual Insurance Company. He started as EVP/CFO, then became President and Chief Operating Officer of Nationwide Direct and Customer Solutions, where he was in charge of direct-to-consumer sales and service, Nationwide Bank, and Nationwide Better Health. After that, he became President and Chief Operating Officer of Nationwide Retirement Plans, where he is still in charge.

Opinion: Insiders have been consistently on the wrong side of the trade at Greif. This recent price collapse looks like a good set up for a change.

Name: Bernard J. Clark

Position: MD, Head of Adivsor Services

Transaction Date: 2023-03-17 Shares Bought: 5,000 Average Price Paid: $54.83 Cost: $274,154

Company: Schwab Charles Corp (SCHW)

Name: Gerri Martin-Flickinger

Position: Director

Transaction Date: 2023-03-17 Shares Bought: 3,700 Average Price Paid: $54.16 Cost: $200,396

Company: Schwab Charles Corp (SCHW)

Charles Schwab Corporation is a bank holding corporation. Wealth management, securities brokerage, banking, asset management, custody, and financial advisory services are all provided by CSC. Individual investors may use the Investor Services section for retail brokerage, investment advising, banking and trust services, retirement plan services, and various corporate brokerage services. The Advisor Services sector offers custodial, trading, banking and trust, and support services to independent registered investment advisers, independent retirement advisors, recordkeepers, and retirement business services. CSC relocated its corporate headquarters from San Francisco, California, to Westlake, Texas, effective January 1, 2021. The Firm has a statewide presence via a network of branches, operations centers, and various overseas sites, with the Westlake facility serving as a strategically positioned hub.

Bernard J. Clark is Charles Schwab’s Executive Committee member and the Managing Director, Head of Advisor Services. Clark has over 30 years of expertise servicing individual and institutional clients in the financial business. In 1998, he joined Schwab as Senior Vice President of Trading and Operations for Schwab Institutional. Afterward, he worked in retail as the client services leader before returning to the adviser sector to run the sales and relationship management department. In 2010, he was appointed to his present position as CEO of Schwab Advisor Services. Clark is a member of the Foundation for Financial Planning’s board of directors and the Arizona State University W.P. Carey School of Business’s Center for Services Leadership. Clark graduated from St. John’s University in New York with a Bachelor of Science in accounting.

Ms. Martin-Flickinger formerly worked as Executive Vice President and Chief Technology Officer of Starbucks Corporation, a coffeehouse chain, and coffee roasting firm, from 2015 until 2021. Before joining Starbucks in 2015, Ms. Martin-Flickinger was Senior Vice President and Chief Information Officer of Adobe Inc., a computer software firm. She managed aspects of Adobe’s technological transition to a cloud-based subscription services business from 2006 to 2015. She formerly held the positions of Chief Information Officer at VeriSign, Inc., Network Associates, Inc., and McAfee Associates, Inc. She started her career with Chevron Company, rising through the ranks. From 2018 to 2019, Ms. Martin-Flickinger was a member of the Board of Directors of Tableau Software, Inc., a computer software firm bought by salesforce.com, inc. The term of Ms. Martin-Flickinger concludes in 2023.

Opinion: Ground zero for the recent debate on available for sale and held to maturity in classifications for bank assets. This is accounting semantics and wizardry. The answer to why banks don’t pay more on their deposits, is that they can’t. Too many have invested in long duration treasury and agency bonds that are 20% underwater or more thanks to the Powell chameleon like transformation into Paul Volker. This should impact Schwab’s earnings less than most banks but time will tell. Lots of insider buying in this name betting significant sums that Mr. Market has overreacted.

Name: Robert L Antin

Position: Director

Transaction Date: 2023-03-16 Shares Bought: 18,000 Average Price Paid: $30.22 Cost: $543,899.00

Company: B. Riley Financial Inc. (RILY)

Name: Randall E Paulson

Position: Director

Transaction Date: 2023-03-17 Shares Bought: 10,000 Average Price Paid: $29.90 Cost: $298,991.00

Company: B. Riley Financial Inc. (RILY)

Name: Bryant R Riley

Position: Chairman and Co-CEO/10% Owner

Transaction Date: 2023-03-17 Shares Bought: 25,000 Average Price Paid: $29.90 Cost: $747,463.00

Company: B. Riley Financial Inc. (RILY)

Investment banking, brokerage, wealth management, asset management, direct lending, business advisory, valuation, and asset disposition services are provided by B. Riley Financial Inc to a diverse client base that includes public and private companies, financial sponsors, investors, financial institutions, legal and professional services firms, and individuals. The Company invests in and buys businesses or assets with attractive risk-adjusted return profiles to benefit its shareholders. The corporation owns and operates multiple unrelated consumer companies and makes significant brand investments. The business’s strategy is centered on high-quality companies and assets in areas where the Company has substantial understanding and can use that knowledge to increase operational efficiencies and optimize free cash flow. The financial, restructuring, and operational knowledge of the employees who collaborate across disciplines is often used in the Company’s direct investments.

Robert L. Antin has been a member of the Board of Directors since June 2017. Mr. Antin co-founded VCA Inc., a national animal healthcare firm that offers veterinarian services, diagnostic testing, and a wide range of medical technology products and services to the veterinary industry. Mr. Antin has been the President and Chief Executive Officer of VCA Inc. since its founding in 1986. Mr. Antin was also the Chairman of the Board of VCA, Inc. from its establishment until its purchase in September 2017. Mr. Antin was an American Medical International, Inc. officer, a healthcare facility owner, and an operator from July 1978 until September 1983. Mr. Antin graduated from Cornell University with an MBA and a hospital and health management certification. Mr. Antin’s senior leadership expertise is a valuable asset to the Board.

Mr. Paulson has been a member of the Board of Directors since June 18, 2020. Mr. Paulson now serves on the boards of Testek Inc. and Dash Medical Holdings, LLC, and formerly on the boards of EAG, Inc. (2008-2017) and L-com, Inc. (2012 – 2016). Odyssey Investment Partners, LLC’s portfolio firms include Testek, EAG, and L-com, for which he acts as a Special Adviser. Mr. Paulson resigned as Odyssey’s Managing Principal in 2019 after serving in that role since 2005. Before joining Bear Stearns, Mr. Paulson worked in GE Capital’s commercial banking business. Mr. Paulson, a native of Minnesota, earned a BSB in Accounting from the University of Minnesota and an MBA from Northwestern University’s Kellogg Graduate School of Management.

Bryant R. Riley has been the company’s Chairman and Co-Chief Executive Officer since June 2014 and July 2018, respectively, and a director since August 2009. From June 2014 until July 2018, he was also Chief Executive Officer. From May 2021, he served as Chairman of B. Riley Principal 250 Merger Corp. From November 2019 through October 2021, Mr. Riley was the director of Select Interior Concepts, Inc. Mr. Riley graduated from Lehigh University with a B.S. in Finance. Mr. Riley’s experience and skills in investment banking provide the Board with unique capital market information. Mr. Riley’s significant expertise in serving on the boards of other public companies is a valuable resource for the Board.

Opinion: I have never quite understood the business model of this boutique investment bank formed out of the merger of National Holdings and and FBR. They seem to be everywhere doing everything at once and it makes me nervous. Bryan Riley, though, is all in buying $millions of his namesake company at much higher prices.

Name: Gregory B Maffei

Position: President, CEO

Transaction Date: 2023-03-16 Shares Bought: 50,000 Average Price Paid: $26.71 Cost: $1,335,515

Company: Liberty Media Corp (LSXMA)

The Liberty SiriusXM Group operates in the entertainment industry in the United States and Canada via its companies. It provides music, sports, entertainment, comedy, chat, news, traffic, and weather channels, as well as podcast and infotainment services through proprietary satellite radio systems and via apps for mobile and home devices and other consumers’ electronic equipment. It also provides connected vehicle services, as well as a suite of data services such as graphical weather, fuel prices, sports schedules and scores, and movie listings; and traffic information services, which provide information such as road closures, traffic flow, and incident data to consumers with compatible in-vehicle navigation systems, as well as real-time weather services in vehicles, boats, and planes.

Maffei is the President and CEO of Liberty Media Corporation, which owns media and entertainment companies such as Formula 1, SiriusXM, and the Atlanta Braves, as well as a stake in Live Nation Entertainment. Maffei is also the Executive Chairman of Qurate Retail, Inc., which includes digital commerce brands such as QVC, HSN, Zulily, and Cornerstone Brands. Maffei is also the Chairman of Liberty-affiliated firms Live Nation Entertainment, SiriusXM, and TripAdvisor and a Director of Charter Communications and Zillow. Maffei is a member of the Dartmouth College Board of Trustees and the Council on Foreign Relations. He has an MBA from Harvard Management School and an AB from Dartmouth College, where he was a Baker Scholar.

Opinion: How do you say “catch a falling knife”?

Name: James M Jr Garnett

Position: Director

Transaction Date: 2023-03-21 Shares Bought: 10,000 Average Price Paid: $26.50 Cost: $265,000.00

Company: Bankwell Financial Group Inc. (BWFG)

Bankwell Financial Group, Inc. is a Bank holding company based in New Canaan, Connecticut, providing various financial services. The Bank offers a comprehensive variety of services to customers in the market, encompassing a 100-mile radius surrounding the branch network. Moreover, the Bank seeks commercial loan possibilities outside of the market, especially in areas where the Bank has strong contacts. The Bank has locations in Connecticut, including New Canaan, Stamford, Fairfield, Westport, Darien, Norwalk, and Hamden. The Bank wants to be the preferred banking service and a viable alternative to the bigger rivals. The Bank aims to develop a brand with a significant market share and continuous revenue growth supported by operational improvements. The Bank believes this will result in excellent risk-adjusted returns for the shareholders.

James M. Garnett, Jr. is the Company’s, Independent Director. After 18 years as a managing director at Citigroup Inc., James M. Garnett retired in 2016. On April 25, 2018, he was named to the Board of Directors of the Business and the Bank. He was the global head of Risk Architecture for fifteen years, overseeing credit, market, liquidity, and operational risks across all of Citigroup’s companies and countries. His duties included overseeing all risk systems and technology, risk analytics and stress testing, performance reporting, risk appetite assessment, policies, and regulatory capital. Mr. Garnett’s decades of substantial expertise in the financial services sector, regulatory interactions, and operational hazards offer the Company’s Board deep and wide knowledge of the current and future companies.

Opinion: A bank, need we say more?

Name: Aj Teague

Position: Co-Chief Executive Officer

Transaction Date: 2023-03-20 Shares Bought: 15,935 Average Price Paid: $25.15 Cost: $400,765.00

Company: Enterprise Products Partners L.P. (EPD)

Enterprise Products Partners L.P. is a Delaware limited partnership that is traded on the public market. Its common units trade on the New York Stock Exchange under the ticker code “EPD.” The preferred units of the corporation are not publicly traded. In April 1998, the company was set up to own and run some EPCO natural gas liquids operations. It is a prominent North American supplier of midstream energy services to producers and consumers of natural gas, NGLs, crude oil, petrochemicals, and refined products. From an economic standpoint, the corporation is held by limited partners. The partnership is managed by Enterprise GP, which has a non-economic general partner stake in the company. EPO and its consolidated subsidiaries handle the majority of the company’s business activities.

Mr. Teague has been a director of Enterprise GP since November 2010 and has served as Co-Chief Executive Officer since January 2020. He is also a member of the Capital Projects Committee. Mr. Teague was Chief Executive Officer of Enterprise GP from January 2016 to January 2020, Chief Operating Officer from November 2010 to December 2015, and Executive Vice President from November 2010 to February 2013. From November 1999 to November 2010, he was Executive Vice President of EPGP, as well as a director from July 2008 to November 2010, and Chief Operating Officer from September 2010 to November 2010.

Opinion: Major oil and gas infrastructure company paying out over 7.5% dividend yield. This looks like a buy to me but Energy Transfer pays out a little more and has millions of Chairman Kelcy dollars buying ET stock.

Name: Scott B Helm

Position: Director

Transaction Date: 2023-03-17 Shares Bought: 11,000 Average Price Paid: $24.72 Cost: $271,920

Company: Vistra Corp. (VST)

Vistra is a holding corporation that primarily serves regions across the United States with integrated retail and electric power-generating operations. Through its subsidiaries, the Company engages in competitive energy operations such as producing electricity, selling and acquiring energy at wholesale prices, managing commodity risk, and selling electricity and natural gas to end users. Delaware legislation was used to create the Company in 2016. To set itself apart from businesses engaged in the exploration, production, refining, or transportation of fossil fuels as well as to more accurately reflect its integrated business model, which combines a retail electricity and natural gas business devoted to providing its customers with cutting-edge products and services with an electric power generation business operating at the forefront of the industry.

Scott Helm Private investor located in Baltimore. Since 2017 he serves as the Board of Directors Chair for Vistra Energy. Helm previously served as a founding partner of Energy Capital Partners, a private equity company that specialized in making investments in the energy infrastructure of North America. He worked for Orion Power Holdings, Inc., a publicly traded firm that owned and ran power plants, as executive vice president and chief financial officer before joining Energy Capital Partners. Before that, he served as a consultant to the private equity group in charge of Texas Genco’s acquisition. Helm started his career at Goldman Sachs & Co., initially working in the fixed-income department before switching to the investment banking department. He graduated from Washington University with a bachelor’s degree in business administration. Helm holds the position of treasurer on the Chesapeake Shakespeare Company’s board.

Opinion: Likely settlement with ERCOT should lift this stock. We like electric utilities as EV usage will increase demand far above historic rates.

Name: Jeffrey Gould

Position: CEO

Transaction Date: 2023-03-21 Shares Bought: 17,417 Average Price Paid: $18.83 Cost: $327,931.00

Company: BRT Apartments Corp.(BRT)

Name: Matthew J Gould

Position: Senior Vice President

Transaction Date: 2023-03-21 Shares Bought: 17,417 Average Price Paid: $18.83 Cost: $327,931.00

Company: BRT Apartments Corp.(BRT)

BRT Apartments Corp. is an internally managed real estate investment trust, or REIT, that specializes in the acquisition, management, and, to a lesser extent, the development of multifamily properties. The company’s primary interests include multifamily property ownership, management, and development. The company typically owns multifamily properties like townhomes, mid-rise apartments, or garden apartments that offer residents access to amenities like a clubhouse, swimming pool, laundry rooms, and cable television. The typical length of a residential lease is one year, and security deposits up to the amount of one month’s rent may be required. These properties have a large percentage of their units leased at market rates.

Jeffrey A. Gould now holds the positions of Director and Senior Vice President of One Liberty Properties, Inc., President, Chief Executive Officer, and Director at BRT Apartments Corp. In addition, Mr. Gould serves as managing general partner at Gould Investors LP, principal at UJA-Federation of New York; member of Young Presidents’ Organization, Inc., World Presidents’ Organization, and Chief Executives Organization, Inc.; principal at Federation Employment & Guidance Service, Inc.; director and senior vice president at Georgetown Partners, Inc.; and member-New York Finance Committee at Real Estate Board of New York, Inc.

Matthew J. Gould has served as the CEO of 5 separate organizations. He currently holds the positions of Chairman of Gould Investors LP, Director and Senior Vice President of Majestic Property Management Corp., Chairman and Chief Executive Officer of Georgetown Partners, Inc., Chief Executive Officer of Rainbow Realty Group LLC, and Chief Executive Officer of Rainbow MJ Advisors LLC. Majestic Property Management Corp. is a subsidiary of Gould Investors LP. In addition, Mr. Gould serves as chairman of One Liberty Properties, Inc., director and senior vice president of BRT Apartments Corp., and senior vice president of REIT Management Corp. He is also on the boards of Sportsvite LLC and Halsa Holdings LLC. Both the University of Michigan and Yeshiva University awarded Mr. Gould undergraduate and graduate degrees.

Opinion: People have to live somewhere and with housing prices at mortgage rates at recent record highs, apartment REITs should be enjoying the best of times. Instead the headlines are reflecting rental rates coming down amidst an overbuilding boom bust cycle. Real estates is notoriously local and I bet that Gould knows their local market better than the market.

Name: Joseph W III Craft

Position: President And Chief Executive/10% Owner

Transaction Date: 2023-03-16 Shares Bought: 148,741 Average Price Paid: $18.49 Cost: $2,749,523.00

Company: Alliance Resource Partners LP (ARLP)

Alliance Resource Partners LP is a diversified natural resource company that generates operating and royalty income from coal production and marketing to major domestic and international utilities and industrial users, as well as from oil and gas mineral interests located in strategic producing regions throughout the United States. The company’s major goal is to maximize the value of its current mineral assets, both in terms of coal output from mining assets and leasing and development of coal and oil & gas mineral holdings. Moreover, the firm is positioned as a dependable energy supplier for the future by pursuing possibilities promoting energy expansion and associated infrastructure.

Joseph W. Craft III has been President, Chief Executive Officer, and Director since August 1999 and has served as Chairman of the Board of Directors since January 1, 2019. He also owns the general partner indirectly. Mr. Craft has previously served as President of MAPCO Coal Inc. since 1986. Mr. Craft is a Director and former Chairman of the Kentucky Chamber of Commerce and a Director and member of the United States Chamber of Commerce’s Executive Committee. Mr. Craft graduated from the University of Kentucky with a Bachelor of Science in Accounting and a Juris Doctorate. Mr. Craft is also an Alfred P. Sloan School of Management graduate of the Massachusetts Institute of Technology’s Senior Executive Program.

Opinion: Coal is back baby so so must President and CEO Craft be thinking. Can they keep up the 13.8% dividend yield? It looks like they can unless the Government shuts them down because we love the lithium economy but one day we may wonder if we just substituted one scarce resource for another.

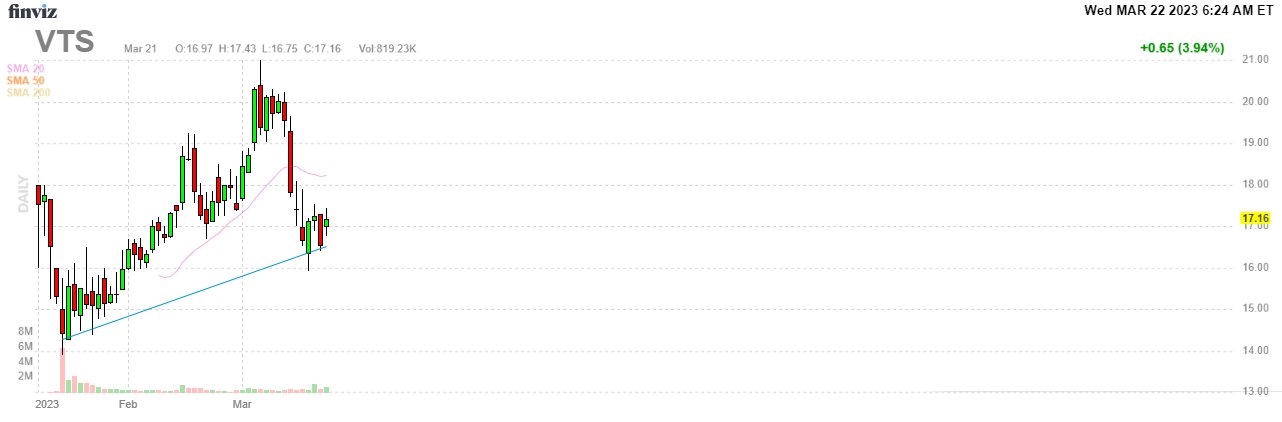

Name: Joseph S Steinberg

Position: Director

Transaction Date: 2023-03-22 Shares Bought: 158,000 Average Price Paid: $16.99 Cost:$2,684,420

Transaction Date: 2023-03-16 Shares Bought: 42,000 Average Price Paid: $16.97 Cost: $712,544

Company: Vitesse Energy Inc. (VTS)

Vitesse Energy Inc is an independent energy firm that focuses on repaying cash to investors by holding financial interests in oil and natural gas wells as a non-operator. The firm acquires, develops, and produces non-operated oil and natural gas assets in the United States, normally operated by premier oil corporations, especially in the Bakken and Three Forks formations of North Dakota and Montana’s Williston Basin. Since its establishment, the firm has amassed a substantial and diverse asset base via property purchases, development operations, and the installation of unique non-operating platforms and procedures that use large data resources.

Mr. Joseph S. Steinberg is the Chairman, President, and CEO of NZCH Corp., an Independent Director of Crimson Wine Group Ltd., the Chairman of Jefferies Financial Group, Inc., the Chairman of Olympus Reinsurance Co. Ltd., and the Chairman of Vitesse Oil LLC. Mr. Steinberg has previously worked as an Independent Director for Pershing Square Tontine Holdings Ltd., a Non-Executive Chairman for Fidelity & Guaranty Life, Inc., a Chairman & Chief Executive Officer for HRG Group, Inc., an Independent Director for Mueller Industries, Inc., a Non-Executive Director for Fortescue Metals Group Ltd., a President & Director for FINOVA Group, Inc., a Chairman for Home He attended New York University for his undergraduate studies and Harvard Business School for his MBA.

Opinion: You don’t hear about many IPOs these days so its kind of striking that we have an oil and gas spinoff. Merchant bank Jeffries let’s go one of its jewels. Steinberg is a scary smart investors so I would be a buyer.

Name: Christopher O Blunt

Position: President & CEO

Transaction Date: 2023-03-23 Shares Bought: 15,000 Average Price Paid: $16.32 Cost: $244,725.00

Company: F&G Annuities & Life Inc. (FG)

F&G Annuities & Life, Inc. offers fixed annuities as well as life insurance. It caters to both retail annuity and life insurance consumers as well as institutional clients. The company was established in 1959 and is based in Des Moines, Iowa. F&G Annuities & Life, Inc. is a division of Fidelity National Financial, Inc.

Chris Blunt joined F&G in 2019 after working in insurance, investment management, and wealth management for 33 years. He most recently served as Chief Executive Officer of Blackstone Insurance Solutions, following nearly 13 years in a range of executive leadership roles at New York Life. Chris is a trustee of the American College of Financial Services and a member of the YMCA of Greater New York’s board of directors.

Opinion: Peter Lynch liked spinoffs and this is one management likes. Bear markets and rising interest rates are good for annuities and life insurance companies.

Name: Noah Knauf

Position: Director

Transaction Date: 2023-03-16 Shares Bought: 208,531 Average Price Paid: $14.43 Cost: $3,008,683.00

Company: Hippo Holdings Inc. (HIPO)

Hippo is a unique home security firm created from the bottom up to deliver a new level of care and safety for homes. The company’s objective is to make houses safer and more secure so that consumers may spend less time worrying about the responsibilities of homeownership and more time enjoying their homes and the lives they lead. The comapny established a comprehensive home safety platform by combining real-time data, smart home technologies, and a growing array of home services. The house insurance sector has traditionally been characterized by century-old incumbents who provide policyholders with a passive, high-friction experience. The sector has not experienced major innovation in decades, owing to outmoded captive-agent distribution strategies, massive bases of current consumers, obsolete technology, and strong incentives not to disrupt their operations.

Noah Knauf has been a board of directors member since July of this year. Mr. Knauf specializes in high-growth technology investments, particularly emphasizing healthcare, finance, gaming, and frontier technology. He is a director of N3twork, Nurx, and Relativity Space. He is also an active investor in BYJU, Hyperscience, and Locus. Mr. Knauf was a Managing Director at private equity company Warburg Pincus from June 2006 until June 2016, where he contributed to around twenty investments in growing firms over nine years. He earned an MBA from Stanford Graduate School of Management as an Arjay Miller scholar and a BS in Business Administration from the University of Arizona.

Opinion: I would wait until this company makes money.

Name: Roland O Burns

Position: President & CFO

Transaction Date: 2023-03-15 Shares Bought: 20,000 Average Price Paid: $9.95 Cost: $198,988.00

Company: Comstock Resources Inc. (CRK)

Comstock Resources Inc is a significant independent natural gas producer focused on the Haynesville shale, a top natural gas region in North Louisiana and East Texas with better economics due to its proximity to Gulf Coast markets. The firm concentrated on building wealth by developing a large inventory of highly profitable and low-risk drilling possibilities in the Haynesville and Bossier shales. The majority of oil and gas activities are centered in Louisiana and Texas.

Roland O. Burns has been President of the company since 2013, Chief Financial Officer since 1990, Secretary since 1991, and a director since 1999. Mr. Burns was the Senior Vice President from 1994 to 2013 and the Treasurer from 1990 to 2013. Mr. Burns worked for Arthur Andersen, a public accounting company, from 1982 until 1990. Mr. Burns spent most of his time at Arthur Andersen in the firm’s oil and gas audit division. From its inception in 2004 until its merger with Stone Energy Corporation in 2008, Mr. Burns served as a director, Senior Vice President, and Chief Financial Officer of Bois d’Arc Energy, Inc. Mr. Burns earned his B.A. and M.A. degrees in 1982 from the University of Mississippi and is a Certified Public Accountant.

Opinion: I wonder if Jerry Jones thinks this is a better investment now than the Dallas Cowboys? I doubt it. We are nursing large losses in this name but are long term believers in natural gas in America.

Name: Jeffrey L. Swope

Position: Director

Transaction Date: 2023-03-20 Shares Bought: 70,000 Average Price Paid: $7.16 Cost: $501,473

Company: Piedmont Office Realty Trust Inc. (PDM)

Name: Kelly Hefner Barrett

Position: Director

Transaction Date: 2023-03-20 Shares Bought: 10,000 Average Price Paid: $7.05 Cost: $70,544

Company: Piedmont Office Realty Trust Inc. (PDM)

Piedmont Office Realty Trust, Inc. is a Maryland corporation that operates in such a way that it qualifies as a real estate investment trust for federal income tax purposes. The company owns, manages, develops, redevelops, and operates high-quality Class A office properties primarily in major U.S. Sunbelt markets. Piedmont was founded in 1997 and began operations the following year. In addition to operational excellence, the firm strongly emphasizes environmental sustainability measures at the sites, as explained below. For the second year, the firm was recognized as Energy Star Partner of the Year in 2022 and a 2022 Green Lease Leader by the Institute for Market Transformation and the US Department of Energy’s Better Buildings Alliance.

Jeffrey L. Swope has served as a director of Piedmont since 2008. He is the Founder, Managing Partner, and Chief Executive Officer of Champion Partners Ltd., a countrywide developer and investor in office, industrial, and retail buildings since 1991. Mr. Swope co-founded Centre Development Co., Inc. and Champion Private Equity, a private real estate financing and investment firm. He is the founding Chair of The Real Estate Council and the Real Estate and Finance Center at the University of Texas, as well as a Trustee of the Urban Land Institute and Director of the ULI Foundation. Mr. Swope is a Hall of Fame Member of the University of Texas McCombs School of Business and the Dallas Board of Commercial Developers. He is also a member of the University of Texas at Austin Business School Advisory Board and a Trustee of the Business School Foundation.

Kelly H. Barrett has been a Piedmont director since 2016. Ms. Barrett worked for The Home Depot for sixteen years before retiring in 2018, holding positions such as Senior Vice President — Home Services, Vice President of Corporate Controller, Senior Vice President of Enterprise Program Management, and Vice President of Internal Audit and Corporate Compliance. Before joining The Home Depot, Ms. Barrett worked for Cousins Properties Corporation for eleven years in different financial responsibilities, eventually becoming Chief Financial Officer. She was actively engaged in the National Association of Real Estate Investment Trusts at the time, serving as the Accounting Committee Co-Chairperson and a member of the Best Financial Practices Council and the Real Estate Group of Atlanta. She has been a certified public accountant in Georgia for over thirty years.

Opinion:

Name: Jonathan Aaron Coblentz

Position: CFO & Chief Admin Officer

Transaction Date: 2023-03-16 Shares Bought: 100,000 Average Price Paid: $3.26 Cost: $326,100

Company: Oportun Financial Corp. (OPRT)

Oportun Financial Corp is a digital banking platform that helps its users achieve their financial objectives by putting those goals within reach. The capabilities of the organization, which include intelligent borrowing, saving, budgeting, and spending, provide members the assurance they need to construct a more secure financial future for themselves. The firm believes that it is well positioned for long-term development since the products have been purposefully designed to assist in resolving the problems with financial health that most individuals in the United States experience.

Jonathan has been with Oportun since 2009. He formerly served as MRU Holdings’ chief financial officer and treasurer from 2007 to 2009, and he has also worked at Fortress Investment Group, Goldman Sachs, and Credit Suisse First Boston. Jonathan proudly completes the New York Times crossword puzzle every day, in addition to completing financial riddles. Jonathan Aaron Coblentz graduated from Yale University.

Opinion: What better mousetrap does this company have?

Name: Brian Yee

Position: Director

Transaction Date: 2023-03-16 Shares Bought: 656,067 Average Price Paid: $2.03 Cost: $1,330,989

Company: Wag! Group Co. (PET)

Wag! Group Co. creates and maintains a unique marketplace technology platform accessible as a website and mobile app and connects independent pet caretakers with pet owners. The platform enables pet owners needing specialized pet care services, such as dog walking, pet sitting, and boarding, to get guidance from registered pet specialists, home visits, training, and access to other services. The firm was established in 2015 and is headquartered in Purchase, New York.

Brian Christopher Yee works as a Partner at ACME Capital and serves on the boards of six other firms. Mr. Yee formerly worked as an Associate for Goldman Sachs & Co. LLC and as an Associate for General Atlantic LLC. He graduated from Georgetown University with a bachelor’s degree.

Opinion: I like Wags. I use them for my cats. That doesn’t mean I’m a buyer of the stock but am certainly more inclined to buy things that I actually use.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data so I like people that eat what they kill.

The bar is different from selling because the natural state of management is to be a seller. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs, referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under this corporate welfare loophole. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on. I say generally because some 10% shareholders are great investors. Think Warren Buffett, Icahn, and others

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have and we curse aloud, what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

A big callout to my assistant Ambreen who sets up this conversation by listing the notable buys that I’ve identified. She probs the 10k for a reasonable description of the business. I’ve found that to be the most accurate and succinct place to find out what a business actually does. The websites and marketing material are just that, poorly disguised marketing material for many. I should know that better than most if you at my past involvement in building the 1st websites for many Fortune 500 companies.

No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full-time to managing my personal investments. Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that.

This blog is solely for educational purposes and the author’s own amusement. Don’t rely on this blog. Think of the blog as part of my personal investment journal that I am willing to share with the DIY investor. We welcome your comments on our analysis but please do your own research. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND prefers to invest in companies at or near prices that management has been willing to invest significant amounts of their own money in but we have no requirement to do so. We also invest in many companies in anticipation of future insider buying or with the expectation that there is none at all.

You can be an insider, too– by clicking here

Prosperous Trading,

Company: Vitesse Energy Inc. (VTS) Director Joseph bought over 3 million dollars of stock in the last half of March. Some info on Vitesse: The company has declared a $0.50 per share quarterly cash dividend for Q1 2023. Impressively, 2022 saw a 682% increase in net income to $118.9 million, alongside a 4% growth in daily oil production and a 58% increase in Adjusted EBITDA ($167.6 million). These strong financial/operational results demonstrate the company’s improved profitability and growth. Predictions in the natural gas industry are that of high supply and lower demand for the year. Predictions up to 2050 are positive on the natural gas industry as it has no perfect replacement. Stock is up 14.18% in the past 5 days. Analysts are rating it as a strong buy with price targets in the low 20s.

[…] don’t trust him. Raising interest rates like this is akin to bleeding the patient. I’ve blogged about this quite a […]