A miserable week, down 3.46% for the bulls ended on a positive note on Friday. The narrative that the bottom was in now seems shaky as stalwarts AMZN, APPLE, MICROSOFT, ALPHABET, and FACEBOOk all plumb new lows. One thing for certain, the hurdle rate for stocks and all things investment-related is much higher. The 10 Year Treasury yield of nearly 4.5% and the Prime rate of 7% are the new realities. We ain’t going back anytime soon to the halcyon days of near-zero interest rates.

I keep repeating my mantra- All bear markets in the last 20 years have ended with a crescendo of insider buying. I wish I could say we were seeing it, but we’re not. As you can see from the cadence of these reports and the lack of notable buying, we are nowhere near such a cathartic moment. But finally, there is a slight uptick in buying. Read on to find out where and if we are partaking. The Insiders Fund last week’s biggest moves were not in stocks that insiders were buying at all but instead in guns and gas. We made large purchases in military drone manufacturer Kratos and Carl Icahn-backed natural gas producer, Sand Ridge Energy., none of which had recent or timely insider buying. Just a reminder that The Insiders Fund is not the same as The Insiders Report. We prefer to invest in companies where management is willing to invest their own money at prices near what the public can buy, but monolithic following insiders is not recommended.

Name: Eric Louis Zinterhofer

Position: Director

Transaction Date: 2022-11-01 Shares Bought: 27,202 Average Price Paid: $374.04 Cost: $10,174,605.00

Company: Charter Communications Inc (CHTR)

Through the Spectrum brand, Charter Communications Inc., a leading provider of internet connection and a cable operator, serves more than 32 million subscribers in 41 states. The company provides a comprehensive variety of cutting-edge home and commercial services, including Spectrum Internet®, TV, mobile, and voice, through an advanced high-capacity, two-way telecommunications network. For small and medium-sized businesses, Spectrum Business® offers the same range of broadband products and services along with unique features and applications to boost productivity, whereas Spectrum Enterprise offers highly tailored, fiber-based solutions for larger businesses and government organizations. Spectrum Reach® provides custom production and advertising for the current media environment. Through Spectrum Networks and Spectrum Originals, the company offers its clients access to prestigious news, sports, and original programs.

Eric Louis Zinterhofer is the Founding Partner of this business and the founder of Searchlight Capital Partners LP. Mr. Zinterhofer serves on the boards of seven more businesses. Mr. Zinterhofer has held positions such as non-executive chairman of Charter Communications, Inc., member of the structured equity group at JPMorgan Investment Management, Inc., senior partner at Apollo Asset Management, Inc., and member of the corporate finance department at Morgan Stanley Dean Witter & Co.

Opinion: This is a massive purchase by Zinterofer in a beaten-up name. This is the kind of carnage we like to bask in but keeping things in perspective, Mr. Zinterofer is a very rich man. He can afford to have $10MM sitting idle, I can’t. The days of monopoly internet providers are over. Debt-riddled Charter doesn’t look like the sure thing it once did. $95 Billion of long-term debt looks like a slow and prolonged death sentence. If I were a creditor, I’d be worried. If I were a shareholder, I would be gone.

Name: Warren S Thaler

Position: Director

Transaction Date: 2022-11-02 Shares Bought: 1,050 Average Price Paid: $191.21 Cost: $200,770.00

Company: Align Technology Inc (ALGN)

Name: Anne Myong

Position: Director

Transaction Date: 2022-11-02 Shares Bought: 1,500 Average Price Paid: $190.26 Cost: $285,385.00

Company: Align Technology Inc (ALGN)

Name: Joseph M Hogan

Position: CEO

Transaction Date: 2022-11-02 Shares Bought: 10,600 Average Price Paid: $188.58 Cost: $1,998,987.00

Company: Align Technology Inc (ALGN)

The primary business activities of Align Technology, Inc. are the development, production, and marketing of Invisalign® clear aligners, iTero® intraoral scanners and dental services, and exocad® computer-aided design and computer-aided manufacturing software for dental laboratories and dental professionals. Under the Invisalign and other brands, the company markets and sells consumer goods that are an addition to the primarily recommended by doctor items, like retainers, aligner cases (clamshells), teeth whitening treatments, and cleaning solutions. The main objectives are to make clear aligners the go-to treatment for malocclusions or the misalignment of teeth, the Invisalign system the preferred treatment option for patients, general dentists, and orthodontists worldwide, intraoral scanners the go-to scanning device for digital dental scans, and exocad CAD/CAM software the go-to choice for dental labs.

Since June 2004, Warren Thaler has been a director of Align Technology. Mr. Thaler has served as president of Gordon Gund Investment Corporation since 2001. This company invests in real estate as well as public and private equity instruments. Mr. Thaler has been a member of the boards of various privately held businesses controlled by the Gund family since 1990. Mr. Thaler served on the boards of directors of the Cleveland Cavaliers and the Gund Arena Company from 1990 to 2005. From 2001 to 2005, he served as the team’s alternate governor at meetings of the National Basketball Association Board of Governors, representing the Cavaliers. Mr. Thaler earned his M.B.A. from Harvard University after earning his B.A. from Princeton University.

Align Technology, Inc. and Goodwill Industries International, Inc. both have Anne M. Myong on their boards. Aura Financial Corp.’s Chief Executive Officer, Walmart Shenzhen Stores Co. Ltd.’s SVP, Chief Financial & Administrative Officer, and Agilent Technologies (China) Co. Ltd.’s Chief Financial Officer, and Vice President were among her prior positions. Ms. Myong earned her undergraduate degree from James Madison University and an MBA from Harvard Business School.

Joseph M. Hogan became President, Chief Executive Officer (CEO), and Director of Align Technology in June 2015. Mr. Hogan is a successful CEO with experience in a variety of areas, including healthcare, technology, and industrial automation. Mr. Hogan was the CEO of ABB, a large amount worldwide power and automation technologies firm based in Zurich, Switzerland, before joining Align. Mr. Hogan oversaw a 25% rise in revenue over his five years at ABB. Prior to joining ABB, Mr. Hogan spent 25 years at General Electric, including eight years as CEO of GE Healthcare, where he oversaw significant global and market portfolio development and more than quadrupled revenue.

Opinion: This one is worth a small bet. It’s hard for me to say that even after this stupendous drop in share price, that Align is priced fairly. Normally multiple insiders buying after a poor earnings report like this puts in an immediate floor in the price. This hasn’t happened which is a reflection that my view is consensus.

I like the technological moat that Align has achieved, and the Company is more than just a cosmetic dentistry tool. It’s on its way to being a permanent fixture in the dentist’s office with 3D imagery and rapid results. Competition has failed to make a big dent in their moat. It’s really just about price and what normalized earnings look like. Since no one is quite sure of that, I’d gamble a little bit with management as they seem to have some confidence we are at that equilibrium. Like I said- I’m not convinced we are, but the bulls are hungry for some victories, no matter how fleeting they may be. I’d put this one down in the take it while you can trading camp

Name: John H Stone

Position: CEO

Transaction Date: 2022-10-28 Shares Bought: 12,500 Average Price Paid: $104.45 Cost: $1,305,612.00

Company: Allegion plc (ALLE)

Leading worldwide provider of security goods and services, Allegion plc ensures that people, property, and livelihoods are safe and secure wherever they live, work, and prosper. With a goal of seamless access and a safer world, the firm pioneered safety and security, bringing peace of mind to its customers. The most effective and frictionless mobility across locations and areas is made possible by seamless access, which enables authorized, automated, and safe transit and movement. In order to provide a faultless experience and enable an uninterrupted and safe movement of people and assets, ecosystem development and partnership are key components of the goal. The business provides a wide range of market-leading brands with a large and adaptable portfolio of security and access control products and solutions.

John H. Stone is now Allegion Plc’s president, chief executive officer, and director. Mr. Stone formerly held the post of President-Global Construction & Forestry at Deere & Company. He graduated from the US Military Academy with a bachelor’s degree and earned an MBA from Harvard Business School. Prior to joining Deere & Company, John worked as a Six Sigma Black Belt quality engineer for General Electric and was a U.S. Army infantry officer.

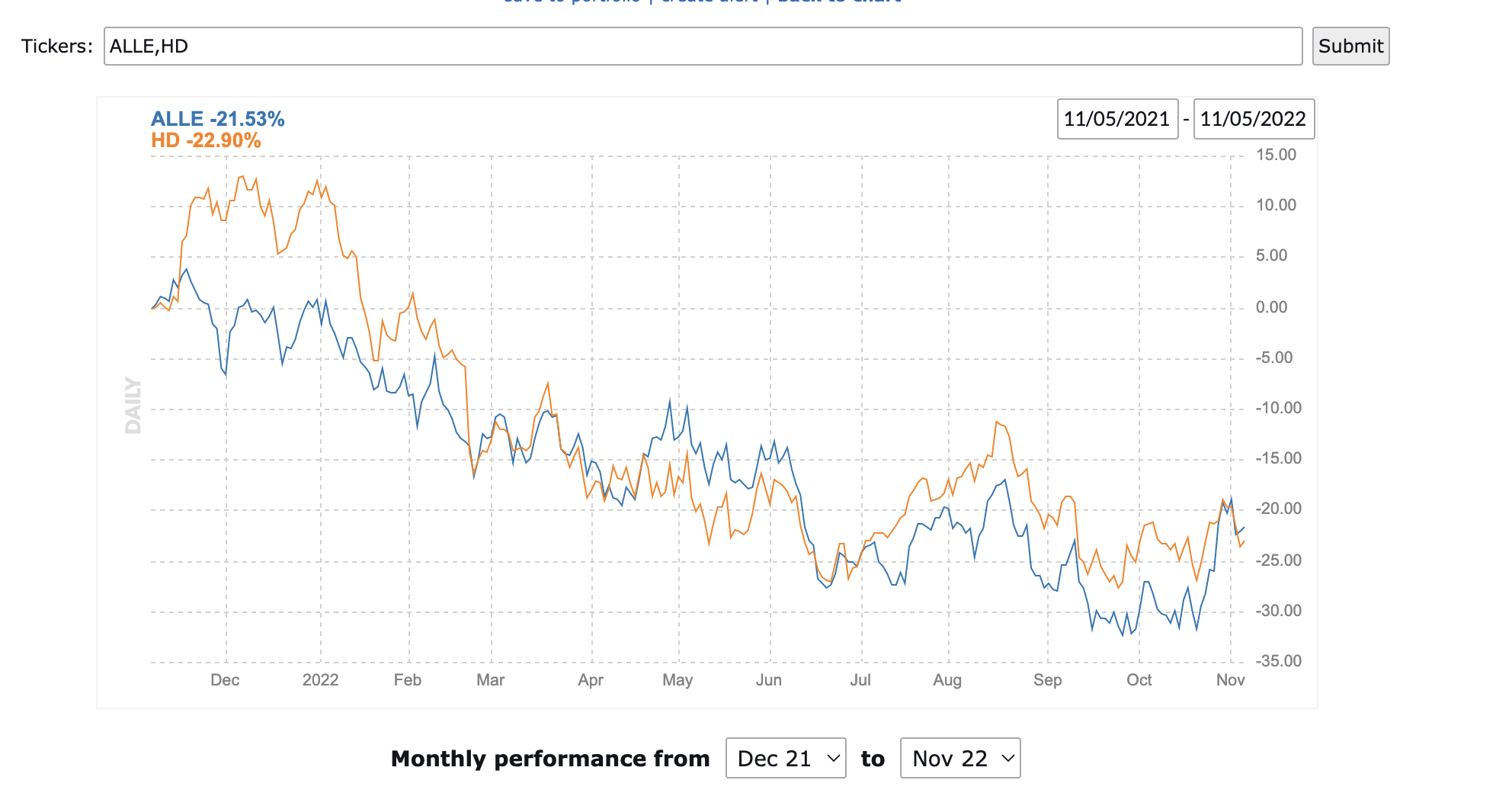

Opinion: I see a $1.3MM buy from the CEO in a beaten-up company, and I want to buy. But why? Allegion sounds like some vital identity security cyber necessity in this very critical time, but when you dig into it, it’s just an old-fashioned home and office lock and key vendor. That’s really not so bad but do you want to buy anything at all tied to this housing cycle with rapidly rising mortgage rates causing the biggest housing slowdown in 40 years?

ALLE is a dominant force in this sector. There are exciting opportunities to digitize all of this standard analog world and interconnect it with the web. That’s been in play for several years now and will continue to be a growth driver, but Allegion is just too tied to the same building material cycle that HomeDepot is on.

For comparison, I’ve added this 1-year performance chart. A picture speaks a thousand words.

Name: Mark J Alles

Position: Director

Transaction Date: 2022-10-31 Shares Bought: 3,625 Average Price Paid: $86.75 Cost: $314,469.00

Company: Biomarin Pharmaceutical Inc (BMRN)

BioMarin Pharmaceutical Inc. creates and markets novel medicines for patients with critical and sometimes fatal uncommon illnesses and medical conditions. The business chooses product candidates for illnesses and ailments that have a high unmet medical need, have a clear biological basis and have a chance to be first-to-market or have a sizable advantage over alternatives. The portfolio includes several clinical and preclinical product candidates in addition to seven marketed medications for the treatment of different illnesses. By devoting considerable funds to research and development initiatives and commercial growth prospects in the fields of science, manufacturing, and technological knowledge, BioMarin continues to invest in the clinical and preclinical product pipeline.

Mark J. Alles serves on the boards of five other businesses. Prior to this, he served as Chairman of Turning Point Therapeutics, Inc., Chairman & CEO of Celgene Corporation, Principal at Centocor, Inc., Principal at Bayer Corp., and Vice President-Oncology Business Unit at Aventis Pharmaceuticals, Inc. Syros Pharmaceuticals, Inc., Juno Therapeutics, Inc., Antengene Corporation Co., Ltd., and Antengene Corp. Ltd. all have Mark J. Alles on their boards. The Lock Haven University of Pennsylvania awarded Mark J. Alles a bachelor’s degree.

Opinion: Oppenheimer analyst Leland Gershell upgraded BioMarin to Outperform from Perform with a price target of $110, up from $92. Entering 2023, the market’s increasing recognition of BioMarin’s improving fundamentals and greater comfort around its near- and potentially long-term revenue opportunities “will translate into more pronounced outperformance,” Gershell tells investors in a research note. The analyst believes the weakness in the shares following last Wednesday’s announcement that an FDA advisory committee will be held for Roctavian provides an attractive entry point.

On October 13th RBC analyst raised their price target to $95 from $90 but kept a neutral rating on the stock. Issi raised his earnings view on BMRN to $.68c on FY 23 and $3.17 on FY24. I don’t see the upside here. I want to see more insiders buying this name before I take the plunge although the chart looks ripe for a bounce.

Name: DUY LOAN T LE

Position: Director

Transaction Date: 2022-11-01 Shares Bought: 3,000 Average Price Paid: $74.97 Cost: $224,900.00

Company: Wolfspeed Inc (WOLF)

An inventor of wide bandgap semiconductors, Wolfspeed Inc., formerly known as Cree Inc., focuses on Silicon Carbide and Gallium Nitride materials and devices for power and radio-frequency applications. A variety of applications, such as electric cars, quick charging, 5G, renewable energy and storage, aerospace, and military, are addressed by the product families, which also comprise Silicon Carbide and GaN materials, power devices, and RF devices. Prior to fiscal 2021, the firm created, produced, and supplied specialty lighting-class light-emitting diode products for use in video displays, electronic signs and signaling, indoor and outdoor lighting, and other electronic applications. Electric cars, motor drives, power supply, solar, and transportation applications employ materials, goods, and power devices. The materials, goods, and RF equipment are utilized in satellite, radar, communications, and military applications. The results and cash flows of the previous LED Products business are now considered discontinued operations as a result.

Since October 2018, Ms. Le has served on the board of directors. In February 2015, she left Texas Instruments Inc., where she had most recently served as a Senior Fellow since 2002. Ms. Le held a number of executive positions over her 33 years at Texas Instruments, including global project manager for the Memory Division and Advanced Technology Ramp Manager for the Embedded Processing Division. She has been the company’s president and only partner since 2016, when DLE Management Consulting LLC was founded. Ms. Le has 33 years of experience in the semiconductor industry, specifically in chip design, the development of silicon manufacturing technology, and the manufacturing of advanced technology from concept to high-volume production. She also has 33 years of experience in international business, managing global R&D centers, joint ventures, foundries, and OSAT (Outsourced Semiconductor Assembly and Test) partnerships in Asia and Europe.

Opinion: We are buying this name in the low $ ’70s or below $70. Citi analyst Atif Malik lowered the firm’s price target on Wolfspeed to $100 from $115 and keeps a Buy rating on the shares after taking over coverage of the name. The analyst believes the semiconductor equipment group has bottomed given the memory pricing collapse, domestic China spend dislocation, and estimated declines. The stocks generally rebound once memory prices hit cash costs and forward estimate revisions bottom approach prior to macro corrections, Malik tells investors in a research note.

We like the sector, and the names are starting to show bottoming action. It’s not a bet the farm back up the truck purchase, but the hype about the semi downturn is a bit overwhelming.

Name: John M Nehra

Position: Director

Transaction Date: 2022-11-01 Shares Bought: 5,000 Average Price Paid: $71.14 Cost: $355,675.00

Company: Davita Inc (DVA)

Leading healthcare company DaVita is committed to modernizing care delivery to raise the patient quality of life around the globe. This organization, one of the biggest in the country when it comes to renal care services, has been a pioneer in clinical quality and innovation for more than two decades. DaVita is dedicated to expanding integrated care solutions, using cutting-edge technology, and pursuing ambitious, patient-centric care models. The business built a values-based culture with a caring mindset that is focused on both patients and colleagues throughout time. The aim of the organization is to “be the provider, partner, and employer of choice,” and the vision is to “create the best healthcare community the world has ever seen.” This culture and philosophy inspire ongoing efforts to achieve these goals.

John M. Nehra holds the positions of Independent Non-Executive Director at DaVita, Inc., Lead Independent Director at CVRx, Inc., and Independent Director at Everside Health Group, Inc. At Everside Health Group, Inc., CVRx, Inc., DaVita, Inc., Baltimore School for the Arts, Bridgepoint Medical, Inc., Denali Medical II, Inc., Everside Health LLC, and Ocutherix, Inc., he serves on the board of directors. Previously, Mr. Nehra worked with NEA Management Co. as a Retired Special Partner and Catalyst Ventures, Inc. as a Managing General Partner. LLC and Alex is a managing director. Inc. Brown & Sons. He graduated from the University of Michigan with his undergraduate degree.

Opinion: I’ve wanted an opportunity to buy Berkshire portfolio manager Ted Wexler’s fav, Davita. With two insiders buying on weakness, this looks like an opportunity for a nice trade. Don’t love the debt load but long term debt is probably manageable. I like Chief Operating officer stepping up in June buying 20,000 shares at $71.14. We are in this name.

Name: Mark Miller

Position: COO

Transaction Date: 2022-10-31 Shares Bought: 8,000 Average Price Paid: $40.01 Cost: $320,092.00

Company: Goosehead Insurance Inc. (GSHD)

A rapidly expanding independent insurance company, Goosehead Insurance Inc. is redefining how personal lines products are distributed across the country. The company is able to provide insurance consumers with a superior experience thanks to a unique business strategy and cutting-edge technological platform. Insurance purchasers want the appropriate coverage, based on their risk tolerance, at the best price, written with a reputable business that will act swiftly and fairly when they need to file a claim. The company thinks that only an independent insurance agent can satisfy these goals. The advantage of having a qualified agent explain and assess coverages to assist the customer in making informed insurance purchasing selections is realized by the clients. Clients will have a wide range of insurance needs throughout their lives, and the approach enables them to assist them at any stage of life. Independent agents frequently use obsolete technology, which causes delays in insurance quotes and very little opportunity for client interaction.

Since March 2018, Mark Miller has been a part of the board of directors. Mr. Miller’s most recent position was as Chief Financial Officer for London-based Finastra, a multibillion-dollar financial technology firm. Prior to Marketo being acquired by Adobe, Mr. Miller also held the position of Chief Financial Officer. Mr. Miller worked as the CFO of Active Network from 2014 to 2016 and of L.H.P. Hospital Group in 2013 and 2014. Prior to joining Marketo, he held these positions. From 2010 through 2013, he served as Sabre’s CFO. Mr. Miller began his career by working for Hertz Corporation, LTV Corporation, and Ernst & Young. Mr. Miller holds an MBA in Finance from Rice University as well as an Accounting degree from Texas Tech University. In the state of Texas, he holds a certificate as a Certified Public Accountant. Mr. Miller was chosen for the board of directors because of his vast company operations, financial, and accounting knowledge.

Opinion: There are just as many if not more insider selling at this price. Ignore it.

Name: Thomas J Hook

Position: CEO

Transaction Date: 2022-11-01 Shares Bought: 27,500 Average Price Paid: $36.27 Cost: $997,295.00

Company: Barnes Group Inc (B)

A global supplier of highly designed goods, distinctive industrial technology, and cutting-edge solutions, Barnes Group Inc., caters to a variety of end markets and clients. Applications as diverse as healthcare, robotics, packaging, aerospace, mobility, and manufacturing employ specialized goods and services. The Company’s highly trained and devoted staff members are committed to meeting the highest performance requirements and realizing steady, profitable development. To provide a steady stream of cutting-edge new goods and services for consumers, the company keeps growing its applied and basic research and development efforts. Focus areas include the creation of new technologies that considerably enhance current goods, parts, integrated systems, and services, as well as the creation of new uses for current goods and services. The approach for product development is driven by customer cooperation and product design teams, especially within Industrial’s Molding Solutions and Automation divisions.

Starting on July 14, 2022, Thomas Hook will serve as Barnes’ president and CEO. Prior to this, Mr. Hook held the positions of Chief Executive Officer and Director of SaniSure, Inc., a pioneer in the design and production of single-use systems and components for pharmaceutical, biotech, and other industries. Additionally, Mr. Hook has held the positions of President, Chief Executive Officer, and Chief Operating Officer of Integer, as well as Chief Executive Officer and Director of Q Holding Company (formerly Greatbatch). Mr. Hook held the position of President of CTI Solutions Group at CTI Molecular Imaging from 2002 until 2004. He served as General Manager of Functional and Molecular Imaging at General Electric Medical Systems from 2000 and 2002. Mr. Hook previously served on the Audit Committee and the Corporate Governance Committee until being nominated to the Barnes Board of Directors in 2016. He is presently one of NeuroNexus Inc.’s directors.

Opinion: This large purchase by the CEO has to be viewed in the context that he just became the CEO. Often that’s in the contract but if not certainly expected that the new CEO will be a substantial shareholder. On October 28th Barnes reported Q3 revenue $315M, consensus $324.92M. “In Q3, Aerospace continued to deliver excellent performance driven by robust year-over-year growth in the Aftermarket business. At Industrial, performance remains challenged as persistent economic headwinds and operational challenges impact our results,” said CEO Thomas Hook. “To address Industrial’s performance, our ongoing, multi-phased, restructuring efforts are targeting core business execution, systematically integrating our business portfolio, rationalizing cost, and advancing an action-oriented culture across the enterprise. Our objective is to return to, and eventually surpass, Industrial’s pre-pandemic margin performance,” added Hook.

That sounds like he’s setting up investors for some pain ahead that’s not his to blame.

Name: Patrick P Gelsinger

Position: CEO

Transaction Date: 2022-10-31 Shares Bought: 8,830 Average Price Paid: $28.16 Cost: $248,647.00

Company: Intel Corp (INTC)

Silicon Valley received silicon from Intel. For more than 50 years, Intel and its employees have had a significant impact on the globe, advancing commerce and society by inventing breakthrough innovations that fundamentally alter how to live. Intel is now using its reach, scale, and resources to help its clients take fuller use of the potential of digital technology. Inspired by Moore’s Law, he works tirelessly to improve semiconductor design and production to assist in resolving the most pressing issues for clients. Release what CEO Pat Gelsinger refers to as the four superpowers: Al, pervasive connectivity, cloud to the edge, and ubiquitous computing by integrating intelligence into the cloud, network, edge, and every type of computing device. The four astonishing technology advancements that are driving the digitization of everything are now significant commercial factors. They will significantly change how to interact with and experience technology, including PCs, other linked gadgets, houses, and automobiles. The COVID-19 epidemic has merely sped up this transformation.

Intel Corporation’s chief executive officer and a member of its board of directors is Patrick (Pat) Gelsinger. On February 15, 2021, Gelsinger returned to Intel, where he had worked for the previous 30 years. Gelsinger was the CEO of VMware before rejoining Intel. In that role, he helped VMware become a global leader in cloud infrastructure, enterprise mobility, and cyber security, nearly tripling the company’s yearly sales. According to an annual Glassdoor study, Gelsinger was again named the best CEO in America in 2019. Gelsinger was president and chief operating officer of EMC’s Information Infrastructure Products group before joining VMware in 2012, where he oversaw engineering and operations for data storage, data computing, backup and recovery, RSA security, and enterprise solutions.

Opinion: Gelsinger has been a consistent buyer of Intel stock since his return to lead the troubled company as the CEO. It hasn’t worked out so well. Eventually, I believe it will, but it may take China invading Taiwan and putting Taiwan Semiconductor under its thumb. Gelsinger is investing billions in building new fabs and investing in technology that Intel neglected for far too long.

Name: Matthew Cohn

Position: Director

Transaction Date: 2022-11-01 Shares Bought: 20,910 Average Price Paid: $28.00 Cost: $585,379.00

Company: Bancorp Inc. (TBBK)

Bancorp Inc. is a Delaware financial holding company, and The Bancorp Bank, which is referred to as the “Bank,” is the main subsidiary. The Bank is the primary source of income and revenue for the company. The business strategy, which is more fully explained below, is centered on payments and deposits activities in the payments business, which anticipate non-interest income generation and attract stable, lower-cost deposits that seek to deploy into lower-risk assets in specialized markets through specialty lending activities. Continually in business, the corporation has financing divisions that include institutional banking, bridge loans for real estate, small business lending, and leasing for commercial fleets. Through investment advisers, the institutional banking business line provides lines of credit backed by securities and those backed by the cash value of insurance policies. Additionally, it provides investment advisors with finance.

Mr. Matthew Cohn holds the positions of President at ASI Transact Co., Vice Chairman at ASI Show, Chairman at ASI Computer Systems, Inc., and Independent Director at The Bancorp, Inc. The Bancorp Bank, The Bancorp, Inc. (Delaware), ASI Show, JDRF International, Young Presidents’ Organization, Inc., and The Advertising Specialty Institute, Inc. all have him on their boards of directors. The Medical Data Institute formerly hired Mr. Cohn as its chief executive officer. Additionally, he held board positions with the Society of Independent Show Organizers and Changing Attitudes, Decisions & Environments for Kids. He graduated from the University of Pennsylvania with his undergraduate degree.

Opinion: TBBK was on absolute fire last week as it rockets on earnings from #23.35 to Friday’s close at $30.55. the quarter came in below consensus but the forecast rocked the stock. CEO Damian Kozlowski stated “Revenue growth continues across our platform as lending volumes steadily increase and new payment partners are added to our ecosystem. The expansion of both net interest margin due to rising rates and payment fees across our verticals should support significantly increased profitability in 2023. We are issuing preliminary guidance for 2023 of $3.20 per share excluding the net impact of future share buybacks but including the expected impact of rate increases based on fed funds futures. We also reiterate $2.25 to $2.30 guidance for 2022. The $3.20 guidance for 2023 would represent approximately a 40% increase in earnings per share over 2022 and would result in an ROE percentage in the mid-20s and an ROA above 2%. We expect to increase our share repurchases to $25 million per quarter, or $100 million in 2023, from $15 million a quarter, or $60 million, in 2022.

I find this interesting as most banks report relatively good news due to increased interest rate margins but others like JP Morgan and Zions added expected recessionary losses to their reserves and reduced loan volumes. Why this bank is different makes no sense to me. Maybe the other banks are being too conservative. I don’t know the answer here but Director Mathew betting $500k shows what side of the coin he keeps up on.

Name: Steven R Downing

Position: CEO

Transaction Date: 2022-10-31 Shares Bought: 10,000 Average Price Paid: $25.74 Cost: $257,400.00

Company: Gentex Corp (GNTX)

In 1974, Gentex Business was established as a Michigan corporation. The company creates, develops, produces, distributes, and provides digital vision, connected automobiles, dimmable glass, and fire protection products, including auto-dimming rearview and non-dimming mirrors and electronics, dimmable airplane windows, and commercial smoke alarms and signaling systems. Designing, developing, producing, and marketing interior and exterior automatic-dimming automotive rearview mirrors that make use of proprietary electrochromic technology to dim in proportion to the amount of headlight glare from trailing vehicle headlamps constitutes the company’s largest business segment. The company also creates, develops, and produces different electronics for interior visors, overhead consoles, and other areas of the car as part of this business sector. It also designs, develops, and manufactures electronics for exterior and interior automobile rear-view mirrors.

Steve Downing started Gentex in 2002 as a financial analyst. He then advanced to senior financial analyst, and before being promoted to vice president of commercial management in 2012, he held a number of positions in commercial management, including director of commercial management. He was in charge of managing the creation of quotes, forecasting, new business development, and cost accounting. He was given the titles of Chief Financial Officer and Vice President of Finance in May 2013 and continued to be in charge of all aspects of commercial management. Steve received additional responsibilities for the Company’s business development and sales department after being appointed to Senior Vice President in June 2015. Steve was given the titles of President, Chief Operating Officer, Interim Chief Financial Officer, and Treasurer in August 2017.

Opinion: A rather small buy and I don’t want to have anything to do with this one.

Name: Leo Lee

Position: Director

Transaction Date: 2022-10-31 Shares Bought: 45,000 Average Price Paid: $17.69 Cost: $796,050.00

Company: Insmed Inc (INSM)

Name: Melvin Md Sharoky

Position: Director

Transaction Date: 2022-10-31 Shares Bought: 30,000 Average Price Paid: $17.59 Cost: $527,600.00

Company: Insmed Inc (INSM)

The goal of the international biopharmaceutical business Insmed is to improve the quality of life for people with serious and uncommon diseases. In September 2018, the US expedited the approval of ARIKAYCE for the treatment of adult patients with Mycobacterium avium complex lung illness who had few or no other treatment alternatives and were in a refractory condition. The European Commission approved ARIKAYCE in October 2020 for the treatment of people without cystic fibrosis who have nontuberculous mycobacterial lung infections caused by MAC and who have few other treatment alternatives. ARIKAYCE was given the green light by Japan’s Ministry of Health, Labour, and Welfare in March 2021 for the treatment of NTM lung illness caused by MAC in patients who had not responded to previous therapy with a multidrug regimen.

Leo Lee holds the role of President of Merck Serono Co., Ltd. Additionally, Mr. Lee serves on the boards of Regeneus Ltd. and Insmed, Inc. (former Chief Executive Officer & Executive Director). He has held positions as General Manager for IQVIA, Inc., Vice President-Sales for Merck & Co., Inc., President-Japan at Allergan Ltd. (Ireland), Senior Director-Western Regional Sales at BIOVIA, Inc., and President-Japan at Merck KGaA. He graduated from the University of California, Los Angeles, with a bachelor’s degree.

Businessman Melvin Sharoky has served as the CEO of five separate organizations. He serves on the boards of LearnWright, Inc., CyBear, Inc., and Insmed, Inc., where he was formerly chairman. Former positions held by Dr. Sharoky include those of Circa Pharmaceuticals, Inc.’s president and CEO, Somerset Pharmaceuticals, Inc.’s president and CEO, Actavis, Inc.’s president, Circa Pharmaceuticals, Inc.’s president, and PharmaKinetics Laboratories, Inc.’s chief medical officer and vice president. He graduated from the University of Maryland Baltimore County with a bachelor’s degree and the University of Maryland School of Medicine with a Ph.D.

Opinion: Insmed just did a secondary on Oct 19th. Bag holders ponied up $20 per share in this JP Morgan offering. The $275 million offering should raise money to fund commercialization of ARIKAYCE, the potential commercial launch of brensocatib, if approved, and further research and development of ARIKAYCE, brensocatib, TPIP, its translational medicine efforts or any of its product candidates, and for other general corporate purposes, including business expansion activities.

These are pretty large buys by directors that should know what they are doing. Dr. Sharosky purchased 20,000 shares of INSM in May 2022 at $17.20 as well. Biotech stocks are tough to evaluate as even the management often doesn’t know whether the drug will work or not. JP Morgan is not projecting profitability even into 2024, so it’s going to be all pipeline news related. Not sure what the catalyst can be to make this stock work in a very tough market.

On Oct 27th reported Q3 revenue $67.7M, consensus$66.85M. “Q3 of 2022 marked a critical inflection point for Insmed as we advanced strong revenue growth for ARIKAYCE, continued to successfully enroll our clinical trials, and, more recently, secured meaningful financing to advance our four pillars through key upcoming clinical trial readouts,” commented CEO Will Lewis. “As we head into the final months of the year, we are extremely well-positioned for the potential transformation that could be ahead for Insmed. We are executing around the world across all aspects of our business and are tremendously excited for the opportunity to serve many more patients with serious and rare diseases.”

Name: Vlad Coric

Position: CEO

Transaction Date: 2022-10-31 Shares Bought: 25,800 Average Price Paid: $15.97 Cost: $411,995.00

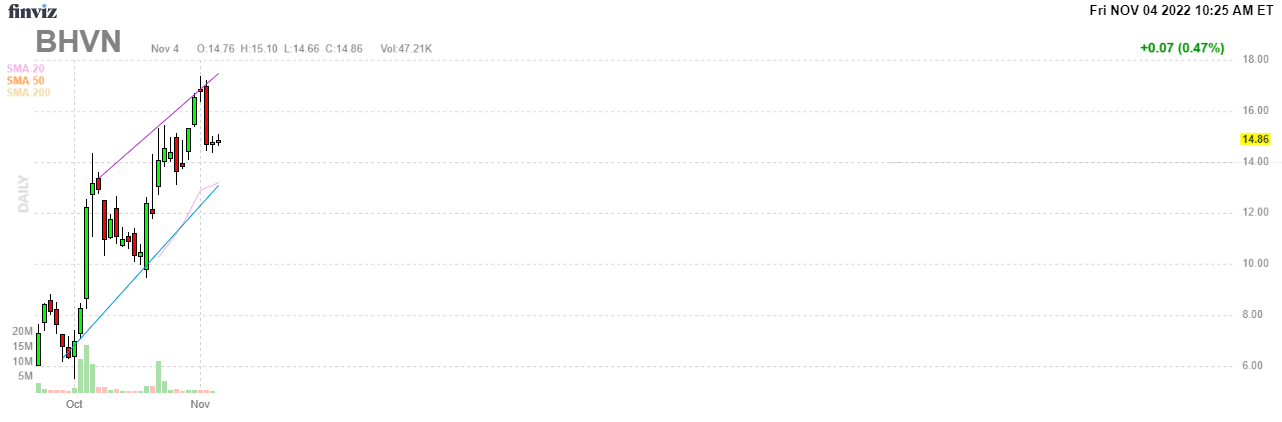

Transaction Date: 2022-10-28 Shares Bought: 141,930 Average Price Paid: $14.84 Cost: $2,105,772.00

Company: Biohaven Ltd. (BHVN)

Biohaven was introduced as a brand-new publicly listed business. As per the acquisition agreement with Pfizer (PFE) in May 2022, Biohaven has now formally started operating as a distinct, independent business. Successful medication development and commercialization have a history at Biohaven. With a Prescription Drug User Fee Act goal date set for the first quarter of 2023, Biohaven’s New Drug Application proposal for zavegepant nasal spray was filed with the FDA and accepted for evaluation. Pfizer will now solely market and develop the Biohaven CGRP business internationally following its acquisition for a total price of around $13 billion, which includes the repayment of existing debt. Biohaven intends to advance a wide range of unique product candidates that are in the early and late stages of development that are intended to treat neurological and neuropsychiatric illnesses, particularly uncommon diseases with unmet medical needs.

The Chief Executive Officer of Biohaven Pharmaceuticals is Dr. Vlad Coric. Dr. Coric has more than 50 peer-reviewed papers and is also an Associate Clinical Professor of Psychiatry at Yale School of Medicine. He formerly held the positions of Director of the Yale Obsessive-Compulsive Disorder Research Clinic and Chief of the Yale Clinical Neuroscience Research Unit. He has held the position of president of the American Psychiatric Association’s district chapter in Connecticut, which has 800 members. At Bristol-Myers Squibb and Yale School of Medicine, Dr. Coric has more than 15 years of expertise in drug research and clinical development. Dr. Coric has experience working in cancer, neurology, virology, oncology, and immuno-oncology within the pharmaceutical business. At the Yale Psychiatry Residency Training Program, where he also held the positions of program-wide chief resident for the Yale Department of Psychiatry and chief resident on the PTSD team at the West-Haven Connecticut Veterans Administration Hospital, Dr. Coric finished his residency training.

Opinion: We’ve been blogging about this stunning mover for the last few weeks. Incredibly enough the CEO is still buying this stock up 45% in just a few days from the separation of its stub in the Pfizer Biohaven purchase. Biohaven is years away from having products to market and the amount of insider buying on an early-stage spinoff is unprecedented. Based on their enthusiasm and large investment, investors can only conclude that management thinks they have something very special. We’d use any weakness as an opportunity to build a position for patient investors. The company just concluded a large capital raise at $10.50, so should it sink below that, there is considerable supply.

Name: Joseph J Deangelo

Position: Director

Transaction Date: 2022-11-03 Shares Bought: 71,600 Average Price Paid: $13.99 Cost: $1,001,684.00

Company: Vertiv Holdings Co (VRT)

The company Vertiv Holdings Co. is a world leader in the development, production, and maintenance of vital digital infrastructure technology that powers, cools, installs, protects, and upkeeps electronic devices that process, store, and transport data. Data centers, communication networks, and commercial and industrial locations throughout the world use the technology that Vertiv provides. The company thinks there is a better way—one motivated by enthusiasm and innovation—to address the world’s growing demand for data. The business supports a diverse group of customers with a suite of all-encompassing offerings, cutting-edge solutions, and a top-tier service organization from engineering, manufacturing, sales, and service locations spread across more than 45 nations in the Americas, Asia Pacific, Europe, the Middle East, and Africa. Enormous volumes of essential data must be transferred, analyzed, processed, and stored in order to support an increasingly linked marketplace of digital systems. This requires hardware, software, and services.

Mr. DeAngelo held each of these positions until the completion of HDS’s acquisition by The Home Depot in 2020. He started as chairman of the board, president, and CEO of HD Supply Holdings, Inc. in March 2015, president and CEO in January 2005, and a member of HDS’s board in August 2007. In 2007, Mr. DeAngelo held the positions of executive vice president and chief operating officer of The Home Depot. He worked with HD Supply as executive vice president from 2005 to 2006. Mr. DeAngelo held the position of senior vice president for Home Depot Supply, Pro Business, and Tool Rental in 2005, as well as senior vice president for Pro Business and Tool Rental from 2004 to 2005. From 2003 to 2004, Mr. DeAngelo held the position of executive vice president at the tool manufacturer Stanley Works. Mr. DeAngelo worked a variety of jobs at GE from 1986 until 2003. President and CEO of General Electric TIP/Modular Space, a branch of General Electric Capital, was his final role with the company.

Opinion: Nothing special about data center businesses anymore and we’d avoid this name.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other within 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors. SECForm4 is one of the smaller ones but I like supporting Frank. He is not arrogant. He’s helpful and has great prices. He also trades on his own data so I like people that eat what they kill.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. Do your own analysis. They can easily be wrong, and in many cases, maybe most cases have no more idea what the future may hold than you or me. In short, you can lose money following them. We have and we curse aloud, what were they thinking!

We like Fly on the Wall for keeping up with what events might be happening, analysts’ comments, and whatever else could be moving the stock. Dow Jones news service is an essential tool but many services pick up their feed like they do Bloomberg. For quick financial analysis, it’s hard to beat Old School Value.

No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax