Curious how well insiders are doing with their buys? Scroll the significant buys of the last year.

I wrote last week that “For many people, the obvious response is to buy nothing, do nothing until the bear market is over. We wish it was that easy as when some stocks have corrected as sharply as they have, down 50-70% in many cases. When they turn, the upswing will be so quick and significant, violent even that there is no way of getting back in anywhere near the bottom.

Last week the S&P 500 stormed 5.8% higher and the average insider buy we tracked was up 15.7% higher. Nasdaq had the biggest move in history. We’ve been buying through this downtown and examining our holdings carefully, with the simple caveat

Knowing what I know today, would I buy this stock again?

Are we out of the woods? Insider buying is definitely ramping higher but not at levels that mark an all-in level. The ratio of buying and selling may not get to that level either but that doesn’t mean there aren’t some great buys. With the war still raging abroad and inflation at home with the Fed raising interest rates, caution is still the operative word. A potential major unraveling of the world’s two largest economies is underway and it’s very hard to game the outcome but I would be leary of anything made in China including Apple. Unfortunately, the leadership of China thinks the U.S is their enemy and they would rather be pals with Putin.

Although you can’t vote in China for any real candidates other than the People’s Republic of China offerings, people do vote with their dollars and feet. I think you will start to see an accelerating capital flight from China as well as brains. President Xi is leading China down a dark and destructive path.

In spite of the gloomy geopolitics, we still find attractive opportunities highlighting SkyWest this week. $SKYW

Name: Atkin Jerry C

Position: Director

Transaction Date: 2022-03-11 Shares Bought: 110,000 Average Price Paid: $25.33 Cost: $2,786,300.00

Company: SkyWest Inc (SKYW)

SkyWest, Inc. operates regional airline operations in the United States through its subsidiary, SkyWest Airlines, Inc. (SkyWest Airlines). SkyWest Airlines and SkyWest Leasing are two of the company’s segments. Revenue collected under appropriate capacity purchase agreements related to flying such aircraft, as well as the associated operational costs, are included in the SkyWest Airlines section. The SkyWest Leasing section contains applicable revenue ascribed to the ownership of new aircraft bought through the issuance of debt, as well as the related depreciation and interest expense of such aircraft. It provides scheduled passenger travel to destinations in the United States, Canada, Mexico, and the Caribbean, with around 2,260 departures every day. Flights for the company are operated by Delta Connection, United Express, American Eagle, and Alaska Airlines.

The Company’s Chairman of the Board is Jerry C. Atkin. Mr. Atkin was recommended as a director by the Board in part because of his extensive expertise and understanding of the Company and the regional airline sector, as well as his experience as the Company’s CEO for more than 40 years. Mr. Atkin’s job as Board Chair is particularly important, as he provides crucial leadership and direction to the Board’s actions and deliberations. His ideals and ethics, according to the Board, are significant assets to the Company and its shareholders.

Opinion: Delta Airlines President Glen Hauenstein said on Friday that the company is seeing an “unparalleled” increase in demand, revealing that the airline experienced its best day of sales in its 100-year history last week. Jerry Atkin, Chairman of the Board just executed his single largest purchase of Sky West stock in history too. I think that says a lot about this setup. Not to mention the insanely low valuation, P.E 12.72 and 9.43 Price to Free Cash flow and trading just .62 of book value. Finding people to fly the planes is their greatest challenge.

Name: Knudson Jeffrey R

Position: CFO

Transaction Date: 2022-03-11 Shares Bought: 5,360 Average Price Paid: $93.30 Cost: $500,087

Company: AMN Healthcare Services Inc (AMN)

AMN Healthcare Services, Inc. offers hospitals and healthcare facilities in the United States healthcare workforce solutions and staffing services. Nurse and Allied Solutions, Physician and Leadership Solutions, and Technology and Workforce Solutions are its three segments. Travel nurse staffing, rapid response nurse staffing, labor disruption, allied staffing, local staffing, and revenue cycle solutions are all available within the Nurse and Allied Solutions division. Locum tenens staffing, healthcare interim leadership staffing, executive search, and physician permanent placement solutions are all available within the Physician and Leadership Solutions section. Language services, vendor management systems, workforce optimization, telemedicine, credentialing, and outsourced solutions are all available within the Technology and Workforce Solutions division. Physical therapists, respiratory therapists, occupational therapists, medical and radiological technologists, lab technicians, speech pathologists, rehabilitation assistants, and pharmacists are among the allied health professions provided by the organization.

Jeffrey R. Knudson is the Chief Financial Officer at AMN Healthcare, where he is in charge of finance, internal audit, tax, accounting, and customer service. Mr. Knudson previously worked at At Home Group, Inc. as Chief Financial Officer and Executive Vice President, Supply Chain. He was in charge of all accounting, financial planning and analysis, treasury, investor relations, internal audit, and supply chain activities in this position. He held various key positions at CVS Health and CVS Caremark Corp. before joining At Home Group, Inc., including Senior Vice President of Finance and Retail Controller. Prior to CVS, he worked for L Brands and Express Scripts, where he was a significant part of the treasury and mergers & acquisitions leadership teams.

Opinion: Anyone that’s been involved in the health care delivery business knows that staffing is a major challenge due to the wear and tear from Covid. The shares of AMN Healthcare Services reached the lowest level since June 2021 on Thursday after the healthcare staffing company announced the upcoming retirement of its Chief Executive Susan R. Salka. Ms. Salka notified her decision to retire by the end of the year. She has served the company for 32 years, including 17 years as CEO.

CFO insider purchases are one of our favorite insider purchases. The chief financial officer is likely to know the true financial picture of the company better than anyone else. They also tend to be frugal-minded so when they buy, it’s a highly confident indicator. Unfortunately, this stock is 13.75% higher than where Knudson purchased it. I don’t think this is the kind of stock you want to chase. If you want to own it, I’d sell puts at $90-$95 if they have any premiums.

Name: Frasch Ronald

Position: Director

Transaction Date: 2022-03-16 Shares Bought: 3,250 Average Price Paid: $77.02 Cost: $250,309.00

Company: Crocs Inc (CROX)

Crocs, Inc., is a Colorado maker of unique clogs that became extremely popular in the early 2000s with both men and women. The inexpensive shoes rely on a proprietary closed-cell resin material called Croslite to produce a lightweight, slip-resistant, odor-resistant, non-marking sole. The material also softens with body heat, thus molding the shoe to the foot of the wearer and providing a comfortable fit. Originally intended for use on boats and in other outdoor activities like hiking, fishing, and gardening, Crocs has also found a market with working people who spend a lot of time in their feet, such as health care and restaurant workers. Moreover, Crocs, generally considered an ugly shoe, has attracted the attention of celebrities, thereby making them fashionable. The shoe features a removable back strap available in 20 colors. In some circles, essentially younger girls, these straps are traded among wearers to provide a different look. Because of their broad appeal, Crocs are available through numerous distribution channels: traditional footwear retailers, sporting goods and outdoor retailers, department stores, uniform suppliers, specialty food retailers, gift shops, health and beauty stores, and catalogs.

Mr. Frasch served as our Lead Director from November 2012 to January 2016. Since February 2014, Mr. Frasch has served as Operating Partner at Castanea Partners, a private equity firm. From June 2014 to June 2015, Mr. Frasch served as a director of EVINE Live, Inc., a NASDAQ-listed digital commerce company. Mr. Frasch also served as a director of Burberry Ltd. since 2017. Mr. Frasch served as President and Chief Merchandising Officer of Saks Fifth Avenue, a division of Saks, Incorporated, an NYSE-listed luxury fashion retailer, from February 2007 until the merger of Saks, Incorporated with Hudson’s Bay Company in November 2013. From November 2004 until January 2007, he held the post of Vice-Chairperson and Chief Merchant of Saks Fifth Avenue.

Opinion: Foot stomping buy. Pun intended. No accident that Frasch is buying. Private equity will be interested in this stock and I would mark it highly likely to be a takeover candidate if it stays at this level for any time and business doesn’t deteriorate.

Name: Eppinger Frederick H

Position: CEO

Transaction Date: 2022-03-15 Shares Bought: 3,000 Average Price Paid: $66.70 Cost: $200,100.00

Company: Stewart Information Services Corp (STC)

Stewart Information Services Corporation is a worldwide provider of real estate services. The Company sells its products and services through its own policy-issuing offices, as well as a network of independent agencies and other enterprises. The business is divided into two segments: title insurance and ancillary services, and corporate. The title insurance and related services (title) section provides services necessary to transfer title to the property in a real estate transaction, such as seeking, examining, closing, and ensuring the property’s title condition. Its title part also includes services such as house and personal insurance. Appraisal management services, search and valuation services, and online notarization and closure solutions are all part of the ancillary services and corporate category.

Frederick H. Eppinger serves as the chief executive officer of Stewart Information Services Corporation. As CEO, Eppinger is focused on identifying chances for expansion and capitalizing on the company’s financial strength. He has a strong desire to win as well as a deep admiration for Stewart’s rich heritage. With over 35 years of experience in the insurance industry, Eppinger is a seasoned professional. Since 2016, he has been a Stewart director, and he now serves on the boards of Centene Corp and QBE Insurance Group Limited. He was president and CEO of The Hanover Insurance Group from 2003 until his retirement in 2016.

Opinion: Most stocks are a buy at some price. STC is in the title search business and with inventory low, mortgage rates rising, its likely to be doing fewer title searches this year than last. This is a volume business and at 5.8PE and P/FCF at just 5.4 Steward might be at the right price. Eppinger has bought significant amounts of STC stock, this being his 5th purchase since 2019 and at the highest price.

Name: Isaacman Jared

Position: CEO Chairman 10% Owner

Transaction Date: 2022-03-14 Shares Bought: 35,958 Average Price Paid: $48.38 Cost: $1,739,758

Company: Shift4 Payments Inc (FOUR)

Shift4 Payments Inc is a company that specializes in payment processing and technology. The Company’s payment platform offers end-to-end payment processing for a variety of payment types, merchant acquiring, omnichannel gateway, software integrations, integrated and mobile point of sale (POS) solutions, security and risk management solutions, and reporting and analytical tools, among other things. Shift4Shop, Lighthouse, Integrated Point-of-Sale (iPOS), Mobile POS, and Marketplace are some of the company’s technology offerings. Customer involvement, social media management, online reputation management, scheduling, and product pricing, as well as reporting and analytics, are all available through Shift4Shop, a cloud-based suite of business intelligence solutions. Its iPOS system offers pre-loaded software suites and integrated payment functions on purpose-built POS workstations.

In 1999, Isaacman was among the vanguard of companies enabling e-commerce with new payment solutions, equipping more businesses to accept credit cards. In turn, Shift4 gained insights into consumer spending habits and other useful information for instance, in how the COVID-19 pandemic affected hospitality and dining, as approximately one-third of hotels and restaurants in the US use the company’s platform. Those sectors were hit particularly hard in 2020, so Isaacman founded the Shift4 Cares Program, providing significant relief to the company’s customers.

Opinion: Jared Isaacman became famous for his sponsorship and Captain of the first SpaceX flight into space with civilians. The question nagging me is that he is heading up another mission into Space. After Netflix did a documentary about the trip, it’s hard to imagine the CEO being very excited about running the company even though he is buying $Millions of dollars worth of the stock. Besides, companies with just top-line growth and not bottom-line results got a temporary reprieve this week. I have a hard time believing this could be lasting.

Name: Hoops Elliot Dean

Position: General Counsel and Secretary

Transaction Date: 2022-03-11 Shares Bought: 4,000 Average Price Paid: $44.01 Cost: $176,040

Company: MP Materials Corp (MP)

MP Materials Corp., formerly Fortress Value Acquisition Corp., is a producer of rare earth materials. The Company owns and operates the Mountain Pass Rare Earth Mine and Processing Facility (Mountain Pass), which is a rare earth mining and processing site of scale in the Western Hemisphere. The Company is focused on producing Neodymium-Praseodymium (NdPr), Lanthanum, and cerium oxides and carbonates. NdPr magnets from the company are utilized in a variety of applications, including electric vehicles, drones, defense systems, medical equipment, wind turbines, robots, and more.

Mr. Elliot D. Hoops is a Secretary & General Counsel at MP Materials Corp. Mr. Hoops was previously employed as a Vice President & Deputy General Counsel by Penn National Gaming, Inc., a Vice President & Legal Counsel by Pinnacle Entertainment, Inc., an Associate by Holland & Knight LLP, and a Vice President & Legal Counsel by Pinnacle Entertainment, Inc. He received his undergraduate degree from the University of Michigan, a graduate degree from Georgetown University Law Center, and a graduate degree from Miami University.

Opinion: I thought this was a short from day one but the stock has held up remarkably well. The last company at Mountain Pass went bankrupt mining there. Perhaps it’s different this time around as China, the largest supplier of rare earth materials is becoming overtly hostile to the U.S.

Name: Shaller Russell

Position: President

Transaction Date: 2022-03-15 Shares Bought: 10,000 Average Price Paid: $43.50 Cost: $435,000.00

Company: Brady Corp (BRC)

Brady Corporation is a global manufacturer and marketer of integrated solutions that help people, products, and locations to be identified and protected. Every day at Brady, we make business decisions based on our dedication to performance. They create goods and solutions that function in ways that others do not. People consistently perform above and beyond expectations. And the focus and discipline as a company work toward solid, long-term performance for customers and shareholders. In short, the essence of Brady, and subsequently their brand is centered on “performance”. The US accounts for around 55% of the company’s sales.

Since June 22, 2015, Mr. Russell R. Shaller has served as Brady Corporation’s Senior Vice President and President of Identification Solutions. Mr. Shaller worked for Teledyne Wireless, LLC as President. Mr. Shaller has over 25 years of experience providing advanced electronic devices to a variety of industries, including medical, defense, industrial, telecommunications, and aerospace. He joined Teledyne in 2008 to help the company expand its business and optimize its operations. He worked with W. L. Gore & Associates (Gore) in a variety of capacities before joining Teledyne, including Divisional Leader for their Electronic Products Division and General Manager for Gore Photonics.

Opinion: Brady did a masterful job of describing their bar code, RFID, labeling products as a new tech identification company. Don’t buy it. That doesn’t mask a business that hasn’t grown the top line since 2017.

Name: Crevoiserat Joanne C

Position: CEO

Transaction Date: 2022-03-11 Shares Bought: 5,700 Average Price Paid: $34.60 Cost: $197,220

Company: TAPESTRY Inc (TPR)

Tapestry, Inc. is a luxury accessories and lifestyle brand house based in New York City. Coach, Kate Spade, and Stuart Weitzman are the company’s three parts. Sales of Coach products to customers through Coach-operated stores, including e-commerce sites and concession shop-in-shops, as well as sales to wholesale clients and through independent third-party distributors, make up the Coach segment. The Kate Spade segment includes sales primarily of kate spade new york brand products to customers through Kate Spade-operated stores, including e-commerce sites, sales to wholesale customers, through concession shop-in-shops, and through independent third-party distributors. The Stuart Weitzman sector covers Stuart Weitzman brand product sales largely through Stuart Weitzman-owned stores, including e-commerce sites, wholesale sales, and sales to various independent third-party distributors.

Joanne Crevoiserat was named Chief Executive Officer of Tapestry in October 2020, following an interim term as Chief Executive Officer since July 2020. She has been the company’s Chief Financial Officer since August of this year. In November 2020, Ms. Crevoiserat was elected to the Board of Directors. From February 2017 through June 2019, Ms. Crevoiserat served as Executive Vice President and Chief Operating Officer at Abercrombie & Fitch Co. She joined Abercrombie & Fitch in May 2014 as Chief Financial Officer and later served as Executive Vice President, Chief Financial Officer, and Chief Operating Officer, as well as Interim Principal Executive Officer. Prior to joining Abercrombie & Fitch, she served in a number of senior management roles at Kohl’s Corporation including Executive Vice President of Finance and Executive Vice President of Merchandise Planning and Allocation.

Opinion: I don’t get it. Business is getting better but the stock is getting worse. Analysts are upgrading the stock but price action is horrible. On Feb 10th, Tapestry reported Q2 Non-GAAP earnings of $1.33 versus a consensus of $1.18. They guided FY22 EPS to $3.60 -$3.65 from $3.45-$3.50 but they will take a hit in Q3 EPS down 20% but expects over 60% increase in Q4EPS. The stock fell out of bed on March 4, 7th losing 25% of its value in two days on no news that I can ascertain other than news about Russia shelling the nuclear power plant in Ukraine.

We don’t like Non-GAAP earnings so we’ll likely sit this one out.

Name: Bachelder Cheryl A

Position: Director

Transaction Date: 2022-03-11 Shares Bought: 6,000 Average Price Paid: $34.57 Cost: $207,420.00

Company: US Foods Holding Corp (USFD)

Name: Bachelder Cheryl A

Position: Director

Transaction Date: 2022-03-15 Shares Bought: 14,040 Average Price Paid: $35.55 Cost: $499,122.00

Company: US Foods Holding Corp (USFD)

US Foods Holding Corp. is a food firm that also distributes food to restaurants. The Company operates in one business segment through its subsidiary, US Foods, Inc., which markets and distributes fresh, frozen, and dry food and non-food products to foodservice customers in the United States. Customers include single and multi-unit restaurants owned by individuals, regional concepts, national restaurant chains, hospitals, nursing homes, hotels and motels, country clubs, government and military organizations, colleges and universities, and retail outlets. About 400,000 fresh, frozen, and dry food stock-keeping units, as well as non-food items, are available from the company’s 6,000 suppliers. The company operates a distribution network of about 70 locations. The Company’s product categories include meats and seafood, dry grocery products, refrigerated and frozen grocery products, dairy, and beverage products.

Since October 2018, Ms. Bachelder has served on the board of directors. From 2007 to 2017, she was the CEO of Popeyes Louisiana Kitchen, Inc., a publicly-traded multi-national restaurant operator, and franchisor. She was President and Chief Concept Officer of KFC Corporation before joining Popeyes. Previously, Ms. Bachelder worked with Yum! Brands, Domino’s Pizza, RJR Nabisco, Gillette, and Procter & Gamble, where she held brand leadership positions. She is a member of C200, an organization that encourages, honors, and advances women’s leadership in business, as well as the advisory board of Procter & Gamble’s franchising initiative, Tide Dry Cleaners. Pier 1 Imports, Inc. is where she sits on the board of directors.

Mr. Carruthers has been a director since July 2016. He has served as the President and Chief Executive Officer of TricorBraun, Inc., a global leader in the design and supply of primary packaging solutions, since October 2017. He is also the principal and founder of CKAL Advisory Partners, which provides private equity advisory services in the distribution, eCommerce, and supply chain sectors. Mr. Carruthers previously worked for W.W. Grainger, Inc., as Senior Vice President and Group President, Americas, from August 2013 to July 2015, President, Grainger U.S., from January 2012 to August 2013, President, Grainger International, from February 2009 to December 2011, and President, Acklands-Grainger, from October 2006 to January 2009.

Opinion: This looks like a private equity take-out. I won’t chase it but food inflation was good for Kroger’s share price and I don’t see why the same dynamics would not be at play here. We’ve had a record 5 positions in our portfolio of 40-60 securities bought out this year. This week I would highlight this one, Crox, and JHG, and COWN from last week- these companies are in play if they stay at these depressed prices on no real fundamental deterioration in the businesses

Name: Peltz Nelson

Position: Director 10% Owner

Transaction Date: 2022-03-11 Shares Bought: 1,412,638 Average Price Paid: $33.05 Cost: $46,685,835.00

Company: Janus Henderson Group Plc (JHG)

Name: Garden Edward P

Position: Director 10% Owner

Transaction Date: 2022-03-11 Shares Bought: 1,412,638 Average Price Paid: $33.05 Cost: $46,685,835.00

Company: Janus Henderson Group Plc (JHG)

Janus Henderson Group PLC is a worldwide asset manager that is independent. The firm focuses on active asset management across all asset types. The investment management business segment is where it operates. Equities, Fixed Income, Multi-Asset, Quantitative Equities, and Alternatives are among the actively managed investment products managed by the company for institutional and retail customers. It operates across various product lines, distribution channels, and geographic regions. The Company conducts its operations in North America, the United Kingdom (UK), continental Europe, Latin America, Japan, Asia, and Australia.

Mr. Peltz is Chief Executive Officer and a Founding Partner of Trian Partners. He serves as the non-executive Chairman of The Wendy’s Company and serves on the board of The Madison Square Garden Company. Invesco Ltd., Legg Mason, Inc., The Procter & Gamble Company, H.J. Heinz Company, Sysco Corporation, Mondelz International, Ingersoll-Rand plc, and MSG Networks, Inc. were among the firms he formerly served on the boards of.

Since February 2022, Edward Garden has served as a Non-Executive Director of Janus Henderson. Edward serves on the Compensation Committee as well as the Nominating and Governance Committee. Since November 2005, Edward has served as Trian’s Chief Investment Officer and a Founding Partner. He is also a director of General Electric Company, where he serves on the Management Development & Compensation Committee.

Opinion: I like the sell-off in this name and would be a buyer on a small pullback. We sold April 30 Puts. In hindsight, we would have been better off buying the stock. We don’t normally pay that much attention to 10% shareholder buys as it’s often other people’s money, not the smart money that corporate insiders represent. Nelson Peltz is an exception. He’s a legend.

Name: Deutschman Robert M

Position: Director

Transaction Date: 2022-03-14 Shares Bought: 15,000 Average Price Paid: $31.66 Cost: $474,900.00

Company: Digital Turbine Inc. (APPS)

Digital Turbine, Inc. is a provider of end-to-end solutions for mobile technology companies to enable advertising and monetization solutions. The Company’s digital media platform powers frictionless end-to-end applications for brand discovery and advertising, user acquisition and engagement, operational efficiency, and monetization opportunities. All participants in the mobile application ecosystem, including mobile carriers and device original equipment manufacturers (OEMs) that participate in the app economy, app publishers and developers, and brands and advertising agencies, can use the Company’s on-device solutions to connect with end-users and consumers who own the device. The Company’s Media Distribution business is an advertiser solution for carrier and OEM inventory, consisting of its core platform as well as other recurring and life-cycle products, as well as professional services supplied through its platform.

Mr. Deutschman has spent more than 30 years specializing in investment and merchant banking activities, with a focus on strategic advising, mergers and acquisitions, and private placements of institutional capital for expanding public and private firms around the world. At FocalPoint Partners, LLC, he is currently the Managing Director. Prior to joining FocalPoint, Mr. Deutschman served as the Vice Chairman of Cappello Global, where he focused on providing both capital markets and M&A advisory services to middle-market companies across a variety of industries. Mr. Deutschman has extensive experience in working through complex and troubling situations.

Opinion: I give up on this one. I can’t see what Deutschamn begins to see. Yes, the stock is cheap or down in price but it looks like it deserves that to me. Ironically the last quarter was the best one in operating profits since they’re been reporting. Companies that grow by acquisition can put up good numbers for a while that masks deteriorating fundamentals. Investors are concerned about recent Google announcements that like Apple, it is pulling back on what information can be shared with 3rd parties like, not specifically mentioning APP but on February 16th Google blog news has shares of Digital Turbine (APPS) down double-digit percentages. Bottom line, companies that grow the top line without any improvement on the bottom line are out of favor and likely to remain so.

Name: Efremov Yavor

Position: CEO

Transaction Date: 2022-03-14 Shares Bought: 9,000 Average Price Paid: $29.75 Cost: $267,750.00

Company: Turning Point Brands Inc. (TPB)

Name: Glazek David Edward

Position: Director

Transaction Date: 2022-03-15 Shares Bought: 13,878 Average Price Paid: $28.65 Cost: $397,605.00

Company: Turning Point Brands Inc. (TPB)

Turning Point Brands, Inc. is a branded consumer product manufacturer, marketer, and distributor with active ingredients. Adult users can purchase a variety of products from the company’s brands Zig-Zag and Stoker’s, as well as next-generation products. Zig-Zag Products, Stoker’s Products, and NewGen Products are the company’s three segments. The Zig-Zag Products sector sells rolling papers, tubes, and related items, as well as finished cigars and make-your-own cigar wrappers. The Stoker’s Products business produces and sells moist snuff, as well as procures and sells loose leaf chewing tobacco. The NewGen Products segment markets and distributes cannabidiol, liquid vapor products, and certain other non-tobacco and nicotine products; VaporBeast distributes a wide range of products to non-traditional retail outlets; and the VaporFi B2C online platform markets and distributes a range of products to individual consumers.

MDH Acquisition Corp’s Independent Director is Dr. Yavor Efremov. Turning Point Brands, Inc. and MDH Acquisition Corp. are both on his board of directors. Dr. Efremov previously worked for Liberty Media Corp. as a Senior Vice President-Corporate Development and Motorsport Network LLC as Chief Executive Officer. He graduated from Furman University with a bachelor’s degree, Yale Law School with a master’s degree, and Yale University with a doctorate degree.

Mr. David E. Glazek is an Independent Director at National CineMedia, Inc., a Chairman at Turning Point Brands, Inc., a Partner at Standard General LP, a Partner at Standard General Management LLC, a Manager at Donau Carbon US LLC, a Manager at Standard Carbon LLC and a Manager-Portfolio & Partner at SG Special Situations Fund LP. He is on the Board of Directors at National CineMedia, Inc. and National CineMedia LLC. He joined Standard General in 2008. He is a Portfolio Manager and a Partner. His responsibilities include investment research and analysis, as well as assisting enterprises controlled or influenced by Standard General with operational, transactional, and financial needs. He worked at Lazard Frères & Co. as an investment banker, where he specialized in mergers and acquisitions and company restructurings. He’s also had experience with the Blackstone Group.

Opinion: I guess there is a price for everything and looking at the chart above and the insider buying you would have to think we must be near it for Turning Point Brands. It’s a mishmash of products and the company is growing revenues. I just have to believe there will be better opportunities out there. It’s also kind of funny thinking about Dr. Efremov with his Yale Law School and Doctorate degree and Zig Zag rolling papers in the same sentence.

Name: Griffin Amy

Position: Director

Transaction Date: 2022-03-17 Shares Bought: 35,200 Average Price Paid: $28.37 Cost: $998,624

Company: Bumble Inc (BMBL)

Bumble Inc is an online dating platform. The Company provides a dating mobile application (app). Its platform enables people to connect and build equitable and healthy relationships on their own terms. The Company operates two apps Bumble and Badoo. The Bumble app is built with women at the center. Its serves across countries, including the United States, United Kingdom, Australia, and Canada. It gives users a variety of subscription lengths, with the most popular being 7-day, 30-day, and 90-day. Beeline, Rematch, and Extend are some of the company’s subscription services. Badoo is a free dating app available on the web and on mobile devices. It emphasizes the need of forming meaningful ties with everyone. Liked You, Extra Shows, and Undo Vote are among the premium subscription services available. Bumble BFF and Bumble Bizz, also facilitate platonic friendships and business networking.

Amy M. Griffin has served as a member of our board of directors since February 2021. Ms. Griffin is the Founder and Managing Partner of G9 Ventures, an early-stage fund dedicated to helping customers live, look and feel better. Ms. Griffin began her career in marketing at Ms. and Working Woman magazines before moving on to work as a Sports Marketing and Olympic Manager at Sports Illustrated. Ms. Griffin began investing in and working with early-stage firms in 2011 after utilizing her operations and branding knowledge. G9 Ventures was formed in 2018 as a formalization of her portfolio. Ms. Griffin co-founded Social Studies, a cutting-edge entertainment platform, in 2019.

Opinion: This massive insider buy got posted late in the day on Friday and could explain the tepid pin action for the Bumble. It should have a big catch-up bounce Monday morning for nimble traders but until Bumble can show revenue growth translates to the bottom line, any bounce will be shallow and short.

Name: Dodge R Stanton

Position: Director

Transaction Date: 2022-03-10 Shares Bought: 20,500 Average Price Paid: $24.17 Cost: $495,485

Company: EchoStar Corp (SATS)

EchoStar Corporation is a holding company that owns other companies. The company is a global provider of satellite technologies, Internet services for residential and small-to-medium-sized corporate customers, and satellite services. It also provides enterprise customers with network technology, managed services, and communications solutions, including those in the aerospace and government sectors. Hughes and EchoStar Satellite Services are the company’s two segments. Its Hughes business delivers home and office broadband satellite technologies and services, as well as network technologies, managed services, and communication solutions to domestic and foreign consumers, as well as enterprise and government customers. The ESS division provides satellite services to the US government, Internet service providers, broadcast news organizations, content providers, and commercial enterprise customers on a full-time and/or occasional-use basis.

Mr. Dodge is a member of the board of directors of our company. Mr. Dodge presently serves as the Chief Legal Officer of DraftKings Inc., where he is responsible for the legal, government affairs, and corporate communications departments. Mr. Dodge was the Executive Vice President, General Counsel, and Secretary of DISH Network Corporation from June 2007 to October 2017, and was in charge of all legal, government relations, and corporate communications for DISH and its subsidiaries. Mr. Dodge served as our Executive Vice President, General Counsel, and Secretary from October 2007 to November 2011 as part of a management services arrangement between DISH and EchoStar that was signed in connection with EchoStar’s 2008 spin-off from DISH. Since November 1996 when Mr. Dodge joined DISH, he held various positions of increasing responsibility at DISH and its subsidiaries.

Opinion: Supposedly, EchoStar has hidden value and optionality in its S-Band spectrum position. This is way beyond my interest in analyzing as the same thing has been said about DISH for years that it has a spectrum that would be extremely valuable to wireless operators or a company interested in getting into the business, perhaps Google, who seems to be intensifying their push into high-speed Internet delivery. For those that want to dig deeper into this, I found a helpful recent article to begin with from Space News.

Name: Lynch Brian P

Position: CFO

Transaction Date: 2022-03-14 Shares Bought: 15,000 Average Price Paid: $21.73 Cost: $325,895.00

Company: Callaway Golf Co. (ELY)

Name: Brewer Oliver G III

Position: CEO

Transaction Date: 2022-03-14 Shares Bought: 16,000 Average Price Paid: $21.55 Cost: $344,800.00

Company: Callaway Golf Co. (ELY)

Callaway Golf Company, together with its subsidiaries, designs, manufactures and sells golf clubs and golf balls, apparel, gear, and other products. It operates through two segments, Golf Equipment; and Apparel, Gear, and Other. The Golf Equipment segment provides drivers, fairway woods, hybrids, irons, wedges, packaged sets, putters, and pre-owned golf clubs under the Callaway and Odyssey brands, as well as golf balls under the Callaway Golf and Strata brand names. The Apparel, Gear, and Other segment offer golf apparel and footwear; golf accessories, including golf bags, golf gloves, headwear, and practice aids under the Callaway brand; and golf and lifestyle apparel, hats, luggage and accessories, footwear, belts, hats, socks, and underwear under the TravisMathew brand name. This segment also provides storage gear for sport and personal use, including backpacks; travel, duffel, and golf bags; and storage gear accessories, as well as outerwear, headwear, and accessories under the OGIO brand.

Brian Lynch is the Executive Vice President and Chief Financial Officer of the Company and has served in this role since January 2019. Prior to his current position, he served as the Company’s Senior Vice President, General Counsel, and Corporate Secretary since June 2012, before being appointed the additional role of Interim Chief Financial Officer in April 2017 and Chief Financial Officer in July 2017. He is responsible for the Company’s finance, legal, IT, corporate governance, and compliance functions. Mr. Lynch also formerly served as the Company’s Chief Ethics Officer.

Since joining Callaway Golf in March 2012, Oliver G. “Chip” Brewer III has served as a Director, President, and Chief Executive Officer. Mr. Brewer is in charge of all aspects of the firm, and under his direction, Callaway has evolved into an unequaled tech-enabled golf brand that provides cutting-edge golf equipment, apparel, and entertainment. The Company’s portfolio of global brands includes Callaway Golf, Topgolf, Odyssey, OGIO, TravisMathew, and Jack Wolfskin. He was the President and Chief Executive Officer of Adams Golf from January 2002 to February 2012.

Opinion: Looking at this chart I would say this is the classic case of catching a falling knife. I can see why the CEO and CFO might want to buy this dog as they have to answer the board of directors, but I’m struggling with why I or for that matter you might want to buy it. Calloway has made a big bet on golf off the golf course with their entry into entertainment, Top Golf. That could pay long-term dividends and fundamentally change the trajectory of the Company. Golf has benefitted from Millenials picking up the sport but investors want to see steady top-line growth translating to the bottom line. Once ELY demonstrates that shareholders will be rewarded.

Name: Harkness James

Position: COO

Transaction Date: 2022-03-15 Shares Bought: 38,968 Average Price Paid: $19.65 Cost: $765,637.00

Company: Inotiv Inc (NOTV)

Inotiv, Inc. is a leading contract research organization dedicated to providing nonclinical and analytical drug discovery and development services and research models, and related products and services. The Company’s products and services focus on bringing new drugs and medical devices through the discovery and preclinical phases of development, all while increasing efficiency, improving data, and reducing the cost of taking new drugs to market. Inotiv is committed to supporting discovery and development objectives as well as helping researchers realize the full potential of their critical R&D projects, all while working together to build a healthier and safer world. In choosing a laboratory partner for discovery and development, expect more: more attention, more insight, and a superlative experience. You’ve worked hard to get this far, and you deserve a provider seamlessly aligned to your needs and goals. Through scientific leadership and ongoing investments, Inotiv delivers a comprehensive range of nonclinical and analytical services that will exceed your expectations.

James currently serves as Inotiv’s Chief operating officer, Research Models, and Services (“RMS”) the portion of operations that encompasses the legacy Envigo offerings. Before joining Envigo as part of the 2019 acquisition of Covance Research Products, Jim spent more than two decades at Covance, most recently serving as vice president of Covance’s Early Development Global Safety Assessment Operations and general manager for Covance Research Products Business. James had previously held a number of worldwide leadership roles with increasing responsibilities for Covance’s central laboratory operations.

Opinion: Inotiv has grown rapidly through acquisitions so analyzing the organic growth rate is impossible. In September last year, they announced a transformational acquisition. Based upon the closing price of Inotiv common stock on Monday, September 20, 2021, the transaction values Envigo at an enterprise value of approximately $545 million, and the combined company at an enterprise value of approximately $1.2 billion. Upon closing of the transaction, Inotiv shareholders are expected to own approximately 64 percent and Envigo shareholders are expected to own approximately 36 percent of the combined company on a fully diluted basis.

Name: Sloan Harry

Position: Director

Transaction Date: 2022-03-14 Shares Bought: 50,000 Average Price Paid: $15.39 Cost: $769,500.00

Company: DraftKings Inc. (DKNG)

Name: Nada Hany M

Position: Director

Transaction Date: 2022-03-14 Shares Bought: 65,000 Average Price Paid: $15.34 Cost: $997,100.00

Company: DraftKings Inc. (DKNG)

DraftKings Inc. is a digital sports entertainment and gaming company created to fuel the competitive spirit of sports fans with products that range across daily fantasy, regulated gaming, and digital media. Headquartered in Boston, and launched in 2012 by Jason Robins, Matt Kalish, and Paul Liberman, DraftKings is the only U.S.-based vertically integrated sports betting operator. DraftKings is a multi-channel provider of sports betting and gaming technologies, powering sports and gaming entertainment for operators in 17 countries. DraftKings’ Sportsbook is live with mobile and/or retail betting operations in the United States pursuant to regulations in Arizona, Colorado, Illinois, Indiana, Iowa, Michigan, Mississippi, New Hampshire, New Jersey, New York, Oregon, Pennsylvania, Tennessee, Virginia, West Virginia, and Wyoming. DraftKings’ daily fantasy sports product is available in 7 countries internationally with 15 distinct sports categories. DraftKings is the official daily fantasy partner of the NFL, MLB, NASCAR, PGA TOUR, and UFC as well as an authorized gaming operator of the NBA and MLB, an official sports betting partner of the NFL, an official betting operator of PGA TOUR, and the official betting operator of UFC.

Harry Evans Sloan is a media investor, entrepreneur, and studio executive, and Vice Chairman of the Board. Mr. Sloan co-founded Flying Eagle (NASDAQ: FEAC), a special purpose acquisition vehicle, in 2020, and serves as its Chief Executive Officer and Chairman. Additionally, Mr. Sloan co-founded Global Eagle Acquisition Corp., a special purpose acquisition vehicle, in 2011, serving as its Chairman and Chief Executive Officer through its business combination with Row 44, Inc. and Advanced Inflight Alliance AG in January 2013, and remains a director of the combined company, Global Eagle Entertainment Inc. (NASDAQ: ENT).

Hany M. Nada, a venture capitalist, co-founded ACME Capital in January 2019 and is one of the firm’s partners. Mr. Nada co-founded GGV Capital LLC (previously Granite Global Ventures, “GGV”), a venture capital firm, in 2000 and served as a Managing Director from 2000 to October 2016 and as a Venture Partner from November 2016 to October 2018. Mr. Nada was a Managing Director and Senior Research Analyst at Piper Sandler & Co. f/k/a Piper Jaffray & Co, an investment banking business that specialized in Internet software and e-infrastructure, prior to co-founding GGV. Mr. Nada currently serves as a member of the board of directors of several companies, including Glu Mobile (NASDAQ: GLUU), in which he sits on the audit committee, compensation committee, and strategy committee; ArchByte; and DraftKings.

Opinion: Draft King is one of Jim Chanos’s favorite short ideas. I can see why. The sentiment on the legalization of sports betting drove prices of all associated companies into the stratosphere. What happened next was entirely predictable, an irrational spending campaign for market share. For companies like Draft King, it’s existential. You’ll spend as much as you can to be a long-term survivor. That’s not a position that shareholders thrive in. Comments by Casear’s management that they are going to reduce their marketing spend, are providing a more positive backdrop that the market share at any cost mentality is abating. I think at the end of the day, sports betting is like any other business and there will be little brand loyalty. Customers will gravitate toward the lowest-cost provider. In gambling terms, that will be the company with the best payouts, not the most profits for its shareholders.

Name: Toler William Douglas

Position: CEO/Chairman

Transaction Date: 2022-03-04 Shares Bought: 25,000 Average Price Paid: $14.28 Cost: $357,100.00

Company: Hydrofarm Holding Group, Inc (HYFM)

In the United States and Canada, Hydrofarm Holdings Group, Inc., along with its subsidiaries, manufactures and distributes controlled environment agriculture equipment and supplies. The company sells agricultural lighting devices, indoor climate control equipment, hydroponics and nutrients, and plant additives for growing, farming, and cultivating cannabis, flowers, fruits, plants, vegetables, grains, and herbs in a controlled environment, as well as CEA equipment and supplies, such as grow light systems, heating, ventilation, and air conditioning systems, humidity and carbon dioxide monitors and controllers, water pumps, heaters, chillers, and anaerobic digestion systems. It also provides hydroponics systems, such as hydro systems, hydro trays and components, meters and solutions, pumps and irrigation systems, water filtration systems, pots and containers, and tents and tarps; atmospheric control equipment comprising controllers, monitors, and timers, ventilation/air conditioning equipment, air purification equipment, and CO2 equipment; and nutrients and additives.

Since May 21, 2014, Mr. William Douglas Toler, better known as Bill, has served as the Chief Executive Officer and President of Hostess Brands, LLC. Until September 2013, Mr. Toler was the Chief Executive Officer and President of AdvancePierre Foods, Inc. From July 6, 2005, to November 7, 2008, he was President of Pinnacle Foods Inc., and from March 19, 2004, to July 2005, he was Executive Vice President of Sales. From March 19, 2004, to July 2005, he worked for Pinnacle Foods Group Inc. as an Executive Vice President of Sales. Pinnacle Foods Finance LLC was his company’s president. At Pinnacle Foods Group Inc., he was in charge of sales and marketing, as well as transportation, warehousing, and customer service. He served as the President of Pinnacle Foods Group Inc. since July 6, 2005. He served as the President of Aurora Foods, Inc. since July 2005.

Opinion: Controlled agriculture is more of a buzzword than a real business at this time. Hydrofarm is really about the indoor growing of cannabis. I have seen no evidence that the hydroponics and highly engineered systems that are used to grow a highly-priced cannabis crop can be applied to the $1Trillion conventional agriculture market in a meaningful way. App Harvest is the best example of growing non-cannabis products in a controlled agricultural environment. The market is tiny with the market leader, APPH reporting Q4 net sales of just $3.1M.

Name: Spreng R David

Position: CEO

Transaction Date: 2022-03-10 Shares Bought: 30,000 Average Price Paid: $12.35 Cost: $370,500

Company: Runway Growth Finance Corp (RWAY)

Runway Growth Finance Corp., formerly Runway Growth Credit Fund Inc., is a specialty finance firm specializing in senior secured loans to high-growth companies in technology, life sciences, healthcare information and services, business services, select consumer services, and products, and other high-growth industries. To expedite expansion, the company works with major venture capital sponsors as well as directly with entrepreneurs seeking finance. Its investment objective is to maximize the total return to stockholders by providing its portfolio companies with financing solutions that are more flexible than traditional credit and less dilutive than equity, primarily through current income on the Company’s loan portfolio and secondarily through capital appreciation on warrants and other equity positions. Runway Growth Capital LLC, the Company’s adviser, is a provider of growth financing for mid-to-late stage and growth stage firms.

David Spreng, Founder, CEO, and Chief Investment Officer of Runway Growth. David Spreng has been associated with two companies, according to public records. The companies were formed over a one-year period with the most recent being incorporated five years ago in March of 2017.

Opinion: There are quite a few seasoned mezzanine loan companies on the public market. This is likely an example of a CEO supporting his newly public company. We’re not following him.

Name: Schultz Alex P

Position: Director

Transaction Date: 2022-03-16 Shares Bought: 36,200 Average Price Paid: $11.84 Cost: $428,630.00

Company: Lindblad Expeditions Holdings Inc (LIND)

Lindblad Expeditions Holdings, Inc. is a company, which allows people to connect with exotic and remote places. The Company operates a fleet of nine owned expedition ships and five seasonal charter vessels. It operates through two segments: Lindblad and Land Experiences. The Lindblad segment consists primarily of ship-based expeditions aboard customized, nimble, and intimately scaled vessels, which offer up-close experiences in the planet’s wild and remote places and capitals of culture. Many of these trips take place in isolated locations with limited infrastructure and ports, such as Antarctica and the Arctic, or in regions that can only be reached by ships, such as the Galapagos Islands, Alaska, Baja’s Sea of Cortez, and Panama. Natural Habitat, DuVine, and Off the Beaten Path are among the company’s three predominantly land-based brands in the Land Experiences category. Natural Habitat offers over 100 different expedition routes throughout all seven continents in around 45 countries.

Alex Schultz is chief marketing officer and VP of Analytics at Meta, formerly Facebook, leading consumer marketing and product analytics globally. Mr. Schultz has been with Meta since 2007 and has led the internationalization team since 2011 and the analytics team since 2015. In addition to his role as CMO and VP of Analytics, Mr. Schultz is the executive sponsor of Meta’s LGBTQ+ Employee Resource Group. Prior to joining Meta, Mr. Schultz worked at eBay as a Marketing Manager, where he was in charge of worldwide targeting for eBay’s onsite merchandising, among other things. Mr. Schultz earned his M.Sc. in Natural Sciences from Magdalene College, Cambridge, with a focus on experimental and theoretical physics.

Opinion: Boutique adventure cruising company represents a tasty acquisition candidate for a larger cruise line that can chop out G&A and drop the revenues to the bottom line. Short of that, I see no opportunity as long as the founder and majority shareholder, Lindblad Sven-Olof, is pounding the bid.

Name: Benhamou Eric

Position: Director

Transaction Date: 2022-03-16 Shares Bought: 23,500 Average Price Paid: $10.88 Cost: $255,680.00

Company: Grid Dynamics Holdings Inc (GDYN)

Grid Dynamics Holdings, Inc. is providing enterprise-level digital transformation services. The Company offers collaborations to provide digital transformation initiatives, which include consulting, development of prototypes, and enterprise-scale delivery of digital platforms. The Company is focused on providing technical consulting, software design, development, testing, and Internet service operations. Retail, technology, consumer packaged goods (CPG)/manufacturing, and finance are among the industries where the company provides solutions. Digital transformation strategy consulting, emerging technology engineering services, lean laboratories, and legacy re-platforming solutions are among the company’s offerings. It uses a variety of technologies to facilitate digital transformation across the company, including artificial intelligence (AI), data science, cloud computing, Big Data, and DevOps.

Eric Benhamou a director since inception, co-founded Bridge Communications, a specialist in computer network technologies in 1981. In 1987, Bridge Communications joined with 3Com Corporation, a networking equipment manufacturer. After that, he worked for 3Com as Chief Executive Officer from 1990 to 2000, and then as Chairman until 2010. As 3Com’s CEO, he oversaw the company’s acquisition of US Robotics, the parent company of Palm, Inc., the company behind the pioneering Palm Pilot. After that, in 2000, Palm, Inc. was spun off, and Mr. Benhamou served as its Chief Executive Officer until 2003.

Opinion: Grid Dynamics entered into a definitive merger agreement with ChaSerg, a special purpose acquisition vehicle (SPAC), to become a publicly listed company on NASDAQ on November 15, 2019 and completed the IPO process on March 5th, 2020. I cannot find any reason to justify buying this stock.

Name: DeFlorio Jane E

Position: Director

Transaction Date: 2022-03-14 Shares Bought: 28,000 Average Price Paid: $10.57 Cost: $295,960.00

Company: Vivid Seats Inc. (SEAT)

Vivid Seats Inc., formerly Horizon Acquisition Corp, is a technology-based marketplace that connects fans of live events with third-party ticket vendors. The business is divided into two segments: marketplace and resale. Its marketplace portion operates as a go-between for ticket buyers and third-party sellers. Through its website www.vividseats.com and Vivid Seats native applications, it facilitates the sale of tickets by third-party ticket vendors. It also offers third-party distribution partners a private label service that includes technological solutions that allow them to sell tickets on their own websites. The resale portion of the company largely functions as an internal research and development group focused on developing seller software and tools. The company’s Skybox platform, an enterprise resource planning (ERP) application that helps merchants manage inventory, modify prices, and fulfill orders, provides support to sellers.

Jane E. DeFlorio is on the board of SITE Centers Corp. and 4 other companies. Ms. DeFlorio previously was MD-Retail & Consumer Sector Investment Banking at Deutsche Bank AG and MD-Retail & Consumer Investment Banking Group at Deutsche Bank Securities, Inc. and Executive Director-Investment Banking at UBS Investment Bank.

Opinion: Another SPAC, AVOID.

Name: Goettler Michael

Position: CEO

Transaction Date: 2022-03-15 Shares Bought: 50,352 Average Price Paid: $9.87 Cost: $496,773.00

Company: Viatris Inc (VTRS)

Viatris Inc. operates as a healthcare company worldwide. Viatris Inc. is an American global healthcare company headquartered in Canonsburg, Pennsylvania. The company was formed through the merger of Mylan and Upjohn, a division of Pfizer, on November 16, 2020. The company operates in four segments: Developed Markets, Greater China, JANZ, and Emerging Markets. It offers prescription brand drugs, generic drugs, complex generic drugs, biosimilars, and active pharmaceutical ingredients (APIs). The company provides drugs in a variety of therapeutic areas, including noncommunicable and infectious diseases; biosimilars in oncology, immunology, endocrinology, ophthalmology, and dermatology; and APIs in the areas of antibacterial, central nervous system agents, antihistamines/antiasthmatics, cardiovascular, antivirals, antidiabetics, antifungals, and proton pump inhibitors, as well as support services such as diagnostic clinics, educational seminars.

Michael Goettler is the chief executive officer of Viatris, with responsibility for the execution of the company’s strategy and a focus on leveraging Viatris’ enhanced commercial capabilities in China and other key markets. He also serves on the board of directors. Goettler was the group president of Pfizer’s Upjohn division, the company’s off-patent and generics business, and a member of Pfizer’s executive leadership team before joining Viatris. Goettler has substantial commercial leadership experience, having lived and worked in a variety of Asian and European regions.

Opinion: I would avoid owning any company that is associated with the corporate looter and shareholder value destroyer, Robert Coury. Coury turned down a $40 billion offer from Teva to purchase Mylan in 2015. “We do not wish to make Teva’s problems Mylan’s problems, or to inflict them on Mylan’s shareholders and other stakeholders,” Robert J. Coury, Mylan’s executive chairman, wrote in a letter to Teva. “This potential combination is clearly in no one’s best interest.” What was he talking about? It was clear to the shareholders of Mylan but Coury, one of the highest-paid corporate chieftains, never gave the shareholders the opportunity to vote on it He would have certainly lost his grotesque salary. Instead, look at where Mylan now Viatris is today. Viatris is worth just under $13 billion and the Company is saddled with over $19 billion in debt.

Name: Massey Richard N

Position: Director

Transaction Date: 2022-03-11 Shares Bought: 50,000 Average Price Paid: $8.92 Cost: $446,000.00

Company: Alight Inc. / Delaware (ALIT)

Delaware-based light Inc. is a prominent cloud-based provider of digital human resources and business solutions. They are adamant that a company’s success begins with its employees, and their solutions combine human insights with technology. The Alight Worklife employee engagement platform enables Alight’s BPaaS model by merging content, AI, and data analytics to deliver a seamless tomer experience. Employees may improve their health, wealth, and well-being with their mission-critical solutions, which enables multinational enterprises to establish a high-performance culture. Currently, they disclose operations results in three parts. Professional Services: This category comprises project-based cloud deployment and consulting services that cover both human capital and financial platforms. For cloud systems like Workday, SAP SuccessFactors, Oracle, and Cornerstone OnDemand, this covers cloud advising and setup, as well as optimization services.

Richard N. Massey has served as Chairman of FTAC since April 2021, has served as Chief Executive Officer of FTAC since March 2020 and has served as a member of the FTAC Board since May 2020. In addition, he serves as a Senior Managing Director of Trasimene Capital Management LLC and has served as Chief Executive Officer of Cannae Holdings since November 2019. Since January 2021, Mr. Massey has also served as the Chief Executive Officer of Austerlitz Acquisition Corp. I and Austerlitz Acquisition Corp. II, as well as a director of both companies. From July 2020 until March 2021, Mr. Massey served as the Chief Executive Officer of Foley Trasimene Acquisition Corp. II, as well as a director of Foley Trasimene Acquisition Corp. II.

Opinion: With any of these cloud-based HR components, it’s difficult to evaluate. Companies spend months with outside consultants evaluating the merits of the enterprise-wide software that takes months if not years to install and then survey. Many companies use a reliable third party, such as Gartner to help navigate through the weeds and thicket to find the honey. We ran some compares through Gartner and they scored high relative to their competitors. This is CEO Massey’s second purchase, his first purchase was in 8-16-202 when he bought 30,000 at $10.79. he sold 62,000 shares at $12.46 in 9-15-21.

Name: Noto Anthony

Position: CEO

Transaction Date: 2022-03-15 Shares Bought: 34,000 Average Price Paid: $8.91 Cost: $303,008.00

Company: SoFi Technologies Inc. (SOFI)

Name: Schwartz Harvey M

Position: Director

Transaction Date: 2022-03-17 Shares Bought: 58,000 Average Price Paid: $8.84 Cost: $512,581.00

Company: SoFi Technologies Inc. (SOFI)

Name: Al-Hammadi Ahmed Ali

Position: Director

Transaction Date: 2022-03-16 Shares Bought: 10,000 Average Price Paid: $8.40 Cost: $84,000.00

Company: SoFi Technologies Inc. (SOFI)

SoFi Technologies, Inc. is a corporation that specializes in digital personal finance. Members can borrow, save, spend, invest, and protect their money through the Company. To offer products to members and suit their financial needs, the Company has built a financial services platform. Lending, Financial Services, and Technology Platform are the three business segments of SoFi. Its Lending division offers a variety of loan options, including school loans, personal loans, and house loans. SoFi Money, SoFi Invest, SoFi Credit Card, and SoFi Relay are among the company’s financial services offerings, which include cash management and investing services. Its Technology Platform provides Clearing Brokerage Services and Technology Platform Services. SoFi ‘s mobile application is available on iOS and Android. The Company also maintains SoFi Bank’s community bank business and footprint, including its three physical branches in Sacramento, Live Oak, and Yuba City, California.

Anthony is the CEO of SoFi and a board member of the company. Prior to joining SoFi, he was the company’s chief operating officer since November 2016, and its chief financial officer since joining in July 2014. Prior to joining Twitter, Anthony worked at Goldman Sachs for over four years as the co-head of global TMT investment banking. He joined Goldman Sachs in 1999 and served as the head of communications media and Internet equity research until being promoted to partner in 2004. Anthony spent almost three years as the National Football League’s chief financial officer before returning to Goldman.

on 1 July 2014, Twitter CEO Dick Costolo announced that Noto would join Twitter as the company’s CFO.[10] The two men built a good relationship the previous year when Noto managed Twitter’s account while at Goldman Sachs.[8] In 2014, Noto received total compensation of $73 million.[11]Noto did a stint at Twitter as CF) and earned $73 Million. It does pay to go to the Ivy League schools as Noto went to Wharton for an MBA

Mr. Harvey M. Schwartz is a member of the SoFi Technologies, Inc. Board of Directors. Mr. Schwartz formerly worked for The Goldman Sachs Group, Inc. as a Co-President and Co-Chief Operating Officer and Goldman Sachs & Co. LLC as a Principal. He graduated from Rutgers State University in New Jersey with a bachelor’s degree and an MBA from The Trustees of Columbia University in The City of New York.

Mr. Ahmed Ali H A Al-Hammadi serves as the Acting Head of Active Investments of Qatar Investment Authority (QIA). Mr. Al-Hammadi serves as the Head of Fund Investments Department of QIA. He oversees the active investment portfolios including sector portfolios, managed portfolios, and fund investments which represent the majority of the QIA’s international investments, and is responsible for fund investments in Private Equity, Equity, Hedge Funds, and Real Estate. Mr. Al-Hammadi served as an Associate in the Asset Management Department

Opinion: Noto has been accumulating shares as SOFI has been bumping along on its downward sloping trend. It’s encouraging to see someone else believing in the company, the vision, and the execution besides former investment banker, Noto. but it will take a lot more than belief to fulfill the ambitious mission of SOFI being a one-stop shopping spot for all your financial needs and requirements, particularly GEN X and Millenials and GEN Z.

I’m a full-blown skeptic about the one-stop shopping dream powered by AI. This is something that I can consider myself a thought leader on as I took one of the first companies in the Internet space public in 1997. We specialized in banking, in a field we labeled it”hyper convergence” Our marketing message was our game is Hypercompetition. Hyperconvergence. It’s played where the lines between banking, insurance, and brokerage are blurring. Pretty much SOFI message 24 years later.

Here’s the pro tip for you Anthony -People with money are generally intelligent enough to have done something to earn it and keep it or lucky enough to have inherited it- in almost all cases they gravitate unconsciously or consciously to best-of-breed applications. . Now if Noto can build best of breed apps from brokerage to loans to credit card perks on a simple intuitive hyper reliable platform, then he’s got my vote and my money and he’ll keep the naming rights to SoFi stadium and SoFi shareholder will grow rich. It’s a very hard task to deliver. I would call it the holy grail of investing and highly unlikely but it’s worth a small gamble.

The $1.2B purchase of Gallielo in April 2020 looks like it brings the tech and an API, relationships to help accelerate this vision. Galileo’s digital payments platform enables critical checking and savings account-like functionality via its powerful open APIs, providing companies with an easy way to create sophisticated consumer and B2B financial services. The company’s offerings are accessible via mobile, desktop, and a physical debit card. Galileo’s APIs power functionalities including account set-up, funding, direct deposit, ACH transfer, IVR, early paycheck direct deposit, bill pay, transaction notifications, check balance, and point of sale authorization as well as dozens of other capabilities. Galileo processed over $53B of annualized payments volume in March 2020, up from $26B in September 2019, with accelerating growth. SoFi Money is already tightly integrated with Galileo’s payment platform including several of its leading account and events API functionalities.

Galileo and SoFi will work together to accelerate the pace of technology innovation to offer Galileo’s partners, and subsequently consumers everywhere, even more value. These new functionalities and services will further help Galileo’s current and new partners capture the secular shift of financial transactions from the physical-only to a multi-channel digital and physical platform.

With the addition of Galileo, SoFi strengthens its capabilities, rounding out its best-in-class technology ecosystem. Additionally, the combination will extend the reach of its products to other Galileo partners in the United States and international markets, while offering diversification and scale to SoFi’s existing infrastructure.

Noto has $494 Million in the bank and with Galileo tech already paid for, this just might be enough to transform the financial services experience. But Antony, if you’re going to be a disrupter, it’s got to be better on all things including just opening an account. I tried today for two hours with their phone support and failed miserably. I wanted to move $50k sitting in a Wells Fargo checking account earning 0.001% interest and see how much progress SoFi has made on finding the holy grail.

Name: Roper Martin F

Position: CEO

Transaction Date: 2022-03-17 Shares Bought: 100,000 Average Price Paid: $8.75 Cost: $875,250.00

Company: Vita Coco Company Inc. (COCO)

The Vita Coco Company, Inc., formerly All Market Inc., is a plant-based functional hydration platform, which provides packaged coconut water. The Company’s portfolio is led by Vita Coco, which is focused on the global coconut water category with additional coconut oil and coconut milk offerings. It operates in two reporting segments: Americas and International. Vita Coco Coconut Water, Private Label, and Other are among the company’s product categories. All branded coconut water product products under the Vita Coco labels make up Vita Coco Coconut Water. All private label product offerings, including coconut water and oil, are included in the Private Label product category. Runa, a plant-based energy drink; Ever & Ever, a packaged water; and PWR LIFT, flavored protein-infused water, are among the other products in the other product category.

From September 2019 to December 2020, Mr. Roper was the President of Vita Coco. From 2001 to 2018, Mr. Roper was the Chief Executive Officer of The Boston Beer Corporation, Inc. (NYSE: SAM), an alcoholic beverage company, where he led the company’s net sales growth and brand diversification. From 1994 through 2001, Mr. Roper worked at The Boston Beer Company, Inc. as Chief Operating Officer and Vice President of Manufacturing and Business Development. Mr. Roper has served on the boards of directors of both Vita Coco and Lumber Liquidators Inc. in addition to Vita Coco.

Opinion: Peter Lynch, the godfather of Fidelity Investments, popularized the investing them of buying what you know in his investment classic One Up on Wall Street. We’ve been buying their coconut water for some time and it seems to dominate distribution whether in Kroger’s or Costco. The company has yet to make a profit as a publicly-traded company but it’s not hemorrhaging cash and is close to profitable at the moment.

Name: Nabi Sue

Position: CEO

Transaction Date: 2022-03-10 Shares Bought: 304,786 Average Price Paid: $8.29 Cost: $2,525,796.00

Company: COTY Inc. (COTY)

Name: Ballini Beatrice

Position: Director

Transaction Date: 2022-03-10 Shares Bought: 7,000 Average Price Paid: $7.87 Cost: $55,090.00

Company: COTY Inc. (COTY)

Coty Inc., together with its subsidiaries, engages in the manufacture, marketing, distribution, and sale of beauty products worldwide. The company provides prestige fragrances, skincare, and color cosmetics products through prestige retailers, including perfumeries, department stores, e-retailers, direct-to-consumer websites, and duty-free shops under the Alexander McQueen, Burberry, Bottega Veneta, Calvin Klein, Cavalli, Chloe, Davidoff, Escada, Gucci, Hugo Boss, Jil Sander, Joop!, Kylie Jenner, Lacoste, Lancaster, Marc Jacobs, Miu Miu, Nikos, philosophy, Kim Kardashian West, and Tiffany & Co. brands. It also offers mass color cosmetics, fragrance, skincare, and body care products primarily through hypermarkets, supermarkets, drug stores, pharmacies, mid-tier department stores, traditional food and drug retailers, and e-commerce retailers under the Adidas, Beckham, Biocolor, Bozzano, Bourjois, Bruno Banani, CoverGirl, Jovan, Max Factor, Mexx, Monange, Nautica, Paixao, Rimmel, Risque, Sally Hansen, Stetson, and 007 James Bond brands. Coty Inc. also sells its products through third-party distributors to approximately 150 countries and territories. The company was founded in 1904 and is based in New York, New York. Coty Inc. is a subsidiary of Cottage Holdco B.V.

Sue Y Nabi, the fifth chief executive of Coty since 2015, is betting the solution to finally fix the problem-plagued, heavily indebted cosmetics maker can be found in a tube of Gucci lipstick sold online in China. Sue is a beauty entrepreneur and innovator. Prior to joining Coty, she founded and ran the new-age luxury skincare line Orveda. She presided over such notable businesses as L’Oréal Paris and Lancôme throughout her 20 years at L’Oréal. Sue is a trained agronomist and environmental engineer with an Advanced Master’s Degree in Marketing Management from ESSEC Paris Business School.

In September of this year, Beatrice Ballini was appointed to the Board. Ms. Ballini is a senior member of Russell Reynolds Associates’ Retail Practice, where she manages Family Business Services and serves on the Board and CEO Advisory Group’s Steering Committee. Between the years of 2014 and 2017, Ms. Ballini served on the Executive Committee. Ms. Ballini was the Chief Executive Officer of a major men’s clothing maker in Milan before joining Russell Reynolds Associates 21 years ago, where she assisted with the company’s strategic growth. She began her career at Bain London and went on to become a Vice President at Goldman Sachs & Co.’s M&A Department in New York and a Manager at Bain & Co. in Boston.

Opinion:

Name: Ho John

Position: CEO

Transaction Date: 2022-03-14 Shares Bought: 30,769 Average Price Paid: $8.91 Cost: $274,152.00

Company: Landsea Homes Corp (LSEA)

Name: Porter Christopher T

Position: CFO

Transaction Date: 2022-03-14 Shares Bought: 38,000 Average Price Paid: $7.73 Cost: $293,740.00

Company: Landsea Homes Corp (LSEA)

Name: Forsum Michael

Position: COO

Transaction Date: 2022-03-14 Shares Bought: 27,300 Average Price Paid: $7.33 Cost: $200,109.00

Company: Landsea Homes Corp (LSEA)

Landsea Houses Corporation (Nasdaq: LSEA) is a publicly listed residential homebuilder based in Newport Beach, California, that designs and constructs best-in-class homes and sustainable master-planned communities in some of the country’s most coveted markets. The firm has built houses and communities in New York, Boston, New Jersey, Arizona, Florida, Texas, Silicon Valley, Los Angeles, and Orange County in California. An award-winning home builder that builds suburban, single-family detached and attached homes, mid-and high-rise properties, and master-planned communities, Landsea Homes is known for creating inspired places that reflect modern living and provides home buyers the opportunity to “Live in Your Element. People can live where they want, how they want in a home that has been designed specifically for them. Landsea Homes’ High-Performance Homes are carefully built to take advantage of the newest developments in home automation technology supported by Apple® and are driven by a pioneering commitment to sustainability. Homes have features that make life easier and provide energy savings, allowing for more comfortable living at a cheaper cost, as well as sustainability features that contribute to a healthier lifestyle for both homeowners and the environment.

Since 2013, John Ho has been the Chief Executive Officer and Director of Landsea Homes. Ho spent ten years in real estate investment and development with Colliers International and Jones Lang LaSalle before founding Landsea Homes. He served as Director at Jones Lang LaSalle from 2011 to 2013, leading the firm in cross-border business development and delivering transactional, consultancy, and other integrated real estate services to outbound Chinese businesses investing overseas. Ho graduated from the University of Southern California with a bachelor’s degree and an MBA from the UCLA Anderson School of Management.

Chris has considerable expertise leading financial operations for real estate companies, especially those that construct best-in-class communities, according to John Ho, CEO of Landsea Homes. His extensive knowledge, financial experience, and strong leadership abilities will assist Landsea Homes to maintain its current and future success. Porter has more than 30 years of experience in public and private equity corporate finance in a variety of industries, including commercial real estate, senior housing, defense contracting, and banking and finance. Porter became president and chief financial officer of Silverstone Healthcare Company, a senior living real estate developer, in 2013.

Landsea Homes’ President and Chief Operating Officer are Mike Forsum. Forsum spent seven years in private equity as a partner specialized in residential real estate investing before joining Landsea Homes in 2016. He also co-founded Starwood Land Ventures, an affiliated firm of Starwood Capital Group Global, in 2008. He has more than 30 years of experience in the homebuilding industry, including overseeing homebuilding operations at KB Homes, serving as Division President of Ryland Homes, and serving as West Region President and a member of the Taylor Woodrow/Morrison North American leadership team. Forsum is a member of HomeAid America’s National Board of Directors and holds a bachelor’s degree from Arizona State University.

Opinion:

Name: Lampen Richard

Position: COO

Transaction Date: 2022-03-10 Shares Bought: 30,000 Average Price Paid: $6.81 Cost: $204,168

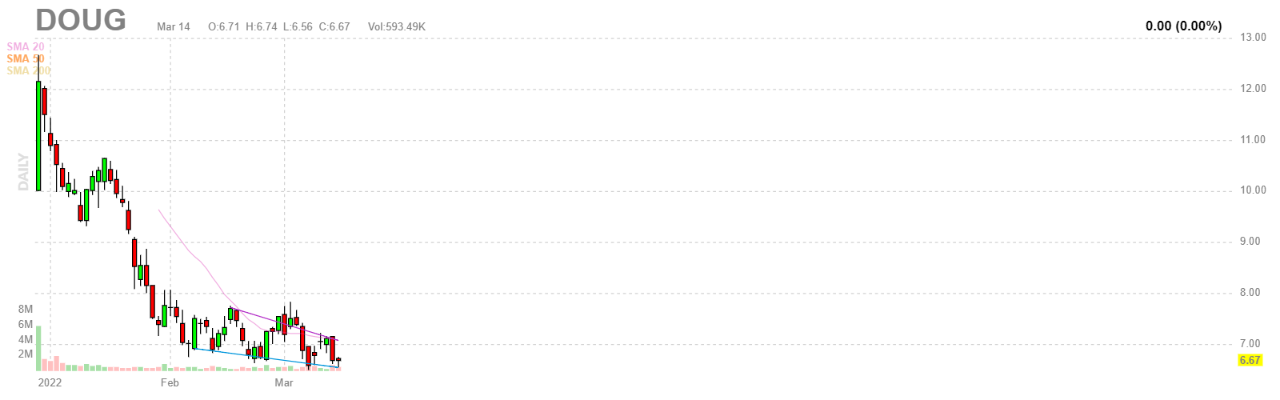

Company: Douglas Elliman Inc (DOUG)

Established in 1911, Douglas Elliman has grown to become the largest regional and the nation’s fourth-largest real estate company, with a current network of more than 5,000 agents in over 70 offices throughout Manhattan, Brooklyn, Queens, Long Island, Westchester, and Putnam Counties, as well as SouthFlorida and California. At Douglas Elliman, they are passionate about delivering exceptional consumer experiences. By offering a complete suite of real estate services, they ensure that they meet their consumers’ every need. From sales and rentals to mortgages, new developments, and title insurance, they have experts in every field to guide you skillfully from the beginning to the end of your real estate journey. Douglas Elliman’s outstanding track record, unique brand promise, and exceptional agent support system attract top talent, ensuring that their team of experts represents the very best in the industry. Douglas Elliman, they believe that access to the best and most timely information can dramatically shape their decisions. Today’s consumer needs a trusted resource that can separate signal from noise and help them navigate the complex process that real estate has become. With their extensive knowledge in every aspect of the field, and fueled by consumer research and insights, they are the go-to source for information and education.

Vice President and General Counsel, as well as a director. He was President and Chief Executive Officer of Ladenburg Thalmann Financial Services from September 2006 until February 2020, as well as a director. From September 2018 to February 2020, Mr. Lampen was Chairman of Ladenburg Thalmann Financial Services. Mr. Lampen was President and Chief Executive Officer of Castle Brands Inc. and a director from October 2008 until October 2019.

Opinion: Hello? Maybe, maybe not. How would anyone begin to evaluate this? It’s tough enough with interest rates and real estate both distorted but this company has no track record even.

Name: Drendel Frank M

Position: Director

Transaction Date: 2022-03-11 Shares Bought: 44,000 Average Price Paid: $6.83 Cost: $300,511.00

Company: CommScope Holding Company Inc. (COMM)

Name: Treadway Charles L

Position: CEO

Transaction Date: 2022-03-11 Shares Bought: 73,965 Average Price Paid: $6.78 Cost: $501,542

Company: CommScope Holding Company Inc. (COMM)