Curious how well insiders are doing with their buys? Click on this link or image above to scroll the significant buys of the last year.

It’s a holiday-shortened week and it’s the 2nd to last week of the year. All companies that report on the quarterly calendar schedule are in a full-blown earnings blackout. No officers, directors, or 10% shareholders are buying and selling unless they’ve done it through one of the increasingly duplicitous 10b5-1 plans that regulators are beginning to scrutinize. Besides is there really much to get excited about? Stock prices, real estate prices, and all matter of collectible and nouveau financial products like crypto and NFTs are near all-time highs. Even the insider‘s purchases that normally would lift animal spirits and cause a pop in their stock price or more like a lump of coal in your XMAS stocking. It’s a time to be exceedingly careful and ask yourself some very basic business questions. What does this company do? When will they make money and how much? and lastly, how much do I really want to pay for it. If you can find anything left to buy, chances are it will be one of these insider buys.

Name: Seipel Kenneth Duane

Position: Director

Transaction Date: 2021-12-17 Shares Bought: 2,950 Average Price Paid: $71.68 Cost: $211,456

Company: Citi Trends Inc. (CTRN)

Citi Trends, Inc. operates as a value-priced retailer of fashion apparel, accessories, and home goods. The company offers apparel, such as fashion sportswear and footwear for men and ladies, as well as kids, including newborns, infants, toddlers, boys, and girls; sleepwear, lingerie, and scrubs for ladies; and kids uniforms and accessories. It also provides accessories and beauty products that include handbags, luggage, hats, belts, sunglasses, jewelry, and watches, as well as undergarments and outerwear for men and women. In addition, the company offers home and lifestyle products comprising home products for the bedroom, bathroom, kitchen, and decorative accessories; and food, tech, team sports, and health products, as well as seasonal items, books, and toys. It provides its products primarily to African American and Latinx families in the United States. As of January 30, 2021, the company operated 585 stores in urban and rural markets in 33 states. The company was formerly known as Allied Fashion, Inc. and changed its name to Citi Trends, Inc. in 2001. Citi Trends, Inc. was founded in 1946 and is headquartered in Savannah, Georgia.

Kenneth Duane Seipel serves as Independent Director of the Company. He has served as the Chief Executive Officer of West Marine Inc., the world’s largest retailer of boating supplies, since January 2019. From April 2017 until December 2018, Mr. Seipel served as a Principal of Retail Business Optimization LLC, a consulting firm helping retailers optimize their retail execution. From March 2013 to March 2017, Mr. Seipel served as Chief Executive Officer of Gabriel Brothers Inc., an off-price retailer selling designer brands and fashions for up to 70% off department and specialty store prices. From March 2011 until February 2013, Mr. Seipel served as President and Chief Operating Officer of Wet Seal Inc.

Opinion: Judging by the chart action alone, this is not the kind of stock we are buying with a perfunctory buy of $200k. Step up Mr. Seipel and buy $2 million and I’ll take notice.

Name: Star James A

Position: Director

Transaction Date: 2021-12-20 Shares Bought: 32,278 Average Price Paid: $55.58 Cost: $1,793,990

Company: Chewy Inc. (CHWY)

Chewy, Inc., together with its subsidiaries, engages in the pure-play e-commerce business in the United States. The company provides pet food and treats, pet supplies and pet medications, and other pet-health products, as well as pet services for dogs, cats, fish, birds, small pets, horses, and reptiles through its chewy.com retail Website, as well as its mobile applications. It offers approximately 70,000 products from 2,500 partner brands. The company was founded in 2010 and is headquartered in Dania Beach, Florida. They have everything you need for your pet at amazing prices, every day. Explore more than 2,000 favorite brands, including Blue Buffalo, Nutro, Natural Balance, and Tidy Cats – all from the comfort of home. Their experts are here 24/7 to answer questions and help you find the perfect items for your pet. They also have a 100% Unconditional Satisfaction Guaranteed Policy on every order, just in case, they’re not crazy about that new food or toy. Shopping for your pet has never been easier. At Chewy, they strive to deliver the best products with the best service – and they want to become even better. Happy customers are always their #1 priority, and their team members are passionate about finding new ways to wow both pet owners and the industry at large.

Mr. Star currently serves as Executive Chairman and Investment Committee Chair of Longview Asset Management LLC (‘‘Longview’’), a multi-strategy investment firm that invests on behalf of individuals, trusts, and charitable foundations. From 2003 to 2019, he served as President and Chief Executive Officer of Longview. Since 1994, Mr. Star has also served as Vice President of Henry Crown and Company, a private family office affiliated with Longview. Mr. Star currently serves as a trustee of Equity Commonwealth, a publicly-traded REIT (NYSE ‘‘EQC’’), where he chairs the Nominating and Governance Committee. He is a director of the Atreides Foundation Fund Ltd, V-Square Quantitative Management LLC, and the holding company of Teaching Strategies LLC. From 2016 to 2018, Mr. Star served as a director of Allison Transmissions Holdings Inc. (NYSE ‘‘ALSN’’) and, from 2014 to 2019, he was a director of the holding company of PetSmart LLC. He also serves or has served, as a director or trustee of pension funds, registered mutual funds, private companies, and a private trust company.

Opinion: No one else at this company is buying including the CTO, the CFO, or the General Counsel. At some price, most stocks can get attractive. Although this was a decent size purchased. it seems like there is more to meet the eye here and until I know what it is, I recommend you stand on the sideline.

Name: English Alexandra Ford

Position: Director

Transaction Date: 2021-12-20 Shares Bought: 38,789 Average Price Paid: $19.33 Cost: $749,791

Company: Ford Motor Co. (F)

Ford Motor Company designs, manufactures, markets, and services a range of Ford trucks, cars, sport utility vehicles, electrified vehicles, and Lincoln luxury vehicles worldwide. It operates through three segments: Automotive, Mobility, and Ford Credit. The Automotive segment sells Ford and Lincoln vehicles, service parts, and accessories through distributors and dealers, as well as through dealerships to commercial fleet customers, daily rental car companies, and governments. The Mobility segment designs and builds mobility services, and provides self-driving systems development services. The Ford Credit segment primarily engages in vehicle-related financing and leasing activities to and through automotive dealers. It provides retail installment sale contracts for new and used vehicles; and direct financing leases for new vehicles to retail and commercial customers, such as leasing companies, government entities, daily rental companies, and fleet customers. This segment also offers wholesale loans to dealers to finance the purchase of vehicle inventory; and loans to dealers to finance working capital and enhance dealership facilities, purchase dealership real estate, and other dealer vehicle programs. Ford Motor Company has a strategic collaboration with ARB Corporation Limited to develop a suite of aftermarket products for the new Ford Bronco. The company was founded in 1903 and is based in Dearborn, Michigan.

Alexandra Ford English was elected to the Ford board of directors in May 2021. Within the company, she is a global brand merchandising director, a position to which she was named in September 2021. In that role, she is responsible for driving growth by leveraging Ford’s storied brand, iconic vehicles, and motor-sports success through an expanded collection of lifestyle merchandise. Previously, English was a director in Corporate Strategy, overseeing enterprise, connectivity, and digital network initiatives. Before that she was director of markets and operations for Ford’s Autonomous Vehicle LLC, including the successful deployment and operation of Ford’s autonomous vehicle business in Miami; Austin, Texas; and Washington, D.C. English was also part of the Ford Smart Mobility City Solutions team, working with cities to understand how mobility services can best be developed and implemented.

Opinion: Ford interests me. With or without “Build Back Better”, the automobile industry is set to enter unprecedented times as all the major manufacturers have plans on their drawing board if not on the factory floor to ultimately replace the combustion engine automobile with EV vehicles. This is big. The is the biggest thing to happen to industry since the replacement of the horse and buggy. Ford seems to have well-received new vehicles, Ford Mustang E (better review that Tesla Y) but production is very limited. If they can scale this car and the new best selling electric version of the best selling truck in the world, the F-150 this stock could be explosive. I like seeing young blood at the family and the scion of Chairman Ford, Alexandra English looks like the heir apparent. We’re gong all in on Ford but based on the chart, not this post. I want to see it base, pull back or have a general market sell-off before we dig deep. Their stake in Rivian could help relieve a lot of corporate debt and I expect them to sell it at some point to shore up the balance sheet. It was a smart and lucky bet but does Ford really need someone to tell them how to make a pick-up truck?

Name: Porter Jennifer E

Position: Chief Marketing Officer

Transaction Date: 2021-12-10 Shares Bought: 30,000 Average Price Paid: $11.99 Cost: $359,700

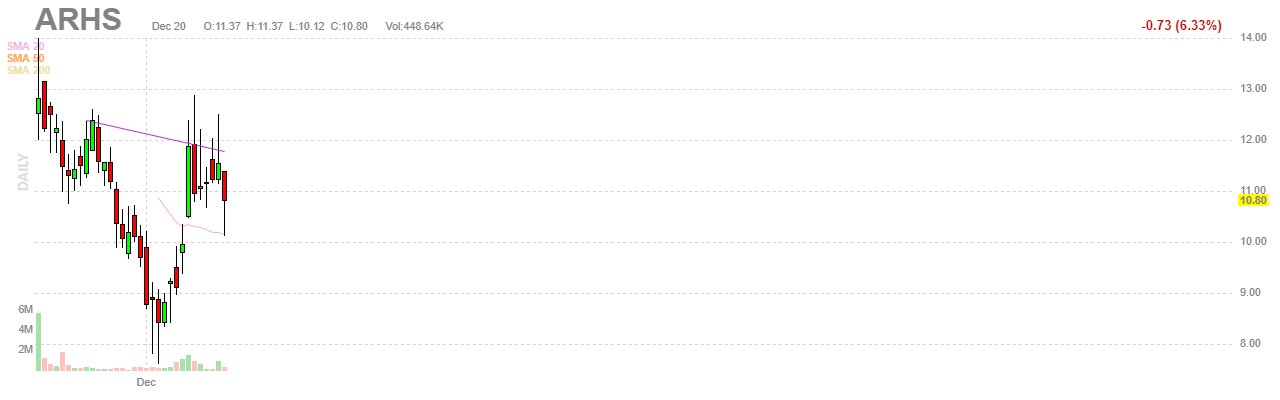

Company: Arhaus Inc. (ARHS)

Arhaus, Inc. provides merchandise assortments across various categories, including furniture, lighting, textiles, décor, and outdoor furniture product that includes bedroom, dining room, living room, home office furnishings; textile products consist of handcrafted indoor and outdoor rugs, bed linens, and pillows and throws décor products include wall art, mirrors, vases, candles, and other decorative accessories and outdoor products comprise outdoor dining tables, chairs, chaises and other furniture, lighting, textiles, décor, umbrellas, and fire pits. The company distributes its products through an omnichannel model comprising showrooms, e-commerce platforms, catalog, and in-home designer services. The company was founded in 1986 and is headquartered in Boston Heights, Ohio. Arhaus offers original handcrafted designs at 70 privately owned and operated store locations in the U.S. and online at arhaus.com. Headquartered in Cleveland, Ohio, we collaborate with skilled artisans worldwide to create (and recreate) pieces that reflect many cultures, from Italy to Indonesia. The result is an eclectic mix of designs exclusive to our stores and arhaus.com. Furnishing a Better World: This is the premise of the Arhaus design philosophy; it dates back to 1986 when the father and son John and Jack Reed opened the first store location in the historic Flats District downtown Cleveland and vowed never to use wood from the world’s endangered rainforests in the making of an Arhaus design. Today, nearly 50 percent of the product assortment is made of recycled material—everything from glass to metals like copper and reclaimed wood from buildings no longer standing and vessels no longer set sail. Timbers are either reclaimed or sustainably sourced. A Port City Called Aarhus: The Danish port city Århus (pronounced ohr-HOOSE) inspired the name. John came across Arhus on a map and took an immediate liking. After a few minor modifications, “Arhaus” represented the warmth and luxury of the then (and now) home furnishings offered. Store Footprint: Stores average 16,000+ sq. ft. and are filled with one-of-a-kind handcrafted home furnishings reflective of a distinct global point-of-view.

Jennifer Porter works as a Chief Marketing Officer at Arhaus, which is a Furniture company with an estimated 1,460 employees; and was founded in 1986. They are part of the Marketing Executive team within the C-Suite Department and their management level is C-Level. Jennifer is currently based in Boston Heights, United States. They used to work at The Corners of Brookfield and Anthropologie.

Opinion: Newly IPO’d home furnishing company is not having an easy go of it. AND WHY would anyone expect anything less when Amazon and Wayfair work at profit margins that few companies can subsist on. Add to the mix, high end First Dibs and Etsy, Ebay, etc- why would you want to do this?

Name: McGarvey Casey Kale

Position: Chief Legal Officer

Transaction Date: 2021-12-16 Shares Bought: 47,700 Average Price Paid: $10.48 Cost: $500,130

Company: Purple Innovation Inc. (PRPL)

Purple — home of the one, the only, the Purple Grid™. They are ranked #1 in Customer Satisfaction with a bed in a box of mattresses by J.D. Power, including best in support and comfort! They’re a one-of-a-kind innovation brand that is on a mission to meaningfully improve lives by helping Every Body get the comfort they deserve and the support they need. Their premium comfort innovation products start in the bedroom and extend beyond to provide optimal comfort everywhere you go. With a variety of mattresses, bedding, bases, seat cushions, dog beds, and more, Purple is quickly becoming the iconic color of true comfort, true innovation, and truly feeling great. While most new mattress companies only focus on just a simpler mattress buying experience with the same foam mattresses, Purple is committed to simply making a better mattress (with the better buying experience, to boot!). The only mattress with the Purple Grid™, Purple is instantly soft where you want it and firm where you need it – all at once. It’s the comfort you crave, the support your back needs. Plus, 1,500+ open airways help dissipate body heat rather than trapping it, so you don’t sleep hot. It all started in 1989 when two engineer brothers, Tony and Terry Pearce, set out with a mission to invent technology and create local jobs that meaningfully improve the lives of everyone involved. Over the last 30+ years, the Brothers Pearce have revolutionized the comfort industry by innovating various No Pressure® cushioning materials used in everything from wheelchairs and critical care hospital beds to sporting goods and high-end mattresses. Then, in September of 2015, they successfully launched The No-Compromise Purple® Mattress on Kickstarter, and it’s been uphill from there — continually inventing, improving, and creating ways to make the world a more comfortable place.

Casey K. McGarvey J.D. serves as Chief Legal Officer and Secretary of the Company. He also has served as General Counsel of various technology companies owned by Terry and Tony Pearce, including EdiZONE, LLC, focused on developing advanced cushioning technology, since August 2008. Prior to joining EdiZONE and Purple LLC, Mr. McGarvey was a shareholder, partner or of counsel at several law firms. Mr. McGarvey brings to the Company over 30 years of legal experience which has included the representation of numerous companies on many diverse business matters. Mr. McGarvey has a Bachelor of Arts in political science, a Juris Doctor, and an Executive Masters of Business Administration, each from the University of Utah.

Opinion: This just looks like a bad idea. Rats are all abandoning the ship. With money so easy to come by, the market is full of companies that should never be public. The mattress market is too crowded t but at some price, everything moves. On December 14th the chief executive stepped down at the mattress retailer and the company lowered sales guidance, prompting analysts to slash their price targets. Chief Executive Joe Megibow will be leaving the company, a move that comes just four months after Chief Financial Officer Craig Phillips departed. The stock dropped 6.9% to $9.12 but was the winner for the week, up 28%. I guess the good news is that the bums are gone.

Name: Meyer Christopher G.B

Position: CEO

Transaction Date: 2021-12-17 Shares Bought: 66,500 Average Price Paid: $5.10 Cost: $338,870

Company: Net 1 Ueps Technologies Inc. (UEPS)

Net 1 UEPS Technologies, Inc., a financial technology company, provides fintech products and services to unbanked and underbanked individuals and small businesses primarily in South Africa and internationally. The company develops payment technologies to offer financial and value-added services to its customers. It operates through three segments: Processing, Financial Services, and Technology. The Processing segment provides transaction processing services that involve the collection, transmittal, and retrieval of all transaction data to its customers. The Financial Services segment includes activities related to the provision of financial services to customers, including bank accounts, loans, and life insurance products. This segment also provides short-term loans to customers. The Technology segment sells hardware, such as point of sale devices, SIM cards, and other consumables; and licenses the right to use certain technology developed by the company, as well as offers related technology services. The company was incorporated in 1997 and is headquartered in Johannesburg, South Africa..

Chris Meyer has been the chief executive officer of Net 1 since July 1, 2021. Prior to joining Net1, Mr. Meyer was the Head of Corporate & Investment Banking and Joint Managing Director at Investec Bank Plc, an LSE-listed specialist bank and wealth manager, having served in many different roles within the Investec Group since 2001. He was also an executive director for various international and regional subsidiaries of Investec Bank Plc. Mr. Meyer is a member of the South African Institute of Chartered Accountants, holds an MSc in Finance from the London Business School and a Post Graduate Diploma in Accounting from the University of Cape Town.

Opinion: This is an interesting situation and I honestly don’t know what’s going on. Lots of insiders are buying this perennial loser. Something is up but I haven’t been able to figure it out. I’d buy a little. Where there’s smoke, there usually is fire.

Follow us on Twitter for real-time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

Insiders sell the stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer-friendly and responsive I’ve used.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019