Curious how well insiders are doing with their buys? Click on this link or image above to scroll the significant buys of the last year.

I’ve been monitoring insider behavior and how it impacts stock prices for about as long as anyone out there I haven’t seen much that shocks me or changes my perception of the usefulness of this information. Now I have. Normally significant insider buying will put a floor on a down-trending stock. That’s changed with SPACS. No matter how encouraging the news is or robust the insider buying is, when you have big shareholders waiting in the background to hit the bid, it’s killing the investment. This is what’s likely happening to Cano Health and other good companies that have gone public through the SPAC process.

Going public through a SPAC rather than the traditional process should not be inherently different. In reality, it seems to be night and day. I analyzed a list of companies that have merged with a SPAC provided by Stock Market MBA. Out of 230 companies, the average company that went public this way is down 54% from their high. In case you’re wondering if the math is misleading, the median company is down 58%.

In the normal IPO process, founders might be restricted from selling their shares for a few months after the IPO but in reality- they are mentally and emotionally invested in their companies and many don’t sell substantial amounts of shares for years. This is how they accumulate great wealth. On the other hand, SPAC investors have no emotional attachment, no real belief other than the power of the almighty dollar. They are anxious to get out and move on, just like private equity investors. In fact, many of them are the same avarice snakes in the grass. The hard lesson learned- Don’t buy a SPAC regardless unless you have reason to believe the big sellers are gone.

This and all reports should be viewed as a continual work in progress, more like a notebook than a newsletter. Check back frequently for updates.

Name: Moskovitz Dustin

Position: CEO and Founder

Transaction Date: 2021-12-1 Shares Bought:250,000 Average Price Paid: $100.00 Cost: $25,000,000

Company: Asana ASAN

Asana is a web and mobile application designed to help teams organize, track, and manage their work. Forrester, Inc. reports that “Asana simplifies team-based work management.” It is produced by the company of the same name. Wikipedia

Opinion: Asana joined the list last Friday of companies that eviscerated its newest shareholders plunging nearly 27% on Friday. The stock has lost more than half of its value in less than a month. With that decline, Asana now has a market capitalization of $12.3 billion. That is still 27 times the company’s own forecast for revenue in the current fiscal year. What’s really curious with this one is not that it lost so much of its value on a beat and raise quarter, but that it did this in spite of its founder buying tens of millions of dollars of the Company’s stock. We’ve blogged about this one before and are even more dazed and confused. Why is he buying the stock in the first place? He sold stock in the Company when it went public just a year ago in the $30s.

Name: Brandon Joseph Patrick

Position: President

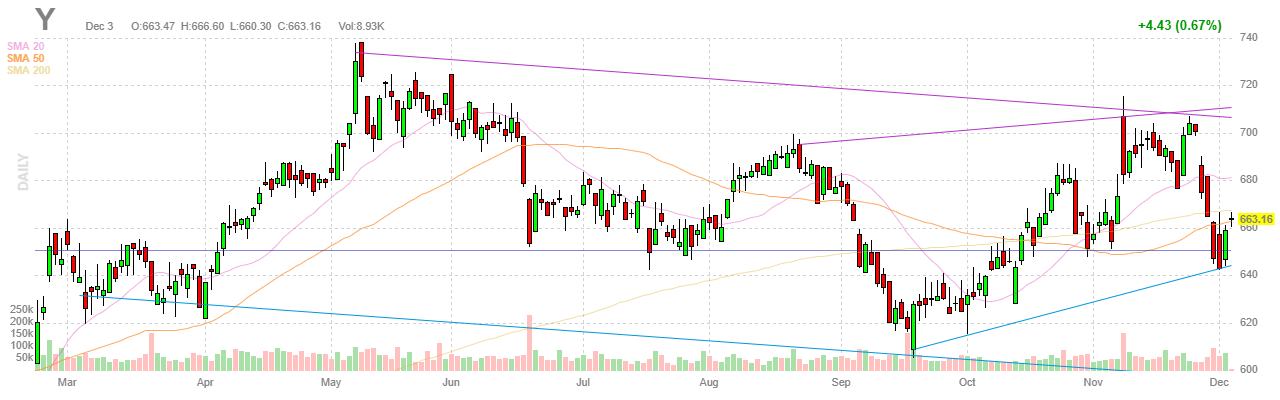

Transaction Date: 2021-11-30 Shares Bought: 8,500 Average Price Paid: $655.25 Cost: $5,569,654

Company: Alleghany Corp. (Y)

Alleghany Corporation provides property and casualty reinsurance and insurance products in the United States and internationally. The company operates in three segments: Reinsurance, Insurance, and Alleghany Capital. The Reinsurance segment offers fire, allied lines, auto physical damage, and homeowners multiple peril reinsurance products; and casualty and other reinsurance products, such as medical malpractice, ocean marine and aviation, accident and health, mortgage, surety, and credit reinsurance products, as well as directors’ and officers’, errors and omissions, general, and auto liability reinsurance. It distributes its products and services through brokers, as well as directly to insurance and reinsurance companies. The Insurance segment underwrites specialty insurance coverages in the property, as well as umbrella/excess, general, directors’ and officers’, and professional liability lines; surety products comprising commercial and contract surety bonds, and workers’ compensation insurance products. It distributes its products through independent wholesale insurance brokers, and retail and general insurance agents. The Alleghany Capital segment provides precision automated machine tool solutions; manufactures custom trailers and truck bodies for the moving and storage industry, and other markets; and operates as a toy, and entertainment, and musical instrument company. It also offers various services for pharmaceutical and biotechnology industries; products and services for the funeral and cemetery industries, and precast concrete markets; and hotel management and development services, as well as operates as a structural steel fabricator and erector. The company also owns and manages improved and unimproved commercial land, and residential lots. As of December 31, 2020, it owned approximately 106 acres of property. The company was founded in 1929 and is based in New York, New York.

President since April 2021, was Executive Vice President from March 2012 to April 2021 and consultant to Alleghany from September 2011 to March 2012. Mr. Brandon was Chairman and Chief Executive Officer of General Re Corporation, a wholly-owned subsidiary of Berkshire Hathaway Inc., from 2001 to 2008. Mr. Brandon is a graduate of The Wharton School of the University of Pennsylvania.

Opinion: $5.56 Million worth of stock of $Y Alleghany $655.25 per share. It’s a great message from the incoming CEO, Joe Brandon, an expert and seasoned insurance executive who headed Berkshire’s General Re division from 2001 to 2008. This mini Berkshire Hathaway is trading near book value. Mr. Brandon is determined to get the share price higher and on the things he intends to address is property and casualty rates under a warming global climate. Expect your P&C bills particularly in geographies that are more often impacted by rising waters and increasing winds, fire, and other by-products of the warming trend.

Name: Krakauer Andrew A

Position: Director

Transaction Date: 2021-11-30 Shares Bought: 1,000 Average Price Paid: $307.23 Cost: $307,232

Company: Teleflex Inc. (TFX)

Teleflex Incorporated designs, develops, manufactures, and supplies single-use medical devices for common diagnostic and therapeutic procedures in critical care and surgical applications worldwide. It provides vascular access products that comprise Arrow branded catheters, catheter navigation and tip positioning systems, and intraosseous access systems for the administration of intravenous therapies, the measurement of blood pressure, and the withdrawal of blood samples through a single puncture site. The company also offers interventional products, which consists of various coronary catheters, structural heart therapies, and peripheral intervention and cardiac assist products that are used by interventional cardiologists and radiologists, and vascular surgeons; and Arrow branded catheters, Guideline and Trapliner catheters, the Manta Vascular Closure, and Arrow On control devices. It provides anesthesia products, such as airway and pain management products to support the hospital, emergency medicine, and military channels; and surgical products, including metal and polymer ligation clips, and fascial closure surgical systems that are used in laparoscopic surgical procedures, percutaneous surgical systems, and other surgical instruments. The company also offers interventional urology products that comprise the UroLift System, an invasive technology for treating lower urinary tract symptoms due to benign prostatic hyperplasia; and respiratory products, including oxygen and aerosol therapies, spirometry, and ventilation management products for use in various care settings. It provides urology products, such as catheters, urine collectors, and catheterization accessories and products for operative endourology; and bladder management services. The company serves hospitals and healthcare providers, medical device manufacturers, and home care markets. The company was incorporated in 1943 and is headquartered in Wayne, Pennsylvania.

Andrew A. Krakauer is on the board of Teleflex, Inc. and KL Acquisition Corp. In his past career, he occupied the position of Chief Executive Officer & Director at Cantel Medical Corp., President & Chief Executive Officer for Medivators, Inc., President-Ohmeda Medical Division at GE Healthcare Ltd. (United Kingdom), and President-Ohmeda Medical Division at Instrumentarium Corp. Mr. Krakauer received an MBA from The University of Chicago and an undergraduate degree from State University of New York at Binghamton.

Opinion: $TFX is a rather high multiple of earnings medical products device company perhaps impacted by delayed procedures due to Covid. KeyBank analyst downgraded to equal weight based on less visibility into UroLift’s long term growth rate- the long term chart looks like a blood bath, Krakauer last bought shares at 8-8-2018 AT 1000 $237.56 We are not buying this name here.

Name: Farber Jeffrey M

Position: VP

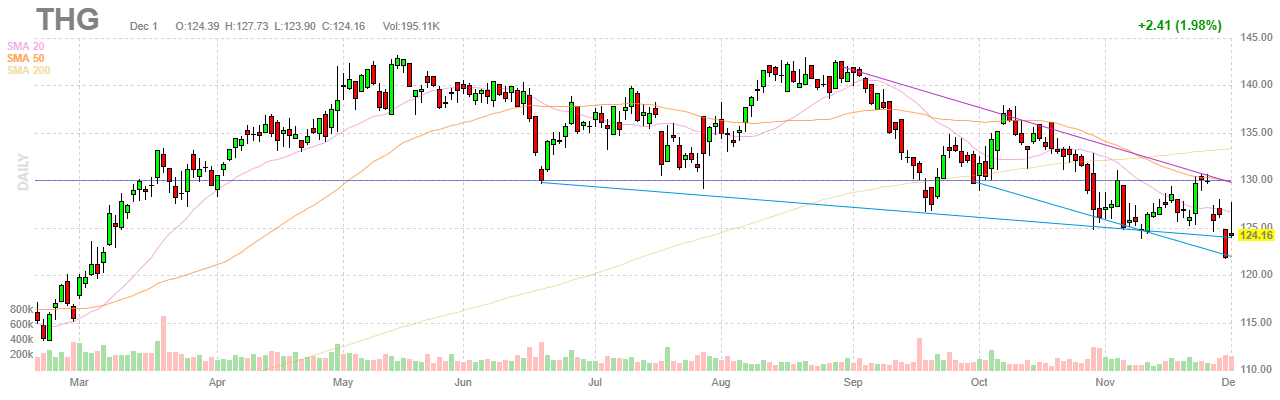

Transaction Date: 2021-11-30 Shares Bought: 5,000 Average Price Paid: $123.60 Cost: $617,980

Company: Hanover Insurance Group Inc. (THG)

The Hanover Insurance Group, Inc., through its subsidiaries, provides various property and casualty insurance products and services in the United States. The company operates through three segments: Commercial Lines, Personal Lines, and Other. The Commercial Lines segment offers commercial multiple peril, commercial automobile, and workers’ compensation insurance products, as well as management and professional liability, marine, specialty industrial and commercial property, monoline general liability, surety, umbrella, fidelity, crime, and other commercial coverages. The Personal Lines segment provides personal automobile and homeowner’s coverages, as well as other personal coverages, such as personal umbrella, inland marine, fire, personal watercraft, and other miscellaneous coverages. The Other segment offers investment management and advisory services to institutions, pension funds, and other organizations. The company markets its products and services through independent agents and brokers. The Hanover Insurance Group, Inc. was founded in 1852 and is headquartered in Worcester, Massachusetts.

Jeff joined The Hanover in October 2016 as executive vice president and chief financial officer. Jeff’s responsibilities include finance, accounting, investments, actuarial, enterprise risk management, treasury, investor relations, M&A, and internal audit. Jeff has established a successful track record in the insurance and financial services industries over the last 30 years. He has held senior executive roles at American International Group (AIG), where he served as the organization’s deputy chief financial officer and as chief risk officer for the company’s commercial and consumer businesses. Prior to AIG, Jeff served as chief financial officer of GAMCO Investors, Inc., a publicly-traded asset manager. Previously, he held senior accounting and finance roles at The Bear Stearns Companies, Inc.

Opinion: $THG This is the second open market purchase of stock, the last being 2500 shares a$90.06.It probably smarts some to pay up to $123.60 for the 5000 shares he bought in 2017 but Jeff looks like a company man and that’s not particularly cheap with stock ownership requirements that come with it.

The Hanover Insurance announced a preliminary estimate on September 22 for Q3 catastrophe losses, based on information available to date, to be in the range of $150M-$165M before taxes, or $119M-$130M after taxes. The midpoint of the estimate is approximately $97M above the company’s pre-tax Q3 catastrophe load, driven primarily by the effects of Hurricane Ida. Estimated losses from this storm are approximately $75M, before taxes, primarily stemming from losses in the Northeast and, to a lesser extent, the Gulf and Mid-Atlantic states. Again the climate is likely going to cause in insurance rates.

Name: Cyr William B

Position: CEO

Transaction Date: 2021-11-26 Shares Bought: 1,819 Average Price Paid: $109.91 Cost: $199,921

Company: Freshpet Inc (FRPT)

Freshpet, Inc. manufactures and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and the United Kingdom. The company sells its products under the Freshpet brand; and Dognation and Dog Joy label through various classes of retail, including grocery, mass, club, pet specialty, and natural, as well as online. Freshpet, Inc. was incorporated in 2004 and is headquartered in Secaucus, New Jersey. They believe they can make truly good food for their pets while being a force for good. They never stop pushing the boundaries of what’s possible. And while they know they’re not perfect, they do all they can to lessen their environmental impact while giving pets the freshest, healthiest food there is. They strive to always source ingredients as locally as possible while getting their pets all the nutrition they need. To support farmers who share their values. To reduce the amount of packaging they use while keeping food fresh. To protect the welfare of their four-legged friends with determination and devotion. They set out on a mission to revolutionize the way all pets are fed by making fresh, natural food. They gathered a team of the best in both pet and human food and in October 2006, They were cooking nutritious, fresh meals for pets. Soon, their little company started to grow and they found themselves delivering fresh, refrigerated pet food to more and more stores.

William B. Cyr has been a member of our Board of Directors and our Chief Executive Officer since September 2016. Before assuming his role at Freshpet, Mr. Cyr served as President and Chief Executive Officer of Sunny Delight Beverages Co. (“SDBC”) from August 2004 to February 2016. Prior to joining SDBC, Mr. Cyr spent 19 years at Procter & Gamble, where he ultimately served as the Vice President and General Manager of the North American Juice Business and Global Nutritional Beverages. Mr. Cyr serves as a Board and Executive Committee Member of the Grocery Manufacturers Association, a position he has held since 2002. Additionally, during his time as President and Chief Executive Officer of SDBC he was a member of the Board of Directors of American Beverage Association from 2007 until 2016 and on the Executive Committee from 2012 to 2016.

Opinion: Pets are not cheap and feeding them fresh food from $FRPT FreshPet is one way to show your love. Just don’t put that crap in your children’s stock portfolio. They won’t love you for it. When did the Company forget that the point of business is to make money?

Name: Danziger Asaf

Position: CEO

Transaction Date: 2021-11-26 Shares Bought: 4,974 Average Price Paid: $102.44 Cost: $509,539

Company: NovoCure Ltd. (NVCR)

NovoCure Limited, an oncology company, engages in the development, manufacture, and commercialization of Optune for the treatment of a variety of solid tumors. The Company uses electric fields to kill some of the most aggressive cancers. The company markets Optune and Optune Lua, a Tumor Treating Fields delivery system for use as a monotherapy treatment for adult patients with glioblastoma. It is also developing products for brain metastases, non-small cell lung cancer, pancreatic cancer, gastric cancer, ovarian cancer, liver cancer, and mesothelioma. The company markets its products in the European Union, Japan, and internationally. It has a clinical trial collaboration agreement with MSD to evaluate tumor treating fields together with KEYTRUDA, an anti-PD-1 therapy; and a strategic alliance with the NYU Grossman School of Medicine’s Department of Radiation Oncology that provides a framework for preclinical and clinical development projects studying Tumor Treating Fields. NovoCure Limited was founded in 2000 and is based in Saint Helier, Jersey. They are a global oncology company working to extend survival in some of the most aggressive forms of cancer through the development and commercialization of their innovative therapy, Tumor Treating Fields. Their commercialized products are approved in certain countries for the treatment of adult patients with glioblastoma and in the U.S. for the treatment of adult patients with malignant pleural mesothelioma. They have ongoing or completed clinical trials investigating Tumor Treating Fields in brain metastases, non-small cell lung cancer, pancreatic cancer, ovarian cancer, liver cancer, and gastric cancer.

Asaf Danziger has served as Chief Executive Officer of Novocure since 2002 and has been a director of Novocure since 2012. Mr. Danziger has led the company and the development of TTFields therapy from preclinical testing through regulatory approvals to commercial sales in Europe and the United States. From 1998 to 2002, Mr. Danziger was Chief Executive Officer of Cybro Medical, a subsidiary of Imagyn Medical Technologies. Mr. Danziger holds a B.Sc. in material engineering from Ben Gurion University of the Negev, Israel.

Opinion: Although the Company has nearly $1 Billion in cash it’s very risky to invest in this technology. As with all biotechs this will take years to play out and this is not the right market for speculative development biotechs.

Name: Kerr Michael T

Position: Director

Transaction Date: 2021-11-26 Shares Bought: 50,000 Average Price Paid: $86.00 Cost: $4,300,000

Company: Eog Resources Inc. (EOG)

EOG Resources, Inc. is one of the largest crude oil and natural gas exploration and production companies in the United States with proven reserves in the United States and Trinidad. EOG is driven from the bottom up by its innovative and highly engaged employees. They are a collaborative organization where employees continuously learn from one another. By providing employees with a quality environment in which to work, and by maintaining a consistent college recruiting and internship program, EOG is able to attract and retain some of the industry’s best and brightest – individuals who will embrace the company’s culture and their commitment to sustainability and corporate responsibility. They are focused on being among the lowest cost, highest return, and lowest emissions producers, and playing a significant role in the long-term future in energy. EOG Resources, Inc., together with its subsidiaries, explores for, develops, produces, and markets crude oil, and natural gas, and natural gas liquids. Its principal producing areas are in New Mexico and Texas in the United States; the Republic of Trinidad and Tobago; the People’s Republic of China; and the Sultanate of Oman. As of December 31, 2020, it had a total estimated net proved reserves of 3,220 million barrels of oil equivalent, including 1,514 million barrels (MMBbl) of crude oil and condensate reserves; 813 MMBbl of natural gas liquid reserves; and 5,360 billion cubic feet of natural gas reserves. The company was formerly known as Enron Oil & Gas Company. EOG Resources, Inc. was incorporated in 1985 and is headquartered in Houston, Texas.

Michael T. Kerr has been appointed as Director of the Company effective 10/5/2020. Mr. Kerr, who will be retiring from the investment management firm Capital Group effective October 1, 2020, has over 36 years of investment experience, including 35 years with Capital Group. During his tenure with Capital Group, Mr. Kerr has served as an equity portfolio manager and has also covered global oil and gas companies and U.S. utilities for Capital Group as an equity investment analyst. Prior to joining Capital Group, Mr. Kerr was an exploration geophysicist with Cities Service Company.

Opinion: Hard to believe this company used to be Enron. Oil and gas has been a good sector performance wise this year but I don’t have room in my portfolio for a lot of names here as they all seem to move up and down together. I’d rather own Exxon with its diversified portfolio, high dividend, improving cash flow, and the potential to participate in carbon recapture.

Name: Rodino-Klapac Louise

Position: Head of R & D CSO

Transaction Date: 2021-11-24 Shares Bought: 3,780 Average Price Paid: $79.33 Cost: $299,867

Company: Sarepta Therapeutics Inc. (SRPT)

Sarepta Therapeutics, Inc., a commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapy, and other genetic therapeutic modalities for the treatment of rare diseases. The company offers EXONDYS 51 injection to treat Duchenne muscular dystrophy (DMD) in patients who have a confirmed mutation of the DMD gene that is amenable to exon 51 skipping; and VYONDYS 53 for the treatment of DMD in patients who have a confirmed mutation of the DMD gene that is amenable to exon 53 skipping. It also developing AMONDYS 45, a product candidate that uses phosphorodiamidate morpholino oligomer (PMO) chemistry and exon-skipping technology to skip exon 45 of the dystrophin gene; SRP-5051, a peptide conjugated PMO that binds exon 51 of dystrophin pre-mRNA; SRP-9001, a DMD micro-dystrophin gene therapy program; and SRP-9003, a limb-girdle muscular dystrophies gene therapy program. The company has collaboration agreements with F. Hoffman-La Roche Ltd; Nationwide Children’s Hospital; Lysogene; Duke University; Genethon; and StrideBio. It also has a research and option agreement with Codiak BioSciences, Inc. to design and develops engineered exosome therapeutics to deliver gene therapy, gene editing, and RNA technologies for neuromuscular diseases; and research collaboration with Genevant Sciences for lipid nanoparticle-based gene editing therapeutics. Sarepta Therapeutics, Inc. was incorporated in 1980 and is headquartered in Cambridge, Massachusetts.

Louise joined Sarepta in June 2018 and was appointed executive vice president, a chief scientific officer in December 2020. Prior to this role, Louise served as Sarepta’s senior vice president, gene therapy. She became head of R&D in November 2021. She has led the design of most of Sarepta’s late-stage gene therapy candidates, has built and led Sarepta’s Gene Therapy Center of Excellence (GTCOE) in Columbus, Ohio, and has oversight for Sarepta’s Gene Editing Innovation Center (GEIC) in Durham, N.C. She is renowned for her contributions to neuromuscular biology, which have profoundly advanced the field.

Opinion: It’s good to see another insider buying SRPT besides the CEO. In this case, it’s encouraging that this insider is a scientist as well.This has been a battleground stock between skeptics who claim the approved drug, EXONDYS 51 doesn’t work, and parents desperate for anything that can help this horrible fatal condition afflicting their children.

Name: Wilder C John

Position: Director

Transaction Date: 2021-11-24 Shares Bought: 21,045 Average Price Paid: $65.19 Cost: $1,371,909

Name: Wilder C John

Position: Director

Transaction Date: 2021-11-30 Shares Bought: 21,414 Average Price Paid: $64.10 Cost: $1,372,660

Company: Evergy Inc. (EVRG)

Evergy is an American investor-owned utility (IOU) with publicly traded stock headquarters in Topeka, Kansas, and in Kansas City, Missouri. The company was formed from a merger of Westar Energy of Topeka and Great Plains Energy of Kansas City, Missouri, the parent company of Kansas City Power & Light. Evergy is the largest electric company in Kansas, serving more than 1.6 million residential, commercial, and industrial customers in the state’s eastern half. Evergy has a generating capacity of 16,000-megawatt electricity from its over 40 power plants in Kansas and Missouri. Evergy service territory covers 28,130 square miles (72,900 km2) in eastern Kansas and western Missouri. Evergy owns more than 13,700 miles (22,000 km) of transmission lines and about 52,000 miles of distribution lines. Evergy is committed to delivering clean, safe, reliable energy sources today and well into the future. So they’re embracing alternative energy sources to generate more power with less impact on our environment and adopting new technologies that let their customers manage their energy use in ways that work for them. Whether it’s new ways to connect with them, electric vehicle charging stations, or the next innovation around the corner, they’re dedicated to empowering a better future. It generates electricity through coal, hydroelectric, landfill gas, uranium, natural gas, oil sources, and solar, wind, and other renewable sources. The company has approximately 10,100 circuit miles of transmission lines, 39,800 circuit miles of overhead distribution lines, and 13,000 circuit miles of underground distribution lines. It serves approximately 1,620,400 customers, including residences, commercial firms, industrials, municipalities, and other electric utilities.

Mr. Wilder is the Executive Chairman of Bluescape. He serves on the boards of directors of several private portfolio companies and has previously served on the board of many private and public companies, including NRG Energy, Inc. and TXU Corp. He served in executive officer roles in TXU Corp., Entergy Corp., and Royal Dutch/Shell Group. Mr. Wilder received his bachelor of science in business administration from Southeast Missouri State University and holds a master of business administration from the University of Texas.

Opinion: $EVRG Wilder continues to buy $millions of regulated electric utility, Evergy. Regulated electric utility stocks offer security, income, and growth- everything the current stock market doesn’t. We’ve been pounding the table on this name.

Name: Tang Vance W

Position: Director

Transaction Date: 2021-11-30 Shares Bought: 5,000 Average Price Paid: $62.10 Cost: $310,500

Company: American Woodmark Corp. (AMWD)

American Woodmark Corporation manufactures and distributes kitchen, bath, and home organization products for the remodeling and new home construction markets in the United States. It offers made-to-order and cash and carries products. The company also provides turnkey installation services to its direct builder customers through a network of eight service centers. American Woodmark Corporation sells its products under the American Woodmark, Timberlake, Shenandoah Cabinetry, Waypoint Living Spaces, Estate by RSI, Continental Cabinets, VillaBath by RSI, Stor-It-All, and Professional Cabinet Solutions brands, as well as Hampton Bay, Glacier Bay, Style Selections, Allen + Roth, Home Decorators Collection, and Project Source. It markets its products directly to home centers and builders, as well as through independent dealers and distributors. The company was incorporated in 1980 and is based in Winchester, Virginia.

Tang joined the Board of Directors in 2009 and has served as non-executive chairman since 2020. Additionally, he served as president and chief executive officer of the U.S. subsidiary of KONE Corporation, a Finnish public company and a leading global provider of elevators and escalators, and executive vice president of KONE Corporation from 2007 to 2012. Presently, he acts as director of Comfort Systems USA, a publicly-traded provider of commercial and industrial specialty contracting including HVAC, electrical, security, and building automation installation and services, and president of VanTegrity Consulting focusing on leadership and growth strategies, both positions he has held since 2012. Tang’s 29-year career in the industry has been highlighted with leadership roles in operations.

Opinion: Housing is booming and this cabinet maker should be doing a lot better than it is. This is the third purchase by Tang and he hasn’t made money on them yet.

Name: Casey Donald M

Position: CEO

Transaction Date: 2021-12-01 Shares Bought: 20,000 Average Price Paid: $49.78 Cost: $995,600

Company: Dentsply Sirona Inc. (XRAY)

DENTSPLY SIRONA Inc. designs develop, manufactures, distributes, and sells various dental products and technologies primarily for the professional dental market worldwide. The company operates in two segments, Technologies & Equipment; and Consumables. Its dental supplies include endodontic instruments and materials, dental anesthetics, prophylaxis pastes, dental sealants, impression, and restorative materials, tooth whiteners, and topical fluoride products; and small equipment products comprise intraoral curing light systems, dental diagnostic systems, and ultrasonic scalers and polishers. The company also offers dental laboratory products, such as dental prosthetics that include artificial teeth, precious metal dental alloys, dental ceramics, and crown and bridge materials; and laboratory-based CAD/CAM milling systems, amalgamators, mixing machines, and porcelain furnaces. In addition, it provides dental technology products, including dental implants and related scanning equipment, and treatment software; orthodontic clear aligners and appliances for dental practitioners and specialists; and dental equipment, such as treatment centers, imaging equipment, dental handpieces, and computer-aided design and machining systems for dental practitioners. Further, the company offers healthcare consumable products, such as urology catheters, medical drills, and other non-medical products. It markets and sells dental products through distributors, dealers, and importers; dental hygienists, assistants, laboratories, and schools; and urology products directly to patients, as well as through distributors to urologists, continence care nurses, general practitioners, and direct-to-patients. The company was formerly known as DENTSPLY International Inc. and changed its name to DENTSPLY SIRONA Inc. in February 2016. DENTSPLY SIRONA Inc. was founded in 1899 and is headquartered in Charlotte, North Carolina

Mr. Casey served from 2012 through 2018 as the Chief Executive Officer of the Medical Segment of Cardinal Health, a manufacturer and provider of medical products and supply chain services. From 2010 to 2012, Mr. Casey served as Chief Executive Officer of the Gary and Mary West Wireless Health Institute, a non-profit research organization focused on lowering the cost of healthcare through novel technology solutions. Prior to that, Mr. Casey served from 2007 to 2010 as Worldwide Chairman for Johnson & Johnson’s Comprehensive Care group and as a member of the Executive Committee. Prior to that, from 2003 to 2006, Mr. Casey served as Company Group Chairman with Vistakon, a division of Johnson & Johnson Vision Care, Inc., and from 1985 to 2003, Mr. Casey held various executive positions throughout Johnson & Johnson’s consumer, pharmaceutical and medical device franchises. Mr. Casey also served as a director of West Corporation from 2015 to 2017.

Opinion: XRAY is another company with a horrible looking chart and an insider purchase that doesn’t have a very good track record. I can’t see any catalysts but with a forward P.E, investors might not need any.

Name: Baker Arthur R

Position: CTO

Transaction Date: 2021-12-01 Shares Bought: 10,000 Average Price Paid: $49.21 Cost: $492,100

Company: Proto Labs Inc. (PRLB)

Proto Labs, Inc., together with its subsidiaries, operates as an e-commerce driven digital manufacturer of custom prototypes and on-demand production parts worldwide. The company offers injection molding; computer numerical control machining; three-dimensional (3D) printing, which includes stereolithography, selective laser sintering, direct metal laser sintering, multi-jet fusion, polyjet, and carbon DLS processes; and sheet metal fabrication products, including quick-turn and e-commerce-enabled custom sheet metal parts. It serves developers and engineers, who use 3D computer-aided design software to design products across a range of end markets. The company was founded in 1999 and is headquartered in Maple Plain, Minnesota. Their company was founded in 1999 by Larry Lukis, a successful entrepreneur and computer geek who wanted to radically reduce the time it took to get injection-molded plastic prototype parts. His solution was to automate the traditional manufacturing process by developing complex software that communicated with a network of mills and presses. As a result, plastic and metal parts could be produced in a fraction of the time it had ever taken before. Over the next decade, they would continue to expand their injection molding envelope, introduce quick-turn CNC machining, and open global facilities in Europe and Japan. In 2014, they launched industrial-grade 3D printing services to allow product developers, designers, and engineers an easier path to move from early prototyping to low-volume production. And in 2017, they acquired Rapid Manufacturing to further expand their machining capabilities and introduce sheet metal fabrication into their suite of services. But that’s not all! Global online manufacturing platform, Hubs, also joined the Protolabs family in early 2021. Their growth and expansion of capabilities over the past two decades have always been about providing you, their customer, with the best possible digital manufacturing experience in the industry. That continued evolution will never stop, and it’s what helps shape their vision and mission as a company.

Dr. Arthur (Rich) Baker joined Protolabs as CTO in May of 2016. Prior to joining that, Rich served as CTO at PaR Systems, a robotics and specialty machine tool builder. From 2005 to 2014 he held multiple positions at MTS Systems including General manager of the Test Division, CTO, VP of Engineering, and Operations. MTS was a leader in mechanical testing and simulation systems for automotive, aerospace, medical, civil-seismic, and general research. Prior to MTS, he was VP of Technology for Rohm and Haas Electronic Materials business from 1999 to 2005.

Opinion: This is the first insider open market purchase at the company in years but it still may not have dropped enough in price to create an attractive opportunity.

Name: Ruchim Arik W

Position: Director 10% Owner

Transaction Date: 2021-11-26 Shares Bought: 250,000 Average Price Paid: $37.24 Cost: $9,310,290

Company: Six Flags Entertainment Corp. (SIX)

Six Flags Entertainment Corporation, more commonly known as Six Flags or Six Flags Theme Parks, is an American amusement park corporation headquartered in Arlington, Texas. It has properties in Canada, Mexico, and the United States. Six Flags owns more theme parks, and waterparks combined than any other amusement park company globally and have the seventh-highest attendance in the world. The company operates 27 properties throughout North America, including theme parks, amusement parks, water parks, and a family entertainment center. In 2019, Six Flags properties hosted 32.8 million guests. Six Flags was founded in the 1960s and derived its name from its first property, Six Flags Over Texas. The company maintains a corporate office in Midtown Manhattan, while its headquarters are in Arlington, Texas. On June 13, 2009, the corporation filed for Chapter 11 bankruptcy protection due to crippling debt, which it successfully exited after corporate restructuring on May 3, 2010. The name “Six Flags” originally referred to the flags of the six different nations that have governed Texas: Spain, France, Mexico, the Republic of Texas, the United States (Union), and the Confederate States of America. Six Flags parks are still divided into different themed sections, although many of the original areas from the first three parks have been replaced.

Arik Ruchim has served as a director of the Company since January 2020. Mr. Ruchim is a Partner at H Partners, LP, an investment management firm. Prior to joining H Partners in 2008, Mr. Ruchim was at Creative Artists Agency and Cruise/Wagner Productions. Mr. Ruchim currently serves as a director of Tempur Sealy International, Inc., the world’s largest bedding provider, where he serves as a member of its Nominating and Corporate Governance Committee and its Compensation Committee, and as a member of the University of Michigan’s Tri-State Leadership Council, a group dedicated to enhancing educational opportunities for undergraduate and graduate students. Mr. Ruchim previously served as a director of Remy International, Inc., a global manufacturer of automotive parts, and as a director of Dick Clark Productions, a television production company.

Opinion: Six Flags is bouncing off technical support here and with the parks open, they may soon generate enough positive cash flow to get a credit upgrade from the rating agencies. If so, expect a short-term trading pop. All the buzz now is about the metaverse but roller coasters may be made in 3D but riding them won’t be the same.

Name: Taylor David S

Position: Director

Transaction Date: 2021-11-26 Shares Bought: 6,000 Average Price Paid: $35.96 Cost: $215,784

Name: Taylor David S

Position: Director

Transaction Date: 2021-11-30 Shares Bought: 6,000 Average Price Paid: $35.59 Cost: $213,510

Company: Delta Air Lines Inc. (DAL)

Delta Air Lines, Inc. provides scheduled air transportation for passengers and cargo in the United States and internationally. The company operates through two segments, Airline and Refinery. Its domestic network is centered on core hubs in Atlanta, Minneapolis-St. Paul, Detroit, and Salt Lake City, as well as coastal hub positions in Boston, Los Angeles, New York-LaGuardia, New York-JFK, and Seattle; and international network centered on hubs and market presence in Amsterdam, London-Heathrow, Mexico City, Paris-Charles de Gaulle, and Seoul-Incheon. The company sells its tickets through various distribution channels, including delta.com and the Fly Delta app, reservations, online travel agencies, traditional brick-and-mortar, and other agencies. It also provides aircraft maintenance, repair, and overhaul services; and vacation packages to third-party consumers, as well as aircraft charters, and management, and programs. The company operates through a fleet of approximately 1,100 aircraft. Delta Air Lines, Inc. was founded in 1924 and is based in Atlanta, Georgia.

Mr. Taylor is Chairman of the Board, President, and Chief Executive Officer of The Procter & Gamble Company. He has been President and Chief Executive Officer since 2015 and was elected Chairman of the Board in 2016. Mr. Taylor joined Procter & Gamble in 1980 and, since that time, has held numerous positions of increasing responsibility in North America, Europe, and Asia. Prior to his current role, Mr. Taylor was Group President-Global Beauty, Grooming & Healthcare, Group President-Global Health & Grooming, Group President-Global Home Care, and President-Global Family Care. Mr. Taylor also serves as the Chairman of The Alliance to End Plastic Waste, an initiative to advance solutions to eliminate unmanaged plastic waste in the environment.

Opinion: We bought some Delta on the latest Omicron Covid scare. Planes are flying packed and rates are high. I don’t expect this latest variant to slow things down much if it doesn’t prove as lethal.

Name: Barth Brett H

Position: Director

Transaction Date: 2021-11-26 Shares Bought: 10,000 Average Price Paid: $35.85 Cost: $358,466

Company: Cowen Inc. (COWN)

Cowen Inc., together with its subsidiaries, provides investment banking, research, sales and trading, prime brokerage, global clearing, securities financing, commission management, and investment management services in the United States and internationally. It operates in two segments, Operating Company (Op Co) and Asset Company (Asset Co). The company offers public and private capital raising and strategic advisory services for public and private companies. It also trades common stocks, listed options, equity-linked securities, and other financial instruments on behalf of institutional investor clients. In addition, the company offers investment products and solutions in the liquidity spectrum to institutional and private clients, as well as provides investment research services. Further, it is involved in private investment, private real estate investment, and other legacy investment activities. Cowen Inc. was founded in 1918 and is headquartered in New York, New York. During their 100+ years as a strong, independent-minded, full-service investment bank, they’ve consistently empowered their clients’ success by delivering a depth and breadth of insights fueled by their tenacious culture of collaboration. In a world where many of their competitors cater to trends and standard solutions, they offer clients insights and ideas that disrupt the status quo and exceed expectations. Whether they are focusing on completing a key deliverable, sharing in a Cowen Cares initiative, or welcoming new talent onto the team, they are fully invested in the success of one another.

Mr. Barth co-founded BBR Partners in 2000 and is a Co-CEO, co-managing the firm and overseeing all investment and client activity. He has extensive experience vetting investment opportunities across the asset class spectrum and through a range of market environments, working with both traditional and alternative investment managers. Mr. Barth is also a member of BBR’s Executive Committee and Investment Committee. Prior to founding BBR, Mr. Barth was in the Equities Division of Goldman Sachs. Previously, he served in Goldman’s Equity Capital Markets groups in New York and Hong Kong. He began his career in Goldman Sachs’ Corporate Finance Department.

Opinion: This one has no appeal to me except as a takeover

Name: Rady Ernest S

Position: CEO Chairman 10% Owner

Transaction Date: 2021-11-26 Shares Bought: 14,236 Average Price Paid: $35.29 Cost: $502,318

Company: American Assets Trust Inc. (AAT)

American Assets Trust, Inc. is a full-service, vertically integrated, and self-administered real estate investment trust, or REIT, headquartered in San Diego, California. The company has over 50 years of experience in acquiring, improving, developing, and managing premier office, retail, and residential properties throughout the United States in some of the nation’s most dynamic, high-barrier-to-entry markets primarily in Southern California, Northern California, Oregon, Washington, Texas, and Hawaii. The company’s office portfolio comprises approximately 3.4 million rentable square feet, and its retail portfolio comprises approximately 3.1 million square feet. In addition, the company owns one mixed-use property (including approximately 97,000 rentable square feet of retail space and a 369-room all-suite hotel) and 2,112 multifamily units. In 2011, the company was formed to succeed the real estate business of American Assets, Inc., a privately held corporation founded in 1967 and, as such, has significant experience, long-standing relationships, and extensive knowledge of its core markets, submarkets, and asset classes. For over 50 years, AAT has been acquiring, improving, and developing irreplaceable office, retail and residential properties with the philosophy that a premier location creates a unique opportunity for success. They find such properties in dynamic, high-barrier-to-entry markets and then add value through increased occupancy, re-tenanting, redevelopment, and renovation. AAT’s office portfolio comprises approximately 3.9 million square feet; Its retail portfolio comprises approximately 3.1 million rentable square feet. They also own one mixed-use property (including approximately 97,000 rentable square feet of retail space and a 369-room all-suite hotel) and 2,112 multifamily units.

Mr. Rady has served as Chairman of the Board of Directors and Chief Executive Officer since September 2015. From our initial public offering in January 2011 to September 2015, Mr. Rady served as the Executive Chairman of the Board of Directors. Mr. Rady has over 40 years of experience in real estate management and development. Mr. Rady founded American Assets, Inc. in 1967 and currently serves as president and chairman of the board of directors of American Assets, Inc. In 1971, he also founded Insurance Company of the West and Westcorp, a financial services holding company. From 1973 until 2006, Mr. Rady served as chairman and chief executive officer of Westcorp. He served as chairman of Western Financial Bank from 1982 until 2006 and chief executive officer of Western Financial from 1994 until 1996 and from 1998 until 2006. He also served as a director of WFS Financial Inc., an automobile finance company, from 1988 until 2006 and as chairman from 1995 until 2006.

Opinion: Office space could be undergoing seismic change due to the hybrid and work from anywhere models that companies are adapting as a result of the pandemic.

Name: Cummins Wes

Position: Director

Transaction Date: 2021-11-26 Shares Bought: 5,000 Average Price Paid: $34.98 Cost: $174,900

Name: Cummins Wes

Position: Director

Transaction Date: 2021-11-29 Shares Bought: 10,000 Average Price Paid: $34.85 Cost: $348,500

Company: Vishay Precision Group Inc. (VPG)

Vishay Precision Group, Inc. designs, manufactures, and markets sensors, sensor-based measurement systems, specialty resistors, and strain gages in the United States, Israel, the United Kingdom, rest of Europe, Asia, and Canada. It operates through three segments: Foil Technology Products, Force Sensors, and Weighing and Control Systems. The company’s product portfolio includes foil resistors, foil strain gages, transducers, load cells, modules, data acquisition systems, and weighing and control systems, as well as sensors that convert mechanical inputs into an electronic signal for display, processing, interpretation, or control by its instrumentation and system products. Its products are primarily used in the military and aerospace, medical, agricultural, steel, and construction sectors for application in waste management, bulk hauling, logging, scales manufacturing, engineering systems, pharmaceutical, oil, chemical, paper, and food industries. The company offers its products under the Vishay Foil Resistors, Alpha Electronics, Powertron, Pacific Instruments, Micro-Measurements, Celtron, Revere, Sensortronics, Tedea-Huntleigh, BLH Nobel, KELK, GleebleVPG Onboard Weighing brands. Vishay Precision Group, Inc. sells its products through field application engineers. Vishay Precision Group, Inc. was incorporated in 2009 and is headquartered in Malvern, Pennsylvania.

Mr. Wesley C. Cummins is an Independent Director at Sequans Communications SA, an Independent Director at Vishay Precision Group, Inc., a Chairman & Chief Executive Officer at Applied Science Products, Inc., and a Founder & Chief Investment Officer at 272 Capital LP. He is on the Board of Directors at Sequans Communications SA and Vishay Precision Group, Inc. Mr. Cummins was previously employed as an Independent Director by TeleNav, Inc., a Research Analyst by Nokomis Capital LLC, an Analyst by Harvey Partners LLC, a Research Director & Head-Capital Markets by B. Riley & Co. LLC, a President by Riley Investment Management LLC, an Analyst by Needham & Co., Inc., and an Analyst by Kennedy Capital Management, Inc.

Opinion: Wes has been a reliable buyer of Vishay. I’ve tried unsuccessfully to date to unearth what he sees in VPG.

Name: Ribieras JeanMichel

Position: CEO Chairman

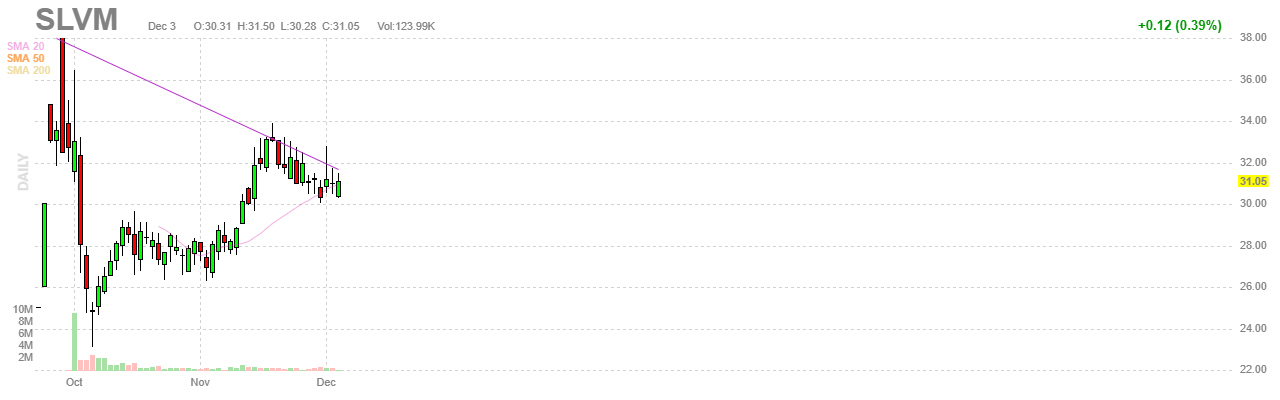

Transaction Date: 2021-11-29 Shares Bought: 10,000 Average Price Paid: $31.07 Cost: $310,720

Company: Sylvamo Corp. (SLVM)

Sylvamo Corporation produces and supplies printing paper in Latin America, Europe, and North America. The company offers uncoated freesheets for paper products, such as cut size and offset paper; and markets pulp, aseptic, and liquid packaging board, as well as coated unbleached kraft papers. It also produces hardwood pulp, including bleached hardwood kraft and bleached eucalyptus kraft; bleached softwood kraft; and bleached chemical-thermomechanical pulp. The company distributes its products through a variety of channels, including merchants and distributors, office product suppliers, retailers, and dealers. It also sells directly to converters that produce envelopes, forms, and other related products. The company was founded in 1898 and is headquartered in Memphis, Tennessee. They believe in the promise of paper to educate, communicate and entertain. Paper connects them to one another and is an enduring bond to renewable natural resources. Their purpose is to produce the paper you need in the most responsible and sustainable way possible. They aim high, innovate and create value for their customers and investors. The future of paper deserves a company committed to the success of the entire ecosystem. From the forests they love, to the communities where they live, to those who rely on their paper, they know the well-being of each depends on the well-being of all. They are Sylvamo, built to help the world realize the promise of paper.

Jean-Michel Ribiéras joined International Paper in 1993. His 35-year paper and packaging career spans three continents, multiple businesses, and a variety of leadership roles such as senior vice president, Industrial Packaging the Americas, and most recently senior vice president, Global Papers. Jean-Michel has served on the boards of the Brazil Pulp & Paper Association and The Ilim Group, a Russia-based joint venture with International Paper. He holds a bachelor’s degree in management from École Supérieure des Dirigeants d Entreprise (France) and a Master of Marketing from the University of Hartford.

Opinion: Several insiders have bought shares in this International Paper spin-off. Spin-offs were one of Peter Lynch’s obsessions when he ran the best performing mutual fund in history.

Name: Hoover R David

Position: Director

Transaction Date: 2021-11-30 Shares Bought: 10,000 Average Price Paid: $29.38 Cost: $293,794

Name: Harrington Michael J

Position: Director

Transaction Date: 2021-11-30 Shares Bought: 2,500 Average Price Paid: $29.25 Cost: $73,123

Company: Elanco Animal Health Inc. (ELAN)

Elanco Animal Health Incorporated, an animal health company, innovates, develops, manufactures, and markets products for pets and farm animals. It offers pet health disease prevention products, such as parasiticide and vaccine products that protect pets from worms, fleas, and ticks under the Seresto, Advantage, Advantix, and Advocate brands; pet health therapeutics for pain, osteoarthritis, ear infections, cardiovascular, and dermatology indications in canines and felines under the Galliprant and Claro brands; vaccines, antibiotics, parasiticides, and other products for use in poultry and aquaculture production, as well as functional nutritional health products, including enzymes, probiotics, and prebiotics; and a range of vaccines, antibiotics, implants, parasiticides, and other products used in ruminant and swine production under the Rumensin and Baytril brands. The company sells its products to third-party distributors; veterinarians; and farm animal producers, including beef and dairy farmers, as well as pork, poultry, and aquaculture operations in approximately 90 countries in North America, Europe, the Middle East, Africa, Latin America, and the Asia-Pacific. Elanco Animal Health Incorporated was founded in 1954 and is headquartered in Greenfield, Indiana.

R. David Hoover is Independent Chairman at Elanco Animal Health, Inc. He is also on the board of DePauw University (former Chairman), Children’s Hospital Colorado, O-Web Technologies Ltd., and Boulder Community Hospital and Member of The Colorado Forum. In the past, he occupied the position of Chairman at Ball Corp. and Vice Chairman & Chief Financial Officer at Ball Aerospace & Technologies Corp. (a subsidiary of Ball Corp.), Member of Can Manufacturers Institute, Inc., and Member-Deans Council at Kelley School of Business.

Michael J. Harrington serves as Independent Director of the Company. Mr. Harrington served in various legal roles for Lilly, including Senior Vice President and General Counsel from 2013 until his retirement in January 2020, Vice President and Deputy General Counsel of Global Pharmaceutical Operations from 2010 to 2012, and Vice President and General Counsel, Corporate from 2004 to 2010. Mr. Harrington’s roles at Lilly have provided him with extensive business development experience, experience with regulatory agencies around the world, and experience with managing intellectual property matters globally. In addition, Mr. Harrington has global operations and leadership experience as he led one of Lilly’s operating affiliates in New Zealand, and has had other leadership roles in the Asia Pacific region. In addition, Mr. Harrington has led Lilly’s information security program and has experience with negotiating transitional services agreements (TSAs), and experience with the oversight of implementing enterprise resource planning (ERP) systems.

Opinion: One would think animal care is a stable business but hasn’t been. There’s been earnings misses, SEC investigations, and chaos. E Li Lilly decided to spin-off its remaining stake in ELAN through a share exchange. LLY shareholders will be able to exchange their shares for shares of ELAN. For each $100 of LLY stock accepted in the tender offer, shareholders will receive $107.53 of ELAN during 2019. Two years later the stock is trading 40% lower. This is not how you grow wealth.

Starboard Value thinks ELANCO could be worth $91 per share and has a similar opportunity as Zoetis. He says there is a bewildering margin gap between the two similar businesses. Zoetis Inc. is an American drug company, the world’s largest producer of medicine and vaccinations for pets and livestock. The company was a subsidiary of Pfizer, the world’s largest drugmaker, and was spun off in June 2013. I tend to agree. There is room for improvement and repeated insider buying is encouraging that it is possible or even happening right now. We are buyers.

Name: Rosensweig Daniel

Position: CEO Chairman

Transaction Date: 2021-12-01 Shares Bought: 25,000 Average Price Paid: $28.52 Cost: $712,908

Company: Chegg Inc. (CHGG)

Chegg, Inc. operates a direct-to-student learning platform that supports students on their journey from high school to college and into their career with tools designed to help them to learn their course materials, succeed in their classes, and save money on required materials. The company offers Chegg Services, which include subscription services; and required materials that comprise its print textbooks and eTextbooks. Its subscription services include Chegg Study, which helps students master challenging concepts on their own; Chegg Writing that provides students with a suite of tools, such as plagiarism detection scans, grammar and writing fluency checking, expert personalized writing feedback, and premium citation generation; Chegg Math solver, a step-by-step math problem solver and calculator that helps students to solve problems; Chegg Study Pack, a bundle of various Chegg Services product offerings, including Chegg Study, Chegg Writing, Chegg Math Solver, video content, and practice quizzes, which creates an integrated platform of connected academic support services; and Thinkful, a skills-based learning platform that offers professional courses in the areas of software engineering, UX/UI design, digital marketing, data science, product management, data analytics, product design, and technical project management directly to students. The company also provides other services, such as Chegg Prep and internships; and rents and sells print textbooks and eTextbooks. Chegg, Inc. was incorporated in 2005 and is headquartered in Santa Clara, California.

In 2010, Dan Rosensweig joined Chegg with a vision to transform the popular textbook rental service into a leading provider of digital learning services for high school and college students. By leveraging technology, mobility, and connected networks, Chegg now offers a suite of high-quality, low-cost, personalized, and on-demand educational resources that help students maximize the return on their investment in education. As Chairman and CEO of Chegg, Dan commits the company to fulfill its mission – “always put students first” – by helping them save time, save money and get smarter. Under Dan’s direction, Chegg has become the always on-demand, connected learning platform so students everywhere have a smarter, faster, more affordable way to achieve their educational and career goals. Prior to Chegg, Dan served as CEO of Guitar Hero, COO of Yahoo!, and CEO of ZDNet. Dan received a Bachelor of Arts degree in Political Science from Hobart and William Smith College in Geneva, New York.

Opinion: Chegg was an amazing stock for a while. Given up for dead as the assumption was college textbooks were dinosaurs and like Betamax, DVDs, and their real-world equivalents, hardcover bestseller books would just be another example of functional obsolescence eliminated the college textbook. Wrong – forgot to figure in cronyism, patriarchy, the way colleges compensate their tenured professors allowing them to publish text books and make it mandatory for students to purchase them. If you want to be part of this chicanery, CHEGG has pulled back enough that it can be a good entry point.

Name: Soaper David R

Position: President

Transaction Date: 2021-11-30 Shares Bought: 40,000 Average Price Paid: $24.96 Cost: $998,482

Company: Air Transport Services Group Inc. (ATSG)

Air Transport Services Group, Inc., through its subsidiaries, engages in aircraft leasing and air cargo transportation services in the United States and internationally. It offers contracted airline operations, aircraft modification and maintenance services, ground services, and other support services. The company also provides air transportation, aircraft parts, crews, insurance, airline express operations, line, and heavy maintenance, freighter conversions, material handling equipment, ground handling, equipment maintenance, load transfer, mailing and package sorting, and flight support services. In addition, it offers equipment installation and maintenance, vehicle maintenance and repair, and jet fuel and deicing services, as well as flight crews training; and resells and brokers aircraft parts. The company offers its services to delivery companies, air transportation, air express integrators, airlines, and governmental agencies, e-commerce, package delivery, freight forwarders, and logistics industries. As of December 31, 2020, its in-service aircraft fleet consisted of 100 owned aircraft and 6 leased aircraft. The company, formerly known as ABX Holdings, Inc was founded in 1980 and is headquartered in Wilmington, Ohio.

Soaper most recently held the position of President and Chief Operating Officer at Connecticut-based Southern Air, Inc. Prior to that he served as Senior Vice President of Aircraft Operations for regional airline Comair, Inc. during a 28-year career with that company. Soaper holds a bachelor’s degree in Business Administration from Wilmington College. He is an FAA-licensed Commercial Pilot with Instrument and Multi-Engine Ratings and is a licensed Aircraft Dispatcher.

Opinion: Soaper has been President of ATSG since February 2017. This is his first open-market buy and its a sizeable one. Covid won’t keep goods on the ground and if the past is any guide, staying at home simulates demand. Supply chain changes are good for air transport companies. At 10.2 P.E. of trailing 12 months earnings, Soaper is smart buying 40,000 shares pf $ATSG at $24.96

Name: Dillon Adrian T

Position: Director

Transaction Date: 2021-11-26 Shares Bought: 10,000 Average Price Paid: $24.04 Cost: $240,400

Company: Datto Holding Corp. (MSP)

Datto Holding Corp. provides cloud-based software and technology solutions for delivery through the managed service provider (MSP) channel to small and medium businesses in the United States and internationally. Its Unified Continuity products include Business Continuity and Disaster Recovery that protects servers and workstations, and minimize downtime; Cloud Continuity, an image-based continuity solution for Windows-based laptops and desktops; SaaS Protection, an automated and secure backup and restoration product; Workplace, cloud-hosted file sync, and share solution, which enable end-users to synchronize files across platforms, including mobile devices; and File Protection, an MSP-managed secure and scalable backup product that enables MSPs to protect and recover files and folders on workstations and laptops. The company’s networking Products comprise access points, switches, edge routers, and managed power devices. Its business management products consist of Autotask Professional Services Automation, an IT business management product; and remote monitoring and management. The company was formerly known as Merritt Topco, Inc. and changed its name to Datto Holding Corp. in January 2020. Datto Holding Corp. was founded in 2007 and is headquartered in Norwalk, Connecticut.

Adrian Dillon joined Datto as an Independent Director and Chairman of the Audit Committee in August 2020. Mr. Dillon is currently the non-executive chairman of the board of directors of WNS Holdings Limited and has served on the WNS board since August 2012. He has also served as a member of the HealthEquity, Inc. board of directors since September 2016, where he chairs the Cybersecurity Committee and serves on the Audit and the Compensation Committees. Mr. Dillon served as a member of the board of directors of Williams-Sonoma, Inc. (NYSE: WMS), from 2005 to 2017, Wonga Group Limited, from 2013 to 2015, NDS Group Limited, from 2011 to 2012, Verigy Pty, from 2006 to 2007, and LumiLeds Inc., from 2002 to 2007.

Opinion: Ready Aim Fire. Short away

Name: Kania Edwin M

Position: Director

Transaction Date: — Shares Bought: 100,000 Average Price Paid: $22.56 Cost: $2,256,215

Company: TransMedics Group Inc. (TMDX)

TransMedics Group, Inc., a commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally. The company offers an Organ Care System (OCS), portable organ perfusion, optimization, and monitoring system that utilizes its proprietary and customized technology to replicate near-physiologic conditions for donor organs outside of the human body. Its Organ Care System includes OCS LUNG, portable perfusion, ventilation, and monitoring system that maintains the organ at a near-physiologic state allowing physicians to assess and improve the condition of lungs between the donor and recipient sites; OCS Heart, portable, warm perfusion, and monitoring system designed to keep a donor heart at a human-like, metabolically active state; and OCS Liver, a system that is evaluated in clinical trials for utilized and unutilized donor livers. TransMedics Group, Inc. was founded in 1998 and is headquartered in Andover, Massachusetts.

Edwin M. Kania Jr. serves as Independent Director of the Company. Mr. Kania is the managing partner and chairman of FarField Partners, a personal venture capital investment and advisory firm. Mr. Kania was co-founder of Flagship Ventures and served as Flagship’s Chairman between 2001 and 2014. He continues as Managing Partner for the three Flagship funds raised during that period and also continues as Managing Partner for the predecessor OneLiberty Funds that were an early lead investor in our company. During Mr. Kania’s 35 years in the venture capital industry, he has served on the boards of numerous privately and publicly held companies, including previous board positions at Acceleron Pharma and Selecta Biosciences

Opinion: One horrible broken chart after another. I feel bad for all the bag holders in these companies but it’s important to note that insiders in this company were all sellers until now. Almost any investment in the stock market can be a good one, depending on the price. That’s the biggest takeaway this week so far. The problem is I see there is no revenue growth. In fact, the last quarter was down substantially. We are passing

Name: Wolf Dale B

Position: Director

Transaction Date: 2021-11-29 Shares Bought: 15,000 Average Price Paid: $22.53 Cost: $337,935

Company: eHealth Inc. (EHTH)

eHealth, Inc. provides private health insurance exchange services to individuals, families, and small businesses in the United States and China. Its eCommerce platforms organize and present health insurance information in various formats that enable individuals, families, and small businesses to research, analyze, compare, and purchase a range of health insurance plans. The company operates through two segments, Medicare; and Individual, Family, and Small Business. It operates a marketplace that offers consumers a choice of insurance products that include Medicare Advantage, Medicare Supplement, Medicare Part D prescription drug, individual and family, small business, and other ancillary health insurance products from health insurance carriers. The company markets health insurance plans through its websites, such as eHealth.com, eHealthInsurance.com, eHealthMedicare.com, Medicare.com, PlanPrescriber.com, and GoMedigap.com, as well as through a network of marketing partners. The company also licenses its health insurance e-commerce technology that enables health insurance carriers to market and distribute health insurance plans online, and provides online sponsorship and advertising, and lead referral services. eHealth, Inc. was incorporated in 1997 and is headquartered in Santa Clara, California.

Dale Wolf has served as a director since 2013 and as chairman of the board since 2017. Mr. Wolf has served as president and a chief executive officer from 2016 to 2019, and executive chairman from 2015 to 2016, of One Call Care Management, and has been the president and chief executive officer of DBW Healthcare, Inc. since 2014. Mr. Wolf served as the executive chairman of Correctional Healthcare Companies, Inc., a national provider of correctional health care solutions, from 2012 to 2014. From 2005 to 2009, Mr. Wolf served as chief executive officer of Coventry Health Care, Inc., a diversified national health care company, and served as the executive vice president, chief financial officer, and treasurer of Coventry Health Care, Inc. from 1996 to 2004. Mr. Wolf was also a member of the board of directors of Correctional Healthcare Companies, Inc.

Opinion: Whoever thought selling health insurance online was a good idea? After all, everything is sold online, why not insurance? If that’s the case how come no one can make money doing it? Just looking at this company’s history of revenues and consecutive losses is enough to dissuade any sound-minded investor.

Name: Tilden Bradley D

Position: Director

Transaction Date: 2021-11-26 Shares Bought: 22,000 Average Price Paid: $21.27 Cost: $467,988

Company: Nordstrom Inc. (JWN)

Nordstrom, Inc., a fashion retailer, provides apparel, shoes, beauty, accessories, and home goods for women, men, young adults, and children. It offers a range of brand name and private label merchandise through various channels, such as Nordstrom branded stores and online at Nordstrom.com; TrunkClub.com; Nordstrom.ca; Nordstrom stores; Nordstrom Rack stores; Nordstrom Locals; Nordstromrack.com, and HauteLook; clearance stores under the Last Chance name; Trunk Club clubhouses; and Jeffrey boutiques. As of March 02, 2021, it operated 358 stores in the U.S. and Canada, including 100 Nordstrom stores, 249 Nordstrom Rack stores, two clearance stores, and 7 Nordstrom Local service hubs. The company was founded in 1901 and is headquartered in Seattle, Washington. An incredible eye for what’s next in fashion. A passionate drive to exceed expectations. For more than 100 years, they’ve worked to deliver the best possible shopping experience, helping their customers express their style—not just buy fashion. This commitment has taken them from a small Seattle shoe shop to the leading fashion retailer they are today. They’re proud to serve customers at 100 full-line stores and 248 Nordstrom Rack locations in 40 U.S. states and Canada, two clearance stores, and five Nordstrom Local service hubs. They believe fashion is a business of optimism, and in that spirit, they continue to grow and evolve. Free shipping and free returns, mobile shopping, and exciting new retail partnerships offer us continued opportunities to serve more customers in more ways with a fresh, relevant shopping experience and inspiring style.

Bradley D. Tilden is a businessperson who has been at the head of 6 different companies. Currently, he holds the position of Chairman at Alaska Air Group, Inc. and Chairman at Alaska Airlines, Inc., Chairman at Horizon Air Industries, Inc., and Chairman at Virgin America, Inc. (which are all subsidiaries of Alaska Air Group, Inc.). Bradley D. Tilden is also Chairman of the Greater Seattle Chamber of Commerce and on the board of 6 other companies. In his past career, he held the position of Chairman at Chief Seattle Council, Chief Financial Officer at Alaska Air Group, Inc., Principal at Pricewaterhouse LLP, and Principal at PricewaterhouseCoopers (Australia). Mr. Tilden received an undergraduate degree from Pacific Lutheran University and an MBA from the University of Washington.

Opinion: I think Nordstrom could close its department store business and live off of Nordstrom Rack online. The valuation already reflects this. I don’t see any end in sight for the rationalization of big box stores. Eventually, malls will get repurposed. People will come back, try on clothes, take a yoga class, meet with their therapist. Real estate in prime locations doesn’t go anywhere unfortunately Nordstrom doesn’t have a formula yet to make it come back.

Name: Encrantz Staffan

Position: Director

Transaction Date: 2021-11-29 Shares Bought: 525,000 Average Price Paid: $20.89 Cost: $10,968,303

Company: Sight Sciences Inc. (SGHT)

Sight Sciences, Inc., an ophthalmic medical device company, engages the development and commercialization of surgical and nonsurgical technologies for the treatment of eye diseases. The company’s products include OMNI Surgical System, a therapeutic device used by ophthalmic surgeons to reduce intraocular pressure in adult glaucoma patients; and TearCare System, a wearable eyelid technology, for the treatment of dry eye disease (DED) for ophthalmologists and optometrists. It offers products through sales representatives and distributors to hospitals, medical centers, and eyecare professionals in the United States. The company was incorporated in 2010 and is headquartered in Menlo Park, California. Sight Sciences is a growth-stage medical device company transforming the two fastest-growing segments in ophthalmology and optometry, glaucoma and dry eye disease. Founded in 2011, the company has developed and is now commercial with intelligently designed and engineered products to assist healthcare practitioners where our products are indicated. The company’s product portfolio features the OMNI® Surgical System, which is indicated for canaloplasty (micro catheterization and transluminal viscodilation of Schlemm’s canal) followed by trabeculotomy (cutting of trabecular meshwork) to reduce intraocular pressure in adult patients with primary open-angle glaucoma. The company’s non-surgical product portfolio consists of TearCare® System, which is now commercially available for both ophthalmologists and optometrists. TearCare® is a software-controlled, wearable eyelid technology that delivers highly targeted and adjustable heat in applications such as Meibomian Gland Dysfunction (MGD), Dry Eye, and Blepharitis, where the current medical community would recommend the application of a warm compress to the eyelids.

Founder and Chairman of Allegro Investment Fund, L.P., a registered Cayman Islands Investment Fund that is managed by Allegro Investment Inc. Located in Menlo Park, CA, Allegro primarily invests in growth-stage private companies and supports its portfolio by providing growth capital as well as strategic, operating and financial expertise. Mr. Encrantz has actively led investments in and operation of a variety of companies for over 30 years. He has led the growth and development of both early-stage companies and established businesses in a wide variety of fields. Mr. Encrantz is currently Chairman of AnaMar AB, ClosingCorp Inc, Evolve Controls, LLC, Nclear Inc, Alestra Ltd., Koncentra Holding AB, and the Koncentra Verkstads AB group. He is also a director of GovX, Inc, Oxymetal SAS, and several other companies.

Opinion: Nope- nothing here to interest me.

Name: Christensen McCord

Position: CEO

Transaction Date: 2021-12-01 Shares Bought: 50,000 Average Price Paid: $20.09 Cost: $1,004,500

Company: PetIQ Inc. (PETQ)

PetIQ, Inc. operates as a pet medication and wellness company. It operates in two segments, Products, and Services. The company offers Rx pet medications, which include heartworm preventatives, arthritis, thyroid, diabetes and pain treatments, antibiotics, and other specialty medications; and co-develops and manufactures its own proprietary value-branded products, as well as distributes third-party branded medications. It also provides OTC medications and supplies primarily within the flea and tick control, and behavior management categories of the health and wellness industry in various forms, such as spot-on (topical) treatments, chewable, oral tablets, and collars. In addition, the company offers health and wellness products that include dental treats and nutritional supplements, which comprise hip and joint, vitamins, and skin and coat products. The company provides its products primarily under the PetIQ, PetArmor, VIP Petcare, VetIQ PetCare, VetIQ, Capstar, Advecta, SENTRY, Sergeants, PetLock, Heart Shield Plus, TruProfen, Betsy Farms, PetAction, Minties, Vera, and Delightibles brands. In addition, the company offers a suite of services at community clinics and wellness centers hosted at pet retailers across 41 states, including diagnostic tests, vaccinations, prescription medications, microchipping, and wellness checks. It operates through approximately 60,000 points of distribution across veterinarian, retail, and e-commerce channels. The company was founded in 2010 and is headquartered in Eagle, Idaho.

Mr. Christensen co-founded PetIQ in 2010 and has served as the Chief Executive Officer since their inception and is a member of our board of directors. In 2015, Mr. Christensen was named Chairman of our board of directors. In addition to his leadership responsibilities as Chairman and CEO, Mr. Christensen’s expertise in retail and consumer products has enabled PetIQ to deliver targeted and well-executed commercial programs and products across the retail industry. Prior to founding PetIQ, Mr. Christensen gained extensive retail and management experience working at Albertson’s and as an executive in consumer product companies selling to leading U.S. retailers. Mr. Christensen holds a Bachelor of Science in Finance from Boise State University.

Opinion: A network of cost savings veterinarians and low-cost drugs sound like something that would take off right? PETQ might have been on the path to achieving this before the pandemic. I think we will take a flyer on this name and it seems that they can get on the growth track, we will add to our position.

Name: Goncalves Celso L

Position: Jr CFO

Transaction Date: 2021-11-30 Shares Bought: 5,000 Average Price Paid: $20.13 Cost: $100,628

Name: Goncalves Celso L

Position: Jr CFO

Transaction Date: 2021-12-01 Shares Bought: 50,000 Average Price Paid: $19.77 Cost: $988,250

Company: Cleveland-Cliffs Inc. (CLF)

Cliffs are the largest flat-rolled steel producer in North America. Founded in 1847 as a mine operator, They are also the largest supplier of iron ore pellets in North America. In 2020, They acquired two major steelmakers, AK Steel and ArcelorMittal USA, vertically integrating their legacy iron ore business with quality-focused steel production and emphasis on the automotive end market. Their fully integrated portfolio includes custom-made pellets and HBI; flat-rolled carbon steel, stainless, electrical, plate, tinplate, and long steel products; as well as carbon and stainless steel tubing, hot and cold stamping, and tooling. Headquartered in Cleveland, Ohio, They employ approximately 25,000 people across their mining, steel, and downstream manufacturing operations in the United States and Canada. Cleveland-Cliffs has been traditionally recognized as the largest and oldest independent iron ore mining company in the United States. In 2020, Cleveland-Cliffs conducted a transformation that will keep the company thriving for the next century with the acquisition of two prominent steel companies in the United States. Today, They are now the largest flat-rolled steel company and the largest iron ore pellet producer in North America. They are vertically integrated from mining through iron making, steelmaking, rolling, finishing, and downstream with hot and cold stamping of steel parts and components. They have the unique advantage of being self-sufficient with the production of the raw materials for their steelmaking operations. As they expand their presence, They continue to operate environmentally responsible and safe. With ongoing initiatives to reduce waste, improve water conservation, and reduce carbon emissions by 25% by 2030, They promise to become North America’s leader in steelmaking and mining sustainability.

Lourenco Goncalves has been Chairman, President, and Chief Executive Officer of Cleveland-Cliffs since August 2014. He designed and led the company through a major strategic initiative transforming Cleveland-Cliffs into a leading player in the U.S. steel industry, starting with a complete financial turnaround, followed by growth initiatives in the metallics market and the entry into the steel business. In 2017, Cliffs started the construction in Toledo, Ohio of the world’s most modern Direct Reduction Plant, which started operations in November 2020. Mr. Goncalves led the acquisition of AK Steel in March 2020, followed by the acquisition of ArcelorMittal USA in December 2020. With these two major acquisitions, Cleveland-Cliffs is now the largest flat-rolled steel company and the largest iron ore pellet producer in the United States and in North America, holding an industry-leading market position in automotive steel.