Curious how well insiders are doing with their buys? Click on this link or image above to scroll the significant buys of the last year.

The game changes this week. Earnings restricted blackouts are winding down as most companies have now reported the 3rd quarter. Insider buying ramped considerably and you should have a lot of fun reading this week’s blog post. There are a lot of tea leaves to pick through. Insiders don’t explain the logic of their big purchases. We have to let the dollars speak for themselves and we can only imagine what they are saying. Add a few insiders willing to buy $millions of dollars instead of constantly selling and we’ve got a barn burner on our hands with Skillz. Ultimately success is spelled in dollars and cents but in the short term, it’s all narrative. This was our largest purchase from this crop of insider buying.

Name: Woodside Dennis

Position: Director

Transaction Date: 2021-11-08 Shares Bought: 2,861 Average Price Paid: $694.58 Cost: $1,987,198

Company: ServiceNow Inc. (NOW)

ServiceNow, Inc. provides enterprise cloud computing solutions that define, structure, consolidate, manage, and automate services for enterprises worldwide. It operates the Now platform for workflow automation, artificial intelligence, machine learning, performance analytics, electronic service catalogs and portals, configuration management systems, data benchmarking, encryption, and collaboration and development tools. The company also provides information technology (IT) service management applications; IT service management product suite for enterprise’s employees, customers, and partners; IT business management product suite; IT operations management product that connects a customer’s physical and cloud-based IT infrastructure; IT Asset Management to automate IT asset life cycles; and enterprise development operations product for developers’ toolchain. In addition, it offers security incident management, threat enrichment intelligence, vulnerability response management, and security incident intelligence sharing security operation products; governance, risk, and compliance product to create policies and controls; human resources, legal, and workplace service delivery products; safe workplace applications; customer service management product; and field service management applications. Further, it provides App Engine products; IntegrationHub enables applications to extend workflows; and professional, training, and customer support services. It serves government, financial services, healthcare, telecommunications, manufacturing, IT services, technology, oil and gas, education, and consumer products through direct sales team and resale partners. It has a strategic partnership with Celonis to help customers identify and prioritize processes that are suitable for automation. The company was formerly known as Service-now.com and changed its name to ServiceNow, Inc. in May 2012. The company was incorporated in 2004 and is headquartered in Santa Clara, California.

Dennis Woodside served as the Chief Operating Officer of Dropbox from April 2014 to September 4th, 2018. Previously he was the Chief Executive Officer of Motorola Mobility from its acquisition by Google, Inc. in May 2012 to winter 2014. He was the successor to Sanjay Jha. Dennis Woodside joined Google in 2003 and was responsible for leading sales operations in Europe, the Middle East, and Africa. Woodside, before becoming the CEO of Motorola Mobility, was the Senior Vice President of Google’s America Operations. On February 12, 2014, it was reported he joined cloud storage company Dropbox as COO. This move came after Google announced the sale of Motorola Mobility to Lenovo in January 2014. Additionally, it was reported that Woodside would be replaced by Jonathan Rosenberg, the former head of product management at Google, who will be appointed as the COO of Motorola Mobility.

Opinion: Service Now has been a long-term wealth creator. The share price this year alone has more than doubled. That makes me nervous. Woodside has been a director of Service Now since August of 2018 and this is his first open-market buy as far as I can tell and it’s a large one, nearly $2 million. Woodside is wealthy, no doubt, but he’s the only insider buying there. The rest are pretty aggressive sellers. That’s not in itself too unusual for tech companies like this where stock grants and options are part and parcel of the pay package. We need a cloud software sell-off to bring some reason to this market but I have no crystal ball when that will happen. Maybe Woodside just watched the price rise 5 x since he was appointed a director and just couldn’t restrain himself any longer. I can’t bring myself to pull the trigger at a forward PE of 95. Selling way out of the money puts is an option though.

Name: Brown Jeffrey J

Position: Director

Transaction Date: 2021-11-08 Shares Bought: 4,200 Average Price Paid: $231.89 Cost: $973,911

Company: Medifast Inc. (MED)

Medifast (NYSE: MED) is the global company behind one of the fastest-growing health and wellness communities, OPTAVIA®, which offers scientifically developed products, clinically proven plans, and the support of Coaches and a Community to help Clients achieve Lifelong Transformation, One Healthy Habit at a Time®. Based on more than 40 years of experience, Medifast has redefined direct selling by combining the best aspects of the model. Its community of independent OPTAVIA Coaches has impacted 2 million lives and teaches Clients how to develop holistic healthy habits through the proprietary Habits of Health® Transformational System. Medifast is traded on the New York Stock Exchange and ranked second on FORTUNE’s 100 Fastest-Growing Companies list in 2020. The company was also named to Forbes’ 100 Most Trustworthy Companies in America list in 2017. Medifast, Inc., through its subsidiaries, manufactures and distributes weight loss, weight management, healthy living products, and other consumable health and nutritional products in the United States and the Asia-Pacific. It offers bars, bites, pretzels, puffs, cereal crunch, drinks, hearty choices, oatmeal, pancakes, puddings, soft serves, shakes, smoothies, soft bakes, and soups under the Medifast, OPTAVIA, Thrives by Medifast, Optimal Health by Taking Shape for Life, and Flavors of Home brands. The company markets its products through point of sale transactions over e-commerce platforms and its franchisee system. Medifast, Inc.

Mr. Brown serves as a member of the Audit Committee and Executive Committee. He has also served as Lead Director of the Company since June 2015. Mr. Brown is the Chief Executive Officer and founding member of Brown Equity Partners, LLC (“BEP”), which provides capital to management teams and companies needing equity capital. Mr. Brown has 34 years of private equity and corporate governance experience. He has served as Chairman of the Board of 12 companies and on the Board of Directors of over 50 companies in both the public and private sectors. He has chaired the Audit, Compensation, Finance, and special committees of these organizations as well as been Lead Director.

Opinion: I’m pretty much over MLM companies and suggest you do the same.

Name: Dreyfus Maria S

Position: Director

Transaction Date: 2021-11-08 Shares Bought: 10,632 Average Price Paid: $188.07 Cost: $1,999,611

Company: Pioneer Natural Resources Co. (PXD)

Pioneer Natural Resources Company is an American company engaged in hydrocarbon exploration headquartered in Irving, Texas. It operates in the Cline Shale, which is part of the Spraberry Trend of the Permian Basin, where the company is the largest acreage holder. Pioneer Natural Resources Company operates as an independent oil and gas exploration and production company in the United States. The company explores for, develops, and produces oil, natural gas liquids (NGLs), and gas. It has operations in the Permian Basin in West Texas. As of December 31, 2020, the company had proved undeveloped reserves and developed non-producing reserves of 31 million barrels of oil, 17 million barrels of NGLs, and 88 billion cubic feet of gas; and owned interests in 11 gas processing plants. Pioneer Natural Resources Company was founded in 1997 and is headquartered in Irving, Texas.

Maria S. Jelescu Dreyfus became a Director of Pioneer Natural Resources in September 2021. She is the CEO and Founder of Ardinall Investment Management, a New York-based independent investment firm established in 2017. Ardinall has an ESG-based investment approach and focuses on climate change and sustainable investments. Prior to Ardinall Investment Management, Ms. Dreyfus spent 15 years at Goldman Sachs, most recently serving as Portfolio Manager and Managing Director in the Goldman Sachs Investment Partners group, where she focused on energy, industrials, transportation, and infrastructure investments in both public and private markets.

Opinion: It’s almost comical reading about Maria Dreyfus touting her ESG credentials and her buying $2 million worth of one of the largest oil producers in the Permian. I’m not a tree-hugging hypocritical environmentalist and I don’t have a problem buying oil and gas stocks. I wish she had shown up earlier in the year when oil was trading at half the price. I also believe that buying stocks that have tripled in a year can be hazardous to your financial health. My stance on this group is that the world is moving away from the internal combustion engine and with it gasoline. It will also take an enormous amount of time and Pioneer will make a ton of money before it’s over but that doesn’t mean investors are going to make any money buying the stock here. The big money has clearly been made on this group already.

Name: Volas Gerald

Position: CEO Chairman

Transaction Date: 2021-11-9 Shares Bought: 6,000 Average Price Paid: $171.52 Cost: $1,029,108

Company: Scotts Miracle-Gro Co. (SMG)

The Scotts Miracle-Gro Company manufactures, markets, and sells consumer lawn and garden products in the United States and internationally. The company operates through three segments: U.S. Consumer, Hawthorne, and Other. It offers lawn care products, such as lawn fertilizers, grass seed products, spreaders, other durable products, and outdoor cleaners, as well as lawn-related weed, pest, and disease control products. The company also provides gardening and landscape products, including water-soluble and continuous-release plant foods, potting mixes and garden soils, mulch and decorative ground cover products, plant-related pest and disease control products, organic garden products, and live goods and seeding solutions. In addition, it offers hydroponic products that help users to grow plants, flowers, and vegetables using little or no soil; lighting systems and components for use in hydroponic and indoor gardening applications; and insect, rodent, and weed control products for home areas. The company offers its products under the Scotts, Turf Builder, EZ Seed, PatchMaster, Thick’R Lawn, GrubEx, EdgeGuard, Handy Green II, Miracle-Gro, LiquaFeed, Osmocote, Shake ÂN Feed, Hyponex, Earthgro, SuperSoil, Fafard, Nature Scapes, Ortho, Miracle-Gro Performance Organics, Miracle-Gro Organic Choice, Whitney Farms, EcoScraps, Mother Earth, Botanicare, Hydroponics, Vermicrop, Gavita, Agrolux, Can-Filters, Sun System, Gro Pro, Hurricane, AeroGarden, Titan, Tomcat, Ortho Weed B Gon, Roundup, Groundclear, and Alchemist brands. It serves home centers, mass merchandisers, warehouse clubs, large hardware chains, independent hardware stores, nurseries, garden centers, e-commerce platforms, and food and drug stores, as well as indoor gardening and hydroponic distributors, retailers, and growers through direct sales force, and network of brokers and distributors. The Scotts Miracle-Gro Company was founded in 1868 and is headquartered in Marysville, Ohio.

Gerald Volas no longer serves as Chief Executive Officer, Director of the Company effective 12/31/2020. Mr. Volas has served as their Chief Executive Officer since June 2015. Mr. Volas was a Group President at Masco Corporation (“Masco”) from 2006 to June 2015 and prior to that, President of Liberty Hardware Mfg. Corp., a Masco operating company, from 2001 to 2005. From 1996 to 2001, he served as a Group Controller supporting a variety of Masco operating companies; and from 1982 to 1996, he served in progressive financial roles including Vice President/Controller at BrassCraft Manufacturing Company, a Masco operating company. Mr. Volas is a Certified Public Accountant.

Opinion: I kid you not. Scotts Miracle Grow is under pressure because there is a glut in the North American cannabis supply. While the shelves at your local Target are empty, try out your friendly neighborhood weed dispensary. They have plenty of marijuana for sale. While the bloom is off the rose, the year-long slide in share price is probably over and this is one you can ride with a ho, ho, ho Jolly New Year.

Scotts Miracle grow is blaming its financial woes on a glut of marijuana

. In their last earnings announcement, they said, “we expect the current over-supply of cannabis to put negative pressure on our growth rate through the rest of the calendar year and into the second quarter, at which point we anticipate a more normal growth rate.” The Company issued guidance for fiscal 2022 based on expected company-wide sales growth of 0 to 3 percent, revenue consensus of $4.74B. It expects U.S. Consumer segment sales to be 0 to minus 4 percent. Hawthorne sales are expected to grow approximately 8 to 12 percent with most of the growth expected in the second half of the year.

;

Name: Childs John W

Position: Director

Transaction Date: 2021-11-10 Shares Bought: 5,000 Average Price Paid: $122.87 Cost: $614,342

Company: Biohaven Pharmaceutical Holding Co Ltd. (BHVN)

Biohaven is a clinical-stage biopharmaceutical company with proven leadership in industry and academic settings. Their portfolio is composed of innovative, late-stage product candidates targeting neurological and neuropsychiatric diseases, including rare disorders. Their progress is fueled by an entrepreneurial organizational structure and an impressive range of experience in drug development along with the confident support of top-tier biopharma investors. Biohaven has combined internal development and research with intellectual property licensed from companies and institutions including Bristol-Myers Squibb Company, AstraZeneca AB, Yale University, Catalent, ALS Biopharma LLC, and Massachusetts General Hospital. Since their initial public offering in 2017, they have made rapid progress with multiple compounds across their CGRP receptor antagonist, a glutamate modulator, and myeloperoxidase (MPO) inhibitor platforms. Nurtec™ ODT (Rimegepant 75 mg) received FDA approval in February 2020 and is quickly gaining traction as the only orally disintegrating CGRP antagonist for acute treatment of migraine. At the same time, Biohaven is advancing novel acute and preventive treatments for migraine with zavegepant and rimegepant. In addition to continued exploration of our CGRP receptor antagonists, multiple clinical trials are ongoing for product candidates across their neuro innovative platforms.

Mr. John W. Childs serves as the Chairman and Partner of J.W. Childs Associates, L.P., a private equity firm. He co-founded J.W. Childs Associates in 1995. Prior to founding J.W. Childs Associates, Mr. Childs was Senior Managing Director of the Thomas H. Lee Company from 1991 to 1995. In this capacity, he had broad responsibilities for originating, analyzing, negotiating, and managing leveraged buyout transactions for the THL funds. For seventeen years prior to joining THL, Mr. Childs was with the Prudential Insurance Company of America where he held various executive positions in the investment area, ultimately serving as Senior Managing Director in charge of the Capital Markets Group. He is currently Chairman of Sunny Delight and a director of Kosta Browne, Esselte, Mattress Firm, WS Packaging, and SIMCOM. Prior to its sale, he was Chairman of the Board of CHG Healthcare Services.

Opinion: It’s been very uneven, you could even say a terrible year for biotech with few exceptions, one of them being Biohaven. Biohaven has been riding the popularity of its revolutionary drug for migraine, Nurtec ODT. It’s the only migraine drug approved for not only the treatment but the prevention of this affliction that strikes millions of people. Migraine is the 3rd most prevalent illness in the world.

Most people in the United States with migraine have 1 to 2 migraine attacks per month. Migraine attacks usually last anywhere from 4 hours to 3 days. If each attack only lasts for 1 day or less, that still adds up to about 12 to 24 sick days a year. A person with 3-day migraines would be sick 36 to 72 days a year.

Biohaven fell 16% on Q3 earnings where the company earned an adjusted EPS (#1.91) versus the consensus ($2.40) on revenues of $135.74M versus $128.4M. They inked a deal with Pfizer to sell and distribute Nurtec outside the U.S. Why that merited a steep stock sell-off is a mystery to me and apparently to director John Childs who made his 4th buy of the year at ever-increasing prices. Childs is averaging up not down and this is very bullish insider buying. Patient investors would be wise to nibble here too.

Name: Lewis Ronald J

Position: COO

Transaction Date: 2021-11-09 Shares Bought: 10,000 Average Price Paid: $91.26 Cost: $912,625

Company: BALL Corp. (BLL)

Ball Corporation is an American company headquartered in Broomfield, Colorado. It is best known for its early production of glass jars, lids, and related products used for home canning. Since its founding in Buffalo, New York, in 1880, when it was known as the Wooden Jacket Can Company, the Ball company has expanded and diversified into other business ventures, including aerospace technology. It eventually became the world’s largest manufacturer of recyclable metal beverage and food containers. The Ball brothers renamed their business the Ball Brothers Glass Manufacturing Company, incorporated in 1886. Its headquarters, as well as its glass and metal manufacturing operations, were relocated to Muncie, Indiana, by 1889. The business was renamed the Ball Brothers Company in 1922 and the Ball Corporation in 1969. It became a publicly-traded stock company on the New York Stock Exchange in 1973. The ball left the home canning business in 1993 by spinning off a former subsidiary (Alltrista) into a free-standing company, which renamed itself Jarden Corporation. As part of the spin-off, Jarden is licensed to use the Ball registered trademark on its line of home-canning products. Today, the Ball brand mason jars and home canning supplies belong to Newell Brands.

Ronald James Lewis is on the board of Ball Beverage Packaging UK Ltd., Ball Beverage Packaging Holdings UK Ltd., and Ball Beverage Packaging Europe Ltd., and President-Beverage Packaging at Ball Corp. In the past, Mr. Lewis was Chief Supply Chain Officer at Coca-Cola European Partners Plc President & Chief Executive Officer for Coca-Cola Bottlers Sales & Services Co. LLC and Senior Vice President-Supply Chain at Coca-Cola Enterprises, Inc. (both are subsidiaries of Coca-Cola European Partners Plc) and Chief Procurement Officer & Vice President at The Coca-Cola Co. and Senior Vice President at Coca-Cola Refreshments, Inc. (a subsidiary of The Coca-Cola Co.).

Opinion: I don’t know why Lewis is spending almost $1M of his own money to buy stock but he is the 9th insider to buy $200k or more of Ball’s stock in the last three months. . Sometimes it’s just not worth trying to put all the pieces of the puzzle together. I’m buying Ball now and perhaps something will reveal itself why insiders are so into this can company.

- SpaceX is preparing to further test its Starlink satellite internet in a demonstration for the U.S. Air Force, the company revealed in a request to the Federal Communications Commission.

- The company disclosed it is working with Ball Aerospace for this test, with the contractor providing antennas necessary to connect to “tactical aircraft.”

Name: ISTAR Inc

Position: 10% Owner

Transaction Date: 2021-10-10 Shares Bought: 6,707 Average Price Paid: $74.55 Cost: $500,007

Company: Safehold Inc. (SAFE)

Safehold Inc. (NYSE: SAFE) is revolutionizing real estate ownership by providing a new and better way for owners to unlock the value of the land beneath their buildings. Through its modern ground lease capital solution, Safehold helps owners of high-quality multifamily, office, industrial, hospitality and mixed-use properties in major markets throughout the United States generate higher returns with less risk. The Company, which is taxed as a real estate investment trust (REIT) and is managed by its largest shareholder, iStar Inc., seeks to deliver safe, growing income and long-term capital appreciation to its shareholders.

iStar Inc. (NYSE: STAR) is focused on reinventing the ground lease sector, unlocking value for real estate owners throughout the country by providing modern, more efficient ground leases on all types of properties. As the founder, investment manager, and largest shareholder of Safehold Inc. (NYSE: SAFE), the first publicly traded company to focus on modern ground leases, iStar is helping create a logical new approach to the way real estate is owned and continues to use its historic strengths in finance and net lease to expand this unique platform. Recognized as a consistent innovator in the real estate markets, iStar specializes in identifying and scaling newly discovered opportunities and has completed more than $40 billion of transactions over the past two decades.

Opinion: The last time Star went on a buying binge like this, it ignited a match underneath the stock. Not this time. Different era, different game

Name: Wilder C John

Position: Director

Transaction Date: 2021-11-10 Shares Bought: 14,175 Average Price Paid: $64.49 Cost: $914,143

Name: Wilder C John

Position: Director

Transaction Date: 2021-11-05 Shares Bought: 21,384 Average Price Paid: $64.09 Cost: $1,370,419

Company: Evergy Inc. (EVRG)

Evergy is an American investor-owned utility (IOU) with publicly traded stock headquarters in Topeka, Kansas, and in Kansas City, Missouri. The company was formed from a merger of Westar Energy of Topeka and Great Plains Energy of Kansas City, Missouri, the parent company of Kansas City Power & Light. Evergy is the largest electric company in Kansas, serving more than 1.6 million residential, commercial, and industrial customers in the state’s eastern half. Evergy has a generating capacity of 16,000-megawatt electricity from its over 40 power plants in Kansas and Missouri. Evergy service territory covers 28,130 square miles (72,900 km2) in eastern Kansas and western Missouri. Evergy owns more than 13,700 miles (22,000 km) of transmission lines and about 52,000 miles of distribution lines. Evergy is committed to delivering clean, safe, reliable energy sources today and well into the future. So they’re embracing alternative energy sources to generate more power with less impact on our environment and adopting new technologies that let their customers manage their energy use in ways that work for them. Whether it’s new ways to connect with them, electric vehicle charging stations, or the next innovation around the corner, they’re dedicated to empowering a better future. It generates electricity through coal, hydroelectric, landfill gas, uranium, natural gas, oil sources, and solar, wind, and other renewable sources. The company has approximately 10,100 circuit miles of transmission lines, 39,800 circuit miles of overhead distribution lines, and 13,000 circuit miles of underground distribution lines. It serves approximately 1,620,400 customers, including residences, commercial firms, industrials, municipalities, and other electric utilities.

Mr. Wilder is the Executive Chairman of Bluescape. He serves on the boards of directors of several private portfolio companies and has previously served on the board of many private and public companies, including NRG Energy, Inc. and TXU Corp. He served in executive officer roles in TXU Corp., Entergy Corp., and Royal Dutch/Shell Group. Mr. Wilder received his bachelor of science in business administration from Southeast Missouri State University and holds a master of business administration from the University of Texas.

Opinion: We’ve written multiple times that regulated electric utilities are among the very best businesses in the world to own. First of all, they are regulated monopolies, guaranteed to earn an agreed-upon rate of return on their various ratepayers, commercial, industrial, and residential. According to Elon Musk, a two-car EV family will cause their electric bill to double. Throw in a heat pump to wean off Co2 emissions and electric consumption goes up 70% at the average household.

EVG and others are big embraces of renewable energy sources. The Government doesn’t have to push them into being green. They are leading the charge. They would like nothing more than to be a complete monopoly and free themselves from the ups and downs of the fossil fuel industry by building their own solar, wind, hydro, and geothermal sources of renewable “free” monopoly. It seems that they will be getting assistance from a willing government and customer groups as well to transform themselves into the most powerful monopolies since the advent of the tech giants today.

One thought- there is no Google, Microsoft, Amazon, Facebook, or Apple without massive electric consumption in hyper-scale server farms.

Oddly enough this group has been one of the worst-performing sectors. For a while, I thought it was fear of rates rising that was holding the sector back but rates haven’t risen. The Fed is holding rates low and appears to be willing to do so forever based on their dual mandate of full employment and stable prices. I think this very stable group with average high dividend yields of 3.5% is just not exciting enough for today’s group of investors. They just don’t get that reality that the stodgy revenue growth of electric utilities is in the rearview mirror. Let me rephrase the value proposition. If you had a chance to invest in a group of companies that were on the verge of the fastest and most enduring growth spurt since the discovery of the light bulb, you were getting paid 3.5% dividends on companies that were monopolies, completely immune from any risk of economic upheaval, and were going to grow at minimum 8%-10% annual rates as far as the eye could see- how much of your portfolio would you put there? Maybe all of it?

Name: Chapman James R

Position: CFO

Transaction Date: 2021-11-10 Shares Bought: 996 Average Price Paid: $75.28 Cost: $74,998

Name: Blue Robert M

Position: CEO Chairman

Transaction Date: 2021-11-10 Shares Bought: 3,321 Average Price Paid: $75.28 Cost: $249,998

Company: Dominion Energy Inc. (D)

Dominion Energy, Inc. produces and distributes energy. The company operates through four segments: Dominion Energy Virginia, Gas Distribution, Dominion Energy South Carolina, and Contracted Assets. The Dominion Energy Virginia segment generates, transmits, and distributes regulated electricity to residential, commercial, industrial, and governmental customers in Virginia and North Carolina. The Gas Distribution segment engages in the regulated natural gas gathering, transportation, distribution, and sales activities, as well as distributes nonregulated renewable natural gas. This segment serves residential, commercial, and industrial customers. The Dominion Energy South Carolina segment generates, transmits, and distributes electricity and natural gas to residential, commercial, and industrial customers in South Carolina. The Contracted Assets segment is involved in the energy marketing and price risk activities. As of December 31, 2020, the company’s portfolio of assets included approximately 30.2 gigawatts of electric generating capacity; 10,500 miles of electric transmission lines; 85,600 miles of electric distribution lines; and 94,200 miles of gas distribution lines. It serves approximately 7 million customers. The company sells electricity at wholesale prices to rural electric cooperatives and municipalities, as well as into wholesale electricity markets. The company was formerly known as Dominion Resources, Inc. and changed its name to Dominion Energy, Inc. in May 2017. Dominion Energy, Inc. was incorporated in 1983 and is headquartered in Richmond, Virginia.

James Chapman is serving as Chief Financial Officer and Treasurer at Dominion Energy, Inc Dominion Energy, Inc. is an active company headquartered in Richmond, VA in the states of VA. The Dominion Energy, Inc. office address is located at 120 Tredegar Street, Richmond, VA, 23219, United States. The company comes under the Utility industry.

Robert M. Blue is president and chief executive officer of Dominion Energy. Before becoming CEO in 2020, Blue was Dominion Energy’s executive vice president and co-chief operating officer, and president of Dominion Energy Virginia, the company’s electric utility in Virginia and North Carolina. Blue joined Dominion Energy in 2005 and has served as vice president of state and federal affairs; senior vice president of public policy and corporate communications; senior vice president of regulation, law, energy solutions & policy; and president, Dominion Virginia Power. Dominion received about $1.3 billion in cash in anticipation of selling the interests in the LNG Cove Point terminal and pipelines to Berkshire Hathaway Energy and would transfer about $430 million in debt once completed. The prior CEO, Farrell said at the time the Company did this to concentrate on its “regulated” electric utility business. The new CEO, Blue, bought $1M worth of stock earlier in the year at $69.44. We’d back up the truck under $70 and are buyers here as well.

Name: Stallings Robert W

Position: Director

Transaction Date: 2021-11-04 Shares Bought: 17,098 Average Price Paid: $61.66 Cost: $1,054,316

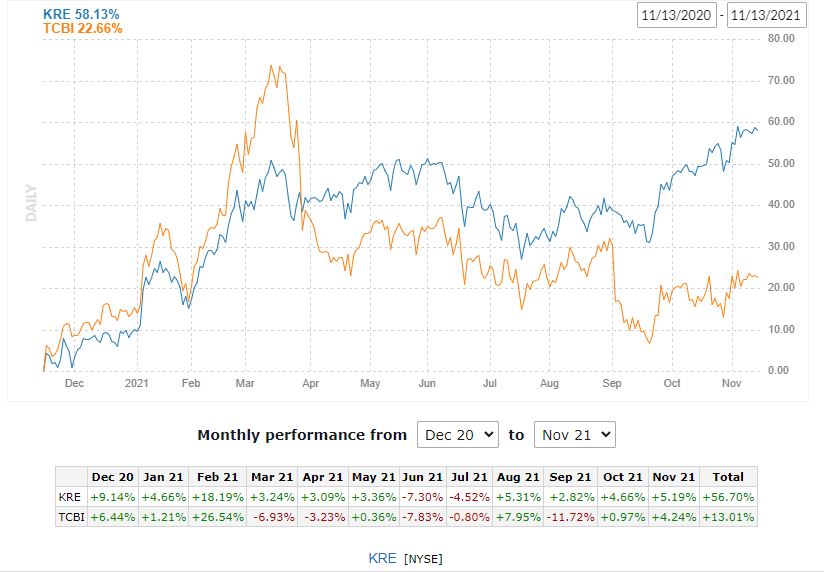

Company: Texas Capital Bancshares Inc. (TCBI)

Texas Capital Bancshares, Inc. operates as the bank holding company for Texas Capital Bank, National Association that provides various banking products and services for commercial businesses, and professionals, and entrepreneurs. It offers business deposit products and services, including commercial checking accounts, lockbox accounts, and cash concentration accounts, as well as other treasury management services, including information services, wire transfer initiation, ACH initiation, account transfer, and service integration; and consumer deposit products, such as checking accounts, savings accounts, money market accounts, and certificates of deposit. The company also provides commercial loans for general corporate purposes comprising financing for working capital, internal growth, and acquisitions, as well as financing for business insurance premiums; real estate term and construction loans; mortgage warehouse lending; mortgage correspondent aggregation; equipment finance and leasing; treasury management services, including online banking and debit and credit card services; escrow services; and letters of credit. In addition, it offers personal wealth management and trust services; secured and unsecured loans; and online and mobile banking services. Further, the company provides American Airlines AAdvantage, an all-digital branch offering depositors. It operates in Austin, Fort Worth, Dallas, Houston, and the San Antonio metropolitan areas of Texas. Texas Capital Bancshares, Inc. was founded in 1996 and is headquartered in Dallas, Texas.

Robert W. Stallings has served as a director since August 2001. He has also served as Chairman of the Board of Directors and Chief Executive Officer of Stallings Capital Group, an investment company, since March 2001. From 1991 to 2001, Mr. Stallings served as Chief Executive Officer of Pilgrim Capital Group, an investment company. He is currently Executive Chairman of the Board of GAINSCO, Inc.

Opinion: Cluster insider buying is a good thing and we bought into this underperforming regional bank. TCBI is underperforming its peers as seen in the chart below. There is no reason to as the Texas economy is one of the best in the nation.

Name: Hamm Harold

Position: Director 10% Owner

Transaction Date: 2021-11-09 Shares Bought: 108,500 Average Price Paid: $47.69 Cost: $5,174,415

Company: Continental Resources Inc. (CLR)

Continental Resources (NYSE: CLR) is a Top 10 independent oil producer in the U.S. Lower 48 and a leader in America’s energy renaissance. Based in Oklahoma City, Continental is the largest leaseholder and one of the largest producers in the nation’s premier oil field, the Bakken of North Dakota and Montana. The Company also has leading positions in Oklahoma, including its SCOOP Woodford and SCOOP Springer discoveries and the STACK and Northwest Cana plays. With a focus on the exploration and production of oil, Continental has unlocked the technology and resources vital to American energy independence and our nation’s leadership in the new world oil market. Continental Resources, Inc. explores for, develops, and produces crude oil and natural gas primarily in the north, south, and east regions of the United States. The company sells its crude oil and natural gas production to energy marketing companies, crude oil refining companies, and natural gas gathering and processing companies. As of December 31, 2020, its proved reserves were 1,104 million barrels of crude oil equivalent (MMBoe) with proved developed reserves of 627 MMBoe.

Growing up in rural Oklahoma, Mr. Hamm went to work in the oil fields as a teenager and established Continental Resources in 1967 at the age of 21. He built a grassroots startup into an NYSE-traded, Top 10 oil producer in the U.S. Lower 48. As a voice for America’s oil and natural gas industry and as the leader of one of America’s top E&P companies, he has helped to make America energy independent. Mr.Hamm also co-founded and serves as Chairman of the Domestic Energy Producers Alliance, which aims to preserve the millions of jobs and billions of dollars in economic activity and tax revenues generated by onshore drilling and production activities within the United States. Through his work with DEPA, Mr. Hamm is widely recognized as the man who led the charge to lift America’s 40-year-old ban on U.S. crude oil exports.

Opinion: I’ve been warning about this situation. Hamm is a figurehead for the wildcatter in today’s modern oil industry. He was the first to open up the Baaken oil fields and made himself a billionaire for it. He is the American self-made legend, even writing at the time at a $1 Billion dollar divorce check, the largest up until then. Hamm almost never sells his company’s stock and is always buying it. Where does he get the money? Investors should be asking this question but they are not. It seems I am the only one pointing out the potential comparison to the ill-fated founder of Chesapeake Energy, Aubrey McClendon.

Name: Papanier George T

Position: President

Transaction Date: 2021-11-05 Shares Bought: 2,250 Average Price Paid: $45.21 Cost: $101,723

Name: Reeves Robeson

Position: President

Transaction Date: 2021-11-05 Shares Bought: 5,750 Average Price Paid: $45.00 Cost: $258,750

Name: Fenton Lee

Position: CEO

Transaction Date: 2021-11-05 Shares Bought: 5,750 Average Price Paid: $44.99 Cost: $258,693

Name: Capp Stephen H

Position: CFO

Transaction Date: 2021-11-05 Shares Bought: 5,500 Average Price Paid: $44.82 Cost: $246,510

Company: Bally’s Corp. (BALY)

Bally’s Corporation owns and operates gaming and racing facilities in the United States. Its gaming and racing facilities include slot machines and various casino table games, and restaurant and hotel facilities. The company owns and manages Twin River Casino Hotel in Lincoln, Rhode Island; Tiverton Casino Hotel in Tiverton, Rhode Island; Hard Rock Hotel & Casino in Biloxi, Mississippi; Casino Vicksburg in Vicksburg, Mississippi; Dover Downs Hotel & Casino in Dover, Delaware; Casino KC in Kansas City, Missouri; Golden Gates, Golden Gulch, and Mardi Gras casinos in Black Hawk, Colorado; Bally’s Atlantic City, Atlantic City, New Jersey; Eldorado Resort Casino Shreveport, Shreveport, Los Angeles; and Arapahoe Park racetrack and 13 off-track betting licenses in Aurora, Colorado. As of April 13, 2021, it owned and operated 12 casinos that comprise 13,308 slot machines, 460 game tables, and 3,342 hotel rooms, as well as a horse racetrack across eight states. The company was formerly known as Twin River Worldwide Holdings, Inc. and changed its name to Bally’s Corporation in November 2020. Bally’s Corporation was founded in 2004 and is incorporated in Providence, Rhode Island.

George Papanier became President Retail, Bally’s land-based casino business, on October 1, 2021. His association with Bally’s began in 2004 when he served as the Chief Operating Officer, an appointment he held until February 2011. He was then appointed to the role of President and CEO of Bally’s. Before joining Bally’s, Mr. Papanier served in the same capacity for Peninsula Gaming with properties in Iowa and Louisiana, from 2000-2004, and as COO for Resorts Casino Hotel in Atlantic City, New Jersey from 1997 – 2000. Both positions involved strategic and tactical planning for the resorts and supervision of major renovation and construction projects. He was also active in evaluating potential acquisitions and the development of projects for the two organizations.

Robeson Reeves became President of the Bally Interactive Division on October 1, 2021. Formerly, he served as the Chief Operating Officer of Gamesys since July 2015. Mr. Reeves joined Gamesys in September 2005 and held a number of positions, most recently Director of Gaming Operations since May 2010 and served as a member of the Gamesys Board of Directors since August 2010. Since joining Gamesys, Mr. Reeves has built a strong record in cohesively connecting player and product experiences to marketing and business KPIs, ensuring sustainable growth.

Lee Fenton became Chief Executive Officer of Bally’s Corporation on October 1, 2021. He was formerly Chief Executive Officer of Gamesys since July 2015. He initially joined Gamesys in November 2008 as Chief Operating Officer. Before joining Gamesys, he was Chief Operating Officer of the mobile division at 20th Century Fox and Global Director of Consumer Products & Content at Vodafone Group plc. He brings deep experience in working with global brands and managing operations across multiple markets.

Mr. Capp joined Bally’s Corporation as Executive Vice President and Chief Financial Officer in January 2019. He previously served as a member of the Bally’s board of directors from 2012 through 2018 and was a member of the audit and compensation committees. From 2003 to 2011, Mr. Capp served as Executive Vice President and Chief Financial Officer of Pinnacle Entertainment, a then-public casino gaming and hospitality company based in Las Vegas. Before working at Pinnacle Entertainment, Mr. Capp was a Managing Director at Bear Stearns in New York from 1997 to 2003, specializing in leveraged finance. Before that was a Managing Director at BancAmerica Securities in Los Angeles and San Francisco.

Opinion: Legalized online sports betting is a game-changer. It may also be a precursor to the liberalization of rules regarding all kinds of online gambling. We provided an adroit analysis of this many months ago saying Draft Kings had a tough competitive environment. I’d rather play an omnichannel gaming company like Bally. We are currently short some Draft King and will likely buy some Bally’s in the coming days. Mind you these are not large buys so don’t go overboard here.

Name: Brown Jeffrey J

Position: Director

Transaction Date: 2021-11-08 Shares Bought: 24,330 Average Price Paid: $43.97 Cost: $1,069,790

Name: Hetrick Christopher B

Position: Director

Transaction Date: 2021-11-08 Shares Bought: 15,000 Average Price Paid: $44.50 Cost: $667,500

Company: Rent A Center Inc De. (RCII)

Rent-A-Center, Inc. and its subsidiaries lease durable household goods to customers on a lease-to-own basis. The company operates in four segments: Rent-A-Center Business, Preferred Lease, Mexico, and Franchising. It offers furniture and accessories, appliances, consumer electronics, computers, tablets and smartphones, tools, tires, handbags, and other accessories under rental purchase agreements. The company also provides merchandise on an installment sales basis; and the lease-to-own transaction to consumers who do not qualify for financing from the traditional retailer through kiosks located within the retailer’s locations. It operates retail installment sales stores under the Get It Now and Home Choice names; lease-to-own and franchised lease-to-own stores under the Rent-A-Centre, ColorTyme, and RimTyme names; and rentacenter.com, an e-commerce platform. As of December 31, 2020, the company owned and operated approximately 1,845 stores in the United States and Puerto Rico, including 44 retail installment sales stores; 45 preferred lease staffed locations in North Carolina; and 121 stores in Mexico, as well as franchised 462 lease-to-own stores in 33 states. Rent-A-Center, Inc. was founded in 1960 and is headquartered in Plano, Texas.

Jeffrey J. Brown is the Chief Executive Officer and founding member of Brown Equity Partners, LLC, which provides capital to management teams and companies needing equity. Mr. Brown’s venture capital and private equity career span 30 years, including positions with Hughes Aircraft Company, Morgan Stanley & Company, Security Pacific Capital Corporation, and Bank of America Corporation. Since June 2015, Mr. Brown has served as the Lead Director of Medifast, Inc., where he also serves as a member of each of the Audit and Mergers & Acquisitions Committees. Mr. Brown also serves as a director of Fieldstone Homes. Mr. Brown previously served as a director of Outerwall Inc., Midatech Pharma PLC, and Nordion, Inc.

Christopher B. Hetrick has been the Director of Research at Engaged Capital, a California-based investment firm and registered advisor with the U.S. Securities and Exchange Commission focused on investing in small and mid-cap North American equities since September 2012. Before joining Engaged Capital, Mr. Hetrick worked at Relational Investors LLC (“Relational”), a $6 billion activist equity fund, from January 2002 to August 2012. Mr. Hetrick began his career with Relational as an associate analyst. He eventually became the firm’s senior consumer analyst overseeing over $1 billion in consumer sector investments. Before heading up the consumer research team, Mr. Hetrick was a generalist covering major investments in the technology, financial, automotive, and food sectors.

Opinion: Rent to own has never been a good business as the collateral is for “shxt” and the creditworthiness of the customer, terrible. Add a 38 state attorney general investigation into your business practices and you can see why RCII is trading at just 9x forward PE. That’s just two cheap for Directors Brown and Hetrick to pass up.

Name: Pasquesi John M

Position: Chairman

Transaction Date: 2021-11-11 Shares Bought: 484,544 Average Price Paid: $41.23 Cost: $19,980,026

Company: Arch Capital Group Ltd. (ACGL)

Arch Capital Group Ltd., together with its subsidiaries, provides insurance, reinsurance, and mortgage insurance products worldwide. The company’s Insurance segment offers primary and excess casualty coverages; loss-sensitive primary casualty insurance programs; collateral protection, debt cancellation, and service contract reimbursement products; directors’ and officers’ liability, errors and omissions liability, employment practices and fiduciary liability, crime, professional indemnity, and other financial related coverages; medical professional and general liability insurance coverages; and workers’ compensation and umbrella liability, as well as a commercial automobile, and inland marine products. It also provides property, energy, marine, and aviation insurance; travel insurance; accident, disability, and medical plan insurance coverages; captive insurance programs; employer’s liability; and contract and commercial surety coverages. This segment markets its products through a group of licensed independent retail and wholesale brokers. Its Reinsurance segment provides reinsurance for third party liability and workers’ compensation exposures; marine and aviation reinsurance; surety, accident and health, workers’ compensation catastrophe, agriculture, trade credit, and political risk products; reinsurance protection for catastrophic losses, and personal lines and commercial property exposures; life reinsurance; casualty clash; and risk management solutions. This segment markets its reinsurance products through brokers. The company’s Mortgage segment offers direct mortgage insurance and mortgage reinsurance. The company was founded in 1995 and is based in Pembroke, Bermuda.

John M. Pasquesi is the Lead Independent Director of the Company. He has been Chairman of the Board of Arch Capital since September 2019. From November 3, 2017, to September 14, 2019, he served as Lead Director. Mr. Pasquesi is the Managing Member of Otter Capital LLC, a private equity investment firm he founded in January 2001. He holds an A.B. from Dartmouth College and an M.B.A. from Stanford Graduate School of Business.

Opinion: It’s been a bad year for reinsurance. Just ask Warren Buffet. Evidently, Pasquesi thinks it will get better. So do the folks at Rennaissance RE who were buyers of their stock last week. Insiders buying in a depressed sector are very bullish for a turnaround. I would bet your homeowner’s insurance bill is going up substantially. Climate change is not cheap.

Name: Bakish Robert M

Position: CEO

Transaction Date: 2021-11-0 Shares Bought: 14,000 Average Price Paid: $35.92 Cost: $502,872

Name: Redstone Shari

Position: Director

Transaction Date: 2021-11-0 Shares Bought: 27,525 Average Price Paid: $36.30 Cost: $999,064

Company: ViacomCBS Inc. (VIACA)

ViacomCBS Inc. operates as a media and entertainment company worldwide. The company operates through TV Entertainment, Cable Networks, and Filmed Entertainment segments. The TV Entertainment segment distributes a schedule of news and public affairs broadcasts, and sports and entertainment programming; acquires or develops, and schedules programming on the CBS Television Network that includes primetime comedies and dramas, reality, specials, kids’ programs, daytime dramas, game shows, and late-night programs; produces or distributes talk shows, court shows, game shows, and newsmagazines; owns and operates 29 broadcast television stations; and operates CBS Sports Network, a 24/7 cable program service that provides college sports and related content, as well as streaming and cable subscription services. The Cable Networks segment creates and acquires programming for distribution and viewing on various media platforms, including subscription cable networks, subscription streaming, and basic cable networks. The Filmed Entertainment segment develops, produces, finances acquires, and distributes films. The company was formerly known as CBS Corporation and changed its name to ViacomCBS Inc. in December 2019. ViacomCBS Inc. was incorporated in 1986 and is headquartered in New York, New York.

Robert M. Bakish is President and Chief Executive Officer of ViacomCBS. Bakish oversees one of the world’s leading media and entertainment content producers, driven by a global portfolio of powerful consumer brands, including CBS, Showtime Networks, Paramount Pictures, Nickelodeon, MTV, Comedy Central BET, Paramount+, Pluto TV, and Simon & Schuster, among others. In this role, which he assumed in December 2019, Bakish is responsible for growing the company’s creative assets and capabilities to serve important and diverse audiences in more than 180 countries. Before the recombination of Viacom and CBS, Bakish was the President and Chief Executive Officer of Viacom since December 2016. He led Viacom’s core businesses to revitalize and evolve, return the company to grow, and extend its leadership across multi-platform entertainment content, next-generation distribution, and advertising.

Shari Redstone is a media executive with wide-ranging experience in the entertainment industry and related ventures. She is the Non-Executive Chair of ViacomCBS’s Board of Directors, having previously served as Vice-Chair of the Boards of Viacom Inc. and CBS Corporation prior to the combination of the companies in 2019. Ms. Redstone is Chairperson, CEO, and President of National Amusements, a world leader in the motion picture exhibition industry. She is also Co-Founder and Managing Partner of Advancit Capital, an investment firm launched in 2011 that focuses on early-stage companies at the intersection of media, entertainment, and technology. Ms. Redstone serves on the Board of Trustees for the Paley Center for Media and is actively involved in charitable, civic, and educational organizations. She is a member of the Board of Trustees at Dana Farber Cancer Institute.

Opinion: ViacomCBS is a cheap stock. Maybe one of the tech giants has eyes on it. I don’t know who would be allowed to buy it though as the consolidation merger mania with tech is severely restrained in this climate. Maybe Apple wants it? Maybe Comcast? Maybe long-time shareholder Mario Gabelli will buy it? Perhaps the sum of the parts are worth more than the whole? In January 2021 Gabelli analyst John Tinker named ViacomCBS as his best idea for 2021. The issues of shrinking carriage and a higher NFL bill are well known and reflected in the stock price, while the company’s “focused leadership” should either grow the company or sell. it to a larger streaming entity, argues Tinker. He has a 2022 private market value estimate of $54 per share for ViacomCBS.

I think something is up. Watch this one carefully. One man’s trash is another man’s treasure or in this case one woman, Sherri Redstone.

Name: Malafronte Michael W

Position: Director

Transaction Date: 2021-11-08 Shares Bought: 21,500 Average Price Paid: $32.99 Cost: $709,285

Company: Adtalem Global Education Inc. (ATGE)

Adtalem Global Education Inc. is an American corporation that operates several for-profit higher education institutions, including American University of the Caribbean School of Medicine, Association of Certified Anti-Money Laundering Specialists, Chamberlain University, EduPristine, OnCourse Learning, Ross University School of Medicine, Ross University School of Veterinary Medicine, and Walden University. Adtalem Global Education Inc. provides workforce solutions worldwide. It operates through two segments, Medical and Healthcare; and Financial Services. The Medical and Healthcare segment offers degree and non-degree programs in the medical and healthcare postsecondary education industry. This segment operates Chamberlain University, American University of the Caribbean School of Medicine, Ross University School of Medicine, and Ross University School of Veterinary Medicine. The Financial Services segment provides test preparation, certifications, conferences, seminars, memberships, and subscriptions to business professionals in the areas of accounting, anti-money laundering, banking, and mortgage lending. It operates the Association of Certified Anti-Money Laundering Specialists, Becker Professional Education, OnCourse Learning, and EduPristine. The company was formerly known as DeVry Education Group Inc. and changed its name to Adtalem Global Education Inc. in May 2017. Adtalem Global Education Inc. was incorporated in 1987 and is based in Chicago, Illinois.

Mr. Malafronte is a founding partner of International Value Advisers, LLC (IVA) where he serves as managing partner and is responsible for overseeing all aspects of IVA, including developing company strategy and managing resources. Prior to IVA, Mr. Malafronte was a senior vice president at Arnhold and S. Bleichroeder Advisers, LLC where he worked for two years as a senior analyst for the First Eagle Funds. Prior to the First Eagle Funds, Mr. Malafronte was a portfolio manager at Oppenheimer & Close, where he assisted in the launch of a domestic hedge fund and offshore partnership and was responsible for all facets of portfolio management for the investment partnerships, including idea generation, in-depth research and stock selection. Mr. Malafronte currently serves as a director of IVA Fiduciary Trust.

Opinion: Is Malafronte throwing good money after bad? This is his second buy this year. He seems to be getting more confidence in it too. His first buy in August was 9000 shares at $35.99. This purchase is for twice the dollar amount at $32.99 per share. It’s unclear what workforce educational spending will get into Biden’s $1.7 trillion dollar social agenda to be voted on. It’s not even clear if there will be a bill to vote on. We are taking a pass here.

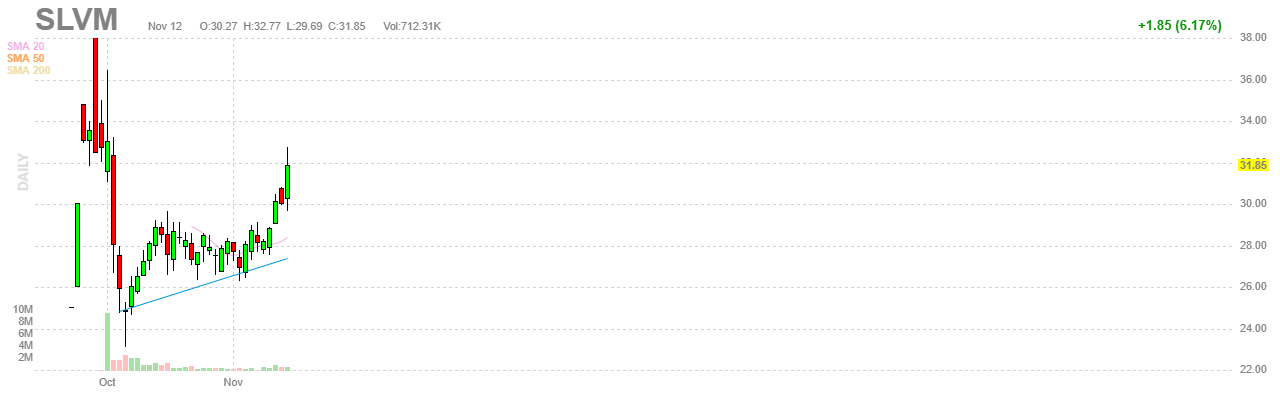

Name: Gibson Gregory C

Position: VP

Transaction Date: 2021-11-11 Shares Bought: 18,800 Average Price Paid: $30.54 Cost: $574,152

Name: Sims John V

Position: CFO

Transaction Date: 2021-11-11 Shares Bought: 21,200 Average Price Paid: $30.46 Cost: $645,752

Company: Sylvamo Corp. (SLVM)

Sylvamo Corporation produces and supplies printing paper in Latin America, Europe, and North America. The company offers uncoated freesheets for paper products, such as cut size and offset paper; and markets pulp, aseptic, and liquid packaging board, as well as coated unbleached kraft papers. It also produces hardwood pulp, including bleached hardwood kraft and bleached eucalyptus kraft; bleached softwood kraft; and bleached chemical-thermomechanical pulp. The company distributes its products through a variety of channels, including merchants and distributors, office product suppliers, retailers, and dealers. It also sells directly to converters that produce envelopes, forms, and other related products. The company was founded in 1898 and is headquartered in Memphis, Tennessee. They believe in the promise of paper to educate, communicate and entertain. Paper connects them to one another and is an enduring bond to renewable natural resources. Their purpose is to produce the paper you need in the most responsible and sustainable way possible. They aim high, innovate and create value for their customers and investors. The future of paper deserves a company committed to the success of the entire ecosystem. From the forests they love, to the communities where they live, to those who rely on their paper, they know the well-being of each depends on the well-being of all. They are Sylvamo, built to help the world realize the promise of paper.

A part of the paper and packaging industry since 1982, Greg Gibson joined International Paper in 2000 through the company’s merger with Champion International. He has served as vice president and general manager for multiple International Paper commercial divisions, including Commercial Printing and Imaging papers, European Papers, European Packaging, and North American Papers. Greg served on numerous boards including the American Forest & Paper Association, Confederation of European Paper Industries, and United Way of the Mid-South.

John Sims joined International Paper in 1994, after serving as an officer in the United States Navy. Throughout his 27-year career with the company, he gained extensive experience in the Printing Papers and Packaging businesses while most recently serving as senior vice president, Corporate Development. John has served on the board of directors of The Ilim Group. He has a bachelor’s degree in mechanical engineering from the United States Naval Academy and a Master’s of Business Administration from the University of Michigan.

Opinion: Sylvamo (NYSE: SLVM), is a spinoff of International Paper’s (NYSE: IP) global papers business. Two insiders loaded up on shares when it sank post-spin-off. Investment legend Peter Lynch liked spin-offs. Paper though is on the way to becoming a quant obsolete product.

Name: Luczo Stephen J

Position: Director

Transaction Date: 2021-11-08 Shares Bought: 100,000 Average Price Paid: $25.04 Cost:$2,504,000

Company: AT&T Inc. (T)

AT&T Inc. provides telecommunication, media, and technology services worldwide. The company operates through Communications, WarnerMedia, and Latin America segments. The Communications segment offers wireless voice and data communications services; video and targeted advertising services; broadband, including fiber, and legacy telephony internet and voice communication; and wireline telecom services. It also sells handsets, wirelessly enabled computers, wireless data cards, and IP-based set-top boxes, as well as various accessories, such as carrying cases and hands-free devices through the company-owned stores, agents, and third-party retail stores. This segment markets its communications services and products under the AT&T, Cricket, AT&T PREPAIDSM, AT&T TV, AT&T Fiber, and DIRECTV brand names. The WarnerMedia segment primarily produces, distributes, and licenses television programming and feature films; distributes home entertainment products in physical and digital formats, and produces and distributes mobile and console games, and consumer products, as well as offers, brand licensing services, and advertising services. It also operates cable networks; video-on-demand streaming platforms under the HBO Max and HBO GO names; multichannel pay television services under HBO and Cinemax; and digital media properties, as well as licenses its content to television networks and over-the-top services. The Latin America segment offers video entertainment and audio programming services under the DIRECTV and SKY brands primarily to residential customers; pay-TV services, including HD sports video content; and postpaid and prepaid wireless services under the AT&T and Unefon brands, as well as sells various handsets through company-owned stores, agents, and third-party retail stores. The company was formerly known as SBC Communications Inc. and changed its name to AT&T Inc. in November 2005. AT&T Inc. was incorporated in 1983 and is headquartered in Dallas, Texas.

Stephen Luczo, Director of the company, Stephen Luczo has served as Seagate Technology’s Chairman of the Board since 2002. From October 2017 to October 2018, he also served as Executive Chairman. Before that, he served two tenures as the company’s Chief Executive Officer and Chairman. Luczo joined Seagate in 1993 as SVP of corporate development and following a series of promotions became president and COO, CEO, and chairman. In 2004 he resigned as CEO but retained his position as chairman. After working as a private investor from 2006-2009, he rejoined Seagate as president and CEO. He currently is chairman of the board.

Opinion: I used to think Luczo was a smart guy but I’m wondering. The last purchase he made of AT&T was in May for 100,000 shares at $29.80. He looks like he is dollar averaging down.

Name: Rothman James

Position: Director

Transaction Date: 2021-11-08 Shares Bought: 4,000 Average Price Paid: $24.35 Cost: $97,400

Name: Lucier Gregory T

Position: Director

Transaction Date: 2021-11-05 Shares Bought: 20,704 Average Price Paid: $24.15 Cost: $500,008

Company: Berkeley Lights Inc. (BLI)

Berkeley Lights is a leading Digital Cell Biology company focused on enabling and accelerating the rapid development and commercialization of biotherapeutics and other cell-based products for our customers. The Berkeley Lights Platform captures deep phenotypic, functional, and genotypic information for thousands of single cells in parallel and can also deliver the live biology customers desire in the form of the best cells. Their platform is a fully integrated, end-to-end solution, comprising proprietary consumables, including their OptoSelect chips and reagent kits, advanced automation systems, and application software. They developed the Berkeley Lights Platform to provide the most advanced environment for rapid functional characterization of single cells at scale, the goal of which is to establish an industry standard for their customers throughout their cell-based product value chain. Their mission is to accelerate the use of cell-based products by providing researchers access to the Berkeley Lights Platform to find the best cells in a fraction of the time and at a fraction of the cost of traditional methods.

Gregory T. Lucier is Director at Berkeley Lights Inc., Inc. Mr. Lucier has over 25 years of experience in developing and growing innovation-driven companies into market leaders, with expertise in contemporary corporate governance matters and executive management. “Mr. Lucier brings substantial experience working with innovative companies in healthcare and technology,” said Michael Marks, Chairman of the Board of Directors of Berkeley Lights. “His extensive leadership skills and forward-thinking, strategic approach to growing companies will provide valuable guidance for Berkeley Lights as we enter new markets and expand the use of our platform globally.

James E. Rothman founded ARIAD Pharmaceuticals, Inc. Dr. Rothman is Senior Advisor at Arsenal Capital Management LP. He is also on the board of TractManager, Inc., Berkeley Lights, Inc. and WCG Clinical, Inc., and Professor & Director-Nanobiology Institute at Yale School of Medicine. James E. Rothman previously was Advisor at Johnson & Johnson, Consultant at Eli Lilly & Co., Consultant at GlaxoSmithKline (New Jersey), Strategic Advisor at The Courtagen Group LLC, Chief Scientist at General Electric Healthcare Technologies, Inc., Consultant at Genentech, Inc., Advisor at Amersham Plc, Professor & Director-Sulzberger Genome at The Trustees of Columbia University in The City of New York, Professor at Stanford University, Professor at Princeton University and Vice Chairman & Chairman-Cellular Biochemistry at Memorial Sloan-Kettering Cancer Center.

Opinion: Berkley LIghts is an ARKK holding. Like many of Cathie Wood’s stock picks, they are all on the come. In the case of Berkley LIghts- there doesn’t seem to be much in the way of revenues to validate the science yet. BLI was the subject of a 158 page short-seller report released by Scorpion Capital in September in which the hedge fund called it a “raging dumpster fire” with a zero price target. The Company responded with a rebuttal that basically said the report was laced with falsehoods, errors, and omissions.

Money speaks louder than words and two insider buys after this report would normally restore some confidence. Unfortunately, that is against a backdrop of persistent insider selling. What really restores confidence is sales from big-name customers that you assume have done the due diligence. According to the Company, GSK also purchased its third Beacon during the quarter, moving upstream in the value chain by adding Beacon Antibody Discovery workflow capabilities to their antibody therapeutic development and manufacturing capability. Year-to-date, they claim to have signed two significant partnerships with industry-leading participants, Thermo Fisher Scientific and Bayer Crop Sciences. Together, these segments carry a potential contract value of more than $30 million. To date, they have recognized approximately $6 million of the $30 million in backlog, including $2.7 million in Q3.

Scorpion in their report states

- “Revenues are basically flat over the last 4 quarters – a striking fact for a ‘growth’ stock; losses have doubled and are accelerating; gross and operating margins have tanked, falling sequentially in each period; the CFO and Chief Accounting Officer just fled; and accounts receivable have spiked despite flattening sales – typically an ominous sign that the final meltdown is near,” the report says.

I don’t know how accurate the Scorpion report can be as in the three months ended September 30, 2021, revenues increased to $24.3 million, up 34% year-over-year and 26% sequentially. Revenue was $16.7 million coming from product revenues and $7.6 million from service revenues. Revenue for the three months ended June 30, 2021, increased 82% year over year to $19.3 million with $13 million coming from product revenue and $6.3 million from service revenue.

Regardless, this one has too much hair on it for us to justify a $1.7B market cap in a yet-to-be profitable business.

Name: Pittman Robert W

Position: CEO

Transaction Date: 2021-11-09 Shares Bought: 24,150 Average Price Paid: $20.77 Cost: $501,680

Company: iHeartMedia Inc. (IHRT)

iHeartMedia, Inc. operates as a media and entertainment company worldwide. It operates through two segments, Audio and Audio & Media Services. The Audio segment offers broadcast radio, digital, mobile, podcasts, social, program syndication, traffic, weather, news, and sports data distribution, and on-demand entertainment, as well as live events, including mobile platforms and products; and operates Premiere Networks, a national radio network that produces, distributes, or represents approximately 120 syndicated radio programs and services to approximately 6,500 radio station affiliates. It also delivers real-time traffic and incident information, weather updates, sports, and news through approximately 2,100 radio stations and 170 television affiliates, and Internet and mobile partnerships. As of December 31, 2020, this segment owned 858 radio stations, including 244 AM and 614 FM radio stations. The Audio and Media Services segment engages in the media representation business. This segment also provides broadcast and webcast software, such as radio station automation, music scheduling, HD2 solutions, newsroom software, audio logging and archiving single station automation, and contest tracking software; and real-time audio recognition technology to approximately 9,000 radio stations, television music channels, cable companies, satellite music networks, and Internet stations. The company was formerly known as CC Media Holdings, Inc. and changed its name to iHeartMedia, Inc. in September 2014. iHeartMedia, Inc. is headquartered in San Antonio, Texas.

Robert W. Pittman serves as Chairman of the Board, Chief Executive Officer of the Company. Mr. Pittman served as Chairman of Media and Entertainment Platforms for iHeartMedia and iHeartCommunications since November 2010. He has been a member of and an investor in Pilot Group, a private equity investment company, since April 2003. Mr. Pittman was formerly Chief Operating Officer of AOL Time Warner, Inc. Mr. Pittman serves on the boards of numerous charitable organizations, including the Alliance for Lupus Research, the Rock and Roll Hall of Fame Foundation, and the Robin Hood Foundation, where he has served as past Chairman. Mr. Pittman was selected to serve as a member of their Board because he served as their Chief Executive Officer, and his extensive media experience was gained through the course of his career.

Opinion: Local radio has a place. It won’t’ go to zero but it’s hard to say if it can compete with the likes of Spotify, Apple, and others in this changing landscape. I’ll watch Mr. Pittman from the sidelines

Name: Arnal Gustavot

Position: CFO

Transaction Date: 021-11-04 Shares Bought: 12,500 Average Price Paid: $20.44 Cost: $255,550

Name: Edelman Harriet

Position: Director

Transaction Date: 021-11-04 Shares Bought: 12,500 Average Price Paid: $19.90 Cost: $248,750

Name: Fleming John E

Position: Director

Transaction Date: 021-11-04 Shares Bought: 10,000 Average Price Paid: $19.28 Cost: $192,800

Name: Fleming John E

Position: Director

Transaction Date: 021-11-05 Shares Bought: 15,000 Average Price Paid: $19.00 Cost: $285,000

Company: Bed Bath & Beyond Inc. (BBBY)

Bed Bath & Beyond’s culture is customer-centric. Their commitment to customer service is supported by significant investments made to strengthen its foundation for future growth. Today, their eCommerce businesses are rapidly growing to meet their customer’s ever-evolving needs. They strive to better engage with their customers wherever, and however, they express their life interests and travel through their life stages. They also recognize that they are people-powered and continuously strive to foster a culture that supports diversity and equity of all types. They are listening and constantly evolving, with concrete goals to create an ever more equitable, inclusive work environment where all their people feel at home and thrive. Bed Bath & Beyond’s family of companies has contributed to their evolution. As they continue to expand, differentiating themselves across all channels, brands, and locations in which they operate, they can better serve their customers. Today, their 40,000+ associates support over 1000+ retail locations, “Business-to-Business” operations, and online destinations for products, solutions, and services. They currently operate in the United States, Canada, Mexico, and Puerto Rico. Bed Bath & Beyond Inc., together with its subsidiaries, operates a chain of retail stores. It operates through two segments, North American Retail and Institutional Sales. The company sells a range of domestic merchandise, including bed linens and related items, bath items, and kitchen textiles; and home furnishings, such as kitchen and tabletop items, fine tabletop, basic housewares, general home furnishings, consumables, and various juvenile products. As of February 27, 2021, the company had 1,020 stores, including 834 Bed Bath & Beyond stores in 50 states, the District of Columbia, Puerto Rico, and Canada; 132 buy BABY stores; and 54 stores under the names Harmon, Harmon Face Values or Face Values. It also offers products through various Websites and applications.

Mr. Arnal joins the Company from Avon, a leading direct-selling beauty company where he helped lead a successful business turnaround effort. Prior to Avon, Mr. Arnal was CFO, International Divisions and Global Functions at Walgreens Boots Alliance. He is a global leader, with experience leading teams across the US, EMEA, APAC, and LATAM, and has previously served in senior positions at Procter & Gamble, including CFO of India, the Middle East and Africa, CFO Global Fabric, and Home Care, and CFO Global Personal Beauty.

Ms. Edelman, 63, is an accomplished senior executive with over 30 years of global operating experience in consumer goods and financial services. Harriet has served on large public company boards for nearly 20 years in the U.S. and Europe. She currently serves on the Board of Directors of Assurant, Inc. and Brinker International, Inc. Harriet is currently Special Advisor to the Chairman of Emigrant Bank, and previously spent over 25 years at Avon Products, Inc. until 2008, rising to senior leadership positions in Marketing, Sales, New Product Development, Business Strategy and Transformation, Global Supply Chain and Information Technology.

John E. Fleming, 60, is currently serving as Interim Chief Executive Officer of r21Holdings, Inc., a specialty retailer of young men and women’s casual apparel and accessories, where he has served as a member of its Board of Directors since August 2017. He has served as a member of the Advisory Board of UNTUCKit LLC, a casual men’s apparel company, since December 2017, and as a member of the Board of Directors of The Visual Comfort Group, a lighting company that serves both wholesale and direct to consumer channels, since May 2017. Additionally, Mr. Fleming has served as an independent director and advisor since August 2016. Previously, Mr. Fleming was the Chief Executive Officer of Global eCommerce at Uniqlo Co. Ltd., a Japanese casual wear designer, manufacturer, and retailer, from October 2013 to August 2016. Prior to that, he was at Walmart, Inc. (“Walmart”), a multinational retail corporation, from 2000 to 2010.

Opinion: Bed Bath Beyond had a positively disastrous 3rd quarter and on 9/30/21 lost nearly half of it stock value. I know because I was a bagholder then based on Director Harriet Edelman’s open market purchase of 11,000 shares for $27.47 on 7-19-21. I just assumed she had some idea of the business but I assumed wrong. The quarter was so bad that at least two firms, Morgan Stanley and BofA moved it to “underweight, underperform” which is double-speak for a sell with a target of $12 and $14.

Then on November 1st BBBY struck back at the short sellers and said they were going to complete their $1B share repurchase before the end of the year and announced some vague pop-up store deal with Krogers beginning in 2022. The stock skyrocketed catching the short sellers with a strong left jab to the nose. We got some of our losses back by shorting this bounce. Meanwhile, a throng of insiders decided it was a good time to buy their stock showing some confidence rather than risk testing the job market for Bed Bath and Beyond executives. Whether that is a selfish move or a correct corporate marketing move remains to be seen but I’m out of this dog with fleas. Short-seller Citron Research now turned bullish analysts said BBBY was worth $5–$70 per share. I’ve always thought BBBY was a nice place to shop but I can’t understand how this management can’t do better than they are in their multi-channel strategy with the biggest housing boom in modern history.

Name: Long David C

Position: CFO

Transaction Date: 2021-11-09 Shares Bought: 9,000 Average Price Paid: $16.25 Cost: $146,250

Company: Sprague Resources LP. (SRLP)

Sprague Resources LP engages in the purchase, storage, distribution, and sale of refined petroleum products and natural gas in the United States and Canada. The company operates through four segments: Refined Products, Natural Gas, Materials Handling, and Other Operations. The Refined Products segment purchases and sells various refined products, such as heating oil, diesel fuel, residual fuel oil, kerosene, jet fuel, gasoline, and asphalt to wholesale, retail, and commercial customers. This segment’s wholesale customers consist of approximately 1,100 home heating oil retailers, and diesel fuel and gasoline resellers; and commercial customers include federal and state agencies, municipalities, regional transit authorities, drill sites, large industrial companies, real estate management companies, hospitals, educational institutions, and asphalt paving companies. The Natural Gas segment purchases natural gas from natural gas producers and trading companies and sells and distributes natural gas to approximately 15,000 commercial and industrial customer locations across 13 states in the Northeast and the Mid-Atlantic United States. The Materials Handling segment offloads, stores, and prepares for the delivery of various customer-owned products, including asphalt, crude oil, clay slurry, salt, gypsum, residual fuel oil, coal, petroleum coke, caustic soda, tallow, pulp, and heavy equipment. The Other Operations segment engages in coal marketing and distribution; and commercial trucking activities. As of December 31, 2020, the company had a combined storage capacity of 14.6 million barrels for refined products and other liquid materials, as well as 2.0 million square feet of materials handling capacity. Sprague Resources LP was founded in 1870 and is headquartered in Portsmouth, New Hampshire. As of May 28, 2021, Sprague Resources LP operates as a subsidiary of Hartree Partners, LP.

David C. Long serves as Chief Financial Officer of Sprague Resources GP LLC of the Company. Mr. Long served as Senior Vice President with Kinetico Incorporated, a subsidiary of Axel Johnson, Inc., during which he was responsible for marketing, sales, and business development activity in North America. From February 2008 through June 2013, Mr. Long served as Senior Vice President and Chief Financial Officer of Kinetico Incorporated where he led the finance and accounting organization. From 1998 through 2008, Mr. Long held a variety of roles with our Predecessor, most recently as Managing Director of Sales, Refined Products. Mr. Long holds a Bachelor’s degree from the University of Maine and a Master’s of Finance degree from Boston College.

Opinion:

Name: Crawford Gordon

Position: Director

Transaction Date: 2021-11-09 Shares Bought: 100,000 Average Price Paid: $15.71 Cost: $1,570,500

Company: Lions Gate Entertainment Corp. (LGF.B)

Lions Gate Entertainment Corporation, doing business as Lionsgate, is an American-Canadian entertainment company. It was formed by Frank Giustra on July 10, 1997, in Vancouver, British Columbia, Canada, and is currently headquartered in Santa Monica, California, United States. In addition to its flagship Lionsgate Films division, the company contains other divisions such as Lionsgate Television and Lionsgate Interactive. It owns a variety of subsidiaries such as Summit Entertainment, Debmar-Mercury, and Starz Inc. The company bought several small production facilities and distributors, starting with Montreal-based Cinépix Film Properties Vancouver, British Columbia. Completing its first year of operation, Lionsgate had revenue of $42.2 million with a loss of $397,000. The company share price dropped to a low of $1.40. it limited the corporation’s ability to make acquisitions via stock swaps. Lionsgate instead made its subsequent acquisition of Termite Art Productions, a reality-based television production company, for $2.75 million by issuing three convertible promissory notes. Giustra had the shareholders vote to move the company’s public listing from the Toronto Stock Exchange to the American Stock Exchange, along with a two-for-one stock consolidation to qualify for greater exposure that might boost share value.

Mr. Crawford has served in various positions at Capital Research and Management, a privately held investment management company. In December 2012, Mr. Crawford retired as its Senior Vice President. Currently, Mr. Crawford serves as Chairman of the Board of Trustees of the U.S. Olympic and Paralympic Foundation. He is a Life Trustee on the Board of Trustees of Southern California Public Radio. Mr. Crawford formerly served as Vice Chairman at The Nature Conservancy, Vice Chairman of the Paley Center for Media, and was a member of the LA24 Olympic Bid Committee board. Mr. Crawford is Co-Chair of the Strategic Advisory Committee.