Every day at FireEye, we see firsthand the impact of cyber-attacks on real people. It inspires us to fulfill our mission to relentlessly protect our customers from the impact and consequences of cyberattacks. They have learned that technology alone isn’t enough to combat cyber attackers. Their fundamental belief is that hands-on frontline expertise and intelligence, combined with innovative technology, provides the best means to protect their customers from cyber threats. FireEye has created a unique learning system. their real-time knowledge of the threat landscape ensures that their offerings provide the best means to protect their customers. Their frontline expertise constantly guides them as we build their products, deliver threat intelligence and arm their services team to prepare for, respond to and prevent breaches. The FireEye Innovation Cycle was created by product teams embracing their world-class frontline threat expertise AND their frontline experts embracing their solutions. They use this innovation cycle to create the most effective cyber defense platform – a seamless, on-demand extension of our customers’ security operations.

Art has served as a member of the board of directors since December 2020. Since 2015 he has been an active investor and advisor in the technology industry, guiding startups both as a private investor and in his roles as a Venture Partner at Rally Ventures, as an advisor to ClearSky Security Fund, and as a Senior Advisor to Blackstone’s Tactical Opportunities Group. Prior to joining Rally Ventures, Art served as Executive Chairman of RSA, the Security Division of EMC. Art joined RSA in 1995 and became CEO in 2000. During his tenure, the company evolved from its roots in authentication and encryption to being a leader in the most important emerging areas of information security, including security analytics, identity, and Governance, Risk & Compliance. Art has been a central figure within the information security industry for more than 25 years.

John serves as FireEye President and Chief Operating Officer. He has served in various roles with the Company since the Company acquired iSIGHT Partners in 2016, including as a consultant from May 2020 to April 2021, as Chairman of the FireEye Advisory Board from April 2020 to April 2021, as Executive Vice President and Chief Strategy Officer from February 2018 to April 2020, as Executive Vice President, Global Services and Intelligence from January 2017 to January 2018, and as President of iSIGHT from March 2016 to January 2017.

Opinion: FireEye Announces Sale of FireEye Products Business to Symphony Technology Group for $1.2 Billion

- All-cash transaction unlocks high-growth Mandiant Solutions business

- Continued partnership after closing supports customers with reseller relationship and shared product telemetry and frontline threat intelligence

- FireEye Board authorizes a share repurchase program of up to $500 million

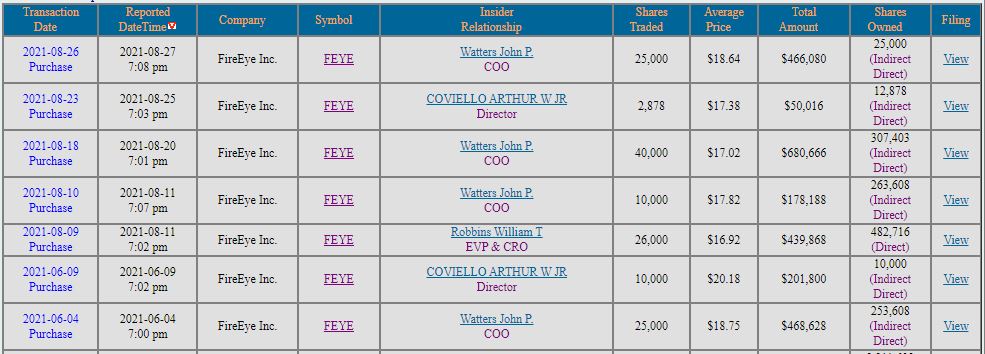

Insiders are buying with conviction but it’s not been a smooth ride for shareholders. For starters, the day they announced the spinoff, the stock had a musted response, dropping slightly. Was this a good idea or a desperate attempt at fixing the company that had lagged behind its peers for years? Incredible potential as cyber security threats became a way of life but what was FireEye going squandering its headstart while others like CrowdStrike and Palo Alto Networks rained money on their shareholder. Then on December 14, 2020 the Government began disclosing massive cyber-espionage involving numerous government agencies including the National Security Administration. All publicly-traded security companies got a jump in value and attention and have never looked back.

So far so good but on June 2nd they dropped the bombshell that there were changing their well-known, FireEye company name to Mandiant and with it the sale of their products business to P.E firm. Wall Street did not like the news and several analysts questioned the logic and downgraded the company. The stock starts dropping from $22.79 to around $18,85 where COO John Waters bought 25,000 shares at $18,75 arresting the slide in price. Another purchase by a Director seemed to do the trick and FEYE began regaining the ground it lost.

Then it slammed unfortunate shareholders again on August 5th when the Company reported a huge revenue drop and blown earnings. The launch of Mandint Advantage caused a confusing revenue recognition as it moved entirely to the cloud. The remaining Mandiant business will be comprised of subscription software and professional services. Mandiant remains the gold standard for the incident response to the growing number of ransomware and high-profile security stocks. The bottom line- the confusion around all the moving parts and price drop caused JP Morgan analyst to reduce his December 22 price target to $24 from $27.

Since then there have been 5 high conviction insider buys as seen from the chart above. If you think cyber security is a growth industry, FireEye now known as Mandiant is a great contrarian play.

[…] Opinion: I wrote quite a bit about FEYE on the previous blog post, Insiders have conviction where the market lacks it. […]