That’s what I thought when I plowed into Trupanion TRUP only to get picked up and thrown on the matt for a bruising loss. Large insider buys with a good track record and a glowing over the top article from Motley Fool caused me a humiliating beat down by Mr. Market.

Usually, you can ride the momentum from a big insider buy for two or three days before really doing your research. During this time-I plow into the finances and hype to determine if you want to follow this insider before you realize he’s smoking crack or just someone very rich who can wait for years for his stupidity to work.

After reading through their latest earnings and listening to the conference call- why anyone is so keen on Trupanion is beyond me.

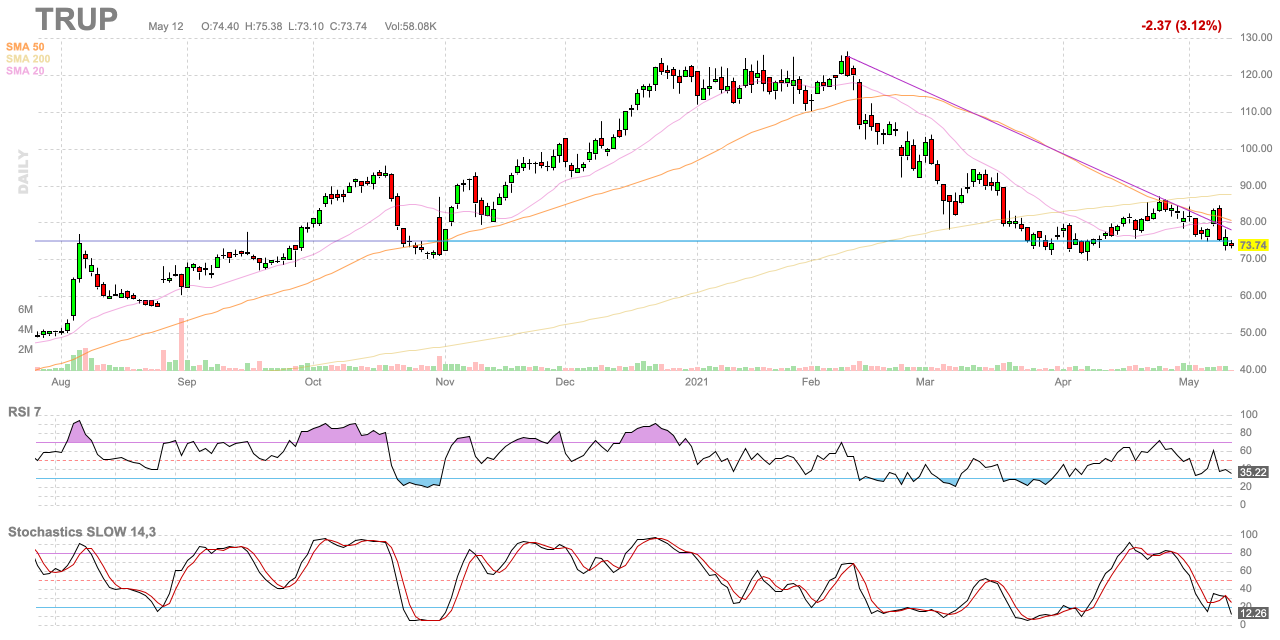

Aflac invested $200 million a few months earlier at $55 per share. Analysts are falling all over themselves with price targets for twice what TRUP is currently trading at. With a setup like that the pet insurer climbed to over $125 in the February momentum stock blow-off top before beating a retreat to the low $70s in April. The insurer was due for a sharp bounce and the $1.4 million purchase by Director Ferracone and the near criminally irresponsible piece of writing in the MotleyFool, caused me to write “I’m buying TRUP on the open if it’s not up more than $2. I was convinced.

So TRUP market makers and short-sellers saw me coming. After all, I was arrogant enough to even advertise it to the readers of the Insiders Report. I loaded up in the premarket- another rookie move The only thing stupider than buying on the open is buying in the premarket. I did that too.

It wasn’t long after I top ticked the stock, it began to roll over like a sinking battleship torpedoed by disgruntled shareholders just hoping to get out, or perhaps day traders and market makers who got illegal looks at the order flow. Whatever it was the stock went nearly straight down after I loaded up.

Then the furious research began. Pro tip-do your research first. TRUP has great revenue graphs going from the bottom left to the top right with every increasing subscription revenue. Nothing more loyal than pets and recurring revenue, I thought. Hey everyone loves their pets, right? Well, that obvious observation has brought at least 20 other insurers into the market including giants like Geico and upstart fintech glamor names like Lemonade. TRUP doesn’t even make money after two decades of pioneering the field. Jesus- it’s just an insurer. How do you put a big value on someone who’s been at it for two decades and still doesn’t make money? Sure, they’ll make money someday. Won’t they? But what do you pay for that now?

Taking the punishing loss, I sold most of the stock and wrote some naked out of the money 10 days to expiration calls to help mitigate my stupidity. Don’t buy on the open unless you have breaking news 10 minutes before the wire services get – or you have a masochistic tendency to throw your money away. I like to say, I’ll make mistakes but not ones that I can’t recover from. I hope I don’t forget this one anytime soon. Mea Culpa.

Follow us on Twitter for real time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

Insiders sell stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer-friendly and responsive I’ve used.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019, 4th Best in November 2020, 4th Best in January 2021 (I kid you not)