For trade details click on this link to the trades

We’ve been talking about how insiders are restricted from buying because of the quarterly earnings blackout period. That sure hasn’t stopped them from selling, making a farce out of the SEC’s measures to protect the public investor from the officers, directors, and 10% or more shareholders that are considered to be privy to special inside information. Rather than rail about the inequities we face, we prefer to take the world as it’s given to us and try to make the best of it. This week is downright ugly. Of the millions of dollars of stock transactions we reviewed, the only thing of interest was a paltry buy in a nearly bankrupt high-end hotel operator, ASHFORD HOSPITALITY TRUST INC. AHT is a high-end hotel REIT struggling to survive the pandemic. One of its Directors, Benjamin Ansell MD purchased 100,000 shares at $2.07. Dr. Ansell purchased shares in AHT back in August of 2020 at prices between $2.92-$3.85.

You would think this would be the kind of place tourists would flock back to once the pandemic lifts, but it’s questionable if anything will be left for equity holders after AHT finishes renegotiating the lifeline lenders provide on the $3.7 billion in debt outstanding. The stock acts poorly, unlike many of the opening-up plays making new highs. This is the most speculative of plays. Who knows what Dr. Ansell is up to? Maybe he is negotiating loyalty rewards points with his $200,000 buy of stock. For now, we have it on our screen with a paltry position and a losing one at that. AVOID until further notice.

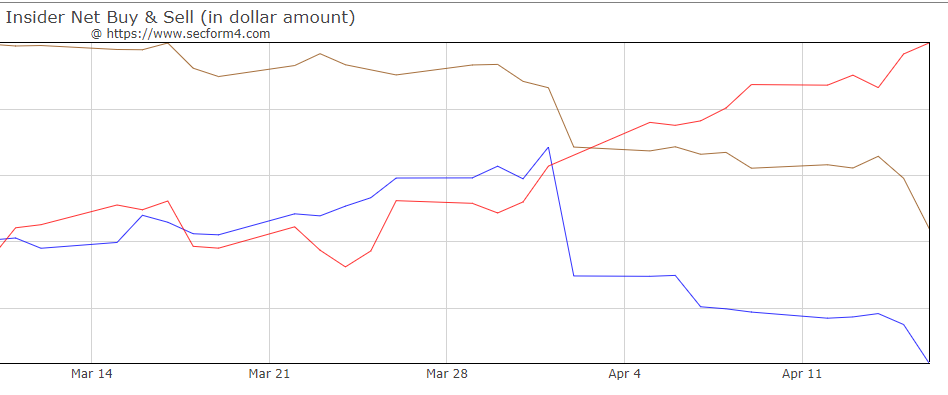

The real action this week was on the sell-side. Insiders unloaded stock with almost a palpable sense of urgency. As you can see in this 22-day moving average the blue line representing the number of insiders by dollar volume is on a steady decline, while the red line, the S&P 500 is rising.

Click on the chart above to blow it up

Well, insiders are always natural sellers but the ugliness of this week’s parade of sellers disturbs me to my core. I feel compelled to call out some of the most egregious.

Coinbase COIN Directors, Officers, and lucky early-stage investors left no question about who the real bag holders are, unloading an unprecedented amount of stock. What happened to lock-ups? This shows the real benefit of direct listings is that insiders can unload their stock with abandon, effectively skirting the mandatory lock-ups investment banks impose on their companies’ IPOs. Blomberg ran a good article on this but all you really to do is look at how insiders dumped stock on the offering. Barron’s ran a piece this weekend touting the stock.

| Transaction Date  |

Reported DateTime      |

Company                                 |

Symbol                                 |

Insider Relationship                                  |

Shares Traded                                  |

Average Price                                  |

Total Amount                                  |

Shares Owned                                  |

Filing |

| 2021-04-14 Sale |

2021-04-16 9:45 pm |

Coinbase Global Inc. | COIN | WILSON FREDERICK R Director 10% Owner |

4,702,324 | $386.36 | $1,816,768,380 | 0 (Indirect) |

View |

| 2021-04-14 Sale |

2021-04-16 9:45 pm |

Coinbase Global Inc. | COIN | Union Square Ventures 2012 Fund L.P. Union Square 2012 GP L.L.C. USV Investors 2012 Fund L.P. USV Opportunity 2014 GP LLC USV Opportunity 2014 LP USV Opportunity Investors 2014 LP Weissman Andy Wenger Albert Burnham Brad Buttrick John 10% Owner |

4,702,324 | $386.36 | $1,816,768,380 | 0 (Indirect Direct) |

View |

| 2021-04-14 Sale |

2021-04-16 9:44 pm |

Coinbase Global Inc. | COIN | Jones Jennifer N. CAO |

110,000 | $394.86 | $43,435,000 | 18,483 (Direct) |

View |

| 2021-04-14 Sale |

2021-04-16 9:44 pm |

Coinbase Global Inc. | COIN | Haun Kathryn Director |

204,885 | $358.83 | $73,517,984 | 860,868 (Indirect Direct) |

View |

| 2021-04-14 Sale |

2021-04-16 9:43 pm |

Coinbase Global Inc. | COIN | HAAS ALESIA J CFO |

255,500 | $388.73 | $99,320,789 | 0 (Direct) |

View |

| 2021-04-14 Sale |

2021-04-16 9:42 pm |

Coinbase Global Inc. | COIN | Ehrsam Frederick Ernest III Director |

60,997 | $334.75 | $20,418,669 | 2,350,375 (Indirect) |

View |

| 2021-04-14 Sale |

2021-04-16 9:42 pm |

Coinbase Global Inc. | COIN | Ehrsam Frederick Ernest III Director |

86,933 | $398.65 | $34,655,590 | 2,411,372 (Indirect) |

View |

| 2021-04-14 Sale |

2021-04-16 9:41 pm |

Coinbase Global Inc. | COIN | Ehrsam Frederick Ernest III Director |

150,859 | $377.24 | $56,909,397 | 2,472,383 (Indirect) |

View |

| 2021-04-14 Sale |

2021-04-16 9:41 pm |

Coinbase Global Inc. | COIN | Choi Emilie President |

299,248 | $403.92 | $120,871,660 | 74,155 (Indirect Direct) |

View |

| 2021-04-14 Sale |

2021-04-16 9:40 pm |

Coinbase Global Inc. | COIN | Choi Emilie President |

302,910 | $326.51 | $98,903,789 | 288,688 (Direct) |

View |

| 2021-04-14 Sale |

2021-04-16 9:39 pm |

Coinbase Global Inc. | COIN | Chatterjee Surojit Chief Product Officer |

160,000 | $386.78 | $61,885,000 | 5,344 (Direct) |

View |

| 2021-04-14 Sale |

2021-04-16 9:39 pm |

Coinbase Global Inc. | COIN | Armstrong Brian Brian Armstrong Living Trust CEO Chairman 10% Owner |

749,999 | $389.1 | $291,827,965 | 300,001 (Indirect) |

View |

| 2021-04-14 Sale |

2021-04-16 9:35 pm |

Coinbase Global Inc. | COIN | Andreessen Marc L Director 10% Owner |

294,775 | $381 | $112,309,275 | 103,075 (Indirect) |

View |

| 2021-04-14 Sale |

2021-04-16 9:34 pm |

Coinbase Global Inc. | COIN | AH Equity Partners III (Parallel) L.L.C. AH Capital Management L.L.C. HOROWITZ BENJAMIN A 10% Owner |

294,775 | $381 | $112,309,275 | 103,075 (Indirect) |

View |

| 2021-04-14 Sale |

2021-04-16 9:33 pm |

Coinbase Global Inc. | COIN | Andreessen Horowitz LSV Fund I L.P. Andreessen Horowitz LSV Fund I-B L.P. CNK Fund I L.P. CNK Fund I-B L.P. CNK Fund I-Q L.P. CNK Equity Partners I L.L.C. AH Equity Partners LSV I L.L.C. Andreessen Horowitz LSV Fund I-Q L.P. 10% Owner |

294,775 | $381 | $112,309,275 | 103,075 (Indirect) |

View |

| 2021-04-14 Sale |

2021-04-16 9:33 pm |

Coinbase Global Inc. | COIN | a16z Seed-III LLC Andreessen Horowitz Fund III L.P. Andreessen Horowitz Fund III-A L.P. Andreessen Horowitz Fund III-B L.P. Andreessen Horowitz Fund III-Q L.P. AH Parallel Fund III L.P. AH Parallel Fund III-A L.P. AH Parallel Fund III-B L.P. AH Parallel Fund III-Q L.P. AH Equity Partners III L.L.C. 10% Owner |

294,775 | $381 | $112,309,275 | 103,075 (Indirect) |

View |

One could make the argument that with all these insiders selling their stock, the pressure on future sales is lifted. That might be true. It looks like they sold most of what they owned. Kathie Woods, the current glamor girl of investing, ARK exchange-traded funds soaked up much of the sales, buying for three of the ARK exchange-traded funds, including the flagship ARK Innovation ETF ARKK, -1.77%. ARK Invest bought Coinbase stock valued at $246 million for the ARK Innovation ETF, ARK Next Generation Internet ETF ARKW, -1.42% and ARK Fintech Innovation ETF ARKF, -1.59%. ARK Invest CEO Cathie Wood spoke of Coinbase’s potential, as well as volatility, in an interview with Bloomberg BNN on Wednesday. To make room, ARK sold $178 million shares of Tesla TSLA, +0.13% on Wednesday, though the electric vehicle maker is still the top holding of the ARK Innovation ETF and the ARK Next Generation Internet ETF.

This leads me to the observation if you think both Coinbase and Tesla are grossly overvalued, I’d say ARKK makes a resaonable shorting vehicle. As a former Tesla owner and an early Coinbase user, I have first-hand knowledge of the products. The Model X I drove for three years is an absolutely stunning vehicle but my finance refused to take any more car trips in it with her two young children as a 5 hour trip to Yellowstone takes 9 hours with the three stops along the way for Tesla’s vaunted Super Charging. I can’t wait to test the new E- Mustang, or the Volkswagen, or the Audi, or let’s see one of the many new competitors entering the fray. Bottom line, Telsa is finally getting competition and I believe there will be a fight to the death amongst the auto companies for the EV business and margins will show it.

On the other hand, if you wanted an easy way to buy bitcoin a few years ago, Coinbase was the only solution. It was costly and still is (nearly 5% in and out) and slow- it took days not seconds to move money from my Wells Fargo bank account to Coinbase to buy crypto. I’m still trying to get Coinbase to send me a login to get back to my original account because I have a few dollars of Etherium, left for dead. Now that Etherium has recovered I’d like to get my money out. Bottom line Coinbase may be easy to use but it’s expensive, slow, and there will soon be lots of competition.

I think the whole bitcoin fascination is a giant trainwreck waiting to happen. The only useful purpose for bitcoin as far as I can see is as a currency of crime. On the other hand, I’ve been a believer in blockchain technology even though I have a limited understanding of it. Even the much-vaunted anonymity offered by bitcoins is vastly overrated. Try buying a car, a home, or anything of considerable value anonymously. The only users who have figured out how to be anonymous are criminals. Almost all ransomware attacks are paid off in bitcoin.

Then there is the store of value argument that some proponents use to justify the value of bitcoin. The cryptography limited amount of bitcoin makes a powerful argument that it doesn’t debase it like fiat currency where governments run massive deficits with unlimited money printing. Lumber has doubled in value in the last year as well. Does that make it a store of value?

The hypocrisy behind bitcoin galls me as well. Bitcoin is enormously energy wasteful. Vast arrays of computers are needed to maintain the blockchains around the world and mine new coins. According to the Washington Post, “Data from the University of Cambridge suggests that the emissions produced by bitcoin mining are the equivalent of between 53 and 127 million megatons of carbon dioxide. The upper bound of these figures would place Bitcoin as the No. 6 highest-emitting company in the world, according to Arabesque’s emissions database. ” Elon Musk is talking about saving the planet by replacing the combustion engine transportation system with zero-emission electric vehicles yet he touts bitcoin and announces that Tesla has bought $1.5 billion in bitcoin.

I’m tired of predicting the collapse of bitcoin as more and more reputable financial institutions jump on the bandwagon, primarily to collect fees and not be left out. Frankly, you just start to look silly and out of touch. I will say paying excessive fees to trade it on virtual wallets like Coinbase is not a growth industry. With more competition, transaction fees will go down. COIN is short. But that brings me back to the first recommendation, just short ARKK. Don’t get me wrong. ARKK invests in a lot of great companies and I’m grateful for the transparency the fund has by publishing daily the complete holdings. I just don’t think it’s a great recipe for making money buying loads of stocks insiders are selling about as fast as they can. That being said, buying the Hottest mutual fund or ETF of the last two years is historically NOT the best place to invest now. You’d likely be doing better finding the Worst performing ETF over the last three years and investing in that.

There was a lot of selling last week and no insider buying of interest. Since selling is the natural state of insiders, we look at unusual patterns of selling. Some examples are:

- Cluster Selling Multiple insiders selling for the first time in a long period.

- Rats abandoning the sinking ship.Insiders selling at a 52 week low. Everyone knows business is bad. It’s just that it’s going to get worse.

- Ticking time bomb Insiders selling coincident with bad headlines like earnings restatement, SEC investigation, patent litigation, and other material events. It’s a good idea to check the 10k for litigation. Some companies have ticking time bombs in their disclosure documents.

- Insiders selling out. Insiders selling a significant portion of their holdings, generally more than 50%.

- Euphoria Selling Volume spikes- let’s say in a euphoric market, stocks move up on 6X more than daily volumes. Insiders sell on this crazed excitement. You can depend on insiders telling you when there is irrational exuberance around their stock. I’ve known many officers of public companies and I can tell you they all watch their stock price closer than their blood pressure or their children’s school grades. Insiders have a great feel for the price action of their stock. They would make great traders in their stock if they were allowed to trade it but fortunately, the SEC has something known as the “short-swing rule” that requires them to disgorge any profits back to the company if they buy and sell their stock within six month period.

- Lockups When companies go public through a traditional investment banker they require a moratorium on selling shareholders, usually a 3-month or 6-month lock-up.

McAfee MCFE lock-up will expire on 4/.20/2021 freeing up 37 million shares for sale. McAfee Corp. is an American global computer security software company headquartered in Santa Clara, California. McAfee was acquired by Intel Corp. for $7.7 billion in August 2010. The chip giant sold majority control of what had become Intel Security to TPG Capital in a $1.1 billion leveraged buyout in 2017 that valued it at about $4.2 billion. Another private equity firm, Thoma Bravo, took a minority stake in the deal. Last October MCFE round-tripped, coming public again at $20 per share for a market value of about $8.6 Billion.

On March 8th, McAfee announced it intended to sell its enterprise business to STG-led consortium for $4B in cash. The deal is expected to close by the end of the year. You can be sure that some investors in this deal who have been waiting for 10 years for an exit will be willing and ready to sell shares when the lock-up expires.

Palantir PLTR lock-up period expired on February 17th. It’s natural to expect insiders to have taken some profit as the company IPO on September 30th at just $7.25 per share. The pace of selling hasn’t slowed down.

| Transaction Date                                  |

Reported DateTime      |

Company                                 |

Symbol                                 |

Insider Relationship                                  |

Shares Traded                                  |

Average Price                                  |

Total Amount                                  |

Shares Owned                                  |

Filing |

| 2021-02-19 Sale(A) |

2021-04-16 8:47 pm |

Palantir Technologies Inc. | PLTR | Sankar Shyam See Remarks |

300,000 | $30 | $9,000,000 | 2,929,793 (Direct) |

View |

| 2021-04-13 Sale |

2021-04-15 9:30 pm |

Palantir Technologies Inc. | PLTR | Taylor Ryan D. See Remarks |

76,000 | $25 | $1,900,000 | 1,418,434 (Direct) |

View |

| 2021-04-06 Sale |

2021-04-08 9:49 pm |

Palantir Technologies Inc. | PLTR | Karp Alexander C. Director |

2,585,723 | $23.14 | $59,831,009 | 6,428,945 (Direct) |

View |

| 2021-04-06 Sale |

2021-04-08 9:49 pm |

Palantir Technologies Inc. | PLTR | Cohen Stephen Andrew Director |

60,000 | $23.16 | $1,389,300 | 168,958 (Direct) |

View |

| 2021-04-01 Sale |

2021-04-05 8:42 pm |

Palantir Technologies Inc. | PLTR | Moore Alexander D. Director |

12,000 | $23.18 | $278,151 | 2,247,249 (Direct) |

View |

| 2021-03-29 Sale |

2021-03-31 9:04 pm |

Palantir Technologies Inc. | PLTR | Karp Alexander C. Director |

461,534 | $22.47 | $10,371,302 | 7,098,781 (Direct) |

View |

| 2021-03-29 Sale |

2021-03-31 9:03 pm |

Palantir Technologies Inc. | PLTR | Cohen Stephen Andrew Director |

173,595 | $22.47 | $3,900,943 | 229,008 (Direct) |

View |

| 2021-03-16 Sale |

2021-03-18 9:31 pm |

Palantir Technologies Inc. | PLTR | Cohen Stephen Andrew Director |

140,455 | $26.07 | $3,662,039 | 63,192 (Direct) |

View |

| 2021-03-01 Sale |

2021-03-03 8:16 pm |

Palantir Technologies Inc. | PLTR | Moore Alexander D. Director |

12,000 | $24.97 | $299,690 | 2,259,249 (Direct) |

View |

| 2021-02-22 Sale |

2021-02-25 9:31 pm |

Palantir Technologies Inc. | PLTR | Long Matthew A. See Remarks |

220,000 | $30.02 | $6,604,092 | 710,389 (Direct) |

View |

| 2021-02-22 Sale |

2021-02-24 9:02 pm |

Palantir Technologies Inc. | PLTR | Taylor Ryan D. See Remarks |

162,500 | $27.41 | $4,453,605 | 1,418,434 (Direct) |

View |

| 2021-02-22 Sale |

2021-02-24 9:01 pm |

Palantir Technologies Inc. | PLTR | Long Matthew A. See Remarks |

71,550 | $27.24 | $1,949,107 | 710,389 (Direct) |

View |

| 2021-02-22 Sale |

2021-02-24 9:00 pm |

Palantir Technologies Inc. | PLTR | Glazer David A. See Remarks |

201,190 | $27.33 | $5,497,522 | 2,916,921 (Direct) |

View |

| 2021-02-19 Sale |

2021-02-23 9:38 pm |

Palantir Technologies Inc. | PLTR | Sankar Shyam See Remarks |

757,510 | $28.34 | $21,469,008 | 2,879,793 (Indirect Direct) |

View |

| 2021-02-18 Sale |

2021-02-22 9:39 pm |

Palantir Technologies Inc. | PLTR | Taylor Ryan D. See Remarks |

218,255 | $25.17 | $5,493,033 | 1,580,934 (Direct) |

View |

| 2021-02-18 Sale |

2021-02-22 9:38 pm |

Palantir Technologies Inc. | PLTR | Long Matthew A. See Remarks |

503,864 | $25.1 | $12,645,086 | 781,939 (Direct) |

View |

| 2021-02-18 Sale |

2021-02-22 9:37 pm |

Palantir Technologies Inc. | PLTR | Cohen Stephen Andrew Director |

2,000,000 | $26.8 | $53,604,009 | 203,647 (Direct) |

View |

| 2021-02-17 Sale |

2021-02-19 8:24 pm |

Palantir Technologies Inc. | PLTR | THIEL PETER Director 10% Owner |

20,003,915 | $25.23 | $504,783,227 | 0 (Indirect Direct) |

View |

Everyone knows Moderna created a novel technology that combats Covid with its mRNA vaccine technology. The stock has been an incredible performer rocketing to $68 Billion in market capitalization. Is that too much too soon? Insiders have started selling MRNA in droves. Can you blame them? I think I”d be more confident if the graph showed a pickup in buying not selling.

Charles Heilbronn has gone from a buyer to a seller of Ulta Beauty, Inc. In the last week, Director Heilbronn sold another 155,945 shares at $328.11 to $334,79 per share. This year Hilbronn sold 1,542,460 shares for proceeds of $481.32 Million. Heilbronn was a buyer two times earlier, once on 10-12-2017 when he purchased 127,889 shares at $195.21 and last on 9-26-2019 when he took advantage of a price drop to pick up 243,849 shares at $241.52. Tell Mr. Heilbroon that insiders don’t have a good feel for the price action of their companies. I’m not saying to sell ULTA but I certainly wouldn’t be buying the stock Mr. Heilbroon is selling.

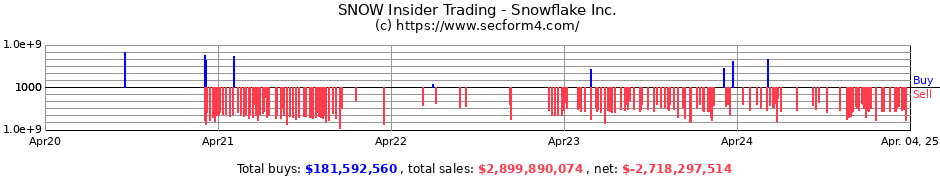

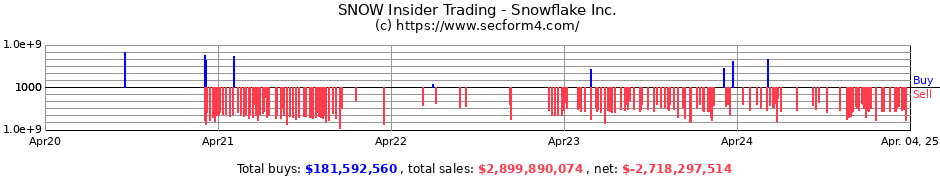

What happened to Snowflake? Lock up expiration, drop in price by 50%, nothing stops insiders from unloading Snowflake. Speculators that chased this stock up to $380 per share will likely not see a return to this price anytime soon. Insiders don’t seem to have any problem selling at half the price.

| Transaction Date                                  |

Reported DateTime      |

Company                                 |

Symbol                                 |

Insider Relationship                                  |

Shares Traded                                  |

Average Price                                  |

Total Amount                                  |

Shares Owned                                  |

Filing |

| 2021-04-12 Sale |

2021-04-14 8:26 pm |

Snowflake Inc. | SNOW | Dageville Benoit President |

29,750 | $228.97 | $6,811,988 | 6,103,165 (Indirect) |

View |

| 2021-04-07 Sale |

2021-04-09 8:09 pm |

Snowflake Inc. | SNOW | Scarpelli Michael CFO |

15,000 | $234.51 | $3,517,650 | 124,895 (Indirect Direct) |

View |

| 2021-04-05 Sale |

2021-04-07 8:49 pm |

Snowflake Inc. | SNOW | Dageville Benoit President |

28,506 | $232.65 | $6,631,793 | 6,141,532 (Indirect) |

View |

| 2021-04-05 Sale |

2021-04-07 8:48 pm |

Snowflake Inc. | SNOW | McMahon John Dennis Director |

9,090 | $237.8 | $2,161,602 | 114,828 (Indirect Direct) |

View |

| 2021-04-01 Sale |

2021-04-05 9:47 pm |

Snowflake Inc. | SNOW | Degnan Christopher William Chief Revenue Officer |

25,563 | $235.53 | $6,020,975 | 35,729 (Indirect Direct) |

View |

| 2021-03-29 Sale |

2021-03-31 8:35 pm |

Snowflake Inc. | SNOW | McMahon John Dennis Director |

9,090 | $230.55 | $2,095,700 | 123,918 (Indirect Direct) |

View |

| 2021-03-29 Sale |

2021-03-31 8:35 pm |

Snowflake Inc. | SNOW | Dageville Benoit President |

28,724 | $226.63 | $6,509,725 | 6,179,208 (Indirect) |

View |

| 2021-03-26 Sale |

2021-03-30 9:32 pm |

Snowflake Inc. | SNOW | Slootman Frank CEO Chairman |

100,000 | $229.07 | $22,907,437 | 0 (Indirect Direct) |

View |

| 2021-03-26 Sale |

2021-03-30 9:32 pm |

Snowflake Inc. | SNOW | BURTON JEREMY Director |

168,218 | $225.63 | $37,955,488 | 0 (Indirect Direct) |

View |

| 2021-03-22 Sale |

2021-03-24 7:45 pm |

Snowflake Inc. | SNOW | Dageville Benoit President |

30,568 | $222.46 | $6,800,190 | 6,207,932 (Indirect) |

View |

| 2021-03-22 Sale |

2021-03-24 7:44 pm |

Snowflake Inc. | SNOW | McMahon John Dennis Director |

9,090 | $220.82 | $2,007,254 | 133,008 (Indirect Direct) |

View |

| 2021-03-22 Sale |

2021-03-24 7:44 pm |

Snowflake Inc. | SNOW | Slootman Frank CEO Chairman |

31,546 | $222.47 | $7,018,058 | 74,367 (Indirect Direct) |

View |

| 2021-03-16 Sale |

2021-03-18 9:16 pm |

Snowflake Inc. | SNOW | McMahon John Dennis Director |

9,090 | $239 | $2,172,510 | 142,098 (Indirect Direct) |

View |

| 2021-03-16 Sale |

2021-03-18 9:15 pm |

Snowflake Inc. | SNOW | BURTON JEREMY Director |

162,301 | $239.18 | $38,819,662 | 0 (Indirect Direct) |

View |

| 2021-03-10 Sale |

2021-03-12 8:48 pm |

Snowflake Inc. | SNOW | Scarpelli Michael CFO |

15,000 | $229.32 | $3,439,800 | 124,895 (Indirect Direct) |

View |

| 2021-03-09 Sale |

2021-03-11 7:17 pm |

Snowflake Inc. | SNOW | Speiser Michael L Director |

650,000 | $219 | $142,350,000 | 3,497,525 (Indirect Direct) |

View |

| 2021-03-08 Sale |

2021-03-10 8:39 pm |

Snowflake Inc. | SNOW | Degnan Christopher William Chief Revenue Officer |

25,563 | $229.07 | $5,855,842 | 43,398 (Indirect Direct) |

View |

| 2021-03-05 Sale |

2021-03-09 8:29 pm |

Snowflake Inc. | SNOW | GARRETT MARK Director |

47,186 | $250 | $11,796,500 | 0 (Indirect Direct) |

View |

| 2021-03-05 Sale |

2021-03-09 8:29 pm |

Snowflake Inc. | SNOW | BURTON JEREMY Director |

122,000 | $237.02 | $28,916,275 | 0 (Indirect Direct) |

View |

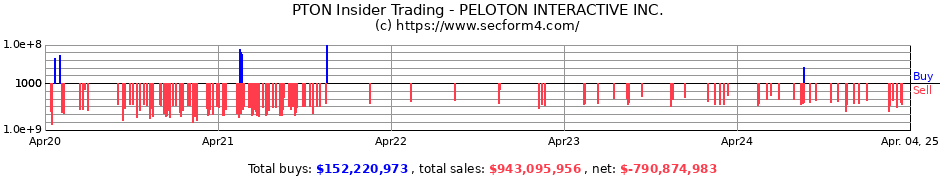

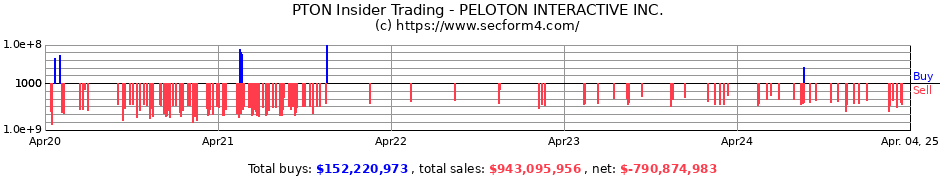

This post could go on and on like this but I’m getting nauseous just thinking how much insiders are taking out of this market. The question is where is it all going? Luxury homes? Exotic cars? Muni bonds? Treasuries? Bitcoin even? We just don’t know. I’m not saying the market is going down but I’m not happy about all the selling. Let’s conclude with Pelaton, the subject of a brutal government warning about toddlers getting dragged under the treadmills and getting killed. PTON has a game-changer bike and networked Peleton community- I doubt the article can hurt the stock as much as all these insiders selling out.

| Transaction Date                                  |

Reported DateTime      |

Company                                 |

Symbol                                 |

Insider Relationship                                  |

Shares Traded                                  |

Average Price                                  |

Total Amount                                  |

Shares Owned                                  |

Filing |

| 2021-04-14 Sale |

2021-04-16 4:33 pm |

PELOTON INTERACTIVE Inc | PTON | LYNCH WILLIAM President |

28,333 | $119.17 | $3,376,582 | 4,200 (Indirect Direct) |

View |

| 2021-04-14 Sale |

2021-04-16 4:32 pm |

PELOTON INTERACTIVE Inc | PTON | CALLAGHAN JON Director |

15,000 | $119.2 | $1,788,036 | 858,954 (Indirect) |

View |

| 2021-04-12 Sale |

2021-04-14 4:35 pm |

PELOTON INTERACTIVE Inc | PTON | Kushi Hisao Chief Legal Officer |

80,000 | $117.59 | $9,407,290 | 1,724 (Direct) |

View |

| 2021-04-12 Sale |

2021-04-14 4:35 pm |

PELOTON INTERACTIVE Inc | PTON | Cortese Thomas COO |

40,000 | $117.88 | $4,715,125 | 413 (Indirect Direct) |

View |

| 2021-04-05 Sale |

2021-04-07 4:31 pm |

PELOTON INTERACTIVE Inc | PTON | Garavaglia Mariana COO |

10,416 | $111.63 | $1,162,745 | 1,101 (Direct) |

View |

| 2021-03-31 Sale |

2021-04-02 4:31 pm |

PELOTON INTERACTIVE Inc | PTON | Garavaglia Mariana COO |

9,375 | $110.1 | $1,032,231 | 1,101 (Direct) |

View |

| 2021-03-22 Sale |

2021-03-24 4:54 pm |

PELOTON INTERACTIVE Inc | PTON | Garavaglia Mariana COO |

98,294 | $110.17 | $10,828,994 | 1,101 (Direct) |

View |

| 2021-03-17 Sale |

2021-03-18 4:31 pm |

PELOTON INTERACTIVE Inc | PTON | Draft Howard C. Director |

20,000 | $105.82 | $2,116,303 | 128,695 (Indirect Direct) |

View |

| 2021-03-15 Sale |

2021-03-17 4:33 pm |

PELOTON INTERACTIVE Inc | PTON | Foley John Paul CEO |

100,000 | $110.67 | $11,066,691 | 400,000 (Direct) |

View |

| 2021-03-12 Sale |

2021-03-15 4:31 pm |

PELOTON INTERACTIVE Inc | PTON | Kushi Hisao Chief Legal Officer |

80,000 | $111.01 | $8,880,756 | 1,724 (Direct) |

View |

| 2021-03-12 Sale |

2021-03-15 4:30 pm |

PELOTON INTERACTIVE Inc | PTON | Cortese Thomas COO |

40,000 | $111.16 | $4,446,369 | 413 (Indirect Direct) |

View |

| 2021-03-10 Sale |

2021-03-11 4:38 pm |

PELOTON INTERACTIVE Inc | PTON | CALLAGHAN JON Director |

15,000 | $114.62 | $1,719,234 | 873,954 (Indirect) |

View |

| 2021-02-16 Sale |

2021-02-18 4:35 pm |

PELOTON INTERACTIVE Inc | PTON | Woodworth Jill CFO |

50,000 | $148.51 | $7,425,584 | 0 (Direct) |

View |

| 2021-02-16 Sale |

2021-02-18 4:34 pm |

PELOTON INTERACTIVE Inc | PTON | Foley John Paul CEO |

100,000 | $148.51 | $14,851,137 | 200,000 (Direct) |

View |

| 2021-02-16 Sale |

2021-02-18 4:34 pm |

PELOTON INTERACTIVE Inc | PTON | LYNCH WILLIAM President |

116,670 | $149.15 | $17,400,923 | 4,200 (Indirect Direct) |

View |

| 2021-02-16 Sale |

2021-02-18 4:33 pm |

PELOTON INTERACTIVE Inc | PTON | Thomas-Graham Pamela Director |

75,000 | $149.06 | $11,179,337 | 0 (Direct) |

View |

| 2021-02-17 Sale |

2021-02-18 4:32 pm |

PELOTON INTERACTIVE Inc | PTON | Draft Howard C. Director |

20,000 | $138.23 | $2,764,597 | 133,695 (Indirect Direct) |

View |

| 2021-02-12 Sale |

2021-02-17 4:35 pm |

PELOTON INTERACTIVE Inc | PTON | Boone Karen Director |

83,500 | $151.28 | $12,632,195 | 0 (Direct) |

View |

| 2021-02-12 Sale |

2021-02-17 4:34 pm |

PELOTON INTERACTIVE Inc | PTON | Cortese Thomas COO |

40,000 | $151.14 | $6,045,450 | 413 (Direct) |

View |

| 2021-02-10 Sale |

2021-02-11 4:34 pm |

PELOTON INTERACTIVE Inc | PTON | CALLAGHAN JON Director |

15,000 | $146.41 | $2,196,174 | 888,954 (Indirect) |

View |

| 2021-02-10 Sale |

2021-02-11 4:34 pm |

PELOTON INTERACTIVE Inc | PTON | Boone Karen Director |

16,500 | $150.16 | $2,477,635 | 0 (Direct) |

View |

| 2021-02-08 Sale |

2021-02-10 4:36 pm |

PELOTON INTERACTIVE Inc | PTON | Boone Karen Director |

35,357 | $144.99 | $5,126,302 | 0 (Direct) |

View |

Follow us on Twitter for real time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

Insiders sell stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer-friendly and responsive I’ve used.

We publish a subscription newsletter called The Insiders Report. We offer a free 30-day trial so you have nothing to lose by trying it out. Be sure to carefully read the TERMS OF SERVICE.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

Until recently this blog was solely for educational purposes and the author’s own amusement. Now that we are offering it as a subscription service, I feel compelled to be more active in it alerting investors more often about our trading activities. I urge you to follow us on Twitter as that’s where we will do short updates rather than stuffing your email inbox. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019, 4th Best in November 2020, 4th Best in January 2021 (I kid you not)