For trade details click on this link to the trades

PROGENITY Inc up 38.05% COO Silvestry bought 58,081 shares of PROG at $4.58. Progenity announced on December 17th that it is expanding the availability of COVID-19 RT-PCR testing across the United States to support the rising demand for testing. Testing is performed using the Thermo Fisher Applied Biosystems TaqPath COVID-19 Combo Kit, under Emergency Use Authorization by the FDA.

Although the stock rocketed on this news combined with insider buying, it’s been a rough haul for shareholders. Give this one a little time to pullback.

PROG recently did a secondary priced at $3.27 on December 3rd for 7.645M shares as well as $75M in convertible senior notes due 2025. Piper Sandler analyst said that on December 8th PROG was not trading on its fundamentals considering the improving balance sheet and the fact that 90% of payers will cover average-risk noninvasive prenatal testing in 2021, which is well ahead of expectation and set a $15 price target.

Progenity provides in vitro molecular tests designed to improve lives by providing actionable information that helps guide patients and physicians in making medical decisions during key life stages. The company applies a multi-omics approach, combining genomics, epigenomics, proteomics, and metabolomics to its molecular testing products and to the development of a suite of investigational ingestible devices designed to provide precise diagnostic sampling and drug delivery solutions.

CuriosityStream Inc. up 18.20% Chairman and former founder of the Discovery Channel, Director Hendricks bought 53,157 shares at $8.91. CuriosityStream offers an unlimited streaming service for documentary films at a very competitive price point. I’m just not sure with all the streaming services now available if there is much demand and much profit to be made on an $11.99 yearly subscription. Hendricks took early retirement from Discovery in May 2014 to focus fully on his new venture, CuriosityStream, a leading global factual media company and streaming service. Launched in 2015, CuriosityStream reaches 13 million subscribers in 175 counties through direct subscriptions as well as bundled and distribution partnerships. On August 11, 2020, it was officially announced that CuriosityStream would undergo a reverse merger with Software Acquisition Group, Inc., a special-purpose acquisition company. As a result of the merger, CuriosityStream started trading on NASDAQ under the Ticker symbol “CURI” on October 15, 2020.[12] This made it the first publicly traded streaming media company focused on factual content.[13]After completing a successful reverse merger in October 2020, CuriosityStream is now the first publicly-traded streaming media company focused on delivering factual content, and the most distributed ‘pure-play’ video streaming service to be publicly listed behind Netflix.

With just $7.2 million in revenues in Q3 CURI has a long way to go challenge the over the top streaming services but the demand for VOD content seems insatiable. This is worth a long term view and we’re likely to bet on CURI.

insider-trading/1680048.htm”>MUSTANG BIO Inc up 15.79% Director Rosenwald bought 100,000 shares at $2.66. Recent medical breakthroughs in cell and gene therapy have signaled a coming revolution in patient care for previously untreatable disease. Mustang Bio are translating these breakthroughs into next-generation therapies for hematologic cancers, glioblastoma and rare genetic diseases. Insiders have been buying MBIO and we would to. Small biotechs are volatile but huge gains can be made as well as significant losses. One of the way best ways to measure your chances of success is to pay attention to what insiders are doing. Over the last 25 years, Dr. Rosenwald has acted as a biotechnology entrepreneur and has been involved in the founding and recapitalization of numerous public and private biotechnology and life sciences companies including the current CEO of Fortress Biotech.

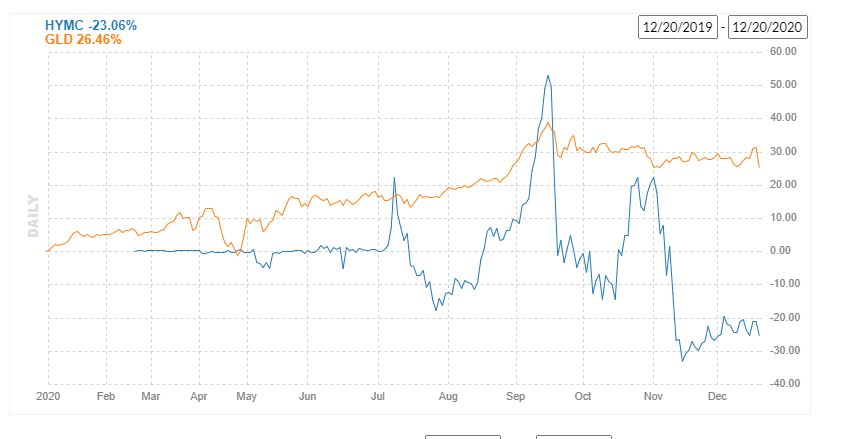

Hycroft MINING HOLDING CORP up 13.57% Two insiders bought this Nevada based gold miner, including the CEO purchase of 34,000 shares at $7.10 and the CFO purchased 15,000 at $7. The Hycroft Mine features one of the largest gold and silver deposits in the world with a low-capital, low-cost process and 34-year mine life. HYMC should be correlated to the price of gold but that hasn’t happened. Perhaps it’s time to buy this gold miner.

GTY Technology Holdings Inc. up 12.60% Director Green bought 60,000 shares at $4 of this government technology firm. Through its six subsidiaries, GTYH is the first in the government-technology industry to offer an intuitive cloud-based suite of solutions for state and local governments spanning functions in procurement, payments, grant management, budgeting, and permitting. Is it time for GTYH to move? The software offerings have gained many new customers in spite of the global pandemic We like this sector and the vote of confidence by the director is a buy signal. The company has a new CEO who has brought significant improvements according to Craig Hallum analyst Jeff Van Rhee. We are buyers here.

The

APPLIED OPTOELECTRONICS Inc up 6.32% Director Lin bought 25,401 shares of AAOI at $7.82. This is a fairly low risk investment for Lin considering he sold 7000 at $58 back in 9-11-2017. The optical market has been a deep slump for some time and we don’t’ have any special knowledge as to when this may change. Look out for other insider buys in this sector for signs of a turnaround. AAOI is a leading provider of fiber‑optic networking products. We serve four growing end-markets: internet data centers (Data Center), Cable Television Broadband (CATV), fiber-to-the-home (FTTH), and telecommunications. They design and manufacture a range of optical communications products employing our vertical integration strategy from laser chips, components, subassemblies and modules to complete turn-key equipment. They design, manufacture, and integrate our own analog and digital lasers using a proprietary Molecular Beam Epitaxy (MBE) fabrication process.

ACACIA RESEARCH up 6.32% CIO Tobia bought 100,000 shares at $3.77 for this patent troll. We traded the name and make a quick profit but don’t like this business. There is probably rewarding litigation in the future but the wheels of justice are too unpredictable and move too slow for us to be long-term investors in ACTG.

Allied Esports Entertainment Inc. up.3.34% We blogged about this name last week. As in-person events take off again once the Pandemic winds down, will these online gaming tournaments take off with it. Apparently, that’s what Knighted Pastures, Roy Chois thinks. He added to his holding with 447,128 shares of AESI at $1.41. My question is where is the money going to come from as they have done nothing but burn cash in their limited history.

UroGen Pharma Ltd. up 2.11%. CEO Barrett bought 10,000 shares at $18.50. The stock has been dismal. Is this about to change? It’s too small a vote of confidence for us to examine it. Time is money.

+

Viatris Inc up 0.51% Director Kilts bought 27,736 shares of this newly IPO stock VTRS at $17.66. Viatris is a global healthcare company formed in 2020 through the combination of Mylan and Upjohn, a legacy division of Pfizer. From their PR, “By integrating the strengths of these two companies, including our global workforce of ~45,000, we aim to deliver increased access to affordable, quality medicines for patients worldwide, regardless of geography or circumstance.” Deriving its name from Latin, Viatris embodies the new company’s goal of providing a path—”VIA”—to three—”TRIS”—core goals: expanding … I hope they didn’t spend a lot of money on that as they just gave pink slips to 9000 people right before XMAS.

I swore I would never invest in Mylan as long as Robert Coury was ever involved in the company. Mylan rejected an unsolicited $40.1 Billion buyout from Teva Pharmaceuticals under his leadership. It’s never seen a price anywhere close to that sense. I remember Coury saying this was a stakeholder company, not a shareholder company. What did he mean by that? My own take is that this was his personal fiefdom and shareholders could go suck an egg.

Things appear to be quite different now. Coury, although still a major shareholder, is now the Executive Chairman, and may not have the lock sway he had before. A little less than a month after Pfizer’s Upjohn unit and Mylan successfully merged to create generics business Viatris, the company is already looking at ways to slash costs .bNewly minted Viatris Friday laid out detailed plans for a global manufacturing initiative that could put thousands of jobs on the line. By 2024 at the latest, the company aims to wring at least $1 billion from its cost base, and it’s planning to close, downsize or divest up to 15 facilities to meet that goal.

Up to 20% of the generics business’s 45,000-strong workforce—some 9,000 staffers—could be impacted by the time the restructuring effort wraps, the company said in a release. Viatris doesn’t appear to be a stakeholder company any longer and we are buyers once again.

Vistra Corp. down 3.29%. CFO Burke adds his name to the list of insider buying stock in VST, this time buying 17,000 shares at $18.25, a day before BofA downgard. We own VST and are setting on a small loss. Anything environmental has taken off like no tomorrow with the Biden administration environmental agenda. Anything but Vistra is on fire, yet (NYSE: VST) a leading, Fortune 275 integrated retail electricity and power generation company. The company is also the largest competitive power generator in the U.S. with a capacity of approximately 39,000 megawatts powered by a diverse portfolio, including natural gas, nuclear, solar, and battery energy storage facilities. In addition, the company is a large purchaser of wind power. The company is currently constructing a 400-MW/1,600-MWh battery energy storage system in Moss Landing, California, which will be the largest of its kind in the world when it comes online.

The dividend yield of 3.0% is enticing too. Based on the early turnout in the Georgia senatorial race, the Democrats might actually win control of the Senate. Watch out for green stocks. Get your shopping list ready. This might not be a name that catches on but I don’t’ see how you lose money with the Fed’s zero-interest policy.

Delek US Holdings Inc. down 11.23% Do you want to invest with Carl Icann in an out of favor industry. Try this refining and gasoline retail play. I think I’ll pass on this when I can buy Exxon and Chevron with outrageous dividend yields.

Follow us on Twitter for real time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

Insiders sell stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer-friendly and responsive I’ve used.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019

Follow us on Twitter for real time insider buying alerts at https://twitter.com/theinsidersfund

[custom-twitter-feeds]

Insiders sell stock for many reasons, but they generally buy for just one – to make money. You’ve always heard the best information is inside information. Everyone who has any experience at all in the stock market pays close attention to what insiders are doing. After all, who knows a business better than the people running it? Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to SECForm4 as they provide a way to manage and make sense of the vast realms of data. I’ve tried a lot of vendors and SECForm4 is one of the most customer-friendly and responsive I’ve used.

Another source for insider buying and selling and much more is FinViz Elite. FinViz stands for financial visualization and they do an amazing job of providing reams of data and the tools to help you get to the bottom of it, the information that helps me make informed decisions and probable outcomes. I’ve been using their site for years and it only gets better over time.

This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal.

BEWARE– Following insiders can be hazardous to your financial health unless you know what you are doing. Unlike the raw, unfiltered data, The Insiders Fund blog informs you of the purchases that count, the ones that are just window dressing into deceiving the public that all is hunky-dory, and those that are just flat out other people’s money and should be just discarded like bad fish. As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing.

The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock and options. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. Also planned sales that just pop up out of nowhere are basically sales and are seeking cover under the Sarbanes Oxley corporate welfare clause. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course, insiders can also be wrong about their Company’s prospects. Don’t let anyone fool you into believing they never make mistakes. No one tracks and understands insider behavior better than us. We’ve been doing it religiously since 2001 when I quit being an insider myself and devoted myself full time to managing my personal investments. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

The Insiders Fund was the 4th best long-short equity fund in the world in 2019