In this report we analyze the investment prospects for Bunge, the giant agricultural trading company. We were initially attracted to Bunge by the large amount of insider buying so we wanted to analyze this further. This was right before the Coronavirus gripped the markets. The stock is considerably cheaper now. We rate it as a 1. Even thought it has a low rating, this much insider buying is attractive. Where there is smoke, there could soon be fire.

This is a checklist I use to quickly come to a conclusion on a stock. I score a stock, each line getting a 1, 0, or -1. A stock that scored 1 on each line would be a perfect 10. Buy it!

Some of these items are quite subjective. For example how would I score Cash Flow? If a company’s cash flow is much lower than it’s reported earnings, that raises a flag and I would score it a -1. If there are more insiders buying than selling, I would score it a 1. If there are no apparent catalysts in the near future I would score it a 0 but on the other hand if there is a pending secondary that will put more stock out on the market, I would score it -1.

Bunge Limited (BG)

- Chart +1 I firmly believe I can improve the price of buying or selling from an understanding of chart action. A good chart gets a 1, a bad one, -1 and inconclusive is 0. Bunge is showing bullish RSI divergence. This is a reliable short term indicator. The stock made a new low yet the RSI line is trending higher. Score +1

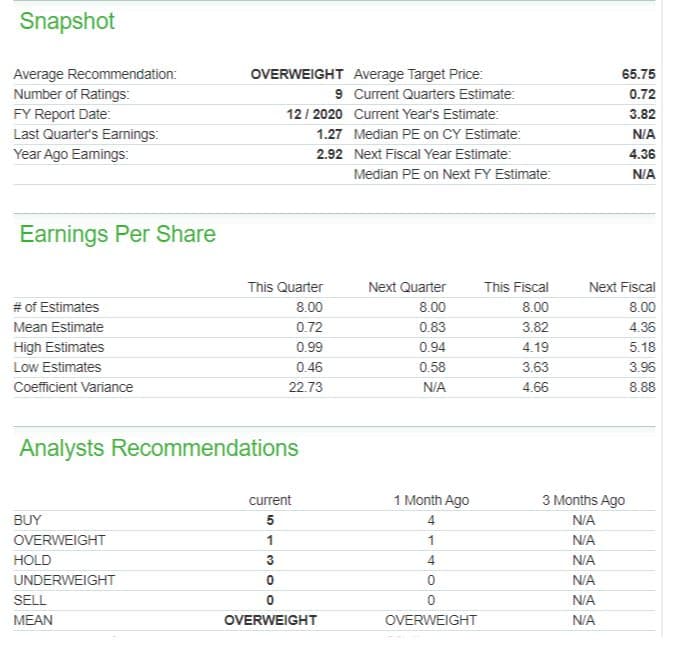

- Analysts +1 I read analyst reports but come to your own conclusions. If the consensus is favorable, 1; if unfavorable -1, and mixed 0. If it is overwhelmingly favorable or negative, take the contrarian view. This stock is a “Buy” as per analysts ratings on Marketwatch.com and Yahoo Finance. So the stock scores a +1 for favorable analysts rating. According to The Fly on the Wall– Goldman Sachs analyst Adam Samuelson upgraded Bunge to Buy from Neutral with a price target of $67, up from $64. The stock has been a notable underperformer year-to-date, only rising 1% versus the S&P 500 index’s gain of 26%, Samuelson tells investors in a research note. However, he sees Bunge as a “unique self-help story” within Agriculture that can gain “increasing appeal” in 2020 as elements of its turnaround become clearer. The analyst believes management will provide incremental disclosure on its plans to achieve a 9%-plus return on invested capital. Further, an improving cyclical backdrop “presents optionality”.

3.Insiders +1 Management has been large buyers of Bunge stock. The most notable recent buys are the CFO’s purchase in February for $655.1K at $52.41, officer’s investment of $508.5K at $50.85, the CEO’s purchase of $2.0M at $53.76, and a VP buy of $802K at $53.47.

4. Management Discussion 10Q and 10K 0 This is the only truthful thing you will read about a company. It’s composed by management, the auditors, and the firm’s lawyers. If all three of them can agree on the verbiage, it’s passed a big hurdle. Read it carefully. Pay particular attention to the Risks, Litigation, and Related Transaction sections. These are the things you will wish you had taken the time to read if something goes bad with your investment.

Some of the key risks to be noticed are –

Bunge operates as a middleman in the commodity industry, due to which it has little control over the prices of products. Fluctuations in prices of agricultural commodities have a severe impact on its revenues.

Bunge has a civil lawsuit pending against its Brazilian subsidiary. Brazil is an important market for Bunge as 17.3% of its long-lived assets were in Brazil in 2019 and Brazil accounted for 12.6% of the revenues in 2019. An unfavorable outcome can have a significant impact on its margins and goodwill in the region.

In the 2019 annual report, Bunge highlighted that its business may be negatively impacted by coronavirus prevalent in the Chinese economy. As the virus has spread globally, its negative impact on Bunge’s margins can be severe. Note that the 10K was filed with the SEC on Feb 21. You can assume it had been in the works for weeks if not months. The CEO bought $2 million the day it was filed. The President of Risk Management bought 10,000 shares at $50.85 on February 26, and the CFO added 2000 more shares on the 28th.

Bunge provides cash advances to suppliers that are collateralized by future crops and physical assets of the suppliers. In the event of a poor harvest, Bunge would not merely face supply chain disruption problems, but it would also face bad debts that can threaten its short-term liquidity. In 2019, secured advances to suppliers accounted for 11.11% of the total current asset base of the company.

5.MARKET DIRECTION -1 80% of stocks follow market direction in the short term. This is your read on the market. Don’t have an opinion, it’s a 0. Obviously the market direction is negative.

6. SECTOR OUTLOOK -1 buying a good stock in a bad sector can be a humbling experience. The agricultural sector has been a rough place to invest.

7.Cash flows -1

- The cash flow from operations have been negative for Bunge since the last 3 years. The primary source of cash inflows for the business have been proceeds from investments and proceeds from interest in securitized trade receivables.

- If the $1,673 million in charges associated with the sale of Brazilian sugar and bioenergy operations are removed (as these are one-time charges), the net income for 2019 would be positive instead of loss of $1,280 million.

- The % change in cash flows are not consistent with the % change in earnings. Profits have improved over the last 2 years, but the cash flows from operations have been negative.

| 2019 | 2018 | 2017 | 2016 | 2015 | |

| Net income attributable to Bunge (mil) | -1280 | 267 | 160 | 745 | 791 |

| Cash flows from operations (mil) | -808 | -1264 | -1975 | 1904 | 610 |

| Year-on-year change | |||||

| Net income attributable to Bunge | Not meaningful | 66.88% | -78.52% | -5.82% | |

| Cash flows from operations | 36.08% | 36.00% | -203.73% | 212.13% |

8.PEG Ratio -1 it’s good to find a company growing faster than it’s multiple.

The PEG ratio is not meaningful for Bunge, as per Nasdaq.com so we score that as a 0

9.Valuation +1

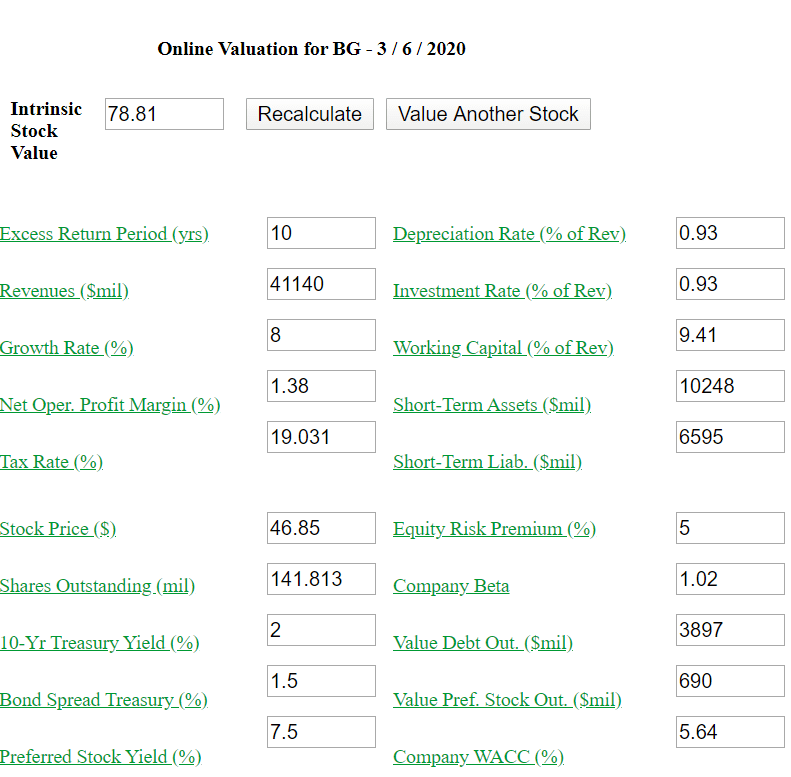

The current stock price is $43.48 on 3/9/20 The best estimate of intrinsic value is $78.81. The stock scores +1 as it is undervalued.

10. Catalyst +1

- As coronavirus fears grip the global economy, the trade barriers are likely to be relaxed to stimulate growth and minimize the chances of recession. This would be a strong positive force for the company.

- China is the largest pork consumer in the world. US and Brazil are the top soybean producers in the world. As the demand for protein picks up in China, which was dampened by swine flu, it is expected that large volumes of soybeans would be needed to feed the hogs. This can improve its profitability and revenues.

- Bunge is in the midst of a leadership transition. In October 2018, at the request of two activist shareholders,Continental Grain and D.E. Shaw, Bunge agreed to appoint four additional directors to the board, increasing its size to 15 directors from 11. Further, three of Bunge’s longest-serving board members will not stand for re-election in 2019, and we expect the activist

shareholders are likely to nominate new directors,increasing their strategic influence over the company.There has been a change in management of the company. If management can streamline costs and reduce expenses, it can boost the razor-thin margins of the business. Its basically a turn around story and probably will be sold once it is on better footing, perhaps Glencore or ADM. - It’s important to note that Continental Grain was a large holder of Smithfield’s Foods, the largest U.S. hog producer before it was sold to the Chinese for twice where it was trading at the time. No analysts liked it at the time. Maybe its the Chinese again that will buy it.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. THE INSIDERS FUND invests in companies at or near prices that management has been willing to invest significant amounts of their own money in. After all, who knows a business better than the people running it? You’ve always heard the best information is inside information. This is as close to “insider information” that an ordinary investor is likely to see- and it’s entirely legal. Officers, directors, and 10% owners are required to inform the public through a Form 4 Filing any transaction, buy, sell, exercise, or any other with 48 hours of doing so. This info is available for free from the SEC’s Web site, Edgar, although we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data.

As a rule, we only look at material amounts of money, $200 thousand or more, as anything less could just be window dressing. The bar is different from selling because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52-week lows. Another red flag is large planned sale programs that start without warning. Unfortunately, the public information disclosure requirements about these programs referred to as Rule 10b5-1 is horrendously poor. I also generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and perhaps not the smart money we are trying to read the tea leaves on.

Of course insiders can also be wrong about their Company’s prospects. They can easily be wrong about how much others will value them, and in many cases, maybe most cases have no more idea what the future may hold than you or I. In short, you can lose money following them. We have and we curse aloud, what were they thinking! Needless to say, past good fortune is no guarantee of future success. We may own positions, long or short, in any of these names and are under no obligation to disclose that. We welcome your comments on our analysis.

This blog is solely for educational purposes and the author’s own amusement. Investing with The Insiders Fund is for qualified investors and by Prospectus only. Nothing herein should be construed otherwise. To learn more about our strategy, visit our website. If you would like to hear more about how you can get involved with the Insiders Fund, please schedule some time on my calendar.

Prosperous Trading,

Harvey Sax

[…] BG Bunge insiders continue to buy stock in this large agribusiness. The business is not particularly attractive but in normal times. The largest being the CEO’s purchase of $4.8 M at $39.85 on 3/11. I think this company is for sale, maybe to the Chinese. See our post here Bunge Buy or Bust […]