18 Companies saw significant insider trades leading up to Labor Day, but no one moved more than Sheffield.

In this week’s report, we present thirteen significant buys and five significant sells as mergers, dividends and company changes shape the blog. See who is on our watchlist and check out our methodology to see why we think these insider trades matter.

In this report, we examine stocks that C-level officers and directors bought and sold throughout the week ending August 31, 2018.

Insiders sell stock for many reasons, but they generally buy for just one – to make money. As a standard, we only look at material amounts of money, $100 thousand or more, as anything less could just be window dressing.

The bar is different with selling, because the natural state of management is to be sellers. This is because most companies provide significant amounts of management compensation packages as stock. Therefore, with selling, we analyze for unusual patterns, such as insiders selling 25 percent or more of their holdings or multiple insiders selling near 52 week lows.

Another red flag are large planned sale programs that start without warning. We generally ignore 10 percent shareholders as they tend to be OPM (other people’s money) and not the SMART money we are trying to go to school on. We also exempt IPOs and secondaries for a variety of reasons from not being available to the public or more nefarious reasons like trying to provide support for additional fund raising.

Although this info is available for free from the SEC’s Website , Edgar, we subscribe to the Washington Service as they provide a way to manage and make sense of the vast realms of data. Charts display one month of data from the date of our analysis at one day intervals. Credit for charts goes to yahoo.com

To learn more about our strategy, visit our website at The Insiders Fund. We welcome your comments on our analysis.

NOTE: We may own positions, long or short, in any of these names and are under no obligation to disclose that.

Significant Insider Buys

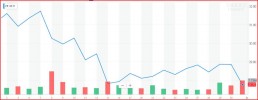

KEURIG DR. PEPPER INC. (KDP)

The Inside Trade: Three insiders at Keurig Dr. Pepper made purchases last week for a combined 96,223 shares and a market value of $2.2 million.

Director Robert Singer purchased 10,000 shares and increased his holdings by 100%.

Chief Commercial Officer Herbert Hopkins bought 22,000 shares which increased his holdings 5.5%.

Chief Corporate Affairs Officer Maria Sceppaguercio-Gever purchased 64,223 shares.

We don’t usually report new purchases but that in combination with two other insiders, and on the same day, made it notable.

Keurig Dr. Pepper’s shares have been on the decline since before the second quarter report was released on the 8th.

About KDP: Keurig Dr Pepper Inc. engages in the brewing system and specialty coffee businesses in the United States and Canada. The company sources, produces, and sells coffee, hot cocoa, teas, and other beverages in K-Cup, Vue, Rivo, K-Carafe, and K-Mug pods brands

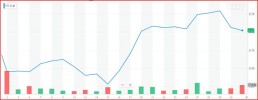

PERSHING GOLD CORPORATION (PGLC)

The Inside Trade: Barry Honig, a Director & 10% shareholder at Pershing Gold, purchased 1,634,810 shares at an average price of $1.61 on Tuesday the 28th. This increased his ownership by 18.7% and had a market value $2.6 million

Barry Honig is no stranger to insider buys and this blog. As an insider due to being a Director & a 10% shareholder, he has a significant amount of time and money invested into this company. This marks his 8th significant buy this year alone, at $2.6 million. “On the same day the Director bought the company made the following press release: completed the exercise of a right of first offer to acquire all of the Newmont USA Limited (“Newmont”) royalty and other rights on specified lands around the Relief Canyon project.” This could also be the reason the share price finally began to rise closing the week out at $1.31.

About PGLC: Pershing Gold Corporation is an emerging Nevada gold producer that is reopening the Relief Canyon Mine.

MGP INGREDIENTS, INC. (MGPI)

The Inside Trade: George Page, a Director, purchased 10,000 jointly with his spouse to increase his holdings by 27.2%. This buy was at an average price of $72.36 and had a market value of $723.6 thousand.

After their second quarter results caused a $9 dip on the 2nd, the MGPI’s share price has been rocky. The director timed his purchase well picking the day the share price hit its lowest value since the 2nd with his purchase on the 28th.

About MGPI: MGP Ingredients, Inc., together with its subsidiaries, produces and supplies distilled spirits, and specialty wheat proteins and starch food ingredients. It operates in two segments, Distillery Products and Ingredient Solutions.

DOMINION ENERGY, INC. (D)

The Inside Trade: Director John Harris purchased 10,000 shares at an average of $71.15 and increased his ownership by 18.3%. This buy took place on Tuesday the 28th and had a market value of $711.5 thousand.

About D: Dominion Energy, Inc. produces and transports energy in the United States.

BERRY PETROLEUM CORPORATION (BRY)

The Inside Trade: The EVP & CFO, Carey Baetz, made a buy on Tuesday the 28th worth $542.9 thousand. He purchased 34,000 shares at an average price of $15.97 and increased his holdings by 68%.

Since their earnings release their share price has gone from $13.10 to $16.39. The share price really took off though when they released their second quarter dividend: “the Board approved a regular $0.12 per share dividend on a pro-rated basis from the date of the Company’s initial public offering, which will result in a payment of $0.09 per share.” The announcement came on the 22nd.

About BRY: Berry Petroleum Corporation, an independent upstream energy company, engages in the development and production of conventional oil reserves located in the western United States. The company’s properties are located in the San Joaquin and Ventura basins, California; Uinta basin, Utah; Piceance basin, Colorado; and east Texas.

COLUMBIA FINANCIAL, INC. (CLBK)

The Inside Trade: Henry Kuiken, a Director, increased his holdings by 42.1% with the purchase of 25,400 shares. This trade had a market value of $429.6 thousand and was executed at an average price of $16.91 on Wednesday the 29th.

Their share price dipped to lows they hadn’t seen since May leading up to their earnings report at the end of July. The report caused an initial dip but their share price has settled out for the month of August, closing last week at $16.93.

About CLBK: Columbia Financial, Inc. operates as an investment holding company. The Company, through its subsidiaries, offers banking services including online and mobile banking and lending facilities, title, investment, and wealth management services.

PACIFIC CITY FINANCIAL CORPORATION (PCB)

The Inside Trade: Don Rhee, a Director, purchased 12,000 shares at an average price of $19.78 on Tuesday the 28th. This buy had a market value of $237.3 thousand and increased his holdings by 4%.

On August 14th, PCB completed their IPO of 2.4 million shares at $20.00 per share.

About PCB: Pacific City Financial Corporation operates as a bank holding company for Pacific City Bank that provides various commercial banking products and services to individuals, professionals, and small-to-medium sized businesses in Southern California.

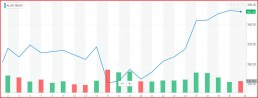

QURATE RETAIL GROUP, INC. (QRTEA)

The Inside Trade: President & CEO Michael George purchased 220,000 shares on Thursday the 30th and increased his ownership by 15.9%. This buy was at an average price of $20.40 and had a market value of $4.5 million.

QRTEA released their second quarter results on the 8th and watched their price hum to $23.16 before it dropped to a year low of $20.15 on the 30th. On the 15th, they announced new debentures with a 3.75% rate due in 2030. This drop was timed with the buy for the President & CEO as he made his purchase the day it reached it’s low. The closing price jumped $0.64 and closed the week out at $20.79.

About QRTEA: Qurate Retail Group, Inc. markets and sells various consumer products primarily through live merchandise-focused televised shopping programs, Websites, and mobile applications.

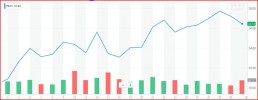

MAGNOLIA OIL & GAS CORP (MGY)

The Inside Trade: Two insiders at Magnolia Oil & Gas combined to purchase 19,450 shares for a market value of $270.2 thousand at the end of last week at an average price of $13.85.

Director Acrilia Acosta purchased 17,950 shares and increased her ownership by 35.5%.

Valerie Chase, the CAO & Controller, purchased 1,500 shares and increased her ownership by 13.6%

Magnolia Oil & Gas has made a few press releases this month and is no surprise to see insider purchases. On the 21st, they released their earnings report and announced the agreement to acquire substantially all South Texas assets of Harvest Oil & Gas Corp. This then closed on the 31st and had an effective date of July 1st 2018. Also on the 31st they announced that their CEO will speak at the Barclays CEO Energy-Power Conference in New York City in September. This may shed light on why the share price started climbing just prior to the 21st.

About MGY: Magnolia Oil & Gas Corporation operates as an oil and gas exploration and production company. It has operations in South Texas in the core of the Eagle Ford. The company is headquartered in Houston, Texas.

ARES CAPITAL CORPORATION (ARCC)

The Inside Trade: Ann Torre Bates, a Director, purchased 9,000 shares at an average price of $17.44 on Wednesday the 29th. Her buy had a market value of $157 thousand and increased her holdings by 67.8%.

At the beginning of the month Ares Capital announced their share dividend of $0.39. With a record date of September 14th and payable of the 28th.

About ARCC: Ares Capital Corporation is a business development company specializing in acquisition, recapitalization, mezzanine debt, restructurings, rescue financing, and leveraged buyout transactions of middle market companies. It also makes growth capital and general refinancing.

MACQUARIE INFRASTRUCTURE CORPORATION (MIC)

The Inside Trade: The CEO and the CFO of Macquarie Infrastructure combined to purchase 5,720 shares at an average price of $47.38 and a market value of $270.7 thousand. The CEO, Christopher Frost, purchased 4,250 shares an increased his holdings by 24.5%. Their CFO, Liam Stewart, purchased 1,470 shares and increased his ownership by 52.9%.

In addition to these two insiders, Macquarie Group Ltd (MGL) has been making large purchases between August 10th and the 30th through one of their subsidiaries, Macquarie Infrastructure Group (MIMUSA). In these fifteen days they have purchased 563,362 shares for a market value of $26 million which increased their ownership by 5.1%. If you include this buy with the CEO and CFO the shares ride to 569,082, and a value of $26.2 million.

About MIC: Macquarie Infrastructure Corporation owns and operates a portfolio of businesses that provide services to other businesses, government agencies, and individuals. It operates through four segments: International-Matex Tank Terminals (IMTT), Atlantic Aviation, Contracted Power (CP), and MIC Hawaii.

ICHOR HOLDINGS, LTD. (ICHR)

The Inside Trade: Jeff Anderson, the CFO, increased his holdings by 108.3% with the purchase of 5,200 shares on Monday the 27th. This buy was at an average price of $24.22 and had a market value of $126 thousand.

On the 20th Ichor announced an increase to the share repurchase program which is incremental to the one they just completed between February and July of this year. They announced additional funds to be used to purchase the companies ordinary shares. The day the company released this the share price was at $22.18. On the 27th when the director made his purchase the shares had risen to $24.22 and on Friday they closed at $25.93.

About ICHR: Ichor Holdings, Ltd. engages in the design, engineering, and manufacture of fluid delivery subsystems and components for semiconductor capital equipment in the United States, the United Kingdom, Singapore, Malaysia, and South Korea.

SCHNEIDER NATIONAL, INC. (SNDR)

The Inside Trade: Director James Gietz purchased 4,000 shares at an average price of $26.92 on Tuesday the 28th. The director’s buy had a market value of $107.7 thousand and increased his holdings by 48.6%.

Schneider National started the month off with three press releases; their quarterly dividend, quarter results and a new board member.

About SNDR: Schneider National, Inc., a transportation and logistics services company, provides truckload, intermodal, and logistics solutions in North America.

Significant Insider Sells

PARSLEY ENERGY, INC. (PE)

The Inside Trade: The Chairman & CEO of Parsley Energy, Bryan Sheffield, made the largest sale of the week under our criteria at $70.4 million. He sold 2,500,000 shares at an average price of $28.15 on Tuesday the 28th. The Chairman & CEO’s sell decreased his ownership by 18.9%.

About PE: Parsley Energy, Inc., an independent oil and natural gas company, engages in the acquisition, development, production, exploration, and sale of crude oil and natural gas properties in the Permian Basin in West Texas and Southeastern New Mexico.

THE CHILDREN’S PLACE, INC. (PLCE)

The Inside Trade: Jane Elfers, the President & CEO of Children’s Place, decreased her holdings by 41.4% on Monday the 27th by selling 100,000 shares. Her sale had an average price of $134.93 per share for a market value of $13.5 million.

About PLCE: The Children’s Place, Inc. operates as a children’s specialty apparel retailer. The company operates in two segments, The Children’s Place U.S. and The Children’s Place International.

FITBIT, INC. (FIT)

The Inside Trade: Steven Murray, a Director at Fitbit, decreased his holdings by 49.0% on Monday the 27th. The Director sold 1,000,000 at an average price of $6.22 per share. This trade had a market value of $6.2 million.

About FIT: Fitbit, Inc., a technology company, provides health solutions in the United States and internationally.

EBAY INC. (EBAY)

The Inside Trade: Jae Lee, the SVP of Europe, the Middle East and Africa, sold 26,204 shares and reduced his holdings by 16.9%. This sale had an average price of $35.08 and a market value of $919.2 thousand.

About EBAY: eBay Inc. operates commerce platforms that connect various buyers and sellers worldwide. Its platforms enable sellers to organize and offer their inventory for sale; and buyers to find and purchase it virtually.

ALIGN TECHNOLOGY, INC. (ALGN)

The Inside Trade: A Director and a SVP Managing Director of Align Technology combined to sell $5.3 million worth of stock on Monday and Wednesday last week.

On Monday, Director Joseph Lacob sold 10,000 shares at an average price of $382.00 to decrease his ownership by 3.5%.

On Wednesday, SVP & Managing Director Simon Beard sold 3,895 shares at an average price of $384.48 to reduce his ownership by 52.1%.

The addition of these two insiders brings the number of Align Technology’s insider sales to seven since August 14th. They have combined to sell 62,065 shares for a total of $21,9 million.

About ALGN: Align Technology, Inc. designs, manufactures, and markets a system of clear aligner therapy, intraoral scanners, and computer-aided design and computer-aided manufacturing (CAD/CAM) digital services.